Is the traditional business model in the automotive industry —centered around selling combustion-engine vehicles through franchise dealerships—running out of gas? New technology, changing customer preferences, upstart mobility players, and other factors are all creating radical disruptions. The changes themselves are not a secret. What is surprising to many executives is the sheer scope and speed of the changes underway, and the amount of money at stake in certain domains.

We recently developed a comprehensive model to analyze these shifts and how they will affect value pools in the global automotive and mobility industry between now and 2035. (Our analysis included only cars and light trucks, not heavier commercial vehicles.) Key findings include:

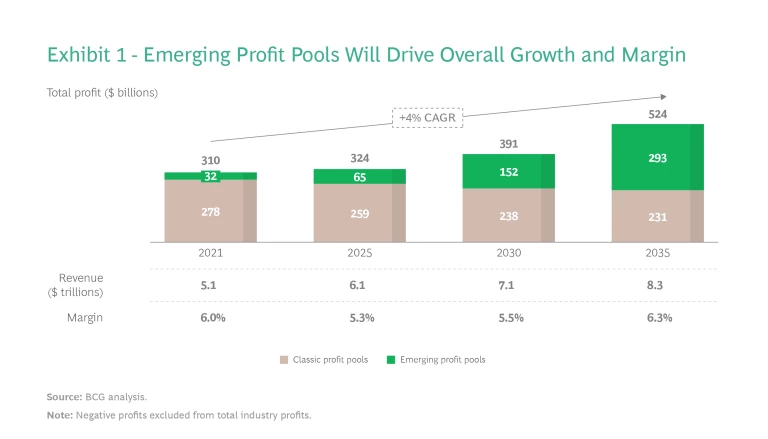

- Total value pools—including both revenue and profit—will increase dramatically by 2035 (to $8.3 trillion and $524 billion, respectively), and overall profit margins for the industry will increase to 6.3% (after a temporary drop).

- Despite this growth, profitability from traditional business models will gradually decline through 2035. Profits from the sale of internal combustion engine (ICE) vehicles—including plug-in hybrid vehicles (PHEVs)—will see the steepest drop, contracting by more than 60%.

- Virtually all revenue and profit growth in the industry will be concentrated in a small number of emerging segments: battery-electric vehicles (BEVs), autonomous vehicles (AVs), the components and software for BEVs and AVs, and on-demand mobility (ODM).

- The decline in classic profits will be particularly pronounced in developed auto markets like the US and Europe that do not see any further growth in total vehicle sales.

Our findings should serve as a wake-up call for management teams at automotive and mobility players—both incumbents and new market entrants. Companies have a narrow window of opportunity in which to get ahead of the disruptions, by identifying and capitalizing on those segments of the market that will grow. Management teams can still run successful, profitable businesses in the automotive and mobility industry, provided they take bold, proactive steps to rethink how they design, build, sell, maintain, and operate vehicles.

Quantifying How Disruptions Will Affect Both the Top and Bottom Line

For more than a century, the business model in the automotive industry has been relatively unchanged. Incumbent companies develop, produce, and sell cars powered by ICEs, service them, and then repeat that process with the next design cycle. But just about every aspect of that model is now in flux.

After more than a century of stability, almost every aspect of the traditional auto industry business model is changing.

BEVs are displacing gasoline- and diesel-powered cars (including PHEVs). New mobility providers give people alternatives to traditional car ownership—particularly in cities—such as ride-hailing apps, car-sharing services, and micromobility programs that offer shared bicycles and scooters. Sales models are evolving from traditional dealerships to online or direct purchases and new formats, such as car subscriptions. And autonomous vehicle (AV) technology is gaining ground. Some industry experts question whether these changes are as disruptive as they seem. We believe there is a real risk in underestimating the level of disruption underway. (See “Debunking Three Myths About the Mobility Industry’s Future.”)

Debunking Three Myths About the Mobility Industry’s Future

Myth: Battery-electric vehicles (BEVs) will cause profits in the auto industry value chain to shrink dramatically.

