Wealth and asset management firms are facing a formidable triad of challenges: rising costs, shrinking margins, and intensifying customer demands. It’s a somewhat unenviable position for an industry long perceived as enviable by other sectors, especially in terms of consistent profitability over long periods of time.

The rising-costs side is partly driven by higher technology spending, as players seek to offer—albeit, not always successfully—the kind of seamless customer experience that’s commonplace in other sectors. On the margin side, the ongoing rise of passive investments and the deterioration of fee income are causing consternation in C-suites. As for wealth and asset management clients, they are less shy about voicing their digital product and services wishes—and are more willing to vote with their feet.

With pressures such as these occurring all along wealth and asset management value chains, incumbents are looking for ways to achieve several goals: accelerate their digital transformations, bring more of what their clients actually want to the table, and bolster assets under management (AuM). But here’s the rub: they need to do it all in the most cost-efficient way possible. But how?

Based on our experience, as well as that of FNZ—a global wealth platform provider that co-developed this report with BCG—a new breed of end-to-end, third-party platforms could be successfully deployed by wealth and asset managers to achieve meaningful impact that can include significant cost savings in the middle office and operations, the creation of new and innovative business models, and the generation of new revenue streams.

In the current environment, the selection of the right platform will require the involvement of the entire executive team, including the CEO. The goals are, first, truly understanding the challenges at hand, and second, taking effective action.

Grasping the Challenges

The first step toward efficient and cost-effective transformation by wealth and asset managers comes from fully understanding the current industry drivers—forces that are made even more challenging by high market uncertainty, elevated interest rates, and slower AuM growth players are presently witnessing.

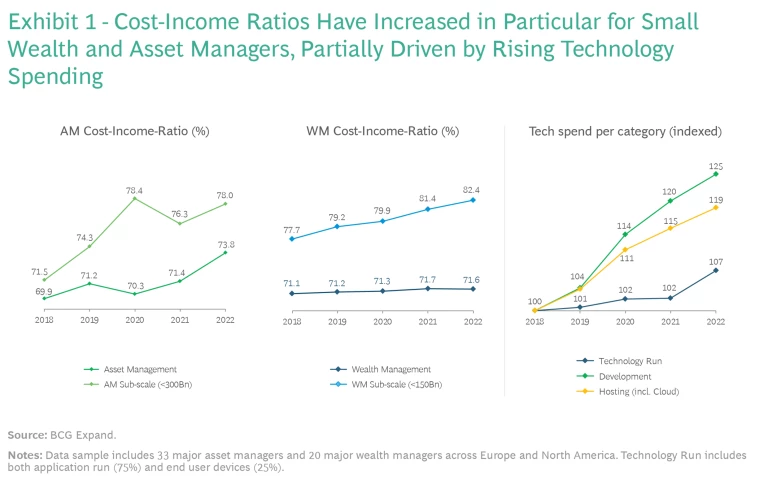

Rising Costs in Technology and Operations. Both wealth and asset managers have been struggling to keep cost-to-income ratios (CIRs) in check. Despite largely favorable market conditions over the past few years, industry CIRs have risen, particularly for smaller players. More specifically, while larger asset managers witnessed a gradual increase between 2018 and 2021—with a rise to 74% in 2022—smaller asset managers with less than $300 billion in AuM saw a more pronounced increase to 78%. CIRs for larger wealth managers have been stable at 71%, while smaller wealth players, with AuM below $150 billion, suffered a steep increase to surpass 82% in 2022, on average. (See Exhibit 1.) While some small wealth players have managed to buck this trend by leveraging very lean setups, the general principle that scale matters is well evident.

Technology spending has been a key driver of these dynamics. The average share of technology in total operating expenses (also known as IT intensity) reached over 15% across both wealth and asset managers in 2022, up from 13% five years earlier. Over the same time frame, IT spending was particularly on the rise in application development (+25%) and hosting (+19%), mirroring both the expansion of new requirements as well as large investments in cloud migration.

Meanwhile, although the pace of new regulation has slowed in recent years, its existing scope (e.g., suitability requirements and regular know-your-customer reviews) continues to impose operational complexity and costs on the industry.

