This article is part of a series on BCG’s Inaugural New Zealand Megatrends. It outlines the growth in one of the megatrends – the green economy – and the opportunity for New Zealand to become a leader in five areas: eco-tourism, sustainable construction, low-carbon energy system, sustainable food production, and green consumer products. The article also builds on the perspectives shared in The Ten Actions to Accelerate New Zealand Towards Net Zero .

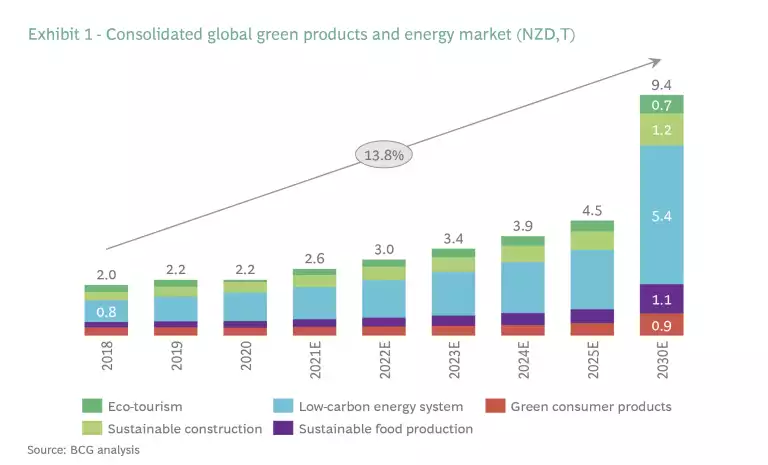

BCG predicts the value of the global green economy will reach NZD$9.4 trillion by 2030 (see Exhibit 1). This presents one of the largest economic opportunities in decades for New Zealand given the country’s 100% Pure brand, pristine natural environment, abundant renewable energy resources, and sustainability-minded society.

To realise these economic opportunities, while preserving and enhancing New Zealand’s natural environment and mitigating the impact of climate change, BCG has explored five fast- growing opportunities for New Zealand’s green economy:

- Eco-tourism: Delivering tourism through more environmentally sustainable travel, business practices, and tourism experiences.

- Sustainable construction: Developing more sustainable homes, buildings, and infrastructure, including leveraging the country’s strong position in biogenic building materials.

- Low carbon energy system: Capitalising on New Zealand’s highly renewable electricity system to attract low-carbon industry and enable the net zero transition through electrification of transport, heat, and industrial processes.

- Sustainable food production: Producing world-leading natural and sustainable food through premium product development, aggressive investment in R&D to reduce agricultural emissions, and adoption of best practice technologies to improve productivity.

- Green consumer products: Developing premium retail products with lower environmental impact, transparent supply chains enabled by digitisation, and clear sustainability metrics to attract a growing segment of customers that value sustainability.

1. Eco-tourism

Tourism is a vital part of New Zealand’s economy. Domestic tourism expenditure has remained relatively stable at $25 billion per year from pre-COVID levels to current levels in the year ended March 2023.

As New Zealand emerges from the pandemic, eco-tourism is an opportunity to reinvigorate the tourism sector and the 100% Pure New Zealand brand. According to Tourism New Zealand data, people actively considering travel to New Zealand score the country highly on its pristine landscapes and scenery, and connection to the land relative to other destinations.

Two global trends are changing the nature of tourism

Rise in eco-tourism: Consumer awareness of the environmental footprint of their travel is on the rise, with 81% of travellers stating that sustainable travel is important.

Demand for premium travel: Consumers are looking for more premium travel experiences. The average spend per traveller in New Zealand grew by 18% in the last three years.

The global eco-tourism industry is forecast to grow to NZD$700 billion by 2030,

New Zealand can harness the rise in eco-tourism

Support sustainable air travel for international visitors to New Zealand: For most international travellers, New Zealand is a remote destination which is a potential threat to the tourism industry as concerns over the carbon footprint of air miles rise. In the future, potential visitors to New Zealand may choose a destination closer to home if air travel to the country is not sustainable. Anticipating this changing consumer preference, Air New Zealand has committed to at least 10% sustainable aviation fuel by 2030 and has set a target for net zero emissions by 2050.

