Buildings are responsible for about one-third of global greenhouse gas emissions—double those produced by air, land, and sea transportation combined. Given the magnitude of the climate crisis, it is therefore imperative that all building stakeholders play their part. They must act with urgency to decarbonize the sector and help mitigate global warming.

While stakeholders need to tackle emissions from design to demolition/deconstruction in order to reach net zero, decarbonizing building operations is a priority action because operations account for the majority of a building’s life cycle emissions. Four stakeholders are key to reducing operations emissions: asset owners, building technology original equipment manufacturers (OEMs), utility companies, and local regulators. Furthermore, in our examination of the global building landscape, we found that the largest opportunities for curbing operations emissions—and the greatest market potential—lie in a handful of regions, building segments, and technologies. Stakeholders can use this information to focus their efforts.

The largest opportunities for curbing operations emissions—and the greatest market potential—lie in a handful of regions, building segments, and technologies.

So far, the building sector has been slow to respond to the climate crisis. A fragmented value chain, mismatched incentives, and the sheer volume of regulation involved have hampered collaboration between stakeholders, while a lack of capabilities and resources has held back progress in implementing green solutions. Nevertheless, stronger regulation, higher energy costs, and a growing recognition of the effects of the crisis are driving more and more stakeholders to seek to decarbonize buildings. Fortunately, the technologies to do so are largely already available.

Stakeholders that act now can gain significant early-mover advantages. For example, by taking steps to curb operations emissions—by retrofitting existing buildings or deploying green solutions in new buildings—they can avoid climate-related penalties, gain reputation benefits, and potentially improve their access to capital. They can also seize a slice of a burgeoning global market in decarbonization solutions for buildings. To achieve their goals, however, stakeholders will need to move swiftly and take targeted actions, both individually and collaboratively.

The Building Sector Must Decarbonize at Speed

Without further action, global emissions—rather than hitting net zero—are projected to increase even further through 2050 if they continue on their current trajectory, according to the United Nations’ Intergovernmental Panel on Climate Change. In response to this worrying possibility, investors and regulators are demanding that companies and industries implement credible net zero measures at pace.

In the building sector, global emissions across the building life cycle need to fall drastically from now through 2050 to reach net zero. According to the International Energy Agency (IEA), however, worldwide floor space is projected to nearly double over the same period. Consequently, emissions could balloon if players fail to act quickly.

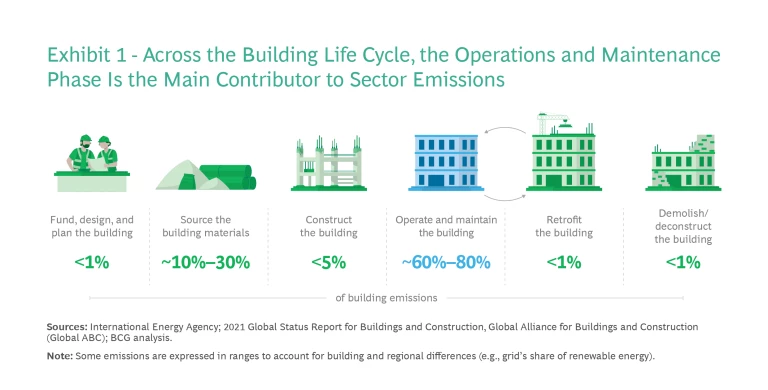

The sourcing of building materials typically accounts for 10% to 30% of building emissions globally (primarily because of the highly carbon-intensive production of concrete and steel), while construction makes up around 5%. (See Exhibit 1.) By contrast, the phase when a building is in use (operations and maintenance) generates 60% to 80% of worldwide building emissions, owing to the ongoing energy requirements and the comparatively long length of this phase. While these proportions apply globally, the picture varies by region depending on the climatic conditions, levels of renewable energy, and penetration of green building solutions.

High-Impact Areas for Decarbonizing Building Operations

Our analysis of the global building landscape established the countries, segments, and emissions sources that are responsible for the greatest operations emissions and that have the biggest market and abatement potential. While stakeholders will need to use all means to achieve net zero, they can apply this knowledge to prioritize green initiatives, seize new opportunities, and help tackle the climate challenge. Here’s what we found.

