Small US and European biotechnology companies are on their way to becoming full-fledged biopharmaceutical companies . After decades of focusing on the development of innovative new drugs, they are increasingly taking on the task of commercializing them as well. The European market holds $246 billion potential, and many biotechs are now building a footprint there.

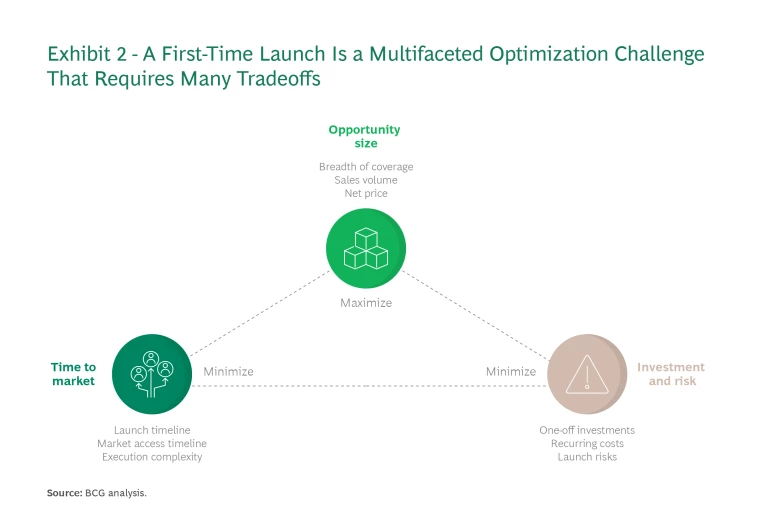

But expanding into the European market is daunting. To succeed, companies need to simultaneously optimize three parameters: the size of the opportunity, the time to market, and investment and risk. This is a complex balancing act that requires weighing various tradeoffs.

The European market holds $246 billion potential, and many biotechs are now building a footprint there.

Companies that get this balancing act right with their newly approved pharmaceuticals will get access to this key market. Those that don’t will miss out on significant value—and a crucial growth opportunity.

Assessing the European Opportunity

In the past, small US and European biotechs focused on the innovation side of the business—discovering and developing assets. They teamed up with pharmaceutical companies for commercialization, either licensing or selling their assets to them.

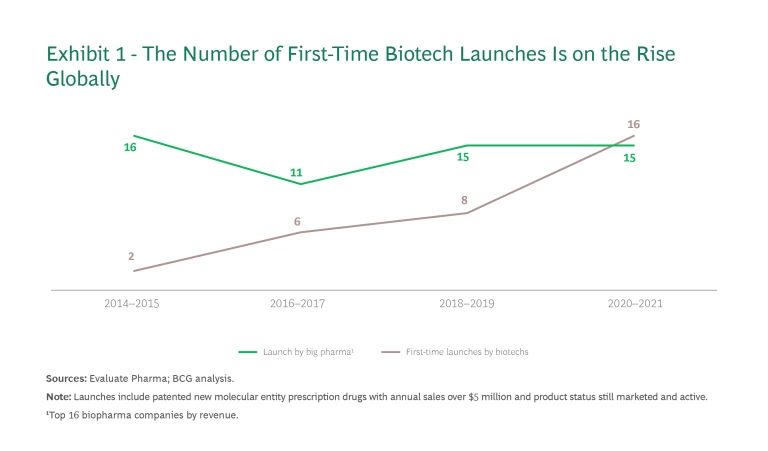

That model began to shift several years ago, when encouraged by easier access to capital, these young companies began assuming commercialization responsibilities themselves. In just six years, the number of successful first-time global launches of new molecular entity prescription drugs by biotech players (with annual sales of over $5 million) rose from 2 to 16. (See Exhibit 1.)

The market for most first-time biotech launches has been the US, where market conditions are favorable for high-priced therapies. Europe is another major opportunity, with a market size about half that of the US. Approximately 70% of the opportunity lies in only five countries—Germany, France, Italy, Spain, and the UK—making it easier for new entrants to stay focused on their core markets.

The European opportunity is especially compelling for companies developing EMA-designated “orphan” drugs— therapeutics for rare diseases that lack an approved treatment. Not only is this space seeing increasing demand: there are significant financial incentives as well. And the investment needs are more limited because the target physician population tends to be quite small.

But Europe poses formidable commercialization challenges. There are three different main regulatory environments—the European Medicines Agency (EMA) in the European Union, the Medicines Healthcare products Regulatory Agency (MHRA) in the UK, and Swissmedic in Switzerland. Moreover, each country has its own requirements regarding market access, commercial, medical affairs, distribution, and supply chain. Biotechs thus have a complex environment to navigate; in most cases, they must do this while simultaneously ensuring successful commercialization efforts in the US.

Confronting the Optimization Challenge

To ensure their launches reach as many European patients as possible, biotechs need to develop a strategy that optimizes three parameters: opportunity size; time to market; and investment and risk. The goal is to simultaneously maximize the opportunity size while minimizing the time to market and investment and risk. (See Exhibit 2.)