Drive low environmental footprint tourism within New Zealand: While improving sustainable travel to New Zealand is vital, it is also important to ensure tourism within the country becomes more sustainable. Low-emissions domestic transport options include e-bike rentals, electric hire car hires, electric buses, electric trains, and sustainable domestic flights. Sustainable accommodation and environmentally friendly tourist experiences are also important. A number of initiatives are underway, such as Waka Kotahi, New Zealand’s leading transport agency, facilitating a nationwide network of fast charging stations for electric vehicles every 75 km along state highways.

Make the most of New Zealand’s natural environment: Natural attractions are one of the primary reasons tourists visit New Zealand, and while consumers are becoming more environmentally conscious, they are also looking for more premium eco-tourism services and experiences – and they are willing to pay more for them. International visitors to New Zealand are generally enchanted by its natural beauty, and there is an opportunity to consider how this can be further leveraged to reinvigorate the tourism industry.

2. Sustainable Construction

Construction is a major part of New Zealand’s economy, contributing NZD$21 billion (7% of GDP) in 2019 and employing 275,000 workers (10% of the workforce).

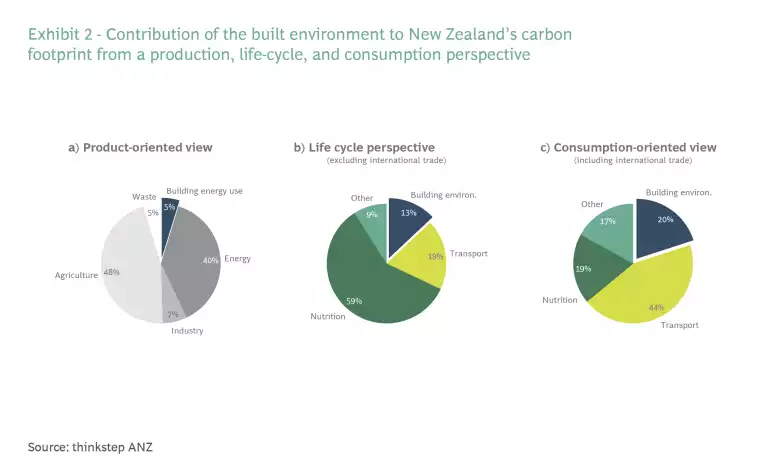

Despite this, the built environment still accounts for around 13% of New Zealand’s emissions when the full lifecycle of built materials is factored in (from raw materials to operations, such as energy consumption)

Two trends are driving the shift to sustainable construction

Consumer awareness of the environmental impact of the built environment: More consumers are conscious that building materials such as steel or concrete often contain embedded emissions, which leads them to consider procuring and using lower carbon options or alternatives such as wood. Government and commercial entities are also becoming increasingly aware of their scope three emissions – these are an entity’s indirect emissions that result from procuring goods and services.

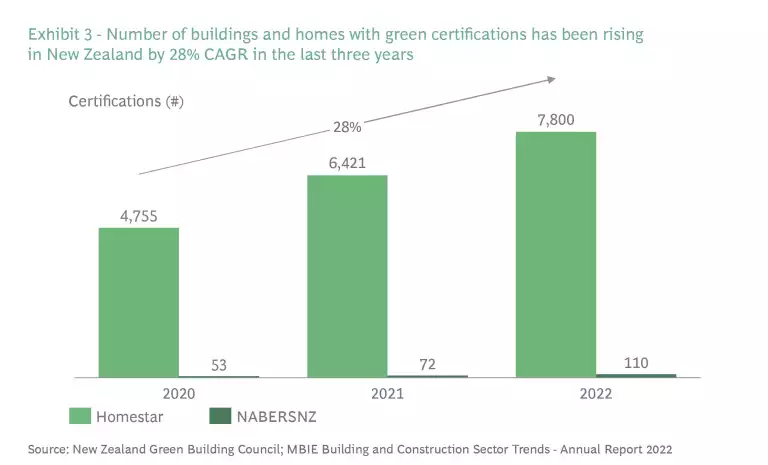

Sustainable construction policies and standards: Regulations in New Zealand and around the world are being updated to drive more sustainable construction. For example, the New Zealand government has introduced minimum healthy home standards for all rental homes, which include insulation and stopping wind draughts to improve energy efficiency. The government and the construction sector are also driving direct change by developing green building standards that set benchmarks for sustainable housing and buildings. The New Zealand Green Building Council has introduced Greenstar building standards and Homestar housing standards, and administers the government-backed NABERSNZ energy efficiency rating system for commercial buildings.

