The world economy is in a precarious position. Interest rates rising in tandem with sky-high inflation, uncertainty from new and ongoing global political conflicts, and a Chinese economy still reeling from the impact of COVID-19, have made for headwinds strong enough for some countries to declare that they face the possibility of a protracted and arduous recession.

However, the economic climate in the Gulf Cooperation Council (GCC) countries seems noticeably brighter. Elevated energy prices, abatement of COVID-related measures, and an increase in tourism resulting from major global events have precipitated what by all accounts would be classified as an economic boom. High energy prices are benefitting hydrocarbon economies and the International Monetary Fund estimates that energy exporters in the Middle East and Central Asia will net a windfall of $320 billion more than it had earlier forecast – approximately $1.4 trillion over the next five years if current global economic conditions persist. Much of this will flow to exporters in the GCC, which number among the top energy-exporting nations in the world.

Additionally, the Kingdom of Saudi Arabia (KSA) is accelerating the transformation of its economy in line with its ambitious Vision 2030 initiative. As part of the plan, the Kingdom is proceeding full steam ahead with the development of a raft of mega-projects, modernization initiatives, as well as reforms and development plans that will diversify its economy and open the country up to the world in a way that it has not attempted before. These developments are being mirrored in the performance of the banking sector in Saudi Arabia, which is experiencing a period of much-welcomed profitability.

Macroeconomic Overview

Inflation around the world resulted from an unprecedented period of monetary expansion pursued by central banks to combat the economic slowdown resulting from the COVID-19 pandemic, followed by a surge in consumer spending once economies reopened.

Interest Rates and Inflation

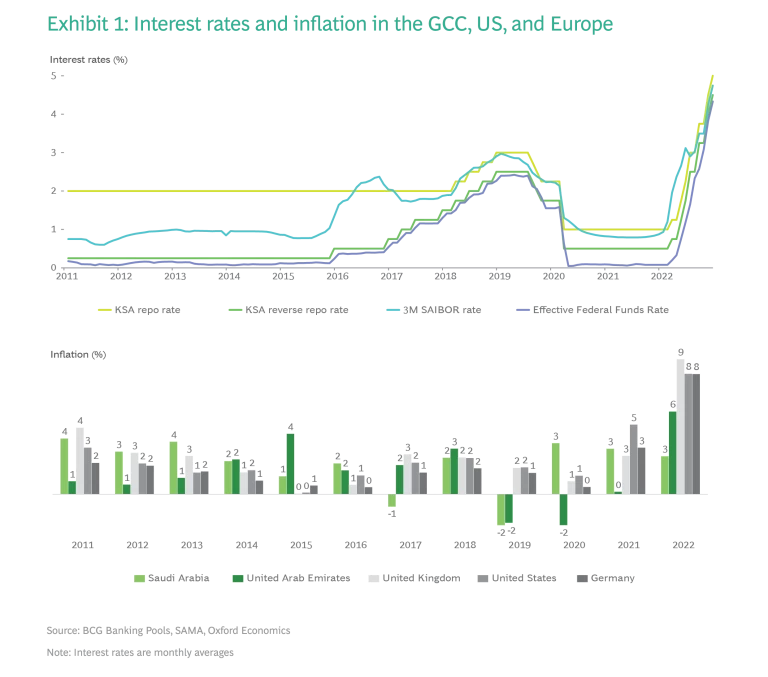

The United States (US), Germany, and the United Kingdom recorded average inflation rates of 8.1%, 8.1%, and 9.1% respectively in 2022 as geo-political events created more disruptions to global supply chains. In the US, the world’s bell-weather economy, the Fed Funds Rate rose seven times in 2022; by 25 Basis Points (bps) in March, 50bps in May, 75bps each in June, July, September, and November, and 50bps in December. Despite a substantial increase in the Fed Funds Rate from 0.08% in March to 4.33% in December, inflation remains stubbornly high and is leading many analysts to expect further rate hikes in 2023.

The burden of inflation is affecting economies globally, but in the case of the GCC, has not been as problematic. This situation holds particularly true in KSA. From historically low levels in 2020 and 2021, the Saudi Arabian Monetary Authority (SAMA) raised policy rates in line with the US Federal Reserve, inevitably, as the Saudi Riyal is pegged to the US dollar. In tandem, SAMA also raised repo rates seven times over the year, from 1% in March to 5% in December. However, with less impact from current geo-political events and high oil prices, inflation in the country has so far largely been controlled.