Opportunity Size. Biotechs need to maximize the breadth of coverage, net price (what customers pay after discounts and taxes are taken out), and consequently the revenue potential per market.

Time to Market. Companies need to minimize two timelines: the one for the overall launch, and the one for obtaining market access (getting the therapeutic into the hands of patients) in each country. Market access timelines are especially challenging to manage because they are largely determined by time required for the last step before market entry: the pricing and reimbursement (P&R) negotiations. These negotiations vary greatly, from 2 months in Germany to 18–24 months in France and Italy.

Investment and Risk. Biotechs are very cash constrained—especially before their first launch—and so must make investment decisions deeply aware of the potential risks. This holds true for one-time infrastructure investments as well for recurring costs for talent. It also applies to other kinds of risks, such as disappointing clinical study outcomes that can delay market entry or jeopardize it altogether.

Building a Viable Expansion Strategy

To find the best balance of opportunity size, time to market, and investment and risk for their launches, biotechs should take certain strategic and operational factors into consideration.

Determine the Sequence of Launches. Companies need to lay out the envisioned order of country launches. There are two key questions to address here. The first is where to focus launch efforts on—either Germany, Italy, France, and Spain along with the UK and Switzerland (EU4+2) or all of Europe. The second is whether to conduct all the launches at the same time or in sequence; and, if the latter, what the launch order should be.

There are three key criteria to consider in market selection. First is the potential for profit, which is influenced by factors such as the prevalence of the disease in the target market, the competitive environment, and pricing potential. Second is international price referencing, the comparison of price levels across countries. Third is time-to-market (TTM) access. A launch invariably raises thorny issues that can throw the timetable off course and require continued management attention to ensure rapid issue resolution.

Biotechs need to determine the appropriate commercialization model for each of the countries they’ve selected.

If the company decides to target all of Europe, management should also determine whether it’s possible to cluster smaller countries, which would reduce the complexity of the operational footprint and create synergies.

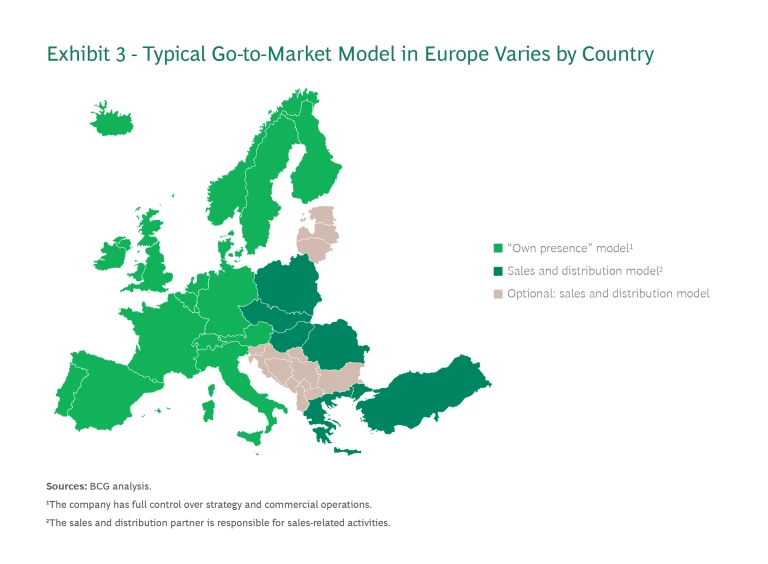

Select the Go-to-Market Model for Each Country. Biotechs need to determine the appropriate commercialization model for each of the countries they’ve selected. Each approach has its own level of control, profit potential, investment requirements, and risk. (See Exhibit 3.)

Own Presence. The “own presence” model provides the largest financial upside and is integral to building an own global commercial presence. Companies, therefore, should use it for their most important markets. Usually this means EU4+2. Depending on the pipeline and opportunity size, it may also include Belgium, the Netherlands, and Luxembourg (BeNeLux) and the Nordics.

In this model, the biotech is the marketing authorization holder (MAH), the company licensed to distribute, sell, and commercialize a medical product. The MAH has full control over strategy and commercial operations, with responsibility for building up commercial operations and the necessary local infrastructure (hiring, renting office space, and so on). The MAH also has full P&L responsibility, with complete capture of profitability and control of the value chain.

Sales and Distribution (S&D) Partners. For smaller markets with limited potential, such as countries in Eastern Europe, companies regularly deploy S&D partners. That’s because these markets generally do not generate enough profits to cover the local activation costs.

In the S&D model the biotech is also the MAH. The S&D partners are responsible for sales and distribution activities, including customer interactions. Biotechs can outsource other activities, such as market access and medical affairs, on a case-by-case basis.

Out-Licensing. Few companies license out an entire European launch to an external business partner, in large part because they consider out-licensing to have the lowest commercial upside.