Our analysis shows that overall profitability for both OEMs and component manufacturers will dip in the near term due to the massive investments required and the fact that these components are not as far along in the learning and cost-reduction curves. But ultimately, profits will increase over the long term.

As highlighted in this article, industry profits will face a variety of influencing forces in the future, but it is worth isolating the effect of electrification on profits. Many classic powertrain-related parts will no longer be needed, and related profit pools such as after-sales service will shrink. But demand for other products, like tires or steering components, will remain just as strong. In addition, BEV powertrain-related components, such as batteries, e-motors, and inverters, are becoming core value drivers and will experience tremendous growth over the next years, thanks to increasing BEV adoption in vehicles sales and vehicle parc. Scale and correlated cost reduction for BEV powertrain components is a key driving factor here (while ICE powertrains experience it as a reversing factor—declining volumes paired with increasingly demanding emission requirements and correlated cost for ICE powertrains). By 2035, new BEV car sales units and profits will have outpaced those of classic new car sales.

Myth: Shared and on-demand mobility services are just a temporary—and unprofitable—blip that will disappear over the long term.

Most providers are not yet profitable, but the path to profitability will become clearer over time, due to industry consolidation among players across the value chain, increasing fleet utilization, better-suited vehicle and service design, and—critically—regulatory and policy support from governments. In particular, government measures that make privately owned vehicles less attractive (such as fees, outright bans, parking that is less available or more expensive) will make on-demand mobility more attractive. Another factor will be the introduction of autonomous vehicles, enabling robo taxi services. Drivers are currently the biggest cost for ride-hailing services. Once vehicles are automated, costs will go down, usage rates will increase, and profitability will rise dramatically.

Myth: Autonomous vehicles will never become technologically feasible. But if they do, they will immediately replace traditional, driver-operated vehicles.

We believe the answer lies somewhere in the middle. Given the range of companies developing autonomous technology and the progress achieved thus far, it is only a matter of time before AVs are operational. Initially, they will be limited to commercial applications in closed-loop routes—such as people movers on predesignated tracks in cities—but as the technology advances, applications will expand to other operating environments. At the same time, autonomous operations in private vehicles will continue to advance. Already, level 3 and 4 technology is being adopted for specific applications such as highways and in stop-and-go traffic.

Deploying AVs in an area requires extensive preparations, such as mapping streets and incorporating local particularities into the control algorithms. Therefore, AV service providers will roll out their services on a cautious, city-by-city approach, with strict geographic boundaries and weather constraints. Within five to seven years of commercial launch, we expect the global robo taxi fleet to grow to 1.5 million vehicles globally. That may seem high, but it equates to a few hundred thousand new robo taxis each year, which is less than 1% of the global sales volume for new cars.

Longer term, even after AVs become operational, they will not replace other vehicles en masse for several reasons. Many rural areas with low population density lack attractive business economics to support autonomous operations, leaving drivers in those regions highly reliant on private car ownership for years. Even in cities, many governments will set operational limits to avoid a wholesale shift away from public transit systems.

To compete, companies need to understand the speed and scope of change, starting with the product itself but also how it is being purchased and used, as well as additional services around the product. To that end, we built an in-depth market model to analyze these changes in the automotive and mobility industry and their implications on financial performance. We considered two broad categories of profit pools.

- Classic profit pools include those linked to traditional business models that have been around for a long period of time: sales of ICE and PHEV vehicles and the components related to them, post-sale service for these vehicles, and the finance and insurance segments for all types of vehicle (ICE, plug-in, hybrid, and BEV).

- Emerging profit pools include non-traditional vehicles—both battery-electric and autonomous—the underlying components and software in those vehicles, the new types of aftermarket sales and service they require (including EV charging), and on-demand mobility (including ride-hailing apps, car-sharing services, robo taxis, and micromobility options such as shared bikes and scooters).

Our analysis points to several key findings.

