Climate technologies—technologies that accelerate decarbonization—are essential to limiting global warming. Despite the many attractive opportunities for investing in clean tech, global investments continue to fall

But we do not have 20 to 30 years.

To reduce emissions and avoid the worst impacts of climate change, we need to spend $3.5 trillion every year on climate technologies. Starting now. Public and philanthropic funding alone cannot fill this giant gap. But public and philanthropic funding combined with market-shaping mechanisms designed to accelerate the development and scaling of climate technologies can. (See “Executive Summary.”)

EXECUTIVE SUMMARY

- To achieve global net zero by 2050, the global community must invest $3.5 trillion per year in emerging climate technologies, such as green hydrogen, clean steel, and long-duration energy storage.

- Emerging climate technologies often require significant amounts of capital with uncertain returns. Market-shaping mechanisms—such as innovative financing, climate-friendly legislation, and industry coalitions—reduce the investment risk.

- All companies, regardless of size or climate maturity, can play a role in creating a market for emerging climate technologies.

- To define their role in shaping the market and accelerating deployment of climate tech solutions, leaders should ask:

- What can my company do now? Define your decarbonization strategy; set tangible, actionable net-zero targets (rather than mere ambitions) and transition plans; issue advance market commitments, especially when you cannot act alone; and set sustainable financing commitments.

- What can my company do with industry partners now? Execute offtake agreements and volume guarantees, pool procurement of climate technologies, and join industry coalitions.

- What should I advocate for? Advocate for just transition incentives, support permitting reform, and engage with the public sector to steer future policy.

The Power of Market Shaping

Market shaping is a strategy used by companies, governments, and investors to address market failures and positively shape the development of a market. By coordinating actions with other stakeholders, organizations can address the bottlenecks and breakdowns that occur within a diverse ecosystem, distribute risk, and leverage purchasing power. In the case of climate technologies, market shaping has the potential to dramatically speed up the green revolution.

Consider this. The global equity market cap is $120 trillion, and the global fixed-income market is another $120 trillion. By leveraging innovative market-shaping mechanisms, this huge pool of private capital that would otherwise go to less impactful investments can instead be directed into climate action. Private capital can be used to advance novel technologies faster, scale up proven solutions, and support adaptation and resilience to improve the lives of billions.

A decade ago, we saw the power of market-shaping mechanisms in global health when governments and philanthropists committed $1.5 billion to GAVI, the Vaccine Alliance. This landmark public-private partnership accelerated development and production of pneumococcal vaccines by at least five years, saving over half a million lives.

Public and philanthropic funding combined with market-shaping mechanisms are key to avoiding the worst impacts of climate change.

The same sense of urgency and investment are needed to address the defining challenge of our time: climate change. Market-shaping activities are most effective when multiple players have a stake in the outcome, but limited incentives to act individually. Climate technology producers face uncertainties around the potential demand and willingness to pay for their products, while climate technology buyers can be reluctant to make long-term purchase commitments. Market-shaping mechanisms play a crucial role in creating the collective incentive for players across the climate technology value chain by derisking both demand-side and supply-side factors and encouraging economies of scale.

We know what happens if we don’t invest aggressively in climate technologies. Recent models show that if we had invested $5 billion into solar in 1985, solar would have scaled—and started displacing carbon-intensive power eight years

The Challenges of Scaling Climate Technologies

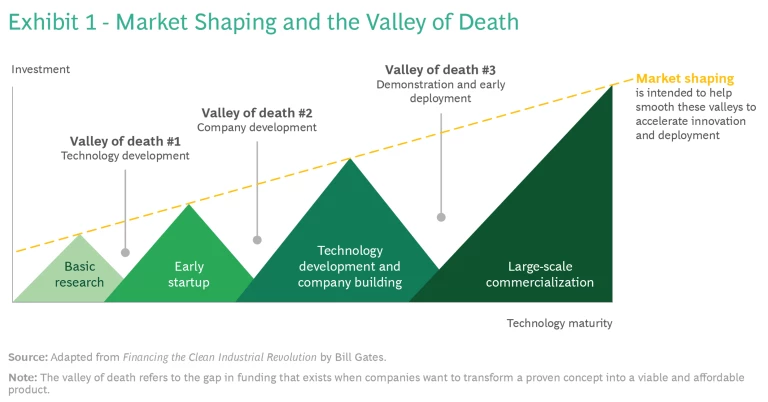

Strategic investments in climate technologies, combined with market-shaping activities, can accelerate the development and deployment of critical climate technologies. The aim of market shaping is to ensure high-potential technologies can successfully cross the so-called valley of death—the gap in funding that exists when companies want to transform a proven concept into a viable and affordable product. (See Exhibit 1.)

