It’s no secret that climate change is a tremendous threat to the future of the planet. The world needs to reach net-zero emissions by 2050 to meet the global temperature reductions outlined in the Paris Agreement. Happily, some progress is being made toward net zero on the business side, with about 33% of the world’s largest companies (and more than 50% of its countries) pledging to reach net zero between 2030 and 2050, and many more stating a clear desire to decrease their carbon footprint.

Yet, achieving this goal will be no small feat. A critical enabler will be going beyond the reduction of carbon emissions to the removal of existing carbon from the atmosphere. In line with the Science Based Targets initiative (SBTi)’s Net-Zero Corporate Standard created to combat greenwashing, while companies need to take rapid action to achieve long-term deep emissions cuts of 90% to 95%, they also need to neutralize any limited residual emissions that are not possible to cut—the final 5% to 10%—through carbon removal.

While carbon removal activity has been low historically, this needs to change. According to the latest report from the United Nations’ Intergovernmental Panel on Climate Change (IPCC), there is now only a 40% to 60% chance of limiting the global temperature rise to 1.5°C above pre-industrial levels by 2030. In addition to immediate and deep emissions cuts across all sectors, carbon removal at scale is essential in order to contain the likely overshoot and gradually bring emissions back down to 1.5°C by 2100. And the contribution of carbon removal initiatives across both engineered and nature-based solutions must increase to 10 gigatonnes of CO2 removed per year by 2050.

To finance carbon removal and avoidance, a growing number of companies are purchasing carbon credits in the voluntary carbon market (VCM). Organizations and individuals are able to purchase these credits via select growth-tech platforms to pay for “carbon offsetting”—the act of applying the credits against an internal accounting of carbon dioxide equivalent (CO2e) emissions to compensate for those emissions with the removal or avoidance of other CO2e emissions through activities such as reforestation, the reduction of methane emissions, and avoided deforestation. Some companies purchase carbon credits through the VCM but do not use them to offset emissions, instead using these purchases as a way to make a broader contribution to climate change mitigation. (See “What Are Carbon Credits?”)

What Are Carbon Credits?

Although avoidance credits (for external projects that avoid emissions production) currently account for about 80% of supply, our analysis projects that removal credits (for projects that lower existing emissions) will reach 35% by 2030.

When individual consumers purchase credits, they are likely to go through a technology partner owing to the lack of direct consumer access to carbon credit projects, capabilities, and resources. It is critical that these credits support high-quality climate projects, with each credit being equivalent to the impact of one additional ton of CO2e being permanently removed or mitigated from the atmosphere. Given the importance of trust and transparency in the market, all projects should also be scientifically reviewed by third parties, audited (with verified impact), and have a registry or tracking system for credits generated. In addition, there should be third-party assessments to verify factors such as permanence (how long the CO2 remains stored), leakage (when a company with strict regulations moves production to a company with more lenient regulations), and risk of reversal (re-release of stored carbon).

Examples of third parties that have created standards (such as guidance on measurement, reporting, and verification to assess the integrity and quality of carbon credits in the voluntary carbon market) include Gold Standard and Verra. Further, there are multistakeholder governance bodies, such as the Voluntary Carbon Markets Integrity Initiative (VCMI) and the Taskforce on Scaling Voluntary Carbon Markets (TSVCM), that were created to drive credible, net-zero-aligned participation in the voluntary carbon market.

Note that CO2e is a metric used for different types of greenhouse gas (GHG) emissions that allows us to compare them in terms of their impact on the climate. Methane, for example, has 25 to 80 times more impact on global warming than CO2 and thus generates 25 to 80 times the emissions that CO2 generates. When we discuss carbon in this publication, we are broadly referring to CO2e.

Given the magnitude of change that must happen for the world to get back to 1.5°C by 2100, all climate efforts are important right now. While governments and industry must take bold action, consumers must also act. Although what consumers have been doing to date, such as recycling, purchasing energy-efficient appliances, and reducing air travel, is helpful, it is not enough. Consumer adoption of carbon credits is a significant opportunity, and we are already starting to see seeds of momentum in the market. A recent survey by BCG found that once carbon credits were explained, 38% of a representative sample of US consumers were interested in purchasing credits in the near future.

