Garbage in, value out?

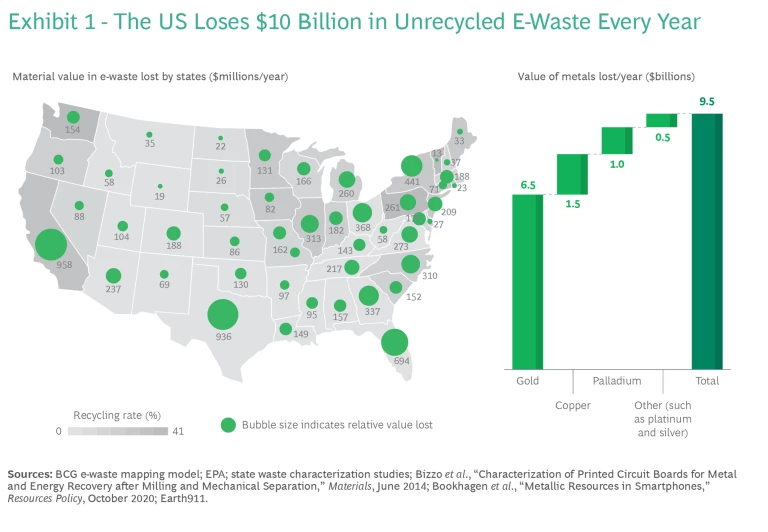

Every year, nearly $10 billion in electronic waste—comprising computer equipment and devices, screens, and small electronic appliances—is thrown away in the US alone. Most of the value loss comes from embedded metals, such as copper, gold, silver, platinum, and palladium. But these products also contain metals such as mercury, cadmium, and lead that can threaten environmental health and well-being. Globally, only about 20% of this waste is recycled, and without intervention, the volume of e-waste will increase.

At the same time, demand for e-waste materials is on the rise, fueled by multiple factors. Consumers and OEMs are reexamining their resource footprints and searching for circular materials. Primary production of many metals is becoming more costly as ore quality in the ground declines and extraction energy and capital costs rise. Geopolitical pressures have increased the urgency of localizing supply chains, with a focus on critical minerals.

Companies in numerous industries, among them telecommunications , IT , metals, retail , manufacturing , and waste management, have an opportunity to recapture the lost value in e-waste and gain from powerful co-benefits.

The Value in E-Waste

E-waste generation is expected to more than double by 2050, according to the United Nations Environment Programme, with global volumes rising from 50 million tons to 110 million tons. The growth will be fueled in part by shorter product life cycles (the average smartphone is replaced every 2.2 years) and the Internet of Things , which is lifting the volume of internet-enabled household appliances (the average US household now owns 20 such devices).

US recycling rates vary by state, but the vast majority of e-waste nationwide (80% to 85% by our estimates, worth about $10 billion annually) ends up in landfills or unaccounted for. (See Exhibit 1.)

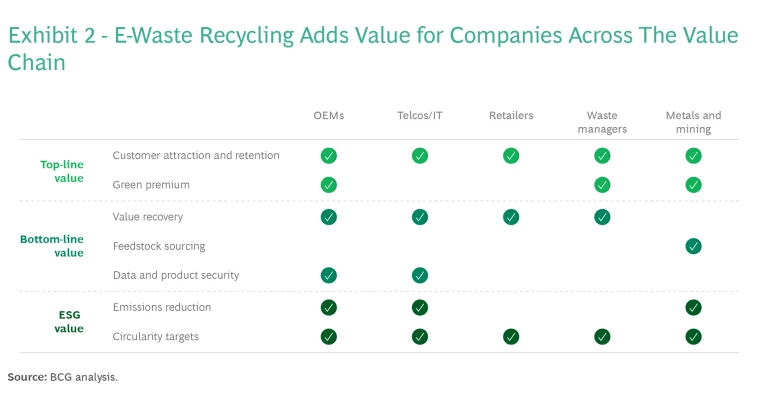

While recycling e-waste is a new endeavor that needs to prove its value, few initiatives offer so many potential means to profit, especially when nonfinancial benefits such as climate and sustainability goals are taken into account. (See Exhibit 2.) Each company along the value chain has a different way of benefiting.

Top-Line Value. Increasing numbers of customers, both consumer and business, are likely to consider sustainability when making purchasing decisions. BCG research has found that more than 80% of Generation Z consumers consider sustainability when choosing brands. Of these, more than 20% say they only buy brands they view as sustainable. In addition, more than 60% of surveyed consumers in eight countries said they feel disillusioned with companies’ sustainability efforts today, providing an opportunity for those that take action to differentiate.

Businesses and municipalities are looking for sustainable waste solutions. Waste managers that can handle e-waste responsibly and at scale are highly sought after by companies seeking to offload large volumes. Many recyclers are unwilling to accept some types of e-waste because of processing hazards and costs, while others have insufficient capacity for large e-waste streams or cannot handle e-waste at scale economically.