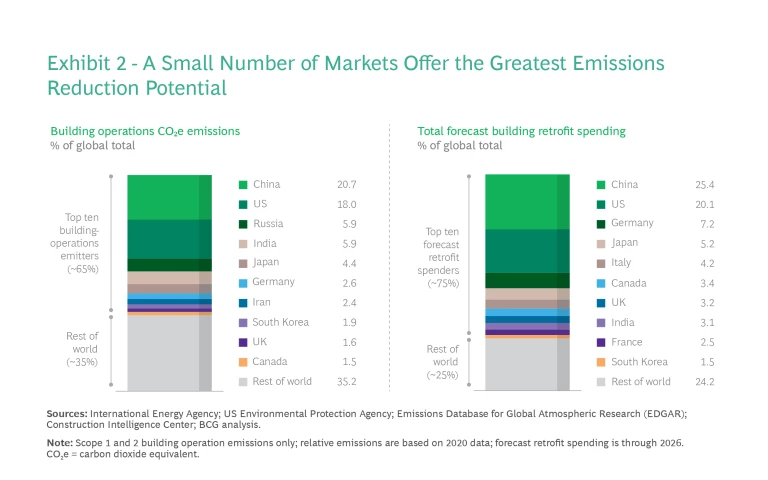

The Largest Markets. Ten countries are responsible for about 65% of global building operations emissions. Of the total emissions, China and the US together account for 40%. (See Exhibit 2.) For decarbonizing the operations of existing buildings, retrofitting will be key. We found that ten countries are responsible for 75% of the projected retrofit spending worldwide. China and the US once again account for the lion’s share, with 45% between them. Eight countries make both these lists.

Residential Buildings. At a segment level, residential buildings account for 60% of building operations emissions globally. Residential exceeds commercial, institutional, and industrial buildings combined. The residential segment makes up the majority of operations emissions in each of the top ten emitter countries. It also dominates forecast retrofit spending. In seven of the top ten countries, residential is set to receive the bulk of projected spending. In the remaining countries (France, India, and South Korea), nonresidential segments will likely account for around 55% of retrofit spending.

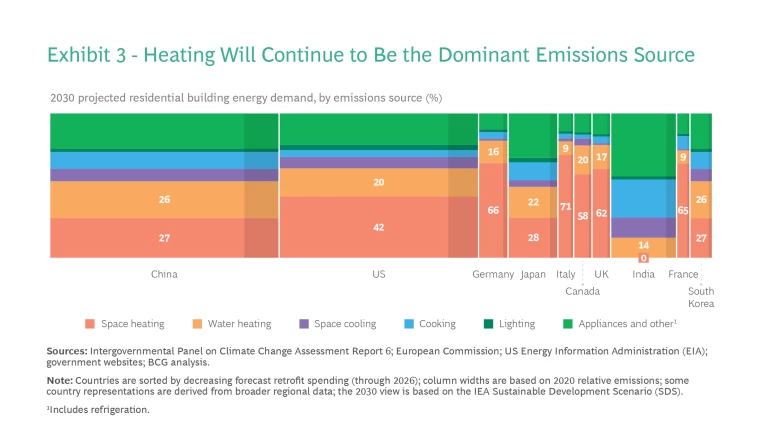

Space and Water Heating. Space and water heating make up about 60% of the residential building operations energy demand worldwide. Heating—mainly space heating—constitutes the biggest emissions reduction opportunity by emissions source. Appliances (including refrigeration) rank second at approximately 20% of demand. And despite our warming climate, cooling accounts for only 4%.

There are two main reasons for this. First, the use of air-conditioning systems in some of the hottest countries is limited because of the expense. For instance, only approximately 5% of India’s population has access to air conditioning. The figure is less than 10% in Indonesia and under 20% in Brazil. Second, while cooling is necessary to achieve a comfortable environment in many hot countries, the change in temperature—and consequently the amount of energy required—is less than that needed to provide heat in cold countries.

Cooling is expected to be the emissions source that sees the most growth, however, as global temperatures rise and air-conditioning access improves. Still, heating will continue to account for the bulk of buildings’ energy demand. As such, heating will be the biggest emissions reduction opportunity by source worldwide. That is also the case in nine of the ten largest building retrofit markets, with demand for heating varying according to climatic conditions. (See Exhibit 3.) In all markets, the choice of decarbonization technology will be key.

Many Mature Decarbonization Technologies Already Exist

Two of the most important levers for decarbonizing building operations are energy efficiency measures (such as smart controls and improved insulation) and electrification/fuel switching (for example, using an electric heat pump in place of a gas boiler and, ideally, ensuring that the electricity powering the heat pump is fossil free). These levers will play a significant role in curbing the emissions of new buildings and decarbonizing existing buildings through retrofitting. (See “The Importance of Retrofitting.”)

The Importance of Retrofitting

The Importance of Retrofitting

Owing to the age of many buildings in mature markets, these structures are prime candidates for retrofitted energy solutions. More than half of residential buildings in Europe and the US were built before 1980, according to figures from the European Commission and the US Energy Information Administration. In Germany and the UK, the proportion is even greater, at around 75%. Heat pumps are one example of a solution that can be deployed in both old and new buildings.