Early Consumer Adoption Is Beginning but Greater Transparency Is Needed

To delve into the motivations and mindsets surrounding US consumers’ purchase of carbon credits, BCG worked with the climate technology company Patch to survey a full panel of 1,320 consumers. This group included a representative sample of the US population, current buyers of carbon credits, and potential buyers of carbon credits. (See “Our Methodology.”)

Our Methodology

This full panel included a representative sample of 503 US consumers, some of whom were actual or potential purchasers of carbon credits, and a second group of 817, surveyed to add more actual and potential purchasers of carbon credits to the study. The final survey total comprised 239 purchasers of carbon credits at some point in the past, 1,001 potential purchasers, and 80 people who had not purchased and said they had no plans to purchase. We further segmented the group of potential purchasers into three subsegments: 116 “potential early purchasers,” 188 “potential late purchasers,” and another 697 who might buy credits someday.

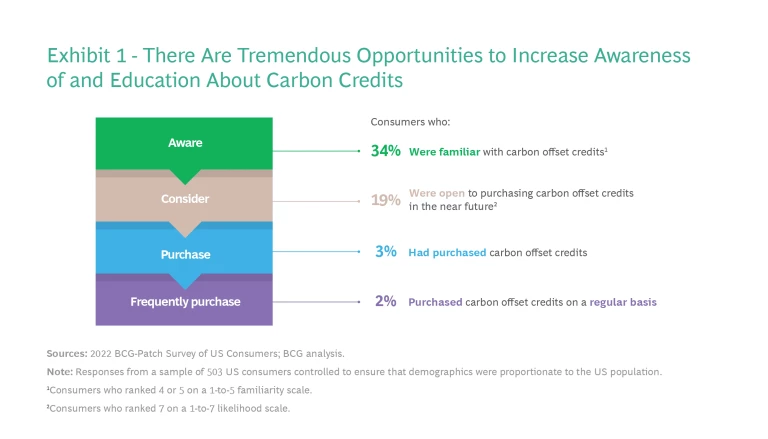

We found that 34% of respondents in the representative sample were familiar with carbon credits, 19% were open to purchasing credits within the next two years, 3% had purchased credits in the past, and 2% purchase credits on a regular basis. These findings suggest there is substantial room for growth in the voluntary market for carbon credits through increased consumer awareness. (See Exhibit 1.)

Relatively low adoption rates thus far could have a wide variety of causes. These include low consumer awareness of carbon credits, the perceived complexity of climate solutions, a poor understanding of the magnitude of action required to mitigate climate change—and the role of carbon credits in this effort—and a fear by businesses of disrupting existing consumer-purchasing flows.

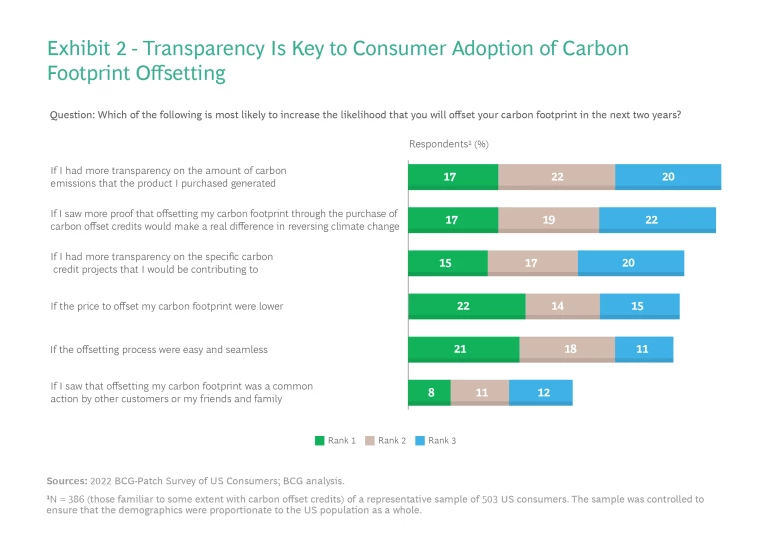

Transparency is key to increasing consumer adoption of carbon credits.

