Now more than ever, business resilience is a business imperative. The ability to thrive amid shocks and uncertainty is something every company desires. But like marathons and mountain peaks, it often remains out of reach.

A recent study on resilience revealed that 90% of companies don’t have enough of it. When disruption comes, they don’t shift gears seamlessly and continue on their path, even accelerating. They respond reactively—and hope for the best. So how can businesses make sure that they press ahead?

To find out, we looked at a focal point of resilience : the tech function. Technology increases a company’s agility, reduces costs through automation, and provides the foundation for AI and generating value from data. It’s a critical enabler but also a prime area for optimization. By thinking carefully about how they fund, organize, and deploy their tech function, companies can achieve the efficiencies, access the capabilities, and ensure the continuity that keep them running—and growing—in the face of disruption.

Now more than ever, business resilience is a business imperative.

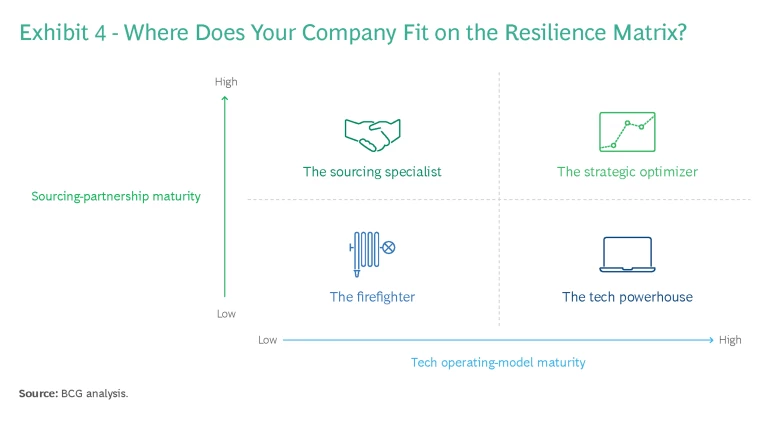

Achieving resilience means building maturity in the two key dimensions of the tech function : the technology operating model, or how a company uses technology to achieve its goals; and sourcing relationships, the interactions and dynamics between the company and its vendors.

Through a 2023 survey of more than 450 large enterprises, we zeroed in on companies that showed high maturity on one or both of these dimensions. Then we looked at the optimization strategies they prioritized.

The idea: to create a roadmap of sorts, revealing what companies that are strong on resilience are doing so that other businesses can gauge their own standing, focus efforts in the right ways, and thrive during crisis and change.

The Path of Most Resilience

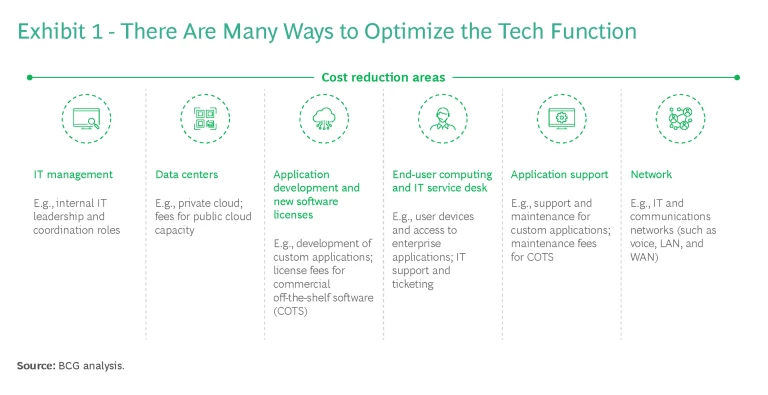

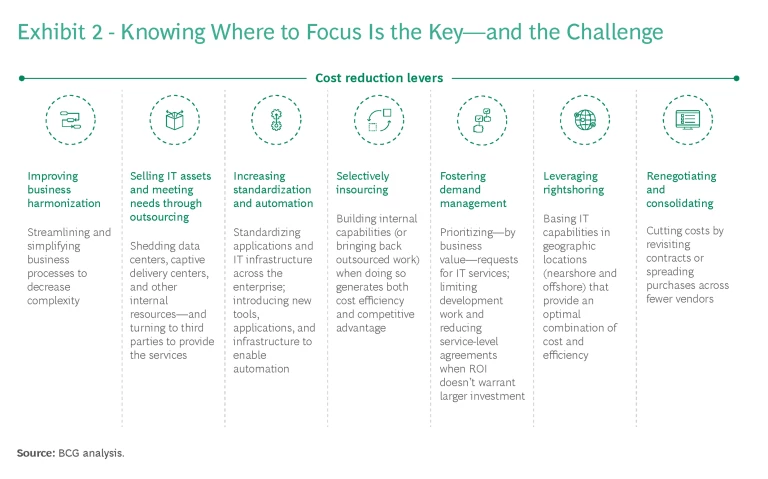

Identifying where to focus is both the key and the challenge when optimizing the tech function. Companies can target different areas for cost reduction: IT management, data centers, app support, to name a few. (See Exhibit 1.) They can apply an array of cost reduction levers, such as selling off IT assets, increasing automation, and renegotiating sourcing contracts. (See Exhibit 2.)