Retrofitting will need to accelerate significantly if the sector is to achieve net zero emissions at the pace required to meet global emissions reduction goals. The IEA estimates that the global retrofit rate—the proportion of the building stock that is retrofitted annually—will have to more than double by 2050, from less than 1% per year currently to around 2.5% per year.

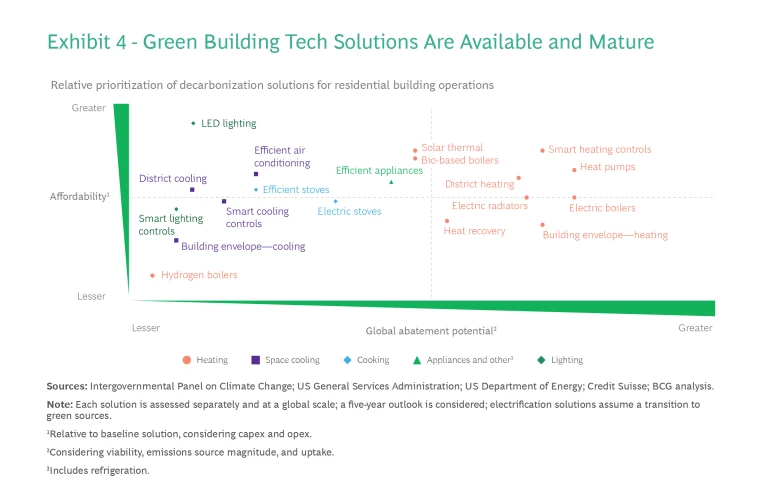

By analyzing the current technology landscape, we found that global building operations decarbonization is for the most part already achievable using existing, mature energy efficiency, electrification, and fuel-switching solutions. Many heating technologies, such as smart heating controls and heat pumps, are already affordable (based on capex and opex over a building’s lifetime) and are supported by a strong business case. Furthermore, because heating is the main source of emissions in building operations, these technologies also offer high abatement potential. (See Exhibit 4.)

Full abatement of a country’s building operations emissions will require a combination of these technologies. Global players need to customize their decarbonization pathway in individual regions by considering a tapestry of local factors. These include climate, regulation, infrastructure, tenant receptivity to technology, the current energy efficiency of the building stock, and the type of technologies already in use. For example, whereas district heating is emerging as a leading solution in Germany, the short-term potential to use this technology to heat commercial and residential buildings is far more limited in the US due to a lack of infrastructure.

At the same time, governments are also taking action: by implementing tougher regulations paired with more generous incentives, they are increasing the pressure on stakeholders to adopt levers that decarbonize building operations. For example, the US has set aside $9 billion in incentives for heat pumps and homeowner retrofit rebates in the Inflation Reduction Act. Germany is providing $6.5 billion in incentives for energy efficiency measures via its COVID-19 recovery and emergency gas programs.

Four Stakeholders That Are Critical for Success

Four stakeholders have a significant influence on building operations and thus can play a key role in tackling emissions at this crucial stage in the building life cycle. These stakeholders—asset owners, OEMs, utility players, and local regulators—must act decisively if the building sector is to reach net zero.

All four can gain significant benefits by doing so. For example, stakeholders can strengthen their license to operate, lock up early access to low-carbon power supplies, expand into new high-growth markets, and drive increased market valuations. We have found that companies with best-in-class sustainability metrics enjoy a premium of 10% to 15% in their valuations. And because about 60% of employees worldwide factor sustainability into their choice of job, building stakeholders can attract much-needed talent.

None of the four stakeholders can solve the building sector’s huge decarbonization challenge alone. Historically, industry players have been slow to collaborate—in part because of a fragmented value chain. But stakeholders will need to cooperate and join forces if decarbonization initiatives are to be effective.

Stakeholders will need to cooperate and join forces if decarbonization initiatives are to be effective.

Nevertheless, each of the four stakeholders has a unique role to play to enable the building sector to reach net zero. By embracing this role, they can seize new opportunities but will also need to tackle critical challenges.

Asset Owners

Role. As the key decision makers on how buildings are constructed, equipped, and renovated, asset owners will play a leading decarbonization role. Unlike other stakeholders, asset owners are ultimately responsible for ensuring that their buildings achieve net zero, and these owners face the prospect of penalties if they fail to comply with low-emissions regulations or meet green targets. By driving the demand side of green solutions, asset owners will set the pace on adoption rates and the sector’s transition to net zero.