Net Interest Margin

Net Interest Margin (NIM), which reflects the difference between income from interest charged to creditors versus interest paid to depositors, moves in tandem with changes in the interest rate environment. Between 2015 and 2019, the three-month (3M) Saudi Arabian Interbank Offered Rate (SAIBOR) yearly average rose by 175 basis points (bps), and NIM over the period increased by 81bps, implying a NIM beta of 46%. From 2019-2021, 3M SAIBOR declined 182bps owing to pressures stemming from the global pandemic, NIM over the period also receded by 46bps, resulting in a NIM beta of 25%.

However, following multiple rate hikes in line with the US FED, SAMA’s last rate hike in December 2022 raised the 3M SAIBOR by ~200bps, taking 2022 NIM higher than the peak levels of 2019. With FED expected to maintain the tight monetary policy in 2023 to combat inflation, and SAMA likely to follow, interest rates are expected to remain high, portending favorably for the KSA banking sector.

Closer Look at the Current State of the Saudi Banking Sector

Loan and Deposit Volumes

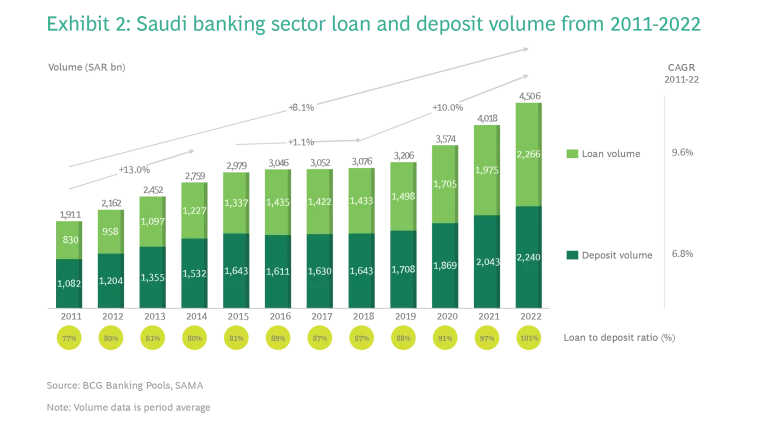

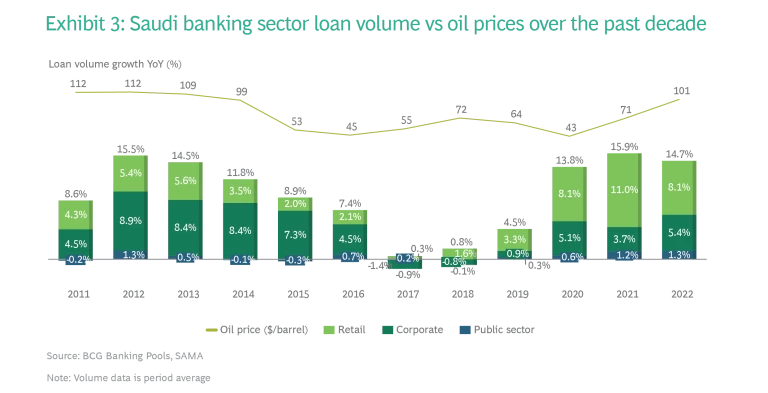

Between 2011 and 2022, the trajectory of the Saudi banking sector’s loan and deposit volumes has closely mirrored the movement in oil prices, reflecting a changing economy. Overall, loan volumes grew at 9.6% CAGR while deposits grew at 6.8%, resulting in a Loan-To-Deposit ratio (LDR) growth from 77% to 101%.

From 2011-2014, high oil prices led to strong increases in lending volumes (roughly 13.9% CAGR) and deposit volumes (12.3% CAGR), with both retail and corporate loan products registering significant growth. Between 2015 and 2018, as oil prices declined to historic lows, loan volumes grew at only 2.3% CAGR while deposit growth remained flat. Between 2018 and 2022, as oil prices rose steadily, loan and deposit volumes also rebounded to 12.1% CAGR and 8.1% CAGR respectively.

- Mortgages: The four-year period from 2018-2022 saw mortgage products outpacing corporate loan growth, rising at roughly 41% CAGR. This development is driven by the Saudi Housing Program (part of Saudi Vision 2030, which is pushing to achieve 70% home ownership in the country by 2030) and the support programs of the Real Estate Development Fund (REDF) to enable Saudi citizens to obtain mortgage loans. As a result, homeownership has already increased from 47% in 2017 to 60% in 2020.