New Zealand’s construction sector can unlock significant opportunities in the green economy

Embrace circular economy opportunities within the construction industry. Using waste materials in construction will reduce the carbon footprint of building materials and construction waste. For example, Golden Bay Cement is using a circular economy solution that reduces coal consumption by using waste tyres and wood to develop a new cement product. The new product reduces waste and reduces the embedded emissions of cement by 27%.

Design homes and buildings with lower environmental footprints. Homes and buildings have both embedded and operational environmental footprints. The embedded footprint comes from the carbon and environmental impact of the materials used (e.g., cement, steel, aluminium) during building, and the operational footprint refers to the energy and water consumed inside the buildings once completed. Homes and buildings that use wood and lower carbon materials will have a lower embedded footprint. New Zealand can reduce the operational footprint of homes and buildings through improved energy efficiency and solar and batteries. For example, Fletcher Living recently introduced a Low Carbon 1.5°C Homes Pilot, with solar panels, high levels of insulation, and efficient heating and cooling that can reduce the operational carbon emissions of a home by up to 85%.

Make economically viable energy efficiency upgrades to existing New Zealand homes and buildings. Between now and 2050, new homes and buildings will make up ~40% of New Zealand’s building stock.

Increased adoption of industry standards for greener construction. The number of green homes in New Zealand is on the rise (see Exhibit 3), and an evolution to more environmentally focussed building standards will continue to reduce both the embedded and operational footprint of homes and buildings. However, the adoption of these standards are still below the levels required to release the full potential of sustainable construction in New Zealand. The sector and Government have the opportunity to work together to increase the adoption of these programs.

3. Low-Carbon Energy System

A low-carbon energy system presents a very large opportunity for New Zealand to attract low-carbon industries and enable the net zero transition through the electrification of transport, heat and industrial processes. Energy has the potential to play a significant role in our decarbonisation targets, as it represents 40% of national emissions and 70% of net zero carbon target emissions, which exlcude biogenic methane.

New Zealand is already a world leader in renewable energy, with 80-85% of electricity coming from renewable sources. Due to the country’s abundant renewable resources, BCG forecasts New Zealand can cost-effectively achieve 98% renewable electricity by 2030. The installed capacity of renewable electricity will also need to increase as transport and heat electrification drive new demand growth.

Three trends are shaping the energy sector in New Zealand

The drive to reduce energy emissions globally and in New Zealand. Energy is the largest source of emissions globally. As a result, countries are placing a lot of focus on the energy transition. For example, the recently signed Inflation Reduction Act in the United States commits ~NZD$600 billion of investment to clean technology over the next 10 years.

Improving clean energy technology and cost reductions. Global investment has driven down clean energy technology costs. Between 2010 and 2020 the cost of wind fell by 65% while the cost of solar fell by 90%.

Government policies to incentivise emissions reduction. New Zealand policies like the Emissions Trading Scheme, Clean Car Discount, Clean Car Standard, and the Government Investment to Decarbonise Industry Fund are all starting to strongly incentivise energy emissions reduction. Since the introduction of the clean car discount the uptake of electric and hybrid vehicles have increased by five times.

The energy sector can help New Zealand to rapidly decarbonise and attract new industry

Accelerate the development of renewable energy. The sector has already made significant progress towards increased renewable generation and is expected to exceed 90% renewable by 2025. However, to achieve the 4.8 GW of new generation needed by 2030, a significant ramp-up in delivery is required.

Electrify transport, process heat and industrial processes. Enabling rapid electrification of transport and heating, powered by renewable electricity, can reduce New Zealand’s emissions by 18.4 Mt CO2-e per year by 2050.

Develop a new low-carbon industry in New Zealand. Growing corporate preference for 100% renewable electricity presents an opportunity to leverage New Zealand’s highly renewable electricity system to facilitate a low-carbon energy- intensive industry. Green data centres present an opportunity for New Zealand to improve data security through onshore data storage, and potentially export data services export to Asia. This could also enable greater growth in New Zealand’s digital economy by attracting leading global technology companies to the country. Efforts are already being made to unlock this industry, with two prominent examples. Microsoft has announced three new carbon-neutral data centres in New Zealand.

4. Sustainable food production

Agriculture and food production is critical to the New Zealand economy, providing ~NZ$40 billion in annual exports (67% of goods exports and 47% of total exports).