Opportunities and Challenges. Assets owners have an opportunity to capture operational savings from more cost-effective technologies and potentially to command a rent premium for more attractive, sustainable buildings. By adopting decarbonization measures now, they can also gain reputation benefits, leverage green sources of capital, and mitigate the impact of future carbon taxes. But they will need to develop capabilities in several areas: measuring the existing CO2 emissions baseline of assets, determining the feasibility of different green solutions so they can allocate capital more effectively, and implementing solutions in both new and existing buildings. Asset owners will also have to explore the optimal combination and sequencing of green solutions for their buildings. Once they have developed these capabilities, they can offer them as a service to other asset owners, thus establishing new green ventures beyond their core business.

OEMs

Role. OEMs need to provide the green technologies and services that are fundamental for the decarbonization of building operations. Their ability to innovate and market energy-efficient solutions and maintain them over the life cycle not only generates customer value but also significantly reduces CO2 emissions.

Opportunities and Challenges. Although some OEMs must deal with the challenge of declining legacy technology (such as oil and gas heating in Europe), most have a promising future driven by an ever-increasing customer appetite for energy-efficient products. The potential for OEMs to differentiate themselves from competitors has historically been based on classical buying criteria like quality, price, and availability. In recent years, this has shifted to a focus on adding capabilities such as the capacity to combine different technologies into a single solution that adds customer value (for example, sector coupling of electricity-based heating with distributed solar photovoltaic) or the ability to offer superior control on the back of IoT-enabled cloud-edge connectivity (such as smart control and optimization of electricity consumption via home or building energy management systems).

In the long term, however, these players face uncertainty about the pace of the green transition, the resilience of their established go-to-market networks, and how incentives and regulations will evolve. Furthermore, it remains unclear whether the regional nature of the green building technology markets will persist. It is likely that global competition will intensify and offer Asian mass producers an even stronger inroad to Western markets. For example, in the market for air-to-air heat pumps, players like Daikin and Mitsubishi are starting to gain share over regional incumbents in Europe. To sustain an advantage, incumbents may need to invest (in expanding their footprint, for instance), forge partnership ecosystems, or consider strategic M&A. Market access and scale will be increasingly important as green building technologies evolve along the maturity curve. The US firm Carrier Global’s acquisition of the climate solution business of Germany’s Viessmann is a good example of strategic thinking in that regard, if approved by regulators.

Featured Insights: Explore the ideas shaping the future of business

Utility Companies

Role. Utility providers need to supply the green electricity that will enable the building sector to reach net zero. And they will have to deliver a lot more of it as buildings increasingly electrify and demand skyrockets.

Opportunities and Challenges. Utility players have an opportunity to capture a share of the growing green electricity market and, in doing so, mitigate their own Scope 3 emissions. They can also establish new business lines, such as installing and servicing green solutions, leveraging their existing field staff and deep, data-driven understanding of customers’ energy usage and requirements. Utility companies will be able to offer large asset owners a one-stop-shopping solution that combines renewable energy services with heat pumps and other green technologies such as district heating.

But utility operators also face uncertainty about the potential trajectory of green solutions as well as challenges in anticipating the future demand for green electricity—and they may lose customers if they do not navigate the energy transition smoothly. In addition, they will need to motivate and forge strong partnerships with independent technical installers. Furthermore, the grid infrastructure in some countries needs upgrading to support renewable energy. Still, many utility companies have seen windfall profits over the past year from higher energy bills. By investing some of this money in the building value chain (for example, in installation services), they can play an important role in the sector’s decarbonization journey.

Local Regulators

Role. These players need to drastically simplify the local regulations that planners must comply with, as these requirements often impede the adoption of green building technologies. At the same time, local regulators should increase sustainability requirements for building approvals and extend incentives for green solutions.

Opportunities and Challenges. Local regulators have an opportunity to significantly accelerate building decarbonization and promote effective green technologies. To do so successfully, they will need to develop new capabilities for assessing and prioritizing green solutions and evaluating building plans that contain new technologies. They must also avoid creating further regulatory complexity that impedes change. Regulators should prioritize introducing new requirements for the highest-emitting sources and segments and should deploy financial incentives to help players with high upfront investment costs.

Given the size of building sector emissions, key stakeholders must act to help mitigate the global climate crisis. Although steps are needed across the building life cycle and from all players, decarbonizing the operations phase by using the dual levers of energy efficiency and fuel switching/electrification will have the greatest impact. While a lot still has to be done, the pieces are in place for the building sector to succeed. Cost-efficient decarbonization technologies already exist, governments are setting tougher targets and providing more generous incentives, and players—faced with higher energy costs—are recognizing the importance of taking action. Building stakeholders must now grasp the challenge and accelerate the push to net zero.