All these areas and levers are important. But are they equal?

That’s a crucial question, especially in light of the nearly universal push to rein in IT costs. Nearly 90% of survey respondents said that managing spending on tech providers—either reducing or maintaining current levels—was a key objective.

But resilience isn’t only about optimizing costs. It’s also about optimizing the way you work and how you access vital capabilities. By striking the right balance of insourcing and outsourcing, for example, companies can achieve cost efficiencies while ensuring that they have the talent, knowledge, and skills necessary to operate—and innovate—in times of stability and uncertainty alike.

We designed our survey to help us gain insight into resilience strategies. Participants shared the cost reduction areas and levers they prioritized, which revealed some overall trends. Among the most noteworthy: momentum for shifting indirect IT spending to direct IT spending. Companies are looking to reduce their layers of management and coordination and focus resources more on development and implementation. In other words, they want to spend “closer to the code.” And they’re taking concrete steps in this direction, such as embracing cross-functional and self-managing teams. Such teams—the lifeblood of agile at scale—decrease the need for separate IT management, boosting cost and operational efficiency and, in turn, resilience.

Overall, IT management ranked as the top cost reduction opportunity, with 37% of respondents putting it number one on their list (application support and data centers shared a distant second place, at 16% each). When we grouped companies by industry, we saw an even stronger trend. IT management was the top-priority cost reduction area for almost all sectors. And for the few where it wasn’t—telecommunications, consumer goods, and energy—it was the runner-up.

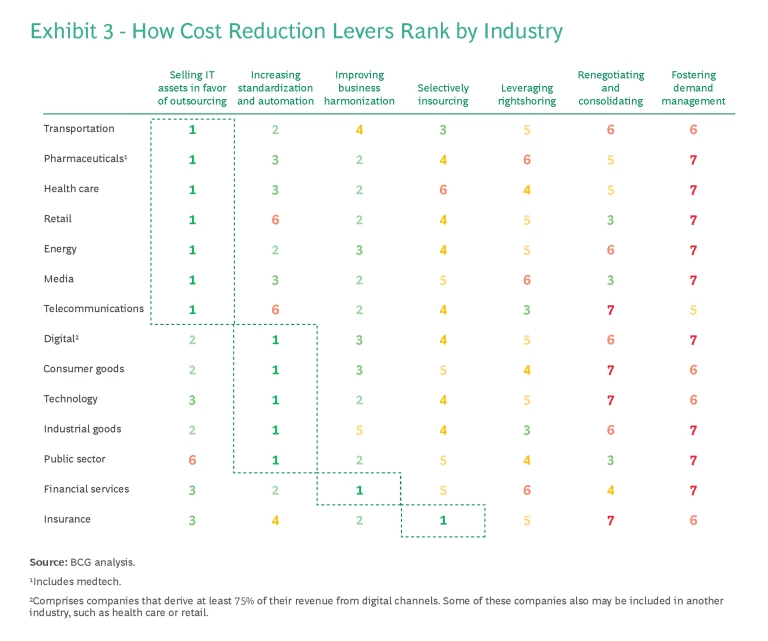

But when we looked at cost reduction levers, we saw notable differences among industries. (See Exhibit 3.) Selling off IT assets (such as data centers and captive delivery centers) and turning to third parties to provide these services was the top priority for the transportation, pharmaceutical, health care, retail, energy, media, and telecommunications industries. By contrast, increasing IT standardization and automation took the top spot for the public sector, as well as the technology, digital, consumer goods, and industrial goods sectors. (The digital industry comprises companies that derive at least 75% of their revenue from digital channels. Some of these companies also may be included in another industry, such as health care or retail.)

The Resilience Matrix

To drill down further and identify the strategies resonating with the most resilient companies, we first had to gauge each respondent’s resilience. Using the tech function as the cornerstone, we looked at maturity levels for technology operating models and sourcing relationships.

For the technology operating model, the more mature players tend to share certain characteristics:

- A high degree of strategic partnership between IT and the business

- Clear KPIs to track cost and performance

- Effective governance of funding, resource allocation, and prioritization of initiatives and projects

For tech-sourcing relationships, we looked for these factors:

- Adaptive (agile) sourcing

- High-quality relationships with strategic vendors

- Supplier network expansion to access digital capabilities

We asked survey participants to rate themselves on each criterion, similar to the process for BCG’s Digital Acceleration Index . This revealed the high performers and, in turn, the optimization strategies they pursue. But it also let us categorize respondents into four groups: a Punnett square of resilience, if you will. (See Exhibit 4.)

