The era of electric vehicles (EVs) is in full swing, with virtually every major automaker and many minor ones committed to EV-only fleets between 2030 and 2035. Yet one profitable vehicle for OEMs in Europe appears to be given short shrift, namely, the B or subcompact segment.

In the traditional internal combustion engine (ICE) arena, the B-segment has long been a staple of the European car market, accounting for 27% of all cars produced on the continent in 2022 versus 39% and 16% for segments C (compact) and D (midsize), respectively. The B-segment has even less of a presence in the US (8%) and China (7%). However, in the early stages of EV emergence in Europe, the number of C- and D-segment EV models is far outpacing B-segment options. A recent French study found that in France there are fewer than 20 available EV models in the B-segment, compared to 40 in the C-segment and 25 in the D-segment.

The main reason OEMs have shied away from this market is the high cost of materials. Until economies of scale are achieved, and the price of electric powertrains and batteries decrease sufficiently to profitably manufacture relatively low-priced B-segment EVs, automakers are more likely to resist focusing on that line of cars.

But this creates a conundrum: on the whole, would-be EV drivers tend to be extremely price conscious. According to the recent BCG Henderson Institute (BHI) Green Premium Willing to Pay (WTP) survey of global consumers, 50% of Americans said they were willing to pay 5% more for an EV, while only 21% would pay 20% more. Meanwhile, only 14% of German consumers said that they would be okay with paying a green premium, and 25% of French respondents cited high cost as the primary reason for not purchasing an electric vehicle. In other words, OEM reluctance to build affordable B-segment EVs because the cost of materials virtually eliminates profit margins is only amplifying the price wariness of many potential EV buyers. In turn, with few B-segment EVs manufactured, achieving economies of scale, which would drive profits in this segment, is impossible.

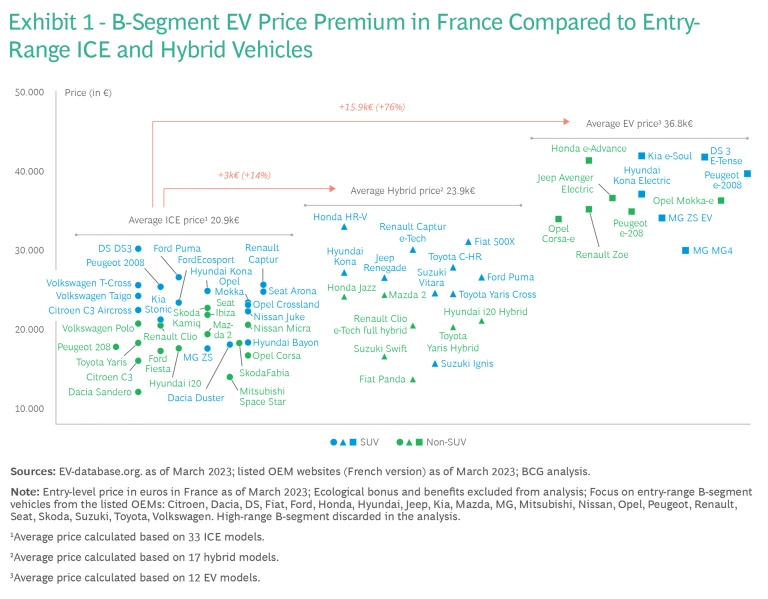

Making matters worse, the price difference between a B-segment EV and a similar ICE vehicle is greater than the price differential for other EV and ICE vehicle segments. An analysis of recent French price data found that the average retail price premium on a B-segment EV compared to its ICE counterpart is around 75% (€36,800 vs. €20,900). In the C- and D-segments, the premium is 47% and 11%, respectively. (See Exhibit 1.)

In some key regions, incentives for purchasing EVs are helping to bring prices down a bit. In Europe, for example, EV buyers can get up to a €9,000 bonus, the US offers a $7,500 consumer tax credit, and although China has ended its national subsidies, regional EV-related incentives are still available. Equally important, some EV pioneers are starting to leverage the expertise and scale they have garnered from their first-in status to offer more affordable entry-range options; for instance, Tesla has announced a $25,000 B-segment EV called the Model 2.

