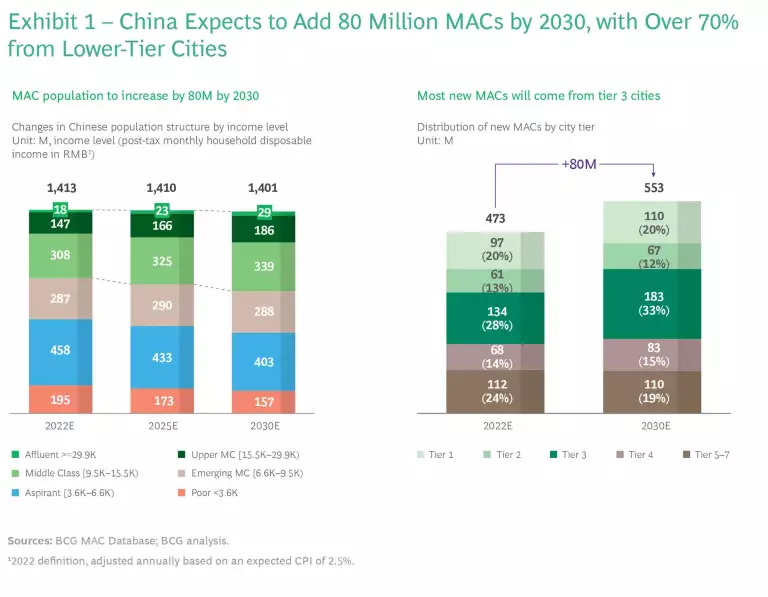

After suffering a downturn during the COVID-19 pandemic, the Chinese consumer market is showing signs of recovery—both now and into the next decade. New BCG research on the evolving consumer class in China shows that its middle-class and affluent consumer (MAC) population will increase by 80 million by 2030. Nearing 40% of the total population, this segment will become a source of long-term resilience for the Chinese consumer market.

To leverage this growth opportunity, businesses need to understand who these consumers are and how their preferences are shaped. This entails differentiating among preferences that naturally ebb and flow according to life stage and those that are unique to each generation represented in the larger group. By doing so, firms can formulate more precise product strategies and optimize their business portfolios.

China’s demographics are at an inflection point. Its population structure is undergoing profound shifts, with direct implications for consumer preferences. In January, the Chinese National Bureau of Statistics released data showing China’s population decreased by 850,000 in 2021—the first instance of negative population growth in 61 years. At the same time, the proportion of the population aged 65 and above reached 14.9%, making China a moderately-aged society by United Nations standards.

Among the 80 million new MACs, over 70% of this group will be from tier-3 cities and below, making lower-tier cities an increasingly important part of the market. (See Exhibit 1.) Our research also shows that even during the relatively difficult last few years, Chinese consumers demonstrated a strong desire to trade up and an increased willingness to pay a premium for quality across product categories.

Intergenerational differences in consumption attitudes and beliefs, based not just on birth year but also on socioeconomic factors, follow generations as they pass through different life stages. A common truth—and one that is particularly salient in China—is that significant historical events and cultural experiences leave indelible marks on groups of people in their formative years, thus shaping common values and ideas. This in turn affects the choices they make as consumers.

Chinese Consumer Profiles

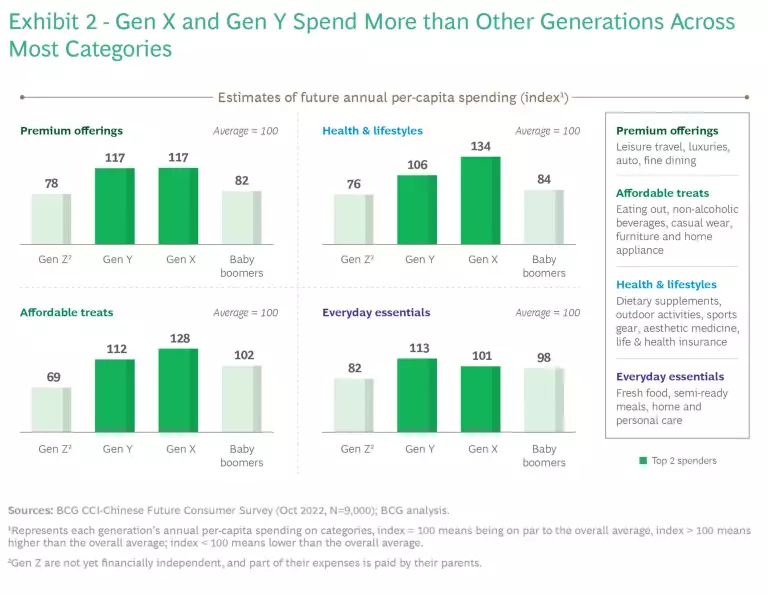

Taken as a whole, 80% of China’s population of 1.4 billion can be said to be composed of four generations: Gen Z, Gen Y, Gen X, and the baby boomers. These generations are the main creators of social wealth, with Gen X and Gen Y consumers accounting for over 60% of total income.