The overall industry will grow dramatically. First, the good news. The industry will continue to grow, with total revenue worldwide increasing from $5.1 trillion in 2021 to $8.3 trillion in 2035. Overall profits will rise in tandem, from $310 billion to $524 billion, a compound annual growth rate (CAGR) of 4%.

However, most of that growth will come from emerging profit pools, which we project to increase almost tenfold. At the same time, classic pools—ICE-powered vehicles and associated services—will actually contract about 17%, from $278 billion to $231 billion. (See Exhibit 1.)

Sales growth for new vehicles will slow. Underpinning these shifts are two central factors. First, after decades of increases in the overall number of new cars sold worldwide, sales growth will slow and volume will plateau at approximately 107 million units by 2035. (See Exhibit 2.) Already, some markets are seeing a deceleration—or even a decline—in new vehicle sales. In addition to market saturation, demographic changes mean a reduction in the number of potential car buyers in many markets. A substantial group of people are considering giving up their private cars entirely, relying purely on on-demand mobility options.

Underpinning this shift is a central factor: the share between private and commercial car buyers will change. In our analysis, about 9.5 million vehicles sold in 2035 will go to shared, on-demand mobility providers such as ride-hailing services and autonomous robo taxis.

Three Major Trends Are Changing the Game

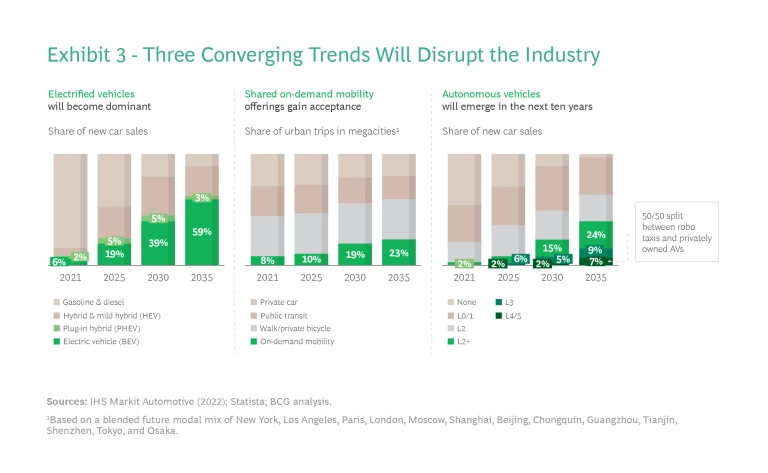

As noted above, on-demand mobility is only one of three trends triggering massive shifts in the industry’s profit pools, along with electrification and automation. To understand the speed and scope of this disruption, we look at each trend separately. (See Exhibit 3.)

BEVs will dominate and drive profits. Worldwide, we are already seeing broad adoption of electric vehicles in most major markets. In countries like Norway, BEVs and PHEVs already make up the vast majority of new car sales. A confluence of trends will further push adoption of plug-in vehicles, including lower-cost manufacturing through scaled production of both cars and battery packs, greater vehicle range, more convenient charging infrastructure, and stricter emissions regulations. By 2035, BEVs will comprise nearly 60% of worldwide new car sales. At the same time, the shift to BEVs will lead to an increase in industry profitability from new car sales (NCS), from $122 billion in 2021 to approximately $135 billion in 2035.

On-demand mobility will become far bigger and more profitable. The use of on-demand mobility services is steadily increasing, and that will likely continue, gradually decreasing reliance on personal cars, taxis, and public transport. By 2035, we project that about 23% of all megacity trips will happen through shared, on-demand mobility offerings (up from just 8% in 2021). Moreover, we expect on-demand mobility to become the second biggest profit pool in the industry, with total profits reaching $82 billion, nearly six times as large as today. Within the on-demand mobility segment, robo taxis will eventually become by far the biggest profit pool with $61 billion by 2035.