- Corporate loans: Corporate loan volumes accounted for roughly 65% of loans between 2011-2018. With high oil prices, the economic recovery of the non-oil sector, and the launch of new Vision 2030 projects, corporate loan volumes are surging once again. Monshaat (The Small and Medium Enterprises General Authority) launched the Small and Medium Enterprises (SME) bank in 2021 in line with the Kingdom’s Vision 2030 to improve financing to MSMEs. As a result of economic recovery and SAMA/Monshaat's support measures, loans to MSMEs increased by 10.7% YoY in Q4 2021.

- Auto loans: Following the 5% VAT announcement on 1 Jan 2018, declining auto loan rates worsened further during the pandemic when VAT increased to 15%. This situation has been compounded by a global shortage of semiconductors causing a reduced supply of cars in the market.

- Deposits: With most retail avenues closed during COVID-19, economic uncertainty prompted most consumers to commit disposable incomes to savings, making demand deposits the primary growth driver for deposits in 2020-2021. Corporations also diverted excess cash/credit in demand deposits to maintain liquidity and mitigate the possibility of adverse financial events stemming from the pandemic. Public sector deposits also increased sharply during the period as SAMA instituted pandemic-related assistance to banks.

Profitability

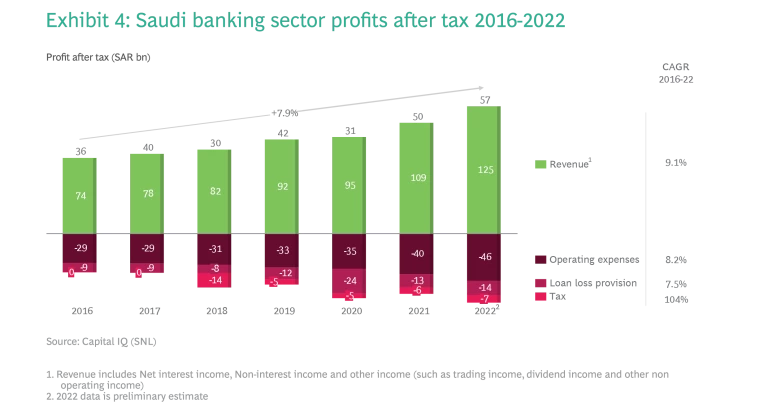

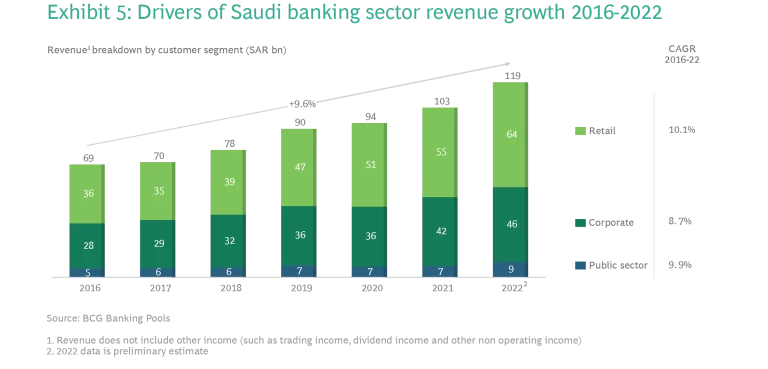

Following a tough economic climate resulting from the collapse of oil prices from historic highs in 2014, the 2016-2022 period saw a steady return to growth. Profit after taxes and payments for the Saudi banking sector grew at 7.9% CAGR driven by strong revenue growth – recorded at 9.1% CAGR – and operating costs and loan loss provisions grew at 8.2% and 7.5% CAGR respectively, slower than revenue growth rates. Profit after taxes and payments suffered a decline in 2020 as banks increased loan loss provisions due to credit risks posed by the pandemic. However, revenue growth rebounded swiftly in 2021 as loan loss provisions also declined, leading to a sharp rise in profits.

Weighing on profits was the cost of taxes and payments. In KSA, banks are subject to an annual Islamic Shariah-based ‘zakat’ payment and corporate taxes. In 2018, the General Authority of Zakat and Tax (GAZT) began collecting additional zakat payments from banks that had been waived in previous years. This led to a sharp rise in the collective zakat and tax costs levied on banks in the country.