In addition, many consumers want more information. They are interested in learning about the carbon footprint of their everyday purchases, seeing evidence that carbon credits are an effective tool to mitigate these emissions, and obtaining details about the specific projects they would be supporting. In fact, with incidents of greenwashing and increasing scrutiny of the voluntary carbon credit market, it is more essential than ever that consumers have access to information regarding the projects they support—including the quality of these projects, often measured by their permanence; their traceability; and the prevention of emissions “leakage,” meaning any associated rise in emissions. Ultimately, factors such as transparency regarding the emissions impact of purchased items and related carbon projects would support greater consumer adoption of carbon credits. (See Exhibit 2.)

In contrast to the low adoption rates, consumer sentiment toward offsetting was significantly positive in our survey. Of respondents who were somewhat familiar with carbon credits (250 of those in our representative sample), 58% believed that carbon credits can encourage more sustainable behavior.

The Spectrum of Potential Purchasers Extends Beyond Early Adopters

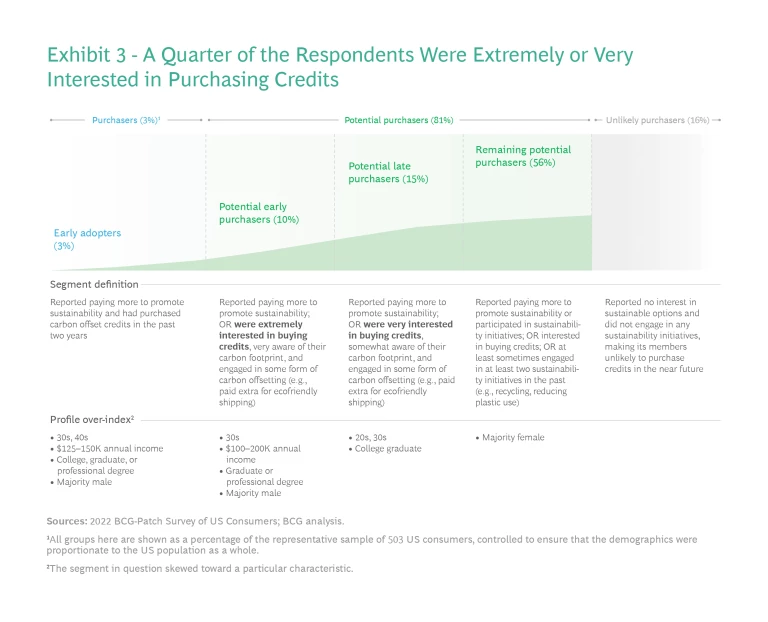

To develop a deeper understanding of consumer perception and adoption of carbon credits, we disaggregated our survey population into five distinct segments: early adopters, potential early purchasers, potential late purchasers, remaining potential purchasers, and those unlikely to purchase. (See Exhibit 3.)

Early Adopters (3% of the Representative Sample). We defined early adopters as US consumers who have bought carbon credits in the past two years. As a group, they said that they were willing to pay more for sustainable options, were familiar with different carbon projects, and would change their shopping behavior significantly—such as by switching to a new, similar brand—if they were offered the option of purchasing carbon credits to offset their purchase. Members of this group were largely urban, millennial, well-educated, tech-savvy males with higher incomes and greater awareness of their carbon footprint compared with other survey segments.

Note that once individuals have purchased credits, they tend to do so again, so many in this group were repeat purchasers.

Potential Early Purchasers (10%). This segment comprised consumers who had not yet purchased carbon credits but seemed likely to do so in the next two years. These respondents said they were willing to pay more for sustainable options, extremely interested in buying credits, and very aware of their carbon footprint. This group was demographically similar to the early-adopter segment.

While a lack of knowledge was the main barrier to purchasing for consumers in other segments, that was not generally the case for this group: 76% were aware that they could offset their carbon footprint, but almost half believed that companies, not consumers, should be responsible for decarbonizing. In addition, close to 40% of these respondents thought that companies should absorb the full cost of their carbon emissions. These findings indicate that creating transparency regarding corporate climate efforts already underway might persuade these consumers to take part as well.

