The COVID-19 pandemic has made clear the urgent need for greater vaccine-manufacturing capacity and capabilities across the African continent. Yet, despite recent progress, the continent supplies less than 1% of its vaccine doses. Much remains to be done to fulfill the vision of the Partnerships for African Vaccine Manufacturing (PAVM): that African manufacturers supply 60% of the vaccines needed by the continent by 2040.

Ramping up from 1% to 60% is no easy feat. A new report by Wellcome, Biovac, and BCG details vaccine manufacturers’ perspectives on the challenges they face and the areas where they most need support. We interviewed more than 60 stakeholders, including representatives from continental and global manufacturers, biopharma companies, industry bodies, health organizations, regulatory agencies, and academia. We also surveyed nine African vaccine-manufacturing companies, modeled economics of African vaccine manufacturers, and analyzed case studies of developing country manufacturers in other parts of the world. On the basis of this research, we have identified some of the key actions stakeholders need to take to expand vaccine access on the continent.

Recent Progress

The past 18 months have seen unprecedented global and continental mobilization to improve Africa’s access to COVID-19 vaccines. In 2021, Gavi, the Vaccine Alliance announced plans to further diversify its supplier base, particularly in Africa. Approximately 30 manufacturing projects were announced across 14 countries. African manufacturers forged partnerships with multinational corporations and developing country vaccine manufacturers. And private and public companies committed a total of more than $4 billion.

But the African vaccine-manufacturing industry is still nascent. Recognizing that more needed to be done, PAVM outlined a continental strategy for building a vaccine-manufacturing ecosystem that could meet the 60% target. The plan called for 22 priority products to be manufactured by a total of 23 manufacturing facilities.

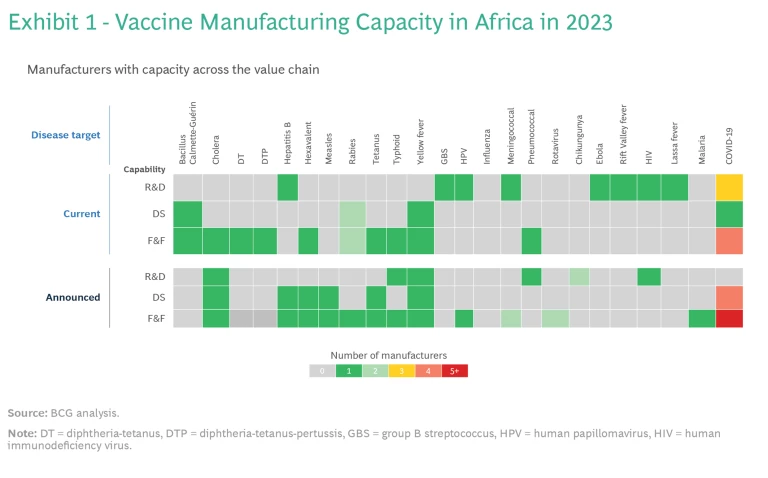

To build this ecosystem, Africa can leverage the capabilities of the 13 operational vaccine companies and organizations across the continent. While two companies are limited to distributing vaccines, eight have fill and finish (F&F) capacity, five possess capabilities for manufacturing drug substances (active pharmaceutical ingredients), and three conduct R&D. Currently, these facilities produce vaccines for six different antigens.

However, should all the announced projects become fully operational, total F&F capacity would exceed the 2040 PAVM targets by more than 60%. The demand-supply misalignment is even more pronounced for drug substance manufacturing: current and announced capacity combined would more than double PAVM’s ambition for 2040. (See Exhibit 1.) It’s not just that billions of doses of some vaccines would not be needed: the mismatch also means that some vaccines would still be in short supply.

Key Challenges for Vaccine Manufacturers

If vaccine manufacturing in Africa is to scale up effectively, it must be economically viable. Three interrelated criteria, therefore, must be satisfied: the business model must be sustainable, companies must produce the right vaccines in the right volumes, and support structures must be in place. Our research, however, revealed that manufacturers found challenges with all three.

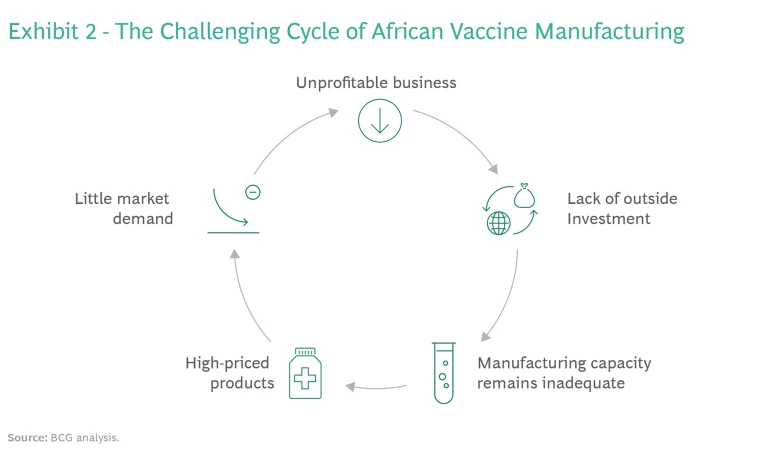

Business Model Sustainability. Most of the African vaccine manufacturers we interviewed said that they are not profitable. Historically, their operating costs have been higher than those of established developing country vaccine manufacturers (DCVMs). This has fueled a challenging cycle. Without a positive bottom line, African manufacturers have been unable to attract the outside investment necessary for building larger plants that can produce at scale. As a result, these companies are unable to compete on price and create substantial market demand for their products, and so the business model is unsustainable. (See Exhibit 2.)