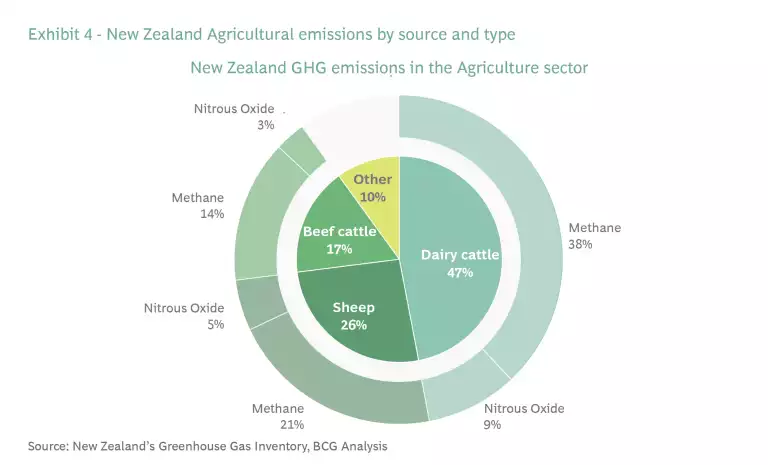

However, agriculture also contributes 48% of New Zealand’s gross greenhouse emissions, dominated by the production of animal products from dairy, sheep, and beef, as outlined in exhibit 4.

To continue growing its agricultural sector, New Zealand will need to increase the use of sustainable farming practices to produce sustainable food. Sustainable food is produced, processed, and distributed in a way that minimises harm to the environment and supports the well-being of communities and animals. Sustainable farming is important, as 89% of New Zealand’s exporters believe that New Zealand’s Pure brand image is important to their business, including in the agricultural sector.

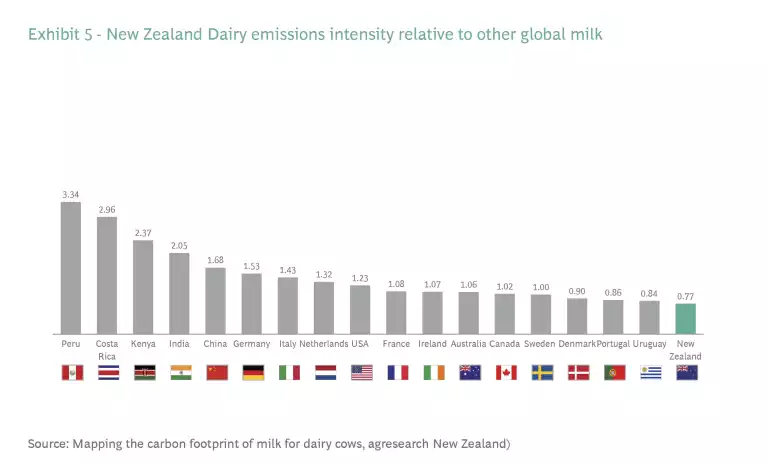

The opportunity is even larger, as New Zealand is well- positioned to lead the sustainable agriculture and food sector globally. Already, New Zealand's agricultural products are some of the lowest carbon and most environmentally friendly in the world. For example, the carbon footprint per unit of milk production in New Zealand is the lowest in the world and roughly half the global average, as outlined in exhibit 5.

New Zealand’s food industry is being affected by four trends

More demand for premium food: Demand is increasing for premium agricultural products that are natural and environmentally friendly. According to a 2020 survey by the International Food Information Council, 62% of consumers are willing to pay a premium for sustainably grown or produced food products.

Decrease in agri-tech costs and rapid adoption of advanced agriculture systems: Advances in agricultural technology are driving greater resource efficiency and production yields. Vertical farming can improve yields per hectare by 10-20 times

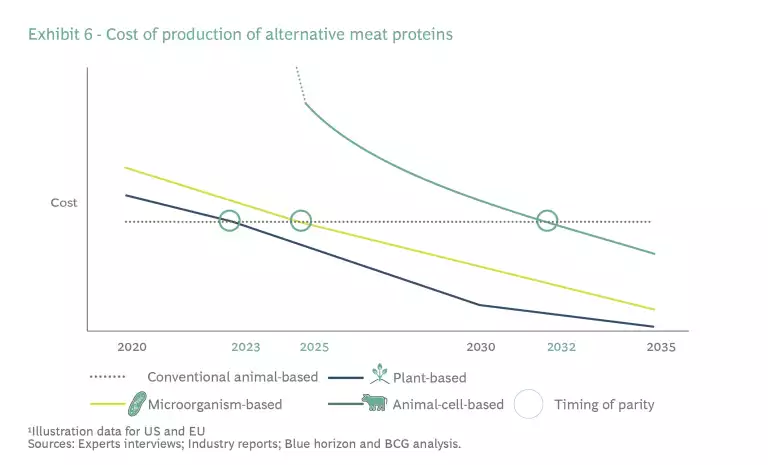

Rise in alternative proteins and alternative milk. Alternative proteins are a potential challenge to the meat and dairy industry given their environmental and animal welfare outcomes. Exhibit 6 outlines that alternative meat protein consumption is expected to grow at 15% per year to 2035 as the cost decreases,

