In a continually evolving M&A landscape, biotech acquisitions remain a vital path for biopharmas and large biotechs looking to bolster pipelines or improve capabilities in new therapeutic areas. All too often, however, acquiring companies focus their post-merger integration (PMI) efforts on the intellectual property without sufficiently considering the people behind it—the employees who are critical to the success of the assets. In a talent market as competitive as biotech, that approach puts enormous value at risk.

To succeed in biotech PMIs, companies need to ensure that key employees from the target company have a good experience and remain for the duration of the integration period and beyond. This requires an employee-centered talent strategy supported by tactical actions that boost the retention of scientific and entrepreneurial talent , minimize the disruption of development programs and commercial operations, and reduce uncertainty for the workforce.

Organizations that invest the time and resources in building a strong talent plan are better positioned to hit their clinical, commercial, and overall acquisition goals.

Organizations that invest the time and resources in building a strong talent plan are better positioned to hit their clinical, commercial, and overall acquisition goals as they accelerate the progress of clinical trials, decrease the time to market, and build lasting capabilities.

The Key Elements of an Employee-Centered Talent Integration Strategy

Upfront—ideally, during due diligence—the acquiring company (AcquirerCo) needs to shape its talent strategy with input from the target company (TargetCo). The strategy will be informed by the target’s critical sources of value including its scientific expertise, clinical programs, and marketed products. An in-depth understanding of the two companies’ cultures will be important as well.

The AcquirerCo’s executive team, HR leadership, and integration management office (IMO) need to play leading roles in developing the talent strategy. The R&D and commercial functions should also have a prominent voice early on because they are vital drivers of the business. So should a communications or culture team: as a key enabler, this group is likely to have a big impact on the way TargetCo employees experience their new home—and whether they decide to stay.

To secure value and provide a good employee experience, the acquirer’s talent strategy should focus on three key areas.

Identifying Priority Talent

First and foremost, the AcquirerCo must determine what priority talent is needed for the business, that is, the employees who need to be retained in functions like R&D and commercial. It’s also important to determine the desired minimal retention duration for different kinds of essential talent: it could vary quite a bit among the head of a clinical program, lead researcher, and sales rep in a niche therapeutic area, and therefore the measures needed to secure different types of talent could vary as well.

R&D. Typically, R&D drives much of the value in a biotech acquisition, so employee retention is critical. But even within R&D, there are many different activities, spanning early discovery through clinical trial execution and regulatory filing. So the talent strategy needs to be tailored even within the R&D team, on the basis of the specific deal, assets, needed capabilities, and individual employees at the target organization.

For example, if the acquirer is buying the target mainly to obtain a clinical-stage asset, the talent strategy should focus more on the staff needed for ongoing clinical development than discovery. It should also account for important upcoming milestones, such as regulatory filings. That way, the AcquirerCo can develop retention approaches that maintain—or even accelerate—the clinical timeline.

Commercial. The same guidance applies to commercial talent. If the target has a salesforce and relationships with physicians in a therapeutic area, region, or modality where the acquirer does not currently operate, retaining those individuals is important as well.

Support Functions. At the same time, organizations should not discount the value of support functions such as technology and HR during a PMI. Understanding where these teams provide business-critical support to value-driving programs—and how to maintain that value after the close—is vital. Regardless of whether the retention needs are short or long term, underestimating them can result in value leakage. So it is important for the business and value teams to align, early in the process, on the mix of target and acquirer functional support that will be required.

Building the Operating Model

While the AcquirerCo’s senior executives are in the process of identifying priority talent, they also need to develop the operating model for day one and beyond. It will be especially important to define the extent and timing of the integration: whether the TargetCo or portions of it will be integrated or will operate at arm’s length. These decisions have major implications for the extent and duration of employee retention.

While the acquirer’s senior executives are in the process of identifying priority talent, they also need to develop the operating model for day one and beyond.

Tactics. The decisions about the operating model also have a bearing on the details that are essential to ensuring the optimal employee experience.

Say the target is going to be fully integrated and integration will begin shortly after day one. To accelerate the integration process and minimize disruption, various tools and processes integral to the employee experience need to be addressed as soon as is practical. IT (computers, phone, data), purchasing and expensing, benefits, building access, and training requirements must all be set up. Many of these are interdependent, so an oversight in one area can create issues with another. If, for example, laptops are distributed without the rapid transition of all systems, the new employees will have to live in two different work environments for a while.

Unless interdependencies are well coordinated, the staff could be easily overwhelmed and operations disrupted. So the acquirer needs to set the direction of the integration early and then rigorously coordinate across these dimensions to ensure thoughtful execution throughout the enterprise.

The Communications Plan. The AcquirerCo should also develop a clear plan for communicating the go-forward operating model to employees on day one and addressing their concerns throughout the integration. (See “Three Tips for Implementing a Strong Post-Close Employee Experience.”) TargetCo staff needs will change over time, and proactive communication about the integration is more likely to support a positive impression of the acquiring company. To ensure honest, transparent communication that doesn’t overpromise, the acquirer should develop employee-related communications in consultation with the target’s leadership and send them to the staff of both companies simultaneously.

Three Tips for Implementing a Strong Post-Close Employee Experience

Three Tips for Implementing a Strong Post-Close Employee Experience

- Define the desired day 1, 30, 60, and 90 employee journey.

- At each point, “live” the experience of an employee at the top, middle, and ground floor of the organization.

- Test the plan’s feasibility with the AcquirerCo’s support functions and the TargetCo’s leaders.