Strategic Guidance. African manufacturers also told us that they are unclear on which products out of the 22 on the PAVM’s list should take strategic priority. Without more-specific guidance, companies will be unable to align their strategies to meet market demand, nor will the needed vaccines be produced in the necessary quantities.

Support Structures. Additionally, manufacturers expressed concern that once the pandemic is behind us, national, continental, and global support for building an African vaccine-manufacturing ecosystem will decline. Companies said they need help securing funding and favorable payment terms, identifying learning opportunities for students and staff, and facilitating technology transfers with global pharmaceutical companies.

Next Steps for African Vaccine Manufacturers and Other Stakeholders

A sustainable manufacturing ecosystem will help Africa attain economic viability for its vaccine producers and sufficient vaccine supply for its people. Although the journey will be a long one, there are some steps that stakeholders can take now.

Creating a Robust Business Model

To create a robust business model, stakeholders have an important role to play in strengthening manufacturers’ business model. The following will be essential.

Advance Purchase Agreements (APAs). Governments should provide APAs (upfront purchase commitments from buyers) to help manufacturers secure funding, expand their capabilities, and attract commercial partners for technology transfers. But APAs that help manufacturers gain traction in the local market are insufficient. To ensure sufficient demand, the agreements should be at the continental level.

Financial Support Mechanisms. Manufacturers also need a mechanism that will subsidize vaccine manufacturing in Africa for the medium term. But it’s not clear whether that mechanism should be funding of the operations, agreements to pay a price premium per dose, or another option. Nor is it clear where the funding should come from—governments, donors, or a combination of the two.

Stay ahead with BCG insights on the health care industry

Procurement Mechanisms. Currently, Gavi, which procures 50% of vaccines used in Africa, gets only 1% of this supply from African manufacturers, compared with 75% from DCVMs and 24% from multinational corporations. Gavi could commit to procuring a minimum share of its supply from African manufacturers, so that a vaccine produced locally is prioritized even if it is more expensive than other options. Another option is to pool the vaccine demand of multiple countries to expand market volumes. Organizations such as the Pan American Health Organization have used this strategy to lower production costs.

Coordination Mechanisms. PAVM or other continental organizations should define and launch coordination mechanisms, such as a platform for information sharing, to help manufacturers make business decisions and guide donors in identifying where to direct their support.

Identifying Strategic Priorities

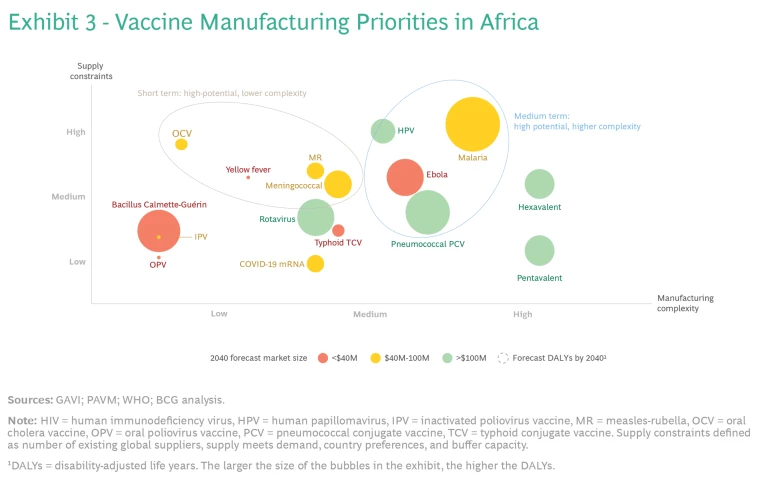

To ensure that manufacturers know which vaccines to focus their F&F efforts on in the short term, stakeholders should identify the vaccines with high supply constraints (such as insufficient number of global suppliers or buffer capacity) and low manufacturing complexity, such as the vaccines for rotavirus and meningitis. (See Exhibit 3.) To determine which vaccines are in this category, stakeholders need to consider current and future global supply and demand. They also need to determine which platforms and vaccines are relatively easy to produce.

At the same time, stakeholders should identify supply-constrained vaccines that are more complex to produce, so that companies can start building F&F capabilities for them for the long term.

Provide Much-Needed Support

Stakeholders also need to provide sufficient and sustained support. Three types of support are especially important.

Financial Support. Donors should provide financial support tailored to manufacturers’ context—in particular, funding with lower interest rates and a longer payback period.

Training. To help manufacturing employees gain practical experience, donors should also fund secondments with experienced manufacturers and bring global experts to work in local manufacturing sites.

Technology Transfers. In addition, donors should encourage and fund technology transfers with global research institutions to support capacity building. Such initiatives have a strong track record of success to build capabilities and attract private partners. Governments, for their part, should provide special economic zones, tax credits, land giveaways, and so on. These efforts will help manufacturers enhance their capabilities and attractiveness to prospective partners.

While there is no panacea for the challenges that African vaccine manufacturers face, an extensive vaccine-manufacturing ecosystem is imperative. It will improve vaccine-supply security, help to better tackle endemic diseases, and contribute to global pandemic preparedness while also boosting the continent’s socioeconomic development. All stakeholders need to work together to make a robust vaccine manufacturing ecosystem in Africa a reality.