Throughout the 2016-2022 period, the retail segment registered the highest revenue increase, with loans (mortgages, credit cards, and corporate loans), payments, and investment products being the biggest drivers of growth. Non-Performing Loans (NPL), which increased in 2020 due to pandemic risks, have declined over the last two years given the rapid economic recovery. Similarly, profitability ratios were impacted in 2020 due to higher provisions but recovered to pre-pandemic levels by Q1 2022.

The prescriptions outlined in Saudi Arabia’s wide-ranging Vision 2030 development plan are poised to enable the banking sector to experience dramatic growth over the decade, especially as the global pandemic recedes further into the rearview. Banking assets in the country surpassed SAR3,515 billion in Q2 2022, three years ahead of time, indicating that strong growth is already underway and will only continue.

Outlook for the Saudi Banking Sector

Loan and Deposit Volumes

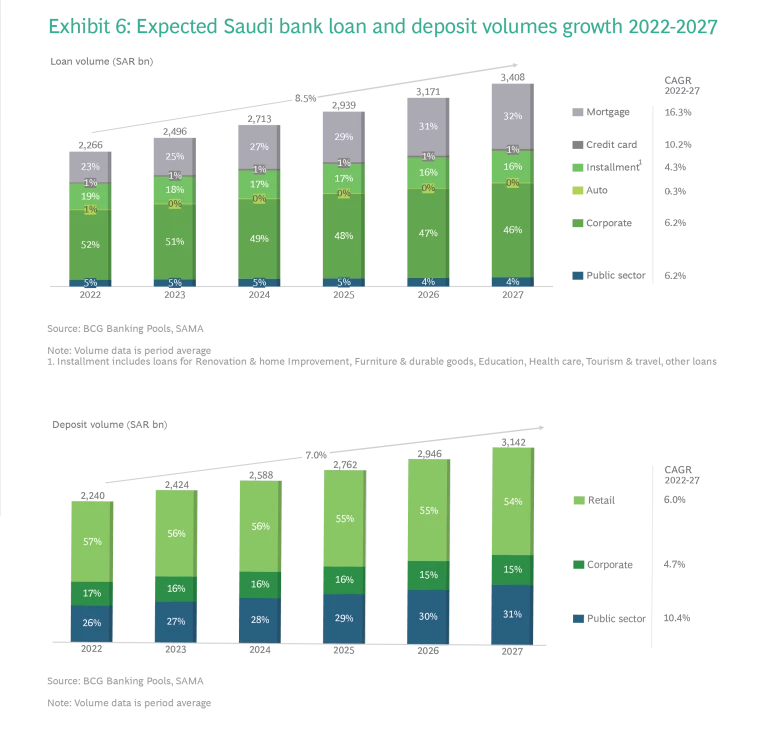

The Saudi banking sector’s overall loan volumes are forecast to grow at 8.5% CAGR from 2022-2027, with retail loans (11.3% CAGR) mainly driven by mortgage, outpacing corporate (6.2% CAGR) and public sector (6.2% CAGR) volumes.

- Mortgages: While Phase two of KSA’s Housing Program, which will run until 2025, will focus on affordable housing, strong growth in mortgage loans at 16.3% CAGR is expected on the back of the Real Estate Development Fund’s plans to provide financial support to more than 420,000 mortgage contracts. Housing prices remain at affordable levels, demand exists within the lower-income segment of the population that the government is supporting via subsidies, and the country’s large young population is experiencing a deficit of housing options. However, cuts in government subsidy programs are downside risks for mortgage volume growth.

- Credit Cards and Installment loans: Credit card loans are expected to account for the second largest driver of retail loan volumes. Growth is expected at 10.2% CAGR given the product’s low market penetration rate. Installment loans are also expected to continue to grow as the country’s economy further relaxes COVID-19 restrictions and consumer spending picks up.

- Auto loans: Auto loan volumes are expected to remain low over the next few years but could register an eventual uptick in volumes.

- Corporate and Public Sector Borrowing: Corporate and public sector loan volume growth is forecast to be strong as improving economic conditions, high oil prices, progress towards Vision 2030, and the launch of major construction projects drive overall credit growth in the kingdom. Corporate lending volumes will also benefit as companies vie over each other in the economic recovery and private sector activity picks up the pace in response to the government’s development agenda.

- Deposits: Volumes are forecast to grow at 7.0% CAGR between 2022 and 2027. Public sector deposit growth is expected to average 10.4% CAGR on the back of high oil prices. Retail and corporate volumes are expected to record 6.0% CAGR and 4.7% CAGR, respectively.

Subscribe to our Financial Institutions E-Alert.