Autonomous vehicles will become a key factor in profitability. AVs will have a big impact on future urban mobility and likewise on profits for the industry—factoring in private vehicle sales and, more relevant, on-demand mobility providers. The first years of robo taxi operations will not be profitable as scale is required to recoup the immense upfront investments into AV technology, but we expect AV vehicle and AV component sales to be profitable at an earlier stage. By 2035 we expect these two categories to account for $13.4 billion and $5.8 billion, respectively.

As classic auto industry profit pools decline in response to new technologies, companies that can pivot to emerging pools will be rewarded.

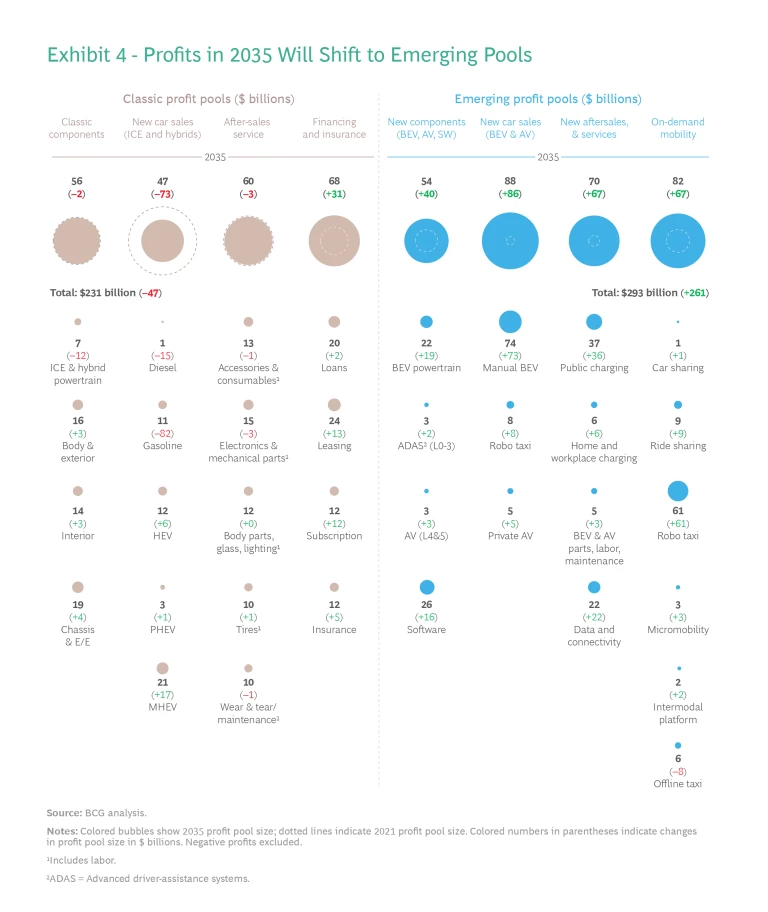

A Dramatic Shift to Emerging Profit Pools

Overall, there is a dramatic swing in profitability for the industry, away from classic pools that incumbents have long dominated and in favor of emerging pools—particularly BEVs, AV, and on-demand mobility. Understanding the composition of this shift more granularly is critical for industry leadership teams to make targeted decisions. For example, although the classic NCS profit vertical will plummet from $120 billion in 2021 to $47 billion in 2035, this development is mainly driven by declines of pure ICE vehicles (−95% for diesel and −89% for gasoline). In the other direction, the $67 billion increase of on-demand mobility profits by 2035 will be predominantly driven by robo taxi services. All other on-demand mobility modes combined will make up only about a quarter of the total profits for that segment in 2035. (See Exhibit 4.) This analysis includes cannibalization effects between new mobility modes (for example, robo taxis replacing manual ride-sharing due to lower operating costs).

It is crucial not to remain overly reliant on declining profit pools. Those that adapt will be rewarded: growth in emerging profit pool buckets will more than compensate the losses in classic profit pools. This is especially true for regions with stagnating vehicle sales where overall industry growth is limited, such as Europe and North America. By 2035, emerging profit pools will constitute 56% of total global industry profits.