Policy and regulatory efforts to reduce agriculture’s environmental impact: The New Zealand Government has committed to reducing biogenic methane emissions by 10% by 2030 compared to 2017 levels, and by 24-47% by 2050.

New Zealand can lead the world in sustainable agriculture

- Capitalise on the premiumisation of food by producing leading natural and sustainable products: Producers will need to improve the sustainability of existing products and expand into new product categories. Existing products can become ‘more premium’ with greater supply chain transparency, ethical sourcing, and certifications and trademarks. For instance, Lewis Road Creamery produces single-breed, organic dairy products for New Zealanders and for export.

37 37 Lewis Road Creamery, 2019, “First single breed standard milk launched by Lewis Road Creamery” The farms are independently certified under the 10 Star Certified Values program which stipulates strict environmental, animal, and human welfare requirements.38 38 Lewis Road Creamery, 2021, “Lewis Rd Creamery owner to get loan discounts for hitting environmental farming targets” - Aggressively invest in R&D to reduce agricultural emissions: New Zealand has a pasture-based farming system which differs from many other farming systems that rear animals on grains in barns. It is likely to be easier for grain-based farming systems to reduce emissions as methane inhibitors can be added to grain feed more easily than to grass. As a result, New Zealand will need to lead the way in R&D for methane-reducing technologies in a pasture-based farming system. With over 90% of emissions being ‘hard-to-abate’ in the agricultural sector, partnering with peer organisations and the government will be critical to unlock technological progress. For example, the Government is investing NZ$339 million to accelerate technological development through the new Centre for Climate Action on Agricultural Emissions.

39 39 NZ Ministry for Primary Industries, Centre for Climate Action on Agricultural Emissions The Centre is set up as a public-private partnership, with the Government working alongside agri-business leaders ANZCO Foods, Fonterra, Rabobank, Ravensdown, Silver Fern Farms, and Synlait to advance methane-reducing technologies like feedstock additives, methane vaccines, and methane inhibitors. Technologies are already showing early signs of promise. For example, Fonterra is trialing developed KowbuchaTM, a set of probiotics in a trial that could reduce biogenic methane emissions in cows by 20%.40 40 Reuters, 2022, “On New Zealand farm, scientists reduce cow burps to save the world” - Reduce environmental impact and improve productivity by adopting emerging technologies and best practices. Adopting agri-tech and regenerative agricultural techniques can reduce farm environmental impact whilst improving productivity. For instance, precision agriculture methods such as smart water management systems can reduce water required for irrigation by ~20% while minimising soil erosion and reducing the risk of disease. Precision agriculture methods that employ advanced geoanalytics can enable more targeted use of fertiliser, reducing emissions and improving soil health. New Zealand companies are already adopting new technologies, with Synlait and Open Country Dairy operating New Zealand’s first large-scale electrode boilers to process milk and clean production lines.

41 41 Synlait, 2019, “Synlait has switched on New Zealand’s first large-scale electrode boiler”

5. Green Consumer Products

The retail sector is a significant part of the New Zealand economy, with over NZ$112 billion in revenue, and employing 220,000 New Zealanders (9% of New Zealand’s workforce). However, retail goods have a significant environmental impact, representing 40% of global plastic usage and more than 25% of global emissions, when accounting for whole-of- life environmental impacts.