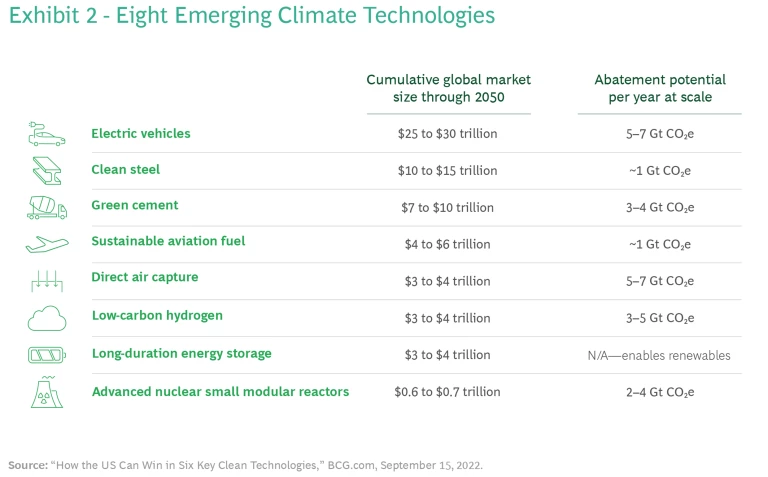

We have identified eight emerging technologies (beyond solar and wind) that, with the help of market shaping, can get us to net zero: electric vehicles, clean steel, green cement, sustainable aviation fuel, direct air capture, low-carbon hydrogen, long-duration energy storage, and advanced nuclear small-modular reactors. (See Exhibit 2.)

At maturity, and if adopted at scale, these technologies could collectively enable about 22 gigatonnes per year in global emissions abatement and fuel a cumulative global market size of $45 to $60 trillion through 2050.

But these emerging climate technologies will not achieve widespread adoption until we remove the following barriers:

- Unattractive Risk-Return Profile for Institutional Investors. Without proper incentives, organizations can be reluctant to invest in unproven technologies under development given the risk that the technologies may fail.

- Unproven Markets. When introducing a new product, companies must prove that it’s safe, reliable, affordable, and scalable—and prove to investors it is commercially viable to raise capital.

- Subscale Investments for Projects. Even promising projects can languish for years in the valley of death as they seek additional funding from governments and other sources to scale up.

- Insufficient Value Proposition for Corporate Buyers. Some climate technologies will come at a cost premium as they scale without additional functional benefits; companies must be willing to pay that differential.

The good news is that these barriers can be overcome with deliberate actions. In the US, for example, the 2022 Inflation Reduction Act provides both production and investment tax incentives for key climate technologies, including incentives to ramp up carbon-capture facilities and boost green hydrogen production. The goal is to improve the overall risk-return profile and spur investments in the innovative technologies most needed to meet net-zero goals. These incentives have spurred action not just in the US but globally, with many major economies developing similar plans to support the market for climate technologies. Market-shaping mechanisms like these can dramatically shift the economic viability of green energy and climate technology.

How to Drive New Forms of Investment

Companies and investors are experimenting with new mechanisms to accelerate the development and scaling of climate technologies. Here are some of the most promising ones being used today.

Mobilize capital through innovative finance and send clear demand signals. Companies can accelerate the development and deployment of climate technologies by mobilizing capital through a variety of mechanisms, including advance market commitments, concessional capital, offtake agreements, volume guarantees, and coalitions. These mechanisms not only provide alternative funding sources beyond institutional investors to help companies cross the valley of death but also support mitigation beyond companies’ value chains and help address some of the imbalance that exists today between net zero targets and available offset mechanisms.

- Advance Market Commitments (AMCs). With AMCs, a pool of money is allocated to purchase large quantities of a product at established prices, which incentivizes large-scale development and deployment at an affordable price.

- Example: Frontier Climate has committed $925 million to fund the development of carbon removal technologies between 2022 and 2030. Frontier’s AMCs send a strong demand signal without favoring any particular technology. Similarly, the Carbon Removal Alliance, an industry group of 20-plus members, is working to advance policies that support permanent carbon removal technologies.

- Concessional Capital. Concessional capital aims to benefit the greater good and catalyze additional third-party investment, making it a more patient and risk-tolerant investment.

- Example: Breakthrough Energy Catalyst has raised over $1.5 billion of concessional capital from philanthropies, governments, and companies to support large-scale demonstrations of critical climate technologies.

- Offtakes, Volume Guarantees, and Pooled Procurement. These mechanisms deploy capital when a technology is available for purchase, reducing the financial risk companies face when scaling up production. Offtakes and volume guarantees can be purchased in conjunction with other companies (using a mechanism called pooled procurement), allowing buyers to gain purchasing power and secure supply.

- Example: The Clean Energy Buyers Association deploys clean energy and tracks utility-scale deals in the procurement of renewables, where the deals serve as customer-led volume guarantees for renewables providers.

- Coalitions can send a clear signal that market demand exists for climate technologies.

- Example: As part of First Movers Coalition, 50+ companies committed to decarbonizing seven hard-to-abate industrial sectors by purchasing clean energy technologies. This includes advance purchasing a portion of materials and transportation needed from suppliers using near-zero or zero-carbon solutions.

Advocate for and implement beneficial policy mechanisms. Companies can also work with governments and regulators to spur investment in promising technologies so they can scale up and become more affordable, which in turn incentivizes financial institutions and buyers to invest in the technology. Here are just a few examples:

- Permitting. Permitting and reviews can be a hurdle that slows deployment of many climate technologies. The direct and indirect costs of permitting can account for 30% of residential solar installation costs and the average wait time for installation has doubled from 2005 to 2020.