This classification has value for any business—not only survey participants. By assessing themselves on the maturity criteria, companies can see where they fit on the matrix and gain insight on the actions they can take to improve resilience.

THE STRATEGIC OPTIMIZER

These companies (accounting for just 11% of survey respondents) are highly mature in their technology operating model and sourcing relationships. They prioritize harmonization—standardizing business processes across the organization—as a cost reduction lever, are guided by agile principles, and have developed robust IT governance and a strong retained organization.

Strategic optimizers are very selective when it comes to insourcing, building internal capabilities only where, and when, they generate both cost efficiency and competitive advantage. If capabilities don’t bring such benefits, these players will reduce asset ownership and look to sourcing partners for the necessary expertise and capacity. This group also sees an opportunity to cut costs by lowering complexity and increasing agility—and doing so as a joint effort between IT and the business.

Strategic optimizers lead the pack on resilience, but the savviest are always asking what more they can do to retain their edge.

Strategic optimizers lead the pack on resilience, but the savviest are always asking what more they can do to retain their edge. One idea is to develop a partnership-based ecosystem of vendors. This can help ensure a robust sourcing capability. Meanwhile, by stepping up their digital game—embedding digital dexterity across the organization—companies can strengthen their tech operating model.

THE SOURCING SPECIALIST

Adept at managing sourcing relationships, these companies (24% of respondents) have less need for internal layers of supervision and control. As such, they stress IT management as a cost reduction area. Rightshoring—choosing locations that offer the best combination of cost and efficiency—and renegotiating with existing suppliers are also key levers. Sourcing specialists emphasize consolidation as well, focusing their spending on a select group of strategic vendors.

Strength in sourcing brings advantages, including ready access to superior market capabilities along with savings from leveraging competition among vendors. But when paired with a less mature tech operating model—a hallmark of this group—the reliance on sourcing carries risks. Among them: a potential loss of internal knowledge, vendor lock-in, ceding of key technology decisions to external providers, and less incentive to harmonize, standardize, and automate internal processes.

Sourcing specialists can minimize the danger by strengthening the strategic collaboration between IT and the business, identifying clear KPIs to track cost and performance, and developing robust governance of IT resources and allocation.

THE TECH POWERHOUSE

With strong in-house capabilities but a weak sourcing function, these companies (20% of participants) are in both an advantageous and a disadvantageous position on resilience. On one hand, tech powerhouses are typically agile and often able to develop—and leverage—the kind of innovative capabilities that set them apart (and help them stay the course in times of disruption). On the other hand, with relatively few sourcing partners, optimization opportunities are limited to areas and levers within the company. These players also risk missing out on superior market capabilities: instances when a provider offers a better solution—and a faster path to growth—than an in-house team.

For many tech powerhouses, the emphasis on internal assets often acts as a disincentive to developing a strong sourcing function. But striking the right balance is crucial for resilience, and shifting some focus to the sourcing dimension is an effort worth making.

THE FIREFIGHTER

Lacking a strong tech operating model and robust sourcing relationships, these players (accounting for nearly half of survey respondents, at 45%) are more reactive than resilient. They respond to change in an ad hoc, in-the-moment fashion, putting out fires—or at least trying to—instead of preventing them from ever sparking. In pursuing cost optimization, decision makers often base their calls on perception: relying on selective data points that support a preferred, but not necessarily the best, course of action.

To boost resilience, firefighters need to take a more strategic, collaborative approach to cost optimization. When IT and the business come together and leverage a broad array of data, companies are more likely to find the best path forward. Firefighters should also focus on the factors, such as clear KPIs and effective governance, that mark a mature tech operating model. In parallel, they should expand their supplier network and implement a more agile form of sourcing, in which requirements and solution designs aren’t set in stone but evolve to sync with learning from the tender process. Adaptive sourcing will be new ground for many companies, but it will also help them reach their goals—and even exceed them—faster and more efficiently.

It Takes a Team

No matter where a company fits in the matrix, one enabler always applies: a joint effort. Strengthening the tech operating model and sourcing partnerships is an endeavor that involves more than a company’s tech executives. It requires collaboration between functions, as well as strategic, well-coordinated action by the board. An engaged board sets the tone and the pace, helping the organization navigate the path to more informed—and more successful—optimization.

Resilience doesn’t need to be elusive. Its drivers are in plain sight. By building maturity in their tech function, businesses can strike the right balance between in-house capabilities and external solutions. And they’ll be better able to apply the optimization strategies that matter most. So when the next crisis comes, companies will be ready: responding instead of reacting—and sparking growth amid disruption.

The authors thank Juuso Soininen and Lauri Eneh for their contributions to this article.