For retailers, in-store e-waste drop-off programs can drive foot traffic and help retain customers. Retailers such as Best Buy and Lowe’s have e-waste drop-off programs, and Staples offers purchase vouchers to customers who bring in e-waste. Customer loyalty can be secured by making e-waste circularity a feature: rather than let used products go to waste, companies such as Apple administer trade-in programs.

Companies engaged in circular e-waste ecosystems may be able to extract a “green premium” in their product pricing. BCG and the World Economic Forum have found that consumers’ willingness to pay such a premium is growing. Most of the sustainably marketed consumer products surveyed the NYU Stern Center for Sustainable Business enjoy a green premium over their conventionally marketed alternatives.

Bottom-Line Impact. Two high-potential avenues to value creation are value recovery and feedstock sourcing. Every year in the US, some $4 billion of copper, palladium, and gold are estimated to be lost in discarded computer equipment alone. Telecommunications and IT players, which produce and install high-grade circuit boards containing large quantities of valuable metals and rare-earth elements, are well positioned to capture this value stream. They can design more circular approaches to product design and use, which would allow them to reclaim components and materials. And waste managers are well positioned to divert high-value e-waste to recycling.

E-waste is an economical source of many metal feedstocks, including copper, gold, silver, platinum, palladium, nickel, lead, and tin as well as rare earths, which are in growing demand from expanding electrification and digitization . In fact, concentrations of some metals are many times higher in e-waste than in mined ores. In 2019, the World Economic Forum estimated the global value of e-waste to be at least $62.5 billion a year. The US loses more than 100 tons (or $6 billion) of gold in unrecycled e-waste annually.

E-waste is an economical source of many metal feedstocks in growing demand from expanding electrification and digitization.

Managing e-waste is also critical to end-of-life data and equipment security. Improper dumping of sensitive electronics, such as servers, can lead to fines and data breaches that jeopardize customer relationships. Proper disposal and recycling can reduce the risk of grey-market sales, counterfeits, and unauthorized reuse.

In some instances, value can be recovered by providing a second life for spent equipment through refurbishment or remanufacturing.

ESG Benefits. In addition to its broad social and environmental benefits—conserving natural resources, reducing landfill use and illegal dumping, preventing pollution, and conserving energy and water—e-waste recycling helps companies meet their net zero goals . Emissions from the smelting and recycling of secondary metals are typically much lower than emissions from the extraction of primary metals. Recycled copper, for example, has a three to five times smaller carbon footprint than virgin copper.

Metals and mining players can reduce Scope 1, 2, and 3 emissions. For manufacturers and telecom and IT firms, recycling e-waste cuts Scope 3 supply chain and end-of-life emissions. Dell is seeking to reduce by 45% its Scope 3 footprint from purchased goods and services by 2030. T-Mobile has committed to reducing its Scope 1, 2, and 3 emissions by 90% by 2040. Nearly 40% of the company’s current emissions come from purchased goods and services.

More and more OEMs and telecom companies are setting circularity targets, which e-waste recycling helps meet. Apple, for example, is working to use 100% recycled and renewable materials in its products. Vodafone has stated that it will reuse, resell, or recycle all network waste by 2025. HP is aiming for 75% product and packaging circularity by 2030 through a variety of means including e-waste recycling.

Why E-Waste Goes to Waste

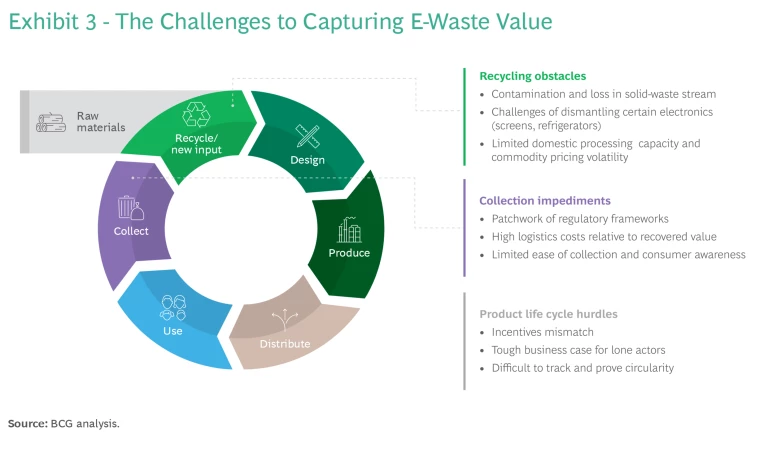

The solutions to e-waste all come down to better management of a valuable resource. For the business case to work, it’s necessary to address breakdowns at three separate stages of a product’s life cycle. (See Exhibit 3.)