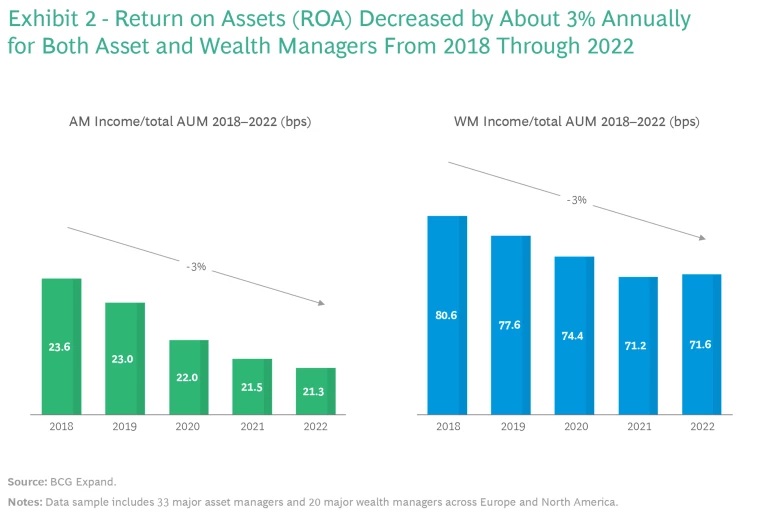

Shrinking Margins and AuM. For the first time since the 2008–2009 financial crisis, global AuM declined in 2022 (by roughly 15%). Moreover, higher interest rates combined with sluggish GDP growth are expected to persist through 2025, leaving little hope for a strong rebound in industry revenues in the short term. At the same time, wealth and asset managers are facing continuous margin compression driven by several trends: the increasing share of passive investments, rising competition from digital players, and the consolidation of large incumbents with significant scale advantages (especially in asset management). As a result, return on assets (ROA) fell by 3% per year across both asset and wealth management from 2018 through 2021. (See Exhibit 2.)

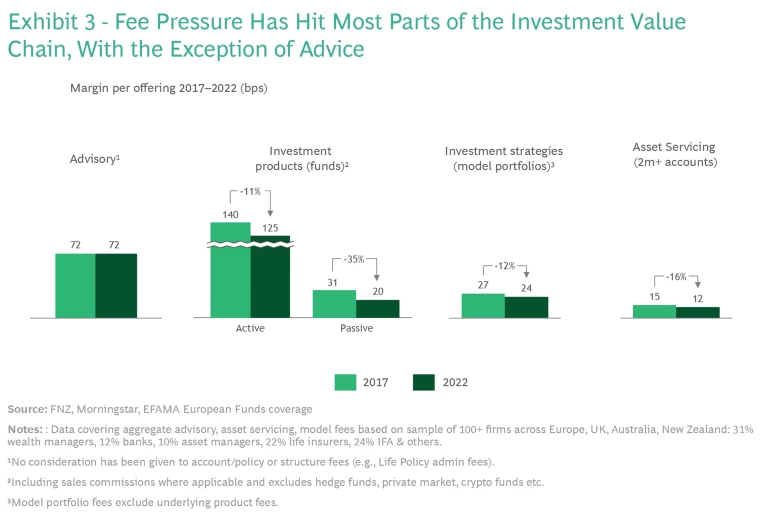

Furthermore, observing the investing value chain, it is clear that while advisory fees have remained relatively stable, product fees have been hit by fierce competition and increased cost transparency—with declines of 11% for active funds and 35% for passive funds since 2017. Although the margin drop for active funds appears less pronounced, the phasing out of sales commissions in certain European markets as well as the increasing use of index funds for individually managed portfolios are exerting significant pressure. Increasing competition is also visible in the declining margins on model portfolio services provided by wealth and asset managers (down 12% since 2017). Finally, asset-servicing margins for clients with more than $2 million have decreased by 16% since 2017, reaching as low as 12 basis points for typical wealth management mandates—a decline driven by technology, scale economies, and increased transparency. (See Exhibit 3.)