Furthermore, potential early purchasers ranked transparency very highly, with a majority saying they would be more likely to buy credits if they had increased transparency regarding the specific carbon credit projects that they would be contributing to, greater transparency on the amount of carbon emissions generated by the product they purchased, or more proof that offsetting their carbon footprint through the purchase of carbon credits would make a real difference.

Potential Later Purchasers (15%). The members of this group were those who, while they had not yet purchased credits, said they were interested in buying credits and were willing to pay more for sustainable options. But they were generally less aware of their carbon footprint and the type of carbon credit projects available than the earlier two groups were—and less enthusiastic about purchasing credits. In terms of demographics, they were split 50/50 male and female, were 52% urban, and 56% had an advanced degree.

While 79% of potential later purchasers understood how carbon offsetting works, a smaller percentage (66%) were aware that they could offset their carbon footprint, with 58% ranking “more transparency on the specific carbon credit projects” in the top three ways to increase the likelihood that they would buy credits. Educating this segment could play a powerful role—more so than in the earlier, already well-informed groups.

Remaining Potential Purchasers (56%). The members of this segment indicated they were willing to pay more for sustainable options, had shown some interest in buying credits, or had acted on two sustainability initiatives, such as recycling. Only 20% of the remaining potential purchasers were familiar with carbon credits, but 49% were interested in them; when asked to identify the main barriers to purchasing them, 42% cited a lack of understanding of the credits and 30% indicated a lack of transparency on the impact of the credits. In terms of demographics, many were in their early 40s, females slightly outnumbered males, and most held college degrees. Educating these remaining potential purchasers about carbon credits could go a long way to increasing adoption among this segment.

Unlikely Purchasers (16%). The final group of respondents had not shown any interest in sustainable options or practiced sustainability initiatives, making the members unlikely to purchase credits. For the purposes of this report, we have not closely analyzed this group.

Consumers Are Open to Switching Brands if Offsetting Is Available

When asked to estimate the carbon intensity of different industries, many respondents (20%) said they consider airlines to be the most carbon intensive, while 16% pointed to car travel and 15% to power and utilities. In contrast, the fewest consumers (8%) ranked streaming and entertainment as the most carbon-intensive industry.

Regardless of whether these perceptions are correct, our survey found that these rankings were somewhat correlated to what consumers said about their willingness to switch brands if it meant they could offset their purchase. For example, once carbon credits were explained to them, 69% of the representative sample and 71% of the potential early-purchaser segment said that they would be likely or very likely to switch train operators if it meant they could offset their carbon emissions. Air travel and household goods were the other top categories in which consumers were willing to switch brands.