- Appoint leads from functions in both companies who are closest to the employee journey.

- Create a clear process to triage issues, make rapid decisions, and update assumptions about the post-close experience.

- Hold town halls or other live forums to provide updates and get a pulse-check on staff sentiment.

- Develop a living resource guide, FAQ, or even a chatbot to serve as an updated single source of truth.

Mapping Out the Timeline of Talent Assessment and Offers

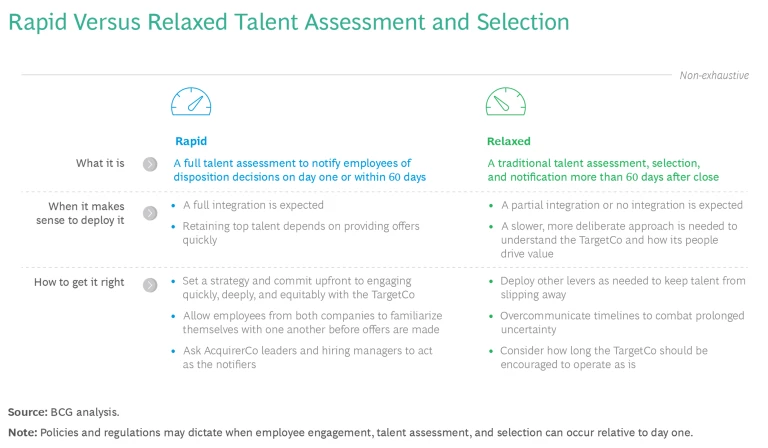

Finally, in cases where the TargetCo employees will be integrated, the AcquirerCo should develop a timeline for conducting a detailed talent assessment, extending offers, and realizing outcomes, along with the supporting HR assessment and offer processes. Often, the acquirer first chooses between two talent assessment approaches: rapid and relaxed. (See the exhibit.)

The timeline decision is not a small one. The AcquirerCo should make this choice upfront as part of its overarching talent strategy. The selected approach will depend on the specific circumstances of the acquisition and may be heavily influenced by local labor laws in the areas where the AcquirerCo’s and TargetCo’s workforces are located. And because the talent assessment and selection process have a major impact on the TargetCo’s employee experience, the acquirer must be sure to stick to the announced timeline.

Rapid. With a swift timeline, the full talent assessment occurs at the time of the close or within 60 days of it. This type of timeline should be used when a full integration is expected and retaining top employees depends on providing offers quickly. This approach is especially useful in hot job markets. It tends to be more effective with smaller target organizations.

The required pace can also pose challenges, however. The speed of the process can hinder the acquirer’s ability to make sound hiring decisions. And it can feel rushed to the TargetCo’s employees if they have not had a chance to familiarize themselves with the AcquirerCo thoroughly. Moreover, it requires the business leaders from the acquirer to commit upfront to engaging quickly, deeply, and equitably with the target company.

To mitigate these challenges, the two companies should align on the steps that need to happen before the close, including:

- 1:1 Touch Points. The AcquirerCo’s functional leaders should meet individually with TargetCo employees who would join that function. It’s important to establish and clearly communicate whether these meetings have an evaluative component and if they will be followed by a formal interview after day one.

- Disposition Decisions. The companies also need to determine how they will communicate the dispositions to employees: in order of seniority, alphabetically, or in some other way. Given that in this approach the notifications typically go out at the time of the close or shortly thereafter, the IMO should enlist a critical number of AcquirerCo leaders—ideally, direct hiring managers—to communicate these decisions.

Relaxed. With a relaxed timeline, the assessment takes place more than 60 days after the close (though if the TargetCo is ring-fenced, the need for talent assessment would be limited). Organizations should use a relaxed timeline when they have less certainty about the priority teams, segments, and people in the business. A longer “get to know you” period allows the AcquirerCo to gain a better understanding of the target and assess its employees for long-term roles—there’s even time for get-to-know-you sessions at the functional level. It also gives potential hires the opportunity to be better informed before they accept an offer.

But a longer timeline raises the possibility that essential talent will slip away to another company. To prevent this from happening, organizations should consider adding retention payments for business-critical staff to stay for a certain length of time. As with a rapid timeline, communicating clearly and frequently about the anticipated timelines is essential to avoid uncertainty.

Four Critical Steps to Developing a Successful Talent Strategy

To ensure that their acquisitions deliver value, companies must treat employees as a strategic asset, managing the talent strategy as rigorously as the business strategy. To start, four practices are key:

- Develop post-merger talent strategies before they are needed. Acquirers should not wait until the next acquisition to think about various types of talent strategies and when they should be used. The sooner companies develop strategies for the different kinds of potential acquisitions, the better positioned they will be to make decisions quickly once a target emerges.

- Include talent strategy decisions in due diligence discussions. Given the importance of staff retention, companies should hold discussions during due diligence about the target talent strategy and any tradeoffs they may need to make upfront.

- Engage key AcquirerCo functions early in the process. Leaders of R&D, commercial, and select support functions who will work directly with the TargetCo are critical to retention success, so it’s a good idea to map out the role of each and how they’ll deliver.

- Communicate flawlessly. Define the frequency, channels, and response processes to connect with TargetCo employees. A talent strategy is strong only if it is communicated clearly and consistently to the staff an acquirer seeks to retain.

An employee-centered talent integration strategy is critical for maintaining the scientific innovation, execution speed, and entrepreneurial spirit that make a biotech target worth acquiring. This approach belongs in the arsenal of every company that sees acquisitions in its future.