Overcoming the B-Segment Hurdle

Given the importance of an affordable B-segment presence, particularly in the European EV market, the competition that is already beginning to emerge, and the technological edge that manufacturing these vehicles can bring, OEMs hoping to make a successful move into the EV world must begin to focus their attention on this segment. The primary challenge that OEMs face is trimming production costs sufficiently to achieve a target price of about €25,000 (US$27,000).

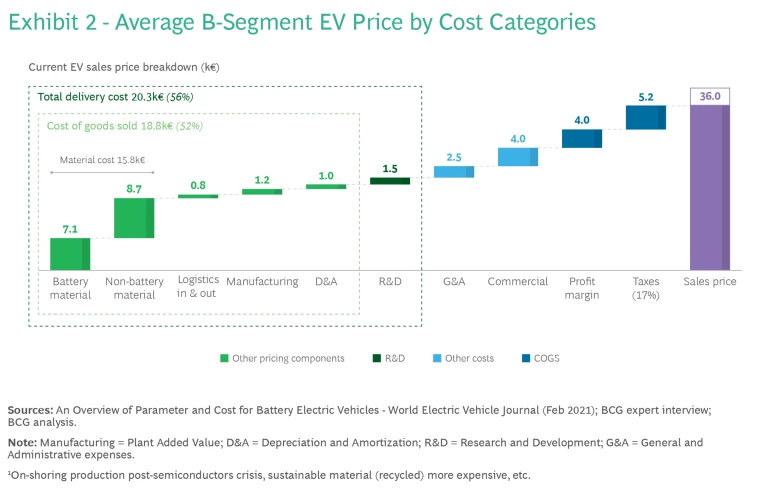

To determine the best approach for achieving this goal, the first step is to break down the total cost to design and build a B-segment EV into its constituent items so they can be individually assessed and, ultimately, reduced. (See Exhibit 2.) We excluded from this analysis G&A, sales operations, profit margins, and taxes, because they are not cost-driven but rather determined by strategic and organizational decision-making. Hence, what we call “total delivery costs” comprise materials, logistics, manufacturing, depreciation and amortization (D&A), and research and development (R&D). There are limited ways to directly control R&D and D&A expenses, which can be positively or negatively impacted by choices related to materials, logistics, or manufacturing. As a result, the primary focus should be mainly on material, logistics, and manufacturing costs, which account for almost 50% of total price and offer substantial optimization potential.

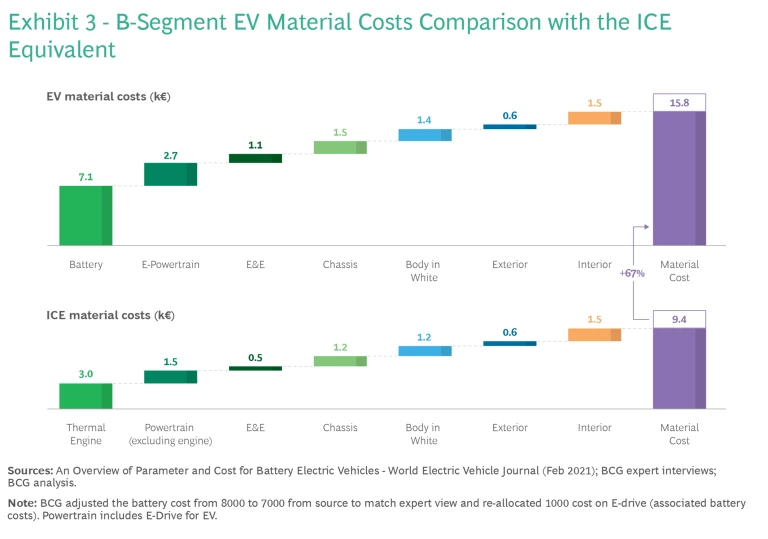

Material costs are the big item, making up about 80% of the total delivery cost. According to recent data, B-segment EV material costs are approximately 65% higher than their internal combustion engine counterparts, averaging around €15,700 per vehicle, compared to just €9,400 for an ICE vehicle. (See Exhibit 3.) Only exterior and interior costs are similar. In the past year, as EVs have continued to gain in market share and battery technology has improved, materials costs have decreased slightly on a year-over-year basis. However, this downward trend is too slow to bridge the cost gap between EVs and ICE vehicles any time soon.