Gen Z (born between 1995 and 2009) is influenced by deep digitization and globalization. They value emotional well-being, aesthetics, intellectual enjoyment, and spiritual fulfillment more than any of their predecessors. They tend to relate to more segmented circles and subcultures. Most of them are currently single (79%). Gen Z is the most educated generation in China so far, and their careers are still largely in the beginning phase.

Gen Y (born between 1980 and 1994) comprises the first generation of only-children in China and, as such, has received both more attention and higher expectations than the two generations before them. Having benefited from the expansion of compulsory education and urbanization, many moved from small towns to work and settle in medium and large cities, striving to improve themselves. A majority of Gen Y (73%) are already married and have children.

Gen X (born between 1965 and 1979) is the generation of accumulated material wealth. Born in the early stages of social and economic reforms, this group became the backbone of China’s market economy. Of all the generations, they currently hold the highest positions in the workplace and have the highest levels of income.

Baby boomers (born between 1950 and 1964) were born during a period of relatively limited material resources. They have rich social and economic experience, a practical nature, and dedication to family and community. As China’s boomers move into retirement and a life of leisure, they have more free time to focus on themselves and explore new possibilities.

Our quantitative and qualitative research into the development and evolution of these consumer generations, as well as their attitudes, beliefs, and consumption behaviors, have given us two important insights.

Gen X and Gen Y will be the twin engines of consumption.

In the past few years, an obsession with youth has swept the Chinese consumer market. Many brands have rushed to focus on Gen Z, studying their needs, preferences, and behavior patterns to capitalize on opportunities for future brand development. However, from the perspective of population base and per-capita category consumption, Gen X and Gen Y will remain the main drivers of consumption for a considerable time to come. (See Exhibit 2.) While Gen X and Gen Y may not be as willing to try new things as Gen Z, they have a stronger willingness to consume and to trade up in various categories: they are more willing to pay a premium for a higher quality of life.

Different generations display clear distinctions in persona.

The evolution of China’s economy has led to different generations of consumers acquiring vastly different life experiences. This in turn has shaped their collective memories and value orientations, such that they do not exhibit the same consumer attitudes and preferences as their counterparts did at the same age. They spend differently and on different things. Not all generations equally value spending on luxury, professional services, medical aesthetics, or maintaining social status. Their ability to spend also varies significantly. How well businesses understand these differentiated preferences and spending capacities could determine their success in the coming years. (The full report includes detailed consumer profiles and underlying emotional needs for each generation.)

Looking to the Future

To win different consumer groups, companies need to understand them better. This entails taking on a lens of segmentation and identifying the values and behavioral patterns displayed by each generation. In particular, firms need to:

Acquire a balanced understanding of consumer groups. As China’s next consumer powerhouse, Gen Z has been and will remain a key focus, but firms should not overlook older generations—especially the large cohorts of Gen X and Gen Y with deep pockets. Firms also need to capture trade-up opportunities in markets driven primarily by older segments.

Distinguish between constants and variables across generations. Consumer preferences naturally change with trends and life stages, but each generation has their own unique attitudes, values, and traits that stick with them throughout life. Firms should identify which aspects of each generational profile are static and which are more fluid——in both short- and long-term horizons—to be able to successfully meet the needs and desires of each consumer group.

Mine segmented opportunities and expose growth potential in existing markets. Segmentation is more important than ever. Traits that stick throughout life for each generation imply great opportunities—for a particular generation. Consequently, it will be more difficult to rely on the success of single product. Firms should consider a portfolio targeted towards niche markets as a new growth driver.

The Chinese consumer story is one of resilience and growth. Our research captures the breadth and depth of consumer preferences in the market and the huge opportunity this presents. As difficulties stemming from the pandemic begin to dissipate, companies looking to succeed in China need to explore—and cater to—the many unique facets of its shifting generations.