- Incentives. In the United States, the 2022 Inflation Reduction Act implemented an $85 per ton credit for permanent geological sequestration of CO2 and a 60% investment tax credit for new solar projects, among many others.

- Climate Auctions. More than 100 countries are using auction-based approaches to subsidize renewable energy, and many have achieved renewable energy prices that are lower than traditional power sources.

- Feed-in Tariffs. With agreement from the regulator, in 2013, Dominion Energy created a feed-in tariff for residential and commercial solar photovoltaic generators in the United States. Participants receive 15 cents per kilowatt hour for all solar photovoltaic-generated electricity provided to the grid, which has helped bring 2,200 megawatts of solar into operation in ten states—enough energy to power about 550,000 homes at peak output.

Investment is flowing. In 2021, venture capital and private equity in climate technologies exceeded $50 billion, and in 2022, the US Inflation Reduction Act devoted approximately $400 billion in funding to accelerate climate tech. Now is the time for corporations and financial institutions to execute market-shaping activities to further legitimize markets, advance climate technologies toward large-scale commercialization, and gain benefits and competitive advantage in the process.

Stay ahead with BCG insights on climate change and sustainability

Next Steps for Developing a Market-Shaping Strategy

Every organization can take steps to dramatically accelerate adoption of climate technologies within and beyond their value chain.

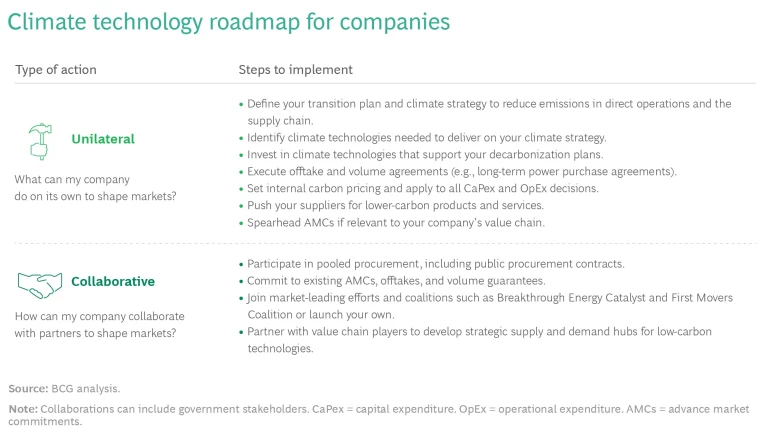

For companies and financial institutions that wish to participate in market shaping and reap its benefits, there are a range of options to consider. For example, companies can reduce carbon emissions throughout their value chain, work with industry partners to increase the scale of existing initiatives, spearhead market-shaping initiatives, and advocate for policies that are favorable to climate technology adoption.

Market shaping is a win-win for companies, allowing them to secure supply, meet climate goals, and increase internal know-how on essential technologies.

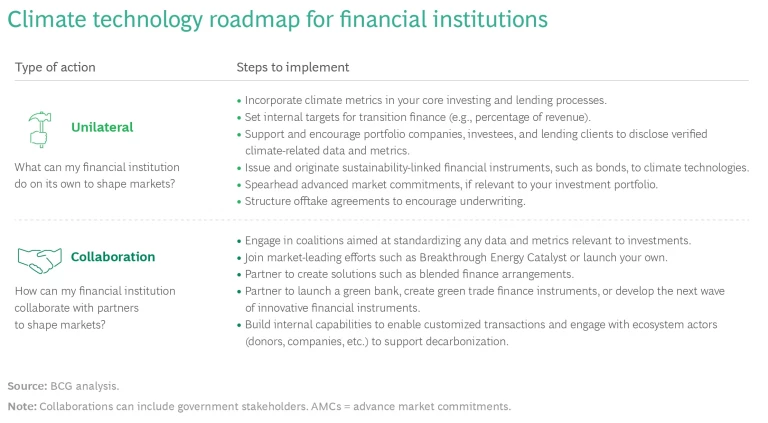

Financial institutions can incorporate climate metrics into their investment strategy, encourage portfolio companies to disclose climate data, launch sustainability-linked instruments, and join market-leading efforts to fund commercial-scale green technologies. While financial institutions are facing scrutiny around climate initiatives, the benefits of climate investments will continue to grow over time, creating a singular opportunity to shape the market.

The slideshow lays out the most important actions companies and financial institutions can take now to shape the market for emerging climate technologies and speed progress toward global decarbonization.

If we want to achieve global net zero, we can’t allow climate technologies to evolve at their current pace. They will take far too long to scale. To move the market faster, we need to encourage new ways of investing.

Market shaping is a win-win for companies, allowing them to secure supply, meet climate goals, and increase internal know-how on essential technologies. By aligning private capital, public capital, and public policy, market shaping can play a key role in ensuring climate technologies gain the traction they need to scale—and ultimately transform our world.

The authors thank BCG’s Connor Sendel and Habib Azarabadi for their contributions to this article.