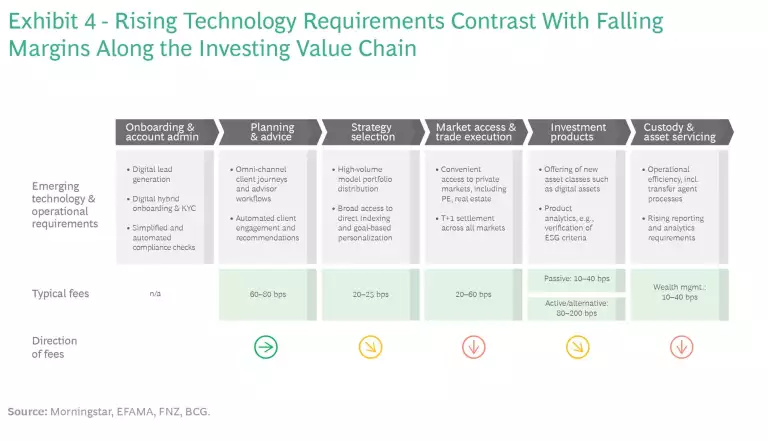

Intensifying Client Demands. At the same time, client demands are steadily rising along the value chain, requiring wealth and asset managers to make further investments. We expect some of the most substantial outlays to be in several areas, such as hybrid advisory (supported by seamless omni-channel capabilities), direct indexing (allowing replication of indices on individual portfolios in a tax-efficient manner), and managed portfolio services (allowing for higher levels of personalization than with traditional approaches for a large investor population). In addition, clients are increasingly demanding full transparency of their investments in order to ensure full alignment with their personal values and goals (e.g., sustainability). Although fintech elements will be required as an enabler for wealth and asset managers to advance their business models, players will also need to adjust their operating models in order to navigate the shifting landscape in a cost-effective manner. (See Exhibit 4.)

Faced with these challenges, how can wealth and asset managers best chart their way forward? The pathway of using third-party players for essential services is becoming more and more viable.

Third-Party Solutions Across the Tech Stack Are Gaining Ground

Given the fast-growing demand for digital customer experiences and automated operations, it’s no surprise that third-party providers are playing an increasingly important role in filling in-house technology gaps. Indeed, the share of third-party technology spend has risen by more than 10% since 2018 across both run-the-bank and change-the-bank initiatives at wealth and asset management firms.

To illustrate the shifts in spending, we’ve segmented the typical technology stack of wealth and asset managers into six layers:

- Digital front-end and engagement, providing omnichannel interfaces to manage customer and advisor interactions and journeys

- Smart workflows, which structure, orchestrate, and automate processes, integrating them with various business solutions

- Core business capabilities, which provide product and service logic along the value chain, such as in advisory, portfolio management, execution, and asset servicing

- Central Data and Analytics Platform, which ingests, stores, and governs data to provide a single client view as well as offer input for various AI and analytics-driven use cases

- Core Booking System, which provides a central repository for customer and account data, processes transactions, and offers reporting and third-party integration capabilities

- Cloud Infrastructure, utilized for scalable computing and network resources, as well as for fundamental services ranging from developer tools to cyber-security

The largest shift to third-party offerings can be observed in differentiating infrastructure and data layers, as companies move workloads to the cloud. Here, a handful of “hyperscalers” are taking advantage of their ability to quickly scale computing resources and software architecture up and down as needed to currently dominate the market. Acceptance of these services is steadily increasing as cloud providers invest to meet the data-privacy and cybersecurity requirements of financial firms. By contrast, in the upper layers of the stack, wealth and asset managers have a better chance of offering a degree of differentiation in their digital front ends and engagement approaches, such as through well-designed customer journeys and seamless omnichannel experiences.

Fresh Approaches to Technology and Operations

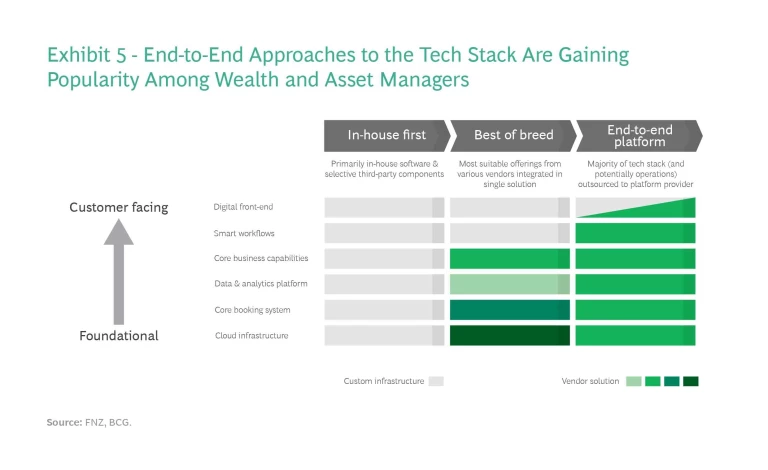

Historically, incumbent players with complex offerings have often developed customized “in-house-first” applications optimized around stable operating models for significant parts of their tech stacks. Yet, with rapidly evolving customer needs and the proliferation of software as a service (SaaS) offerings, more players have started to opt for a “best-of-breed” approach, integrating a wider array of third-party solutions along the stack. While this approach benefits from faster access to innovation, it requires significant integration capabilities and strong architecture standards to manage complexity.