Collection Impediments. Several barriers inhibit e-waste collection. Current regulations provide, at best, mixed motivations to recycle. Most US states do not have e-waste landfill bans, and many of those that do cover only some categories of waste (screens, for example, but not small equipment). Half of US states have e-waste recycling programs, but they do not necessarily mandate recycling, even for products with hazardous components such as video screens. Twenty-four states have extended producer responsibility laws, but the manufacturers and the products that these laws cover vary widely.

The high cost of logistics relative to recovered value is a key problem, since logistics make up a substantial portion of the total recycling bill. Low-value e-waste, such as TVs and printers, have large plastic casings and small circuit boards, increasing transport costs relative to e-waste density. (Transportation can account for a third of total recycling costs.) Rural areas often have insufficient critical density to offset the capital investment needed to start a large recycling network, resulting in sparse or infrequent collection.

All aspects of collection can be a challenge. Collection points include municipal drop-off centers, recycling centers, retailers, and charities, but availability and options for treating end-of-life electronics vary down to the level of the individual municipality. Collection can be as infrequent as once a month at some locations. Participation rates also differ, with some localities reporting less than 30% household uptake.

Limited consumer awareness of the possibilities for e-waste is another challenge. Consumers are not always (or even widely) knowledgeable about the environmental and social benefits of depositing spent electronics with a responsible recycler, let alone where to do so. E-waste collection can be a profit center for retailers, but companies must see sufficient consumer awareness and willingness before they invest in a collection capability. According to a 2020 survey in Waste Advantage Magazine, 60% of Gen Z and Millennial consumers in the US reported being unfamiliar with the term “e-waste,” and 57% said they were unaware of the impact of e-waste on the environment.

Recycling Obstacles. E-waste is costly to recover. Separating e-waste that is intermingled with municipal solid waste must be done by hand. Worse, smaller devices, such as phones, laptops, and printers, are often crushed and contaminated with hazardous household waste.

Dismantling certain electronics is difficult, and some types of e-waste, including screens and refrigerators, contain hazardous materials. The need for specialized technicians (in the case of refrigerants) or processes (in the case of mercury-bearing cold-cathode fluorescent lamps in LCD screens) drives up processing costs.

Limited domestic processing capacity and commodity price volatility are additional barriers. Despite export restrictions under the Basel Convention, export continues: one study found that more than 40% of tagged e-waste was being exported, most of it likely illegally. Commodity volatility disrupts the business case for investing in the equipment needed to better extract materials from e-waste by making revenue streams unpredictable. Indeed, much of the business case for e-waste recycling will rest on the ability to stabilize revenue streams.

Even when intentions are good, economic incentives can work against circularity by emphasizing rapid product updates and sales volumes over product longevity.

Product Life Cycle Hurdles. Circularity, which goes well beyond recycling, is about doing more with fewer resources. But even when intentions are good, economic incentives can work against circularity by emphasizing rapid product updates and sales volumes over product longevity. These disincentivize repairability or refurbishment (some devices cost less to buy new than to repair), impeding recycling.

In addition, lone players have a tough time making a business case for recycling some kinds of e-waste. Those that make the investment can end up collecting or recycling other companies’ products as well as their own—without compensation. Absent partnerships along the value chain or programs that highlight the value of e-waste, landfilling and export continue to be cheaper than responsibly recycling many kinds of e-waste.

Reaping ESG rewards from circularity requires strengthening standards and oversight. Data-tracking capabilities are limited, the origins of product inputs are unknown, and end-of-life products are not commonly tracked. Primary and secondary metals are often smelted into the same product, limiting traceability.

Waste Not

The biggest potential enabler of greater e-waste recycling is the public sector: legislation or regulation, which can be modeled on rules in place in some US states or regulatory measures currently implemented in Europe. For example, “polluter pays” laws can obligate manufacturers to finance e-waste recycling, especially of computer equipment and screens, if they do not recycle the waste themselves. Extended producer responsibility laws (such as those that require companies to put in place measures to recover plastic packaging) can incentivize recycling and divert e-waste from landfills.

Export bans, linked to recycling mandates, can increase the domestic supply of e-waste and boost the attractiveness of some e-waste categories to recyclers. The Secure E-waste Export and Recycling Act, which would establish such a ban, is currently under consideration in Congress. The inclusion of copper on the critical-minerals list would also motivate domestic retention of e-waste. Still, public-private partnerships may be needed to ensure that municipal e-waste is recycled responsibly.

For their part, companies and industry associations can address the roadblocks described above with their own actions.

Improving Collection with Incentives, Infrastructure, and Consumer Education. E-waste collection can be improved by providing incentives to consumers and partners. Retailers can increase collection and drive foot traffic by offering vouchers for e-waste. Manufacturers can offer retailers new-product rebates for collecting their end-of-life products.