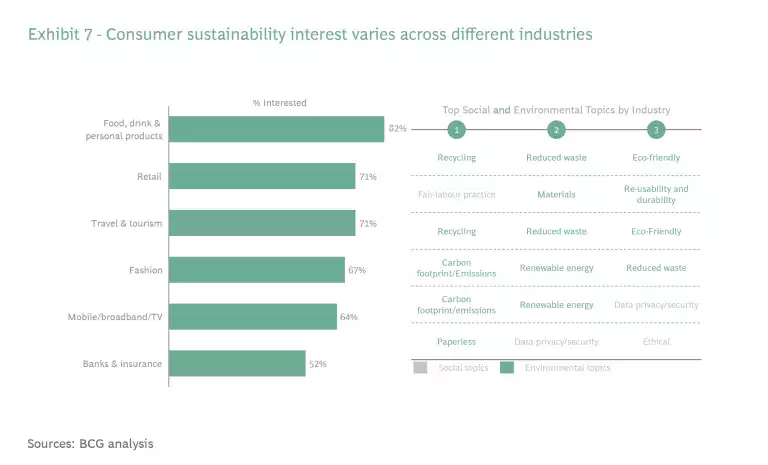

Green consumer products are those which are designed, manufactured, and marketed in a way that minimises environmental impact. Up to 80% of consumers think about sustainability in their day-to-day purchases,

Three trends are driving the growth of green consumer products:

- Personalisation as ‘table-stakes’ and a drive for products to reflect consumer value: Consumers increasingly want products to reflect their individuality, including their environmental and social sustainability values. 72% of consumers want brands and products to reflect their environmental and social values.

45 45 Retail TouchPoints, 2020, “72% of US consumers want brands to reflect their values” - Conscious consumption, with a particular focus on health and environmental impact: A report by Nielsen Insights suggests ~70% of consumers would change their consumption habits to reduce their impact on the environment, placing greater emphasis on targeted purchasing decisions in line with their values.

46 46 The Conversation, 2020, “Climate explained: are consumers willing to pay more for climate-friendly products?” As a result, consumers are demanding greater transparency on product and supply chain sustainability. - Increased digitisation of consumer purchases. Accelerated by Covid-19, consumers have heightened expectations of e-commerce, supported by frictionless fulfilment, through click-and-collect and/or home delivery. E-commerce purchases have nearly tripled as a share of total retail sales from 7% in 2015 to 20% in 2022, representing a major shift in consumer preferences.

47 47 Statista, 2022, E-commerce as percentage of total retail sales worldwide

New Zealand product producers and retail businesses can address these changing consumer preferences

- Deliver premium retail products with lower environmental impact, especially on key issues such as waste minimisation: Recycling and reducing waste are the two most important environmental considerations for consumers for food, drink, personal and retail products. Some New Zealand companies have been focusing on sustainable, premium products - for example, Ecostore has established a position in New Zealand as a leading sustainable brand, providing low environmental impact goods and a comprehensive circular economy offering.

48 48 Inside Retail, 2019, “Ecostore named leading sustainable brand in NZ for fifth consecutive year” Delivering services, such as refill stations and container drop-offs, 100% recycled packaging and plastic-free products,49 49 Ecostore, About Us has helped Ecostore to develop a successful sustainable brand. - Provide greater supply chain transparency by digitising supply chains: 71% of New Zealanders are actively researching a product’s environmental impact before making a purchase.

50 50 Sustainable Business Council NZ, 2019, “In Good Company – How New Zealanders assess the sustainability of brands”, p.20 Digitising supply chains enable greater transparency for organisations and opportunities to optimise their supply chain (e.g., ensuring ethical suppliers and finding opportunities to reduce carbon footprint) whilst entrenching consumer trust. Similarly, attracting trademarks and certifications from respected institutions can deliver significant economic benefits. One study found sustainability certifications enable upwards of 45% higher price premiums and improved market access by up to 85%.51 51 My NZTE, 2021, Understanding sustainability certifications & accreditation options - Measure, report, and promote sustainability metrics. In addition to making meaningful sustainability improvements to products, New Zealand businesses must measure, report, and communicate sustainability efforts to consumers. Consumers want confidence that products they purchase are sustainable across a range of dimensions: up to 40% of consumers are more likely to make sustainable choices when sustainability is linked to the environment and other factors such as health, safety, and quality.

52 52 World Economic Forum, 2023, “How companies can scale green businesses for a net zero world” However, consumers lack quality information about how sustainable products are: 80% of Kiwis feel that communication from businesses on their social and environmental commitments is confusing.53 53 INCLEAN NZ, 2019, “NZ businesses need to promote sustainability credentials, says ecolabel head”

As the transition to a green economy accelerates New Zealand is well-positioned to capitalise on the numerous opportunities this presents. Leaders need to consider the implications of these green economy trends for their business and how this could impact value.

The authors are grateful to a number of colleagues for their support and assistance. They include Jan Loubal and Paul Sutherland for marketing, and Debbie Spears, Sean Hotter and Esteban Zapiola for visual services.