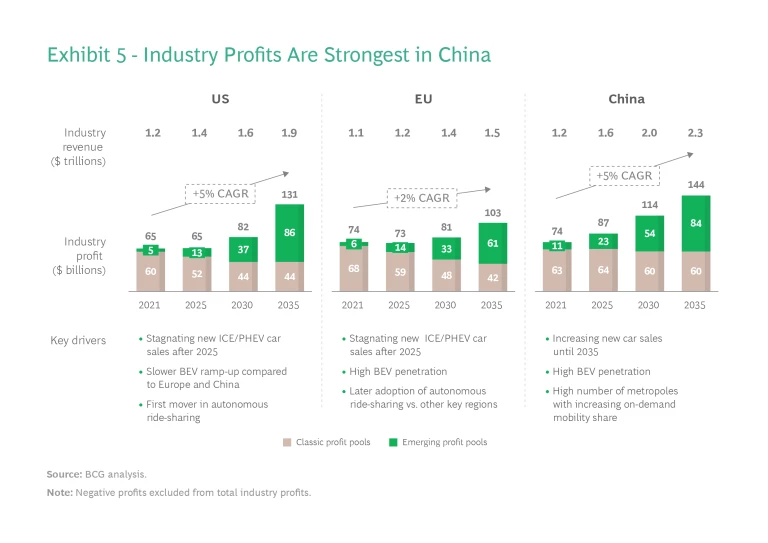

Geographic Differences in the Future Outlook

Another key aspect of our research shows how the speed of change and urgency of action vary across regions. While profits in the US and China grow at a similar pace, they show differences in growth composition over the years—especially regarding the start of classic profit pool decline. This decline has begun now in the US and is set to begin after 2025 in China. Europe, in contrast, will see slight overall profit growth. (See Exhibit 5.)

The US will see strong growth in on-demand mobility, including from autonomous vehicles. In the US, sales of new cars with traditional ICE powertrains (along with plug-in hybrids) will decline sharply to approximately one-third of current levels, with total sales of all vehicles virtually flat after 2025. New profits will grow rapidly to comprise a larger share of overall profits, while classic pools contract. By 2035, 65% of all profits will come from new pools, due to broad adoption of BEVs and AVs, particularly for robo taxi services. The on-demand mobility segment overall will show faster growth—and generate a larger profit pool—than in any other region, to $39 billion, as providers roll out new offerings across major US cities.

Europe will see the highest rates of BEV adoption. Europe will see an even bigger decline in traditional ICE vehicles long-term (somewhat temporarily compensated by growth in PHEV sales through 2024). Environmental regulations and ambitious efforts from OEMs will push BEVs to make up 93% of new car sales by 2035 (or even more, according to recent announcements by the European Union). That growth will create profit pools of $21 billion from BEV sales, plus another $15 billion in services (including an attractive charging market). Overall, new profit pools from BEVs, AVs, and on-demand mobility will make up nearly 60% of total industry profits.

China will remain the biggest overall contributor to industry profits. China will see the smallest decline in classic profit pools. Continued economic development and increasing per-capita vehicle sales will mean that traditional profit pools will continue to grow through roughly 2025—and remain approximately in line with their current levels by 2035. Profits from the sale of ICE cars and PHEVs will decline by more than half, but the finance and insurance market will make up most of the difference, as that segment sees dramatic growth due to continued increases in vehicle sales, higher vehicle prices, and increasing penetration of financial services .

Yet, as in both the US and Europe, the biggest opportunity lies in emerging profit pools as BEV adoption grows. We see tremendous growth in profits from BEV sales ($25 billion in 2035) and BEV powertrain components ($8 billion). Likewise, software components will have become a significant profit pool ($8 billion) as will new aftermarket sales and services ($23 billion), driven mainly by digital services within and around the car, such as infotainment and over-the-air updates. In 2035, around 58% of total industry profits will be captured by emerging profit pools.