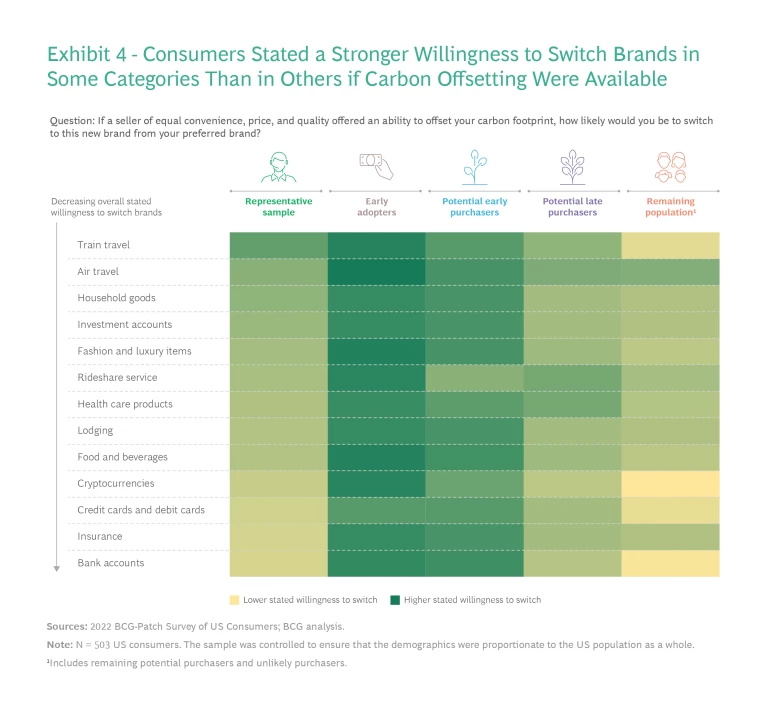

But we also note a general receptiveness to switching brands across nearly every category if consumers can offset their carbon emissions, particularly among respondents in the early-adopter and potential early-purchaser groups of the full panel. (See Exhibit 4.)

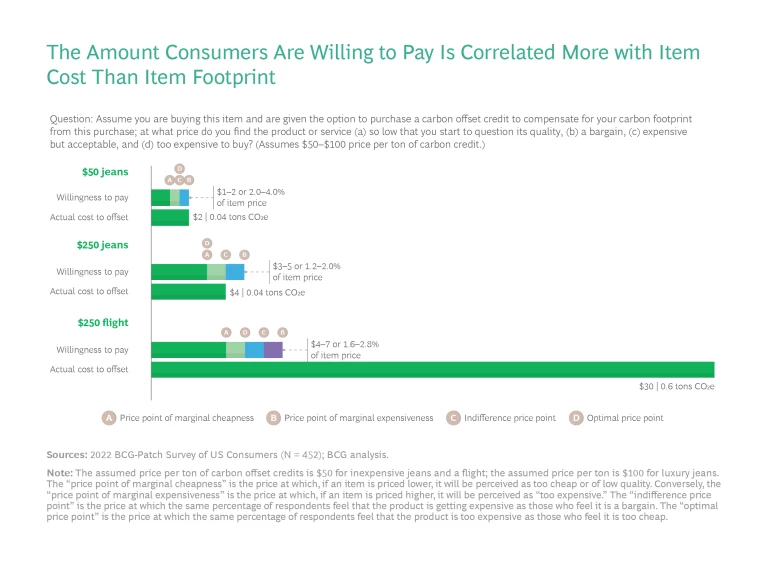

The Amount Consumers Are Willing to Pay Is Correlated More with Price Than Offset Cost