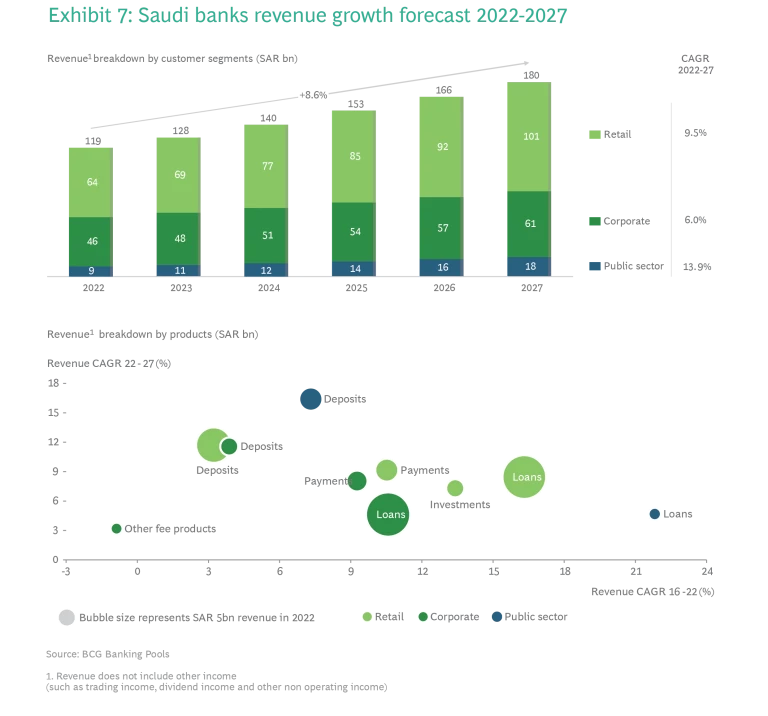

Revenues

With the growth in volumes forecast earlier, and margins also expected to rise, banking revenues are expected to grow at 8.6% CAGR in the 2022-2027 period, driven by strong growth from public sector clients (13.9% CAGR) and retail clients (9.5% CAGR). Revenues from corporate clients are projected to grow at a 6% CAGR.

- Retail: Deposits, payments, mortgages, and credit card loans will drive revenues in this segment. Deposit revenues are expected to grow at 11.7% CAGR, driven by a strong recovery in margins as interest rates continue to rise. Payment revenues are forecast to grow at 9.2% CAGR as the government pushes to achieve its Vision 2030 target of 70% non-cash payments by 2030. Meanwhile, loan revenue growth (8.4% CAGR) will be mainly driven by fast volume growth in mortgages and credit card loans.

- Corporate: Deposits (11.6% CAGR) and transaction revenues (8.0% CAGR) are forecasted to drive revenue growth. Revenues from investment banking, which rose sharply during 2019-21 (due to higher M&A and IPO activity) are expected to come down.

Avenues for Saudi Banking Sector Growth Beyond 2022

Given the forecasts presented in the previous section, the following four avenues emerge as viable options for Saudi banks to consider when pursuing strategies to strengthen their position:

- Manage funding effectively: Despite healthy loan growth, tighter funding conditions (as a result of higher borrowing costs and government inflows receding following a softening in energy prices) could impact loan volumes and NIM growth. Saudi banks should revisit their deposit-gathering strategy and in parallel, proactively encourage searching for other funding sources such as term deposits and wholesale funding.

- Revisit and re-balance product strategies: By taking advantage of favorable interest rates, banks can acquire new customers through a range of savings products. Campaigns to improve financial literacy, as prescribed by Vision 2030 to drive growth in the banking sector, can also help raise the savings rate from 6% to 10% of total household income.

- Invest for growth: By leveraging favorable macro conditions and strong sector growth, Saudi banks can pursue strategic investments to grow revenues and optimize costs. Areas with promising investment opportunities include emerging digital initiatives, re-imagined customer journeys, and the upgrade of underlying technology infrastructure.

- Leverage partnerships: To counter new digital competitors, banks should consider tapping into growing consumer spending trends to expand their portfolio of partnerships. For instance, by partnering with e-commerce businesses and retailers on agency banking and POS microfinancing solutions, banks can expand their customer base. Banks can also work with non-banking financial institution partners to extend low-cost financing options to targeted SMEs.

The authors would like to thank their BCG colleagues from Banking Pools Team: Jeewan Goula and Michael Schickert for their valuable contributions to the development of this report.