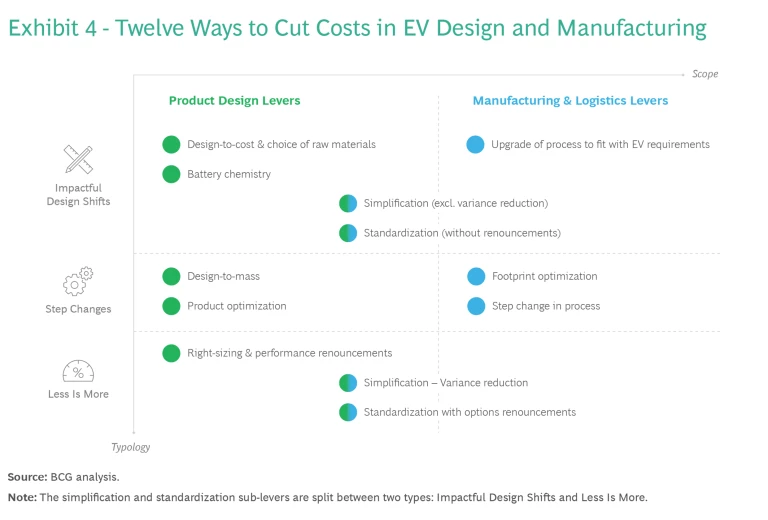

To examine these costs in detail and determine where the best opportunities for reduction are, BCG held expert workshops with European automotive design engineers from major OEMs. Out of these sessions we identified 12 macro levers that can be indispensable in decreasing the final cost of B-segment EVs. (See Exhibit 4.) These levers can be broken down into three categories: Impactful Design Shifts, Step Changes, and Less Is More.

Impactful Design Shifts

This category involves going beyond typical cost-cutting exercises—so-called design-to-cost drills—to challenge fundamental technology and manufacturing choices, component standardization, and parts integration, while maintaining ICE performance levels.

On the product design side, the main cost factor is battery cells. As battery chemistry advances, new options will become more cost-effective, and OEMs should be willing to change course and adopt them as soon as feasible. For instance, Lithium Iron Phosphate (LFP) batteries are expected to drop in cost substantially over the next few years while demonstrating real gains in life span and thermal stability compared to Nickel-Manganese-Cobalt (NMC) batteries. NMC batteries are more commonly used today in EVs outside of China, where about half of EVs contain LFP batteries. Already slightly less expensive than NMC batteries, LFP batteries are expected to cost about €67–86/kWh in 2026 and €62–75/kWh in 2030, well below the cost of NMCs by that time. Later in the 2030s, solid-state batteries will reach commercial maturity, which will largely improve energy density and decrease weight.

Beyond looking for cost savings in batteries, other impactful design-to-cost techniques that have generally not been optimized for EVs should be explored. Without compromising performance or safety, EV makers can focus on using lighter materials and revisiting systems complexity across the vehicles, including powertrains and electric motors. For example, on battery parts, new coiling systems in cylindrical cells, improved wiring connectivity, and lighter battery packs could reduce the total battery cost by 13%.

Currently, finding cost savings in the choice of materials can be difficult for OEMs striving to meet ambitious emissions targets. For instance, using recycled materials can increase EV costs in the short term by about €500 for a B-segment vehicle. However, as recycling EV materials becomes more commonplace, their costs should drop.

Efforts to standardize and simplify parts and improve parts integration without affecting performance can drive scale and reduce costs in design and manufacturing. The best strategy is to carry the same parts across models, while choosing more off-the-shelf components whenever possible. We found that doubling the order volume for a part can cut costs by as much as 10%. And beyond procurement benefits, this trims R&D budgets and reduces complexity in manufacturing processes. Looking at improvements in parts integration, there are opportunities to systematically combine powertrain and cabin cooling as in ICE vehicles, blend high-voltage components, and situate the on-board charger into the external charging device. Moreover, some electric and electronics components (wiring, plugs, and screen in particular) can be further merged with the interior structure, such as the center console. Taken as a whole, these steps would increase energy efficiency, make better use of limited space, and reduce materials costs.