Seven Ways for Companies to Proactively Adapt

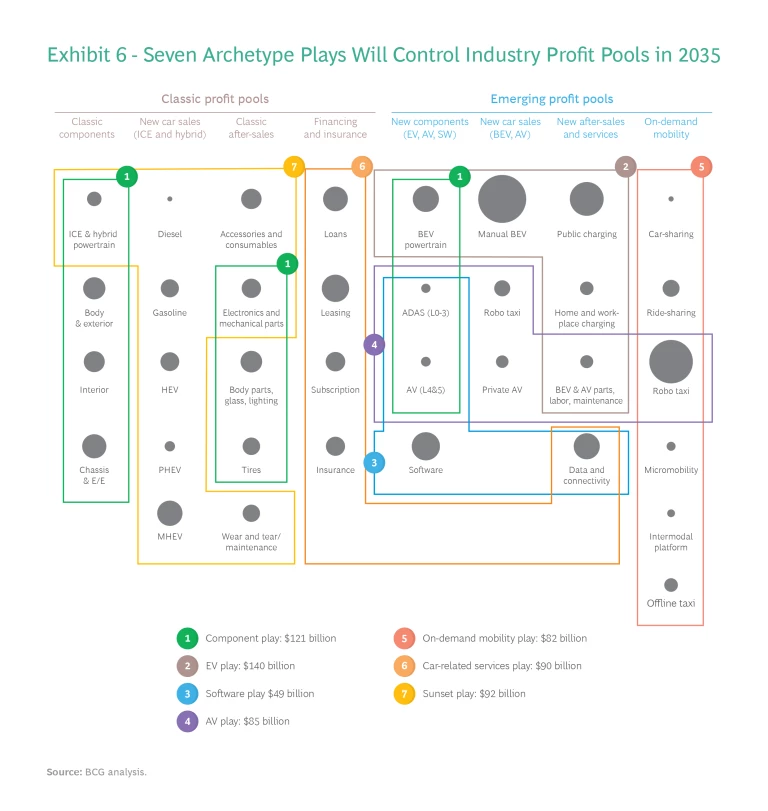

Once leadership teams understand the speed and magnitude of change at the industry level, the next question is how they can prepare. There is no universally applicable solution. Business leaders and strategists should reflect on how much of their business is at risk, and how they can reposition into higher-growth areas. Based on our experience working with leading automotive and mobility players, we have defined seven principal plays. (See Exhibit 6.) Each targets different profit pools and requires varying capabilities, but all have one aspect in common: tremendous profit potential.

Components. This play summarizes both classic and emerging components and is already both sizeable and highly profitable today. In our analysis, the profit pool for components is expected to reach $121 billion by 2035. However, component manufacturers face varying degrees of exposure to profit-pool shifts. A supplier of seating systems does not care too much about ICE vehicles being replaced by BEVs, but a supplier of ICE components such as fuel-injection systems will be profoundly disrupted. Companies pushing this play need to identify emerging component fields with long-term demand. For example, a camshaft supplier might look closely at the market for BEV powertrain components or other adjacent fields. In parallel, a component supplier might look to enter new geographic markets or expand into new industries (such as offering BEV components not only for light vehicles but also for other types of vehicles or even stationary products).

Electric vehicles. Electrification is the ultimate disrupting force in the industry right now. It draws competition from traditional OEMs and suppliers, newcomers and startups, and adjacent incumbents such as energy companies—and is expected to reach a total profit pool size of $140 billion by 2035. Success in this play can come through different strategies, such as serving the mass market by producing EVs in volume versus developing purpose-built EVs for specific applications. Players can develop cost-efficient standard equipment (for example, e-motors, batteries, inverters) or capture a premium niche with high-performance or customized versions of those products. They can even pursue an orchestrator role in the EV ecosystem approach—for example, by taking an active role in EV charging.