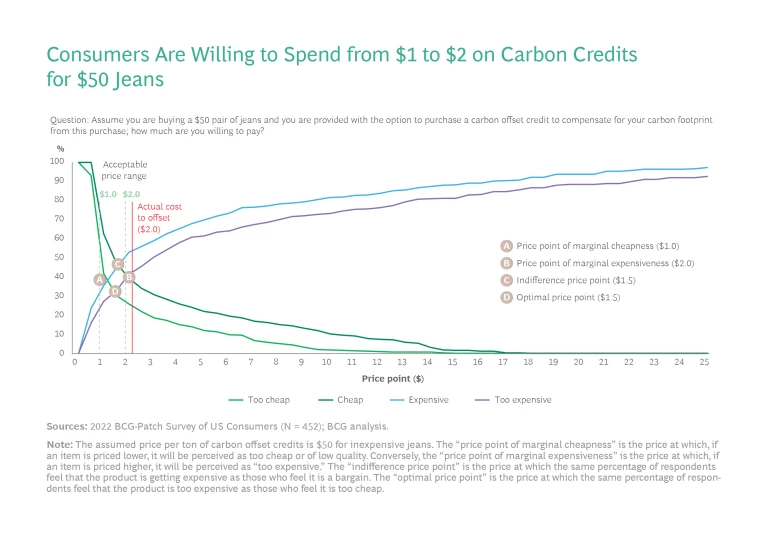

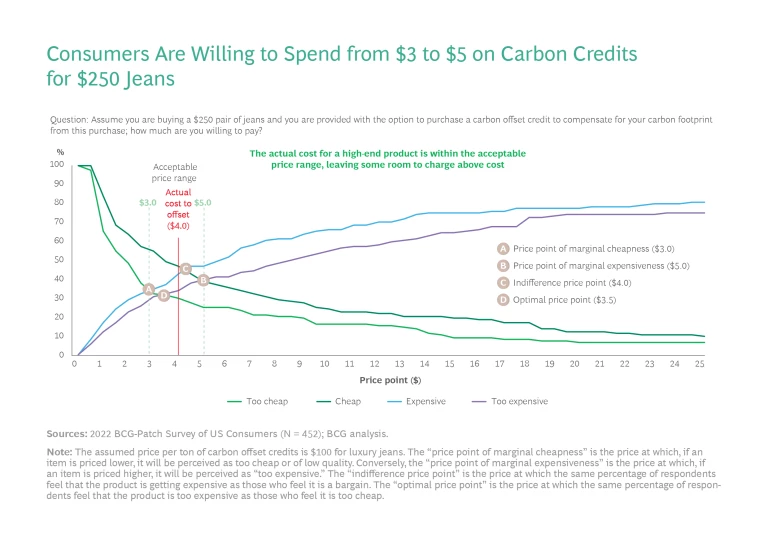

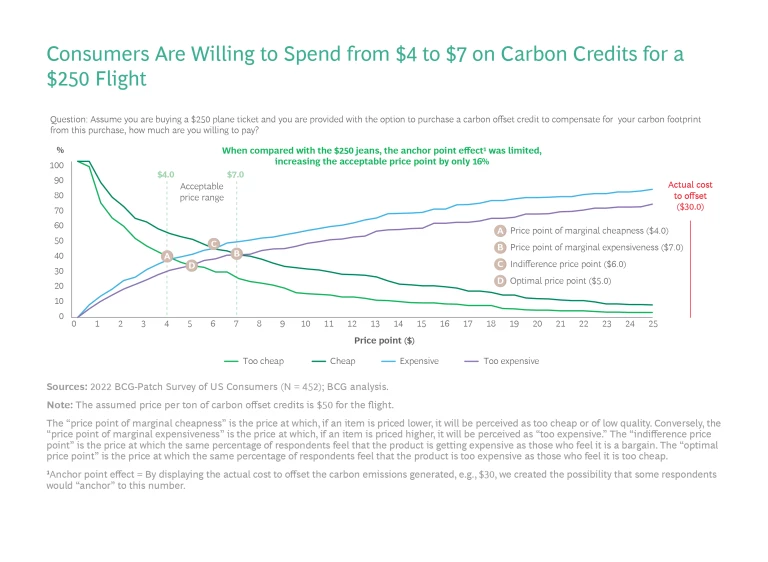

Within our survey, we conducted a Van Westendorp price-sensitivity analysis, a price-testing approach that measures how sensitive consumers are to price and derives the acceptable price range for a particular product by asking them to evaluate four price points. (See the slideshow.)

With the full survey panel, our analysis looked at consumer-pricing preferences for three different products—an everyday fashion item ($50 jeans), luxury item ($250 jeans), and travel service ($250 flight). We also provided respondents with the estimated cost to offset the carbon generated by each of the products with high-quality credits. We used the following assumptions regarding the price per ton of carbon credits: $50 for the inexpensive jeans, $100 for the expensive jeans, and $50 for the flight.

In the process, we discovered that consumer willingness to pay was not consistently driven by the actual cost to offset a given product’s carbon emissions. Across all price points and categories tested, the willingness to pay for carbon credits hovered around $1 to $7 for the average US consumer, showing a general threshold above which consumers seemed unwilling to contribute, irrespective of the purchase.

When we looked at the representative sample of 503 respondents, for instance, we saw that the average stated willingness to pay for carbon credits was largely proportionate to the actual cost to offset emissions for the jeans (up to 4% of the total cost). But for an airline flight, which had a much higher proportionate cost to offset its emissions (about 12% of the total product price), the stated consumer willingness to pay—although higher than for the jeans—was still well below the cost to offset. Clearly, some categories present more promising opportunities for consumer offsetting than others.

Perhaps unsurprisingly, we also found that the most engaged groups—early adopters and potential early purchasers—stated a considerably higher willingness to pay across products and product price points, sometimes as high as ten times that of the representative sample. While their interest in sustainability was clearly a factor, demographics (including more free income) may have helped as well.