In the manufacturing realm, restructuring assembly lines to focus solely on producing EVs will automatically lower assembly costs. In both greenfield and brownfield EV plants there are 75% fewer engine preparation and 25% fewer mechanical preparation steps per vehicle compared to ICE factories. This, in turn, improves productivity and factory output while decreasing the number of full-time employees.

Step Changes

The levers in this category align transformative product design and architecture choices with aggressive cost cuts. Until now, these steps have generally been the province of hard-charging EV pioneers.

The first lever, design-to-mass, involves using smart, cost-effective design ideas and resizing parts to meet a lighter vehicle target weight. For instance, down-sizing a B-segment EV by 20% (from a 1500 kg Renault Zoe to a 1200 kg Renault Clio) can significantly cut battery capacity requirements for the lighter vehicle and reduce battery costs by 15%. Similarly, the budget for steel needed to build the vehicle could drop by one-fifth and, due to the vehicle’s lower mass, the savings on braking systems could be as much as 40%.

Specific product optimization can further reduce costs. For example, integrating battery cells directly within the vehicle’s body structure would eliminate the battery pack and, even after accounting for substructural reinforcement, cut B-segment EV costs by about €200 per vehicle. Other specific product initiatives could include software and hardware decoupling, which would simplify electric and electronic architectures, trimming back the number of required electronic control units, and allowing for more standardization. And even replacing rear-view mirrors with cameras could make a difference.

On the manufacturing side of the ledger, nearshoring or offshoring can reduce labor and energy costs compared with central European rates. Production costs could drop by as much as 45% in a nearshoring facility and 70% in an offshoring arrangement. However, offshoring strategies are somewhat politically and optically risky for OEMs. One alternative, then, would be to optimize the current footprint by replacing large engine assembly plants with smaller and simpler battery assembly plants, which require less capital expenditure (CAPEX). Another option is increasing vertical integration of parts. By increasing the number of components that they manufacture themselves, OEMs could simplify the supply chain and trim costs further.

A bit riskier are transformative process step changes—because they require high CAPEX and the returns can be long in coming. For example, Tesla bet on the use of advanced equipment like the Gigapress to revolutionize its assembly operations. The Gigapress molds chasses as a single module step, instead of assembling multiple pieces, thus decreasing the number of assembly steps as well as the manufacturing workforce and footprint. However, at current scale, the significant financial outlay for asset-heavy innovations like the Gigapress offsets the manufacturing savings. But in the future, such potential step changes could pay off.

Less Is More

In this case, less means lesser performance—and more means more savings as a result. Although there is a downside, if OEMs are willing to accept some compromises in performance in a B-segment EV, savings are possible. However, these cost tradeoffs must be carefully considered given their potential negative impact on vehicle attractiveness and customer perception of the brand. In other words, these levers are only useful if savings, mostly on labor, parts, and materials, are greater than the perceived customer value of the part, function, or service that the vehicle lacks.

Right-sizing and performance curbs, which involve purposefully choosing lower specifications and features than the standard level for a B-segment vehicle, can affect pure driving conditions, such as battery range, or comfort and design. However, the performance reduction must not diverge from customer expectations for a B-segment car too radically or it will seriously affect market share. For instance, decreasing the weight, size, and cost of the battery could reduce a B-segment vehicle’s range from 400 to 300 kilometers without upsetting customers too much. Depending on how sharply the range is slashed, battery right-sizing could cut battery costs by 20% to 40%.

Other possible performance reductions that could save money include limiting charging speed and removing fast charging cables, reducing the size of wheels and tires from 17 inches to 15 inches, and forgoing steering wheel advanced settings. Some low-cost brands could also consider lowering the EuroNCap ranking from 5-stars to 4-stars to save on performance, crash, and body-in-white rigidity standards.