Software. The software play overlaps significantly with the component play, in that many components and modules already include a certain share of software. However, pure software plays go beyond this and focus on core domains within a vehicle, such as its operating system or data connectivity services like in-vehicle infotainment, vehicle-to-grid communication, vehicle data management, and related offerings. The emergence of AVs further increases the software-based value component in vehicles. Overall, software play profits will reach $49 billion by 2035, with further growth in following years. Scale in this play requires platform-agnostic software that can be tailored to individual OEMs at limited cost, deep data analytics expertise, and—critically—the ability to monetize data with commercially sellable insights.

Autonomous vehicles. Despite excessive hype, AVs have experienced some highly publicized incidents recently, causing some to lose trust in the technology. Nonetheless, AVs are slowly gaining traction, and we expect them to reach a total profit pool of $85 billion by 2035. The core of this play lies in providing robo taxi service in cities around the world, but it also includes additional profit pools: private AVs, AV components such as cameras or sensors, and after-sales services such as technology upgrades, software updates, and maintenance. However, this play requires significant upfront investments and the financial backing to survive years without making any money before efforts will materialize. On the positive side, we expect the developed technical capabilities required—especially on fully autonomous driving technology—to provide a significant competitive advantage over many years, as only a handful of players will be able to develop a viable commercial offer.

With the right perspective and timely action, companies can realize tremendous profits from the profound changes in the industry.

On-demand mobility. For many players, on-demand mobility is a scale game. However, given recent macroeconomic dynamics, finding the right balance between growth and profitability becomes much more challenging. Players that offer the best service in terms of cost, coverage, reliability, and flexibility—while also showing a realistic near-term path to break even—will succeed. For long-term success, it will also be crucial to consider stakeholders and their needs, especially municipal governments that increasingly regulate new mobility solutions to align them with their transportation strategy. Although robo taxis will claim the dominant share of the $82 billion pool by 2035, smaller segments such as micromobility or intermodal platforms will become attractive as well. In addition, the on-demand play provides further opportunities along the value chain—from asset ownership over fleet management and operation to the development of mobility platforms and end-user interfaces. Each position in the value chain requires a different set of capabilities.

Car-related services. Contrary to the others, the car-related services play provides relative stability. The current market size is already significant, and profits are expected to grow to $90 billion by 2035. Vehicles—autonomous and/or electric—will still need financing and insurance (F&I) options. Due to increased usage, shortened technology lifecycles, and uncertainties such as battery lifetime or performance of autonomous vehicles, there is further upside in these segments. Nevertheless, clearly understanding and addressing new markets requirements will be crucial, as customers are already asking for increasingly flexible and digital F&I services, such as short-term vehicle possession (car subscriptions) or customized insurance packages (pay-as-you-drive). Through data access, this play can also open up the data and connectivity profit pool in the vehicle.

Subscribe to our Automotive Industry E-Alert.

Sunset. With classic components and ICE car sales declining, individual suppliers and OEMs are losing volume and scale, making profitability more difficult and making potential divestments of classic assets an option to consider. This creates an opportunity for an incumbent to consolidate declining volumes and become the leader in the sunsetting ICE business, including ICE and hybrid powertrain components, vehicle sales, and mostly ICE-related after-sales services such as consumables and mechanical parts. Core to this play is leveraging ICE engineering and production capabilities to create a competitive advantage in terms of cost and performance. While classic vehicle sales will cease quickest within this bucket, after-sales services for such vehicles will continue even longer, thanks to the very gradual diffusion of BEV into the global car parc. It will take several decades until the global auto fleet is fully converted to zero-emission vehicles, leading to a still-sizeable profit pool of $92 billion in 2035.

The automotive and mobility industry is changing faster today than at any point in history, with disruptions triggering a profound impact on profitability over the coming decade. For incumbents, this kind of accelerating change can be unsettling, but trying to fight emerging trends or clinging to established ways of working is a certain path to irrelevance. Companies must change... or they will gradually die. With the right perspective, management teams can look ahead to identify high-growth, high-profit segments and take the organizational steps needed to capitalize.

The industry’s brightest days are ahead. Established companies can—and must—take the lead in shaping that future.