In addition, as many players struggle with integration capabilities, we have started to witness a growing number of setups in which the financial institution deploys an end-to-end vendor platform for a large portion of the stack—typically covering the non-differentiating activities. This approach significantly reduces the need to develop a proprietary technology architecture and, in some cases, even lowers the need for in-house staff. Indeed, some vendors offer outsourcing for “commodity” functions in the middle office and operations (See Exhibit 5.)

Although such vendor-based options have mostly been used by smaller players or in minor office locations of larger players, they have become increasingly popular with major incumbents in recent years. This trend is owing to the rising importance of a faster time to market (e.g., in the context of business strategy changes or frequent M&A activity), a general move toward open-finance and ecosystem use cases, and the limited availability of in-house tech talent.

Of course, varying approaches have diverse benefits. The in-house-first and best-of-breed pathways offer advantages such as full control over technology and functional specifications (allowing for more customization and differentiation), better control over operational and security risks, the development of in-house technology expertise as a potential competitive advantage, and not having to depend on an individual vendor. Moreover, in-house applications with fully depreciated development spend can have lower run costs—provided they don’t require significant change or maintenance work.

End-to-end platforms, for their part, also offer a multitude of benefits such as lower maintenance costs; automated regulatory and stability upgrades provided by the vendor; lower interface complexity and higher ease of integration through more standardized solutions; greater flexibility to execute operating-model changes; more capacity for in-house tech talent to focus on value-adding parts of the stack; lower requirements for upfront capital expenditures; and a higher share of variable costs. Also, for firms that lack the scale to develop and run their own solution stack, this approach may be the only viable option.

How It Really Happens

The following three case studies illustrate typical benefits of the end-to-end model of technology and operations—ranging from cost savings to customization at scale to the ability to quickly launch new business models.

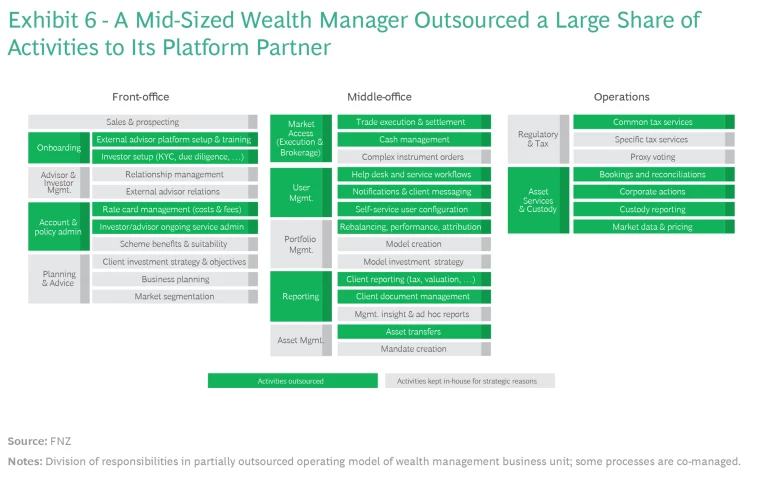

Case Study: Cost Savings with End-to-End Wealth Platforms. A mid-sized wealth manager moved from a legacy technology stack to an end-to-end model for a significant portion of its middle-office and operational applications. The company provides a range of services including planning and advisory, investment fund management, brokerage, accounts, and retirement products across several countries, utilizing both in-house and external advisors as well as distribution agents. The scope of its outsourcing included several business applications, IT infrastructure, application management, core processes, and business operations teams, with certain activities co-managed between the wealth manager and the platform partner. (See Exhibit 6.) The transformation took place over five key stages: target operating model (TOM) agreement; staff and system reassignment; realignment of business processes; building the model (including quality assurance, and test release); and full client and asset conversion.

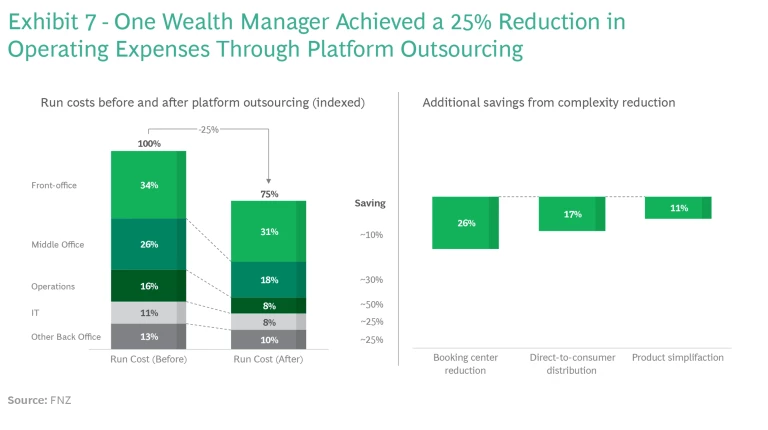

The migration achieved an overall reduction of 25% in operating expenses across the entire organization, with four key efficiency drivers (See Exhibit 7.)