Standardizing across models and eliminating customization can be a valuable OEM approach that can save hundreds of euros per vehicle.

Standardization across models and eliminating customization—while accepting some reduction in performance and features—can be a valuable approach for OEMs that can save hundreds of euros per vehicle. Among the possible standardization options are using basic displays, such as switching from a 9-inch to a 7-inch screen or a standard instrument panel instead of a best-in-class option.

Avoiding variances and customization can directly improve scale since parts order volume will increase substantially if customers have fewer or no options. For instance, wheels, bumpers, battery, paint, or seat trim choices could be eliminated relatively easily. Most customers won’t balk at a standard black bumper for all models instead of multiple body-in-white paint assortments. Additionally, offering just a single level of ADAS (advanced driver-assistance system) and connective features so that the global wiring system and connectors are the same in all vehicles across the brand would simplify design and procurement. The goal of this lever is to reduce manufacturing costs by having assembly lines with few, or maybe no, personalization features.

Five Strategies to Build Affordable B-Segment EVs

Choosing which levers to focus on to reduce total delivery cost of a B-segment EV can be a bit of a challenge. Ultimately, this depends on a variety of factors, chiefly, an OEM’s willingness to manage disruption, its growth strategy for the brand, and available capital to invest in an aggressive B-segment design and marketing initiative.

But one thing is certain: OEMs need to determine their strategic thrust quickly and act. Otherwise, they are vulnerable to falling further behind in a vehicle segment that is critical to eventual success in the EV market. Already, startup EV makers are targeting this segment, notably using the macro levers we have described. For example, Tesla has adopted impactful design shifts under the cover of design sobriety. The company has successfully achieved savings on the Model 3’s interior using low-cost plastic cladding, a futuristic steering wheel, and large but inexpensive screens.

Additionally, Tesla has opted to eliminate physical knobs and switches in favor of voice and touch controls, further reducing costs. The EV maker also reduced software and hardware costs by limiting electronic control unit variety and wiring harness complexity. And in a nod towards less standardization, Tesla offers limited options and ordering a vehicle is down to a streamlined 5-click process on the website. The total number of possible Model 3 combinations is only 180, a stark contrast to a Volkswagen Passat’s staggering one billion combinations.

On the manufacturing side, BYD has stood out by adopting an extensive vertical integration strategy, designing and manufacturing an increasing number of vehicle parts, including batteries, motors, and electronic controls. More than 70% of BYD’s vehicle components are made by the company itself, which has brought significant savings in R&D, supply chain, and logistics costs.

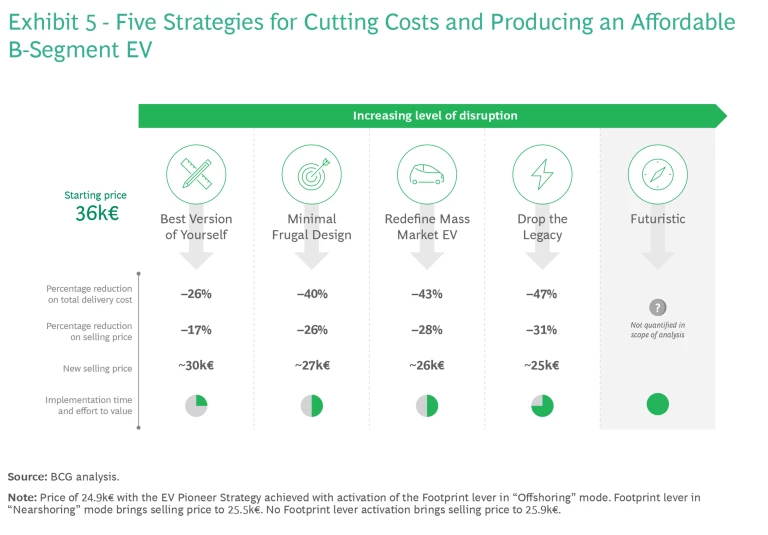

Bearing in mind the many possible tactics available to minimize B-segment EV costs, BCG and auto industry costing engineers have identified five overall strategies for implementing the cost reduction levers that are suitable for individual OEMs. (See Exhibit 5.) Each strategy carries with it different performance and disruption levels, which are prime considerations when automakers explore enhancing or expanding into a particular segment.