As consumer concern over sustainability rises, companies can capitalize by integrating e-waste collection into their business models.

As consumer concern over sustainability rises, companies can capitalize by integrating e-waste collection into their business models. Implementing in-store end-of-life collection systems, including buyback and takeback programs, can become a source of competitive advantage. Similarly, reverse-logistics programs can provide distributors and e-retailers with valuable data and boost loyalty.

More aggressive and continuous consumer education can help promote circularity by raising awareness of existing e-waste programs and of the value of e-waste and its potential for environmental harm.

Boosting Recycling by Stabilizing Off-Take and Upgrading Capabilities. Value recovery rebates or long-term contracts can be key enablers for recyclers and waste management companies to increase e-waste volumes. They can stabilize future cashflows for e-waste and protect recyclers against volatile commodity prices while securing feedstock for material processors and OEMs. Recyclers can offer municipalities waste management sorting-as-a-service with long-term recovery contracts.

Upgrading separation and refining technology is a prerequisite to extracting value from many grades of e-waste. Robotic processing (using robots to dismantle monitors, for example) can mitigate hazards and reduce costs, but its impact is currently limited by throughput speed. There may be viable business cases for upgrading harder-to-process classes of e-waste or shredded products, such as advanced mechanical sorting of fine granulates to separate valuable metal fines from organics.

Establishing a domestic recycling network can reduce logistics costs and offer other ecosystem benefits. Players need to work together to optimize logistics through, for example, regionalized recycling strategies that minimize the distances that waste needs to travel. ERI runs a national network of electronics and IT asset disposition services, including recycling.

Circularity by Design, Life Cycle Extension, and Service Models. Manufacturers need to adapt products to a circular future, implementing circularity-by-design principles that emphasize durability, repairability, and modularity. They can conduct full-life-cycle assessments across the product portfolio to identify points for intervention and use more lightweight materials (which also bring cost benefits) and easily separable monomaterials. Cisco has committed to incorporating circular-design principles into all products and packaging by 2025; these principles include standardization and modularization as well as design for disassembly, reuse, and repair.

Enabling repair and reuse can extend the product life cycle, and using refurbished equipment reduces companies’ carbon footprint. Philips refurbishes some classes of electronics, including medical equipment, to lengthen their useful life.

Business model creativity may be necessary to make the transition from linearity to circularity. One example is adopting an everything-as-a-service model. HP Managed Print Services enables longer product life cycles through a charge-for-usage rather than a sales model, selling printed pages, for example, rather than the machine itself, with the company retaining ownership and keeping equipment in use for as long as possible.

Manufacturers need to adapt products to a circular future, implementing circularity-by-design principles that emphasize durability, repairability, and modularity.

Closing the Loop: Collaboration, Standards, and Validation Systems. Addressing the roadblocks is essential, but private- and public-sector actors can go further. Some industry alliances, such as the Global System for Mobile Communications Association, are developing blueprints for a circular economy , including recommendations for data gathering. Circularity tracking and data ecosystems can improve visibility into end-of-life product outcomes, reveal pockets of opportunity, illuminate unexpected challenges to achieving a circular future, and enable green premiums.

Products with “digital passports” facilitate the transition to a more circular economy by collecting and storing product information throughout the life cycle. In May 2023, the European Health and Digital Executive Agency opened a grant program to investigate digital passports. Among other goals, the program aims to “enable sharing of key product related information that are essential for products’ sustainability and circularity” and “provide new business opportunities to economic actors through circular value retention and optimization (for example product-as-a-service activities, improved repair, servicing, remanufacturing, and recycling) based on improved access to data.”

Subscribe to our Climate Change and Sustainability E-Alert.

In Up to the Waste

While these individual steps can help bridge the gap, the biggest opportunity comes in the form of new and inventive collaboration models, such as value-chain partnerships and joint ventures, which will be needed to turn e-waste into a positive-sum game. Manufacturers, recyclers, retailers, and IT and telecom companies should evaluate their opportunities in e-waste.

The first step is understanding the company’s role in the e-waste ecosystem, setting goals (both financial and nonfinancial), and assessing the capabilities required to play.

Next, identify market pain points by considering where circular solutions currently face roadblocks and where you can leverage your company’s capabilities to break through them.

Then, test partnerships. As customers, investors, regulators, and others place more importance on climate concerns and environmental responsibility, there may be opportunities for both early-mover and longer-term competitive advantages from committing to a circular ecosystem.

Finally, start small and scale quickly by mitigating upfront investments and risks while demonstrating the viability of solutions through pilots.

E-waste is a complex and growing challenge. The solutions will require time, creativity, and ecosystems of actors. But there are substantial returns to be gained for those that are prepared to think beyond linear supply chains.

The authors thank Pol Cardona, Chirine Mouharam, and Diana Sukailo for their assistance with this article.