Create a Market Access and Pricing Strategy. For each target country, companies need to assess the size of the commercial opportunity and determine how to maximize prices and volume while minimizing the access timeline. This challenging task requires an in-depth understanding of the country’s pricing and reimbursement pathways as well as the key criteria for the local health technology assessments (HTAs) that are used to curb government expenditures on very high-priced drugs.

Creating the Operational Capabilities to Support Expansion

With these strategies in place, the organization should focus on developing a comprehensive execution plan.

Start at the end and go backward. We recommend that companies first ascertain the launch dates for key countries and then plan the activities that immediately precede the launch, especially the process for obtaining market access.

This process includes getting scientific advice and submitting the value dossier (the value proposition and supporting evidence). Companies must also plan for medical affair activities including the prelaunch expert and registry engagement) and supply chain activities (track and trace, localization of product labels, and packaging).

Set up the future target operating model. Companies should also develop a blueprint of the future organization on both regional and local levels and define the resources that will be needed over time. They should ramp up the new organization in stages that are fully aligned with launch activities and their urgency relative to the envisioned launch dates to optimize use of the time until launch. US-based companies especially need to establish an international or European regional structure early on to align launch activities across different countries. The launching process typically starts with Germany and the UK.

Strengthen regional teams. Biotechs often start by hiring talent with expertise in marketing, medical affairs, and market access in key markets. Given the inherent risk of biotech product development, companies often rely on contractors and consultants for this early phase of the launch.

Build local capabilities and empower teams. To limit upfront investments, biotechs should build local organizations that leverage existing global resources as much as possible. Companies should look for professionals with commercialization expertise and provide them with sufficient autonomy to drive local execution and decision-making. People with knowledge of European markets, the relevant therapeutic areas, market access, medical affairs, and regulatory are a must, even when there isn’t the budget for full-time positions. If necessary, companies can hire contractors, particularly in technical fields like regulatory affairs or market access. This is a useful way to acquire expertise while balancing the risk that the product could still fail in late clinical trials.

Avoiding the Pitfalls

In our experience, small biotechs launching new products in Europe commonly encounter certain pitfalls that can endanger the success of their efforts.

On the strategic side, companies lack clarity on the size of the European opportunity and how to realize it. Some underestimate the complexity of the market, with its various access environments and care systems, and lack the deep expertise needed to manage them effectively. As a result, companies may be overly ambitious, taking on too many countries or patient segments. Or they may be shortsighted, neglecting to develop a long-term strategic view on the entire European market that’s needed for setting up easily scalable operations.

On the operational side, companies often find themselves late in preparing for market access discussions and engaging key opinion leaders owing to waiting for R&D results that could reduce launch risks. In many companies, functional silos can make it difficult to share information and address interdependencies. Resource pitfalls, too, are common. For example, on one extreme, companies may allocate too much talent to the US market at the expense of the European opportunity. On the other extreme, once they have entered the European market, they may use local expertise for certain functions when a regional person would suffice.

Setting Up for Success

Making the shift from an R&D engine to a commercialization machine is not an easy task. We’ve found that four practices will help set companies up for success.

Remain ambitious while understanding the market. Many biotechs are rightfully excited about their products. But although they have engaged with clinical experts throughout the development process, they often lack an in-depth understanding of major local commercialization challenges, including reimbursement requirements, pricing limitations, and the competitive landscape. Leveraging market research, multistakeholder advisory boards, and mock-pricing negotiations is critical.

Defining the timeline, deliverables, and process is critical to mounting a successful European launch for biotechnology companies.

Set up a project management organization (PMO). A flexible and agile PMO with sufficient prior Europe experience is vital to meeting timelines and the important milestones along the way. This small cross-functional team must be able to switch between issues on the critical path and manage all the arising interdependencies between the different functional teams while continuously tracking the launch efforts. The key here is that the PMO be able to quickly resolve any issue that could introduce delays.

Subscribe to our Health Care Industry E-Alert.

The PMO is vital to success because it is essentially doing two tasks at once—building the European presence and launching a new product.

Start engaging with key stakeholders early on. Stakeholders, including regulators, medical associations, market access third-party suppliers, payers, and patient engagement organizations, need to be part of the effort from the beginning. Biotechs must determine the stakeholders to include and the discussion to have with each, following industry-specific compliance standards.

Establish an agile process for updating the strategy. The launch strategy will need to evolve as additional market data is generated, new customer insights become available, and the first launches indicate what works and what does not. So it’s important to have an agile process that makes it easy to finetune the strategy on a regular basis.

Mounting a successful European launch for biotechnology companies is not simple or straightforward. Acting as a catalyst and thought partner, BCG can help you define the timeline, deliverables, and process to prepare your launch effectively. The key is to start 24 months prior to launch; think through the market access requirements and approach to bring your product to various EU markets; and set up the future target operating model along a set of interim steps to build a sustainable and compliant organization for the future.