Front Office: Increased self-service and advisor efficiency via improved user experience and automation of tasks previously performed by front-office support teams.

Middle Office: Achieved standardization of processes related to non-complex products, accounts, and investment schemes; improved market-access economics through automation and high trade volumes; and lowered product-development costs through faster production cycles.

Operations: Accelerated automation and standardization of administrative, accounting, and securities workflows; extended third-party connectivity; improved centralization of controls and non-client data management; and enhanced scale economies in servicing high asset volumes.

IT: Shifted to cloud-based IT services, advanced data management and application programming interfaces, as well as to centralization of application management and services.

In addition to short-term cost savings, the simplified operating model enabled the firm to modernize its portfolio of offerings and consolidate a number of legacy services into a single seamless experience for both its distribution network and its clients. These steps put the organization in a position to serve a broader set of client needs with a single platform, allowing the business to place more attention on acquiring new clients and expanding into new markets.

Further review of the operating model, in the wake of the platform migration, identified additional savings potential along three main levers. First, a reduction of booking centers eliminated significant local fixed costs (including custody, client data storage, compliance controls, and financial reporting per jurisdiction). Moving to direct-to-consumer distribution had the effect of centralizing services and limiting the need for regional sales, advisory, and relationship-management staff to those strictly required to cover major clients and regulatory compliance in each jurisdiction. Finally, product simplification resulted in streamlining offerings that were not easy to automate or handle via straight-through processing, such as highly customized discretionary portfolios, direct investments in alternative assets, and complex legal structures such as trusts and foundations.

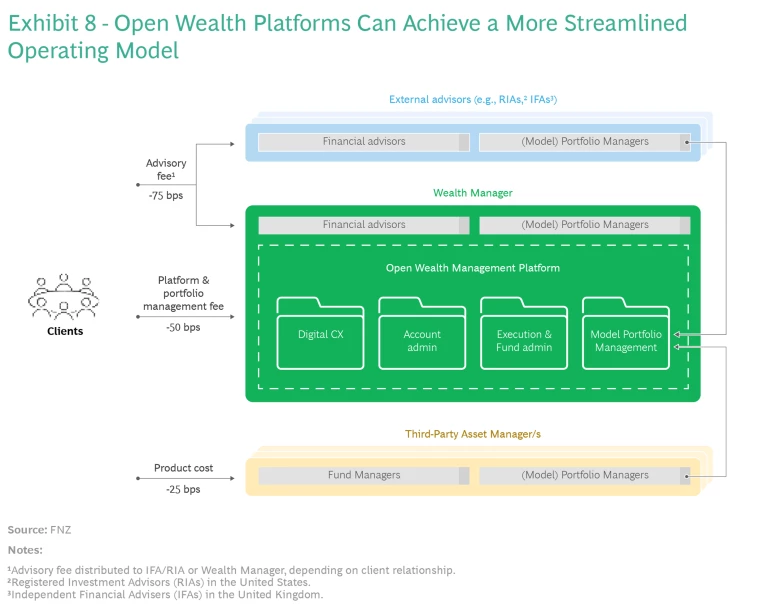

Case Study: Achieving Personalization at Scale Through Open Wealth Platforms and Managed Portfolio Services. A large-scale European wealth manager with several hundred thousand affluent and high-net-worth investors migrated from a complex setup with multiple legacy tech stacks and entities to a single, open wealth platform.

The migration was completed against the backdrop of strong demand for discretionary managed portfolios in the local market, including restrictions on fund sales commissions and the growth of defined contribution pensions—many of which had to be managed by accredited financial advisors. The new open-platform architecture allowed investors to be served both in house as well as through external advisers. The setup included a choice between three types of discretionary model portfolios: a “house” model managed internally by the wealth manager itself, a model provided by a third-party asset manager, and a model provided by the advisor covering the client. (Some external advisors might also employ dedicated portfolio managers.)

Under the new model, clients pay separate advice fees (to either the platform or their external advisor) as well as administrative fees to the platform for providing a range of services. Such services could include digital customer journeys; access to a wide range of funds and underlying securities for portfolio construction; exchange and distribution of model