Our analysis of each strategy is based on an initial price of €36,000 for an average performance B-segment EV, and then calculating how much closer to the target price of €25,000 a company can come by applying any of the approaches. Only total delivery costs are affected, and non-cost items remain unchanged.

Best Version of Yourself

This strategy focuses on leveraging impactful design shifts along with some basic step changes to optimize cost without compromising the current performance level. This can result in a €29,900 vehicle due chiefly to manufacturing and purchasing improvements and scale. This strategy is suitable for traditional OEMs with a strong brand who can transfer their reputation for ICE performance to EVs and also can afford to be a little above market price. While it is certainly not a breakthrough strategy, it is relatively easy and quick to implement, with no major investments required.

Minimal Frugal Design

This strategy combines right-sizing, performance reductions, and aggressive design-to-cost tactics to reach a price of about €27,000. Costs are reduced through the elimination of features, the use of off-the-shelf components, and less variance in parts and options. Since comfort and driving performance will be sacrificed with this strategy, the overall attractiveness of the vehicle and the brand could take a big hit. However, this strategy can be implemented relatively quickly and could appeal to consumers who are looking for an inexpensive vehicle to use on short, daily urban rides of, for instance, less than 200km.

Redefine Mass Market EV

This strategy involves significant design changes that ultimately creates an EV that in size sits between segments A (small vehicles that are sometimes called city cars) and B. The primary cost cuts come from the vehicle’s reduced weight and volume, which, in turn, trims expenditures on materials and parts. Despite the downsizing, this redefined car should maintain standard B-segment features. By adopting this approach, it is possible to achieve a price of €26,000 with little disruption while maintaining a satisfactory performance level for the car.

Drop the Legacy

This strategy is characterized by step changes and transformative measures in both design and manufacturing, on top of significant design shifts, and at €25,000 essentially hits the price target. This strategy includes product optimization (for instance, cell-to-pack, increasing voltage, and removing rear mirrors) as well as rethinking EVs through aggressive manufacturing choices that include new localization tactics and remade processes. In fact, offshoring is necessary to achieve the full total delivery cost reductions; any other factory footprint strategy will drive the price of a B-segment EV closer to €26,000. Implementing this strategy could take a significant amount of time as well as require substantial CAPEX investments and internal operational capabilities to drive change and innovation. While the level of disruption is higher than the other strategies, so is the vehicle’s performance.

Futuristic Mass Market EV

This strategy completely alters vehicle design, performance, features, parts, and components—and is the most radical. We are already seeing some of the innovations that fit in this strategy, including in-wheel motors, removing the front part of the car to improve aerodynamics, wireless charging, and instead of batteries, body panels that generate energy. What sounds revolutionary today will cut costs in tomorrow’s EVs. The success of this strategy obviously depends on time, a large R&D team, substantial development investments, and strong engineering capabilities, coupled with a view to disrupt the status quo. Starting from scratch to re-invent the concept of a car might be easier for new entrants.

OEMs Must Act—and Quickly

Our analysis focused on reducing total delivery costs to decrease overall vehicle price. However, 45% of the price is the result of non-cost related aspects, such as G&A or sales operations. Consequently, OEMs can supplement their cost-reduction tactics with a non-cost strategy that also offers optimization opportunities. For instance, G&A expenses can be trimmed by right-sizing the organization’s structure, streamlining operations, and reducing unnecessary expenses. Moreover, sales expenses can be managed more efficiently with a direct go-to-market approach and online commerce.

But more than anything, reducing the cost to manufacture and the sales price of electric vehicles is crucial for traditional OEMs to remain competitive in an industry that is being transformed in an accelerated fashion. And they must do so quickly, particularly in Europe where an opportunity in the popular B-segment is still awaiting European automakers—but not for long. Without taking rapid action to cut costs and produce an affordable (and profitable) B-segment vehicle, European OEMs can expect price wars and competition from global players to heat up, potentially leaving them behind.