Subscribe to receive the latest insights on Technology, Media, and Telecommunications.

In viewing the findings from a generational perspective, we note that millennials stated a considerably higher willingness than other generational segments to pay for carbon credits when purchasing everyday apparel, luxury apparel, and airfare.

Companies Must Bridge the Gap to Consumer Action

To accelerate consumer action with carbon offsetting, the carbon credit market needs the support of consumer-facing businesses. Even when consumers have the intention to help address climate change through carbon credits, they may not always act. This gap between intention and action is a well-known challenge in the climate sector.

Businesses can help by offering low-friction ways for consumers to access reputable credits in the purchasing journey. For example, companies can partner with third parties to provide an option to buy credits during or after the core purchasing journey. They should also enable consumers to choose which climate project to support from a specified list. We found in our study that this choice increased the likelihood that the consumer would buy credits by 23%. Offering choice will be fundamental to boosting adoption overall, particularly among potential later purchasers and remaining potential purchasers.

Further, we found that giving consumers a choice of projects had an added benefit: for 73% of the respondents in our representative panel, the ability to select the carbon credit project at checkout had a positive impact on the perceived trustworthiness of the company providing the option.

Businesses could create even more seamless ways for consumers to contribute to climate action by offering an auto-payment option; in fact, 70% to 80% of purchasers and potential early purchasers in our study said they would agree to having an auto-payment setting to offset carbon at checkout.

Companies should also provide education and transparency. They must be as clear as possible about the nature of the projects being supported, the process for supporting them, and the amount of carbon mitigated—for example, by showing each purchase’s carbon footprint at checkout—because this can be a meaningful step toward turning consumers into carbon credit purchasers. Furthermore, giving consumers information about the geographic area of impact may help tip the scales in favor of purchasing; our study found that consumers were more likely to say they were willing to purchase credits when they learned that the project was in close proximity to their community.

As the global effort to mitigate climate change accelerates, carbon credits are a crucial tool to help put us on a path to rebalancing the planet.

As these businesses enable consumer climate action, it is also critical that they employ science-based strategies to mitigate greenwashing and other risks. There are already high-profile examples of companies being criticized, and sometimes sued, over inaccurate claims that overstated climate impact. If companies do not employ high-integrity strategies, there is a second-order risk of creating a “moral hazard” whereby consumers do not believe they have impact and therefore take no action to mitigate emissions. Businesses will need to address this and other important questions, such as how to educate consumers sufficiently about the impact and integrity of carbon projects, whether to predetermine project selection in order to ensure the integrity of carbon credits, and if a business should offer consumers an opportunity to contribute to climate action projects without an associated “offset” in the company’s carbon accounting.

Finally, organizations should act as role models and give consumers the confidence that their businesses are walking the walk, not just talking the talk. Companies need to contribute to climate action alongside their customers, particularly given that so many potential early purchasers believe that companies should be the party responsible for absorbing the full cost of their carbon emissions. Such actions will bolster organizations’ trustworthiness and increase the likelihood that their consumers will purchase credits.

As the global effort to mitigate climate change accelerates, both companies and consumers have a responsibility to act. An essential tool that sits at the intersection of corporate and consumer action is the carbon credit. Although gaining individual consumer engagement on any topic is tricky, the positive consumer sentiment seen in our survey, the broad interest in purchasing credits once they are understood, and the myriad ways in which companies can support and sustain this growing market all indicate high potential to accelerate consumer adoption of carbon credits in the future.

It’s time for consumers to not only learn more about climate change and the role of carbon credits but also take action through carbon offsetting. Similarly, businesses have a responsibility to enable ways for consumers to offset purchase emissions seamlessly and provide transparency regarding the carbon footprints created and proof of carbon project impact. Once consumer adoption has been fully catalyzed, carbon credits will be primed to join other key mitigation efforts in putting the world on track to net zero.

The authors thank their colleagues Joe Vasquez, Amir Goldberg, and Kevin Zhang for their invaluable contributions to the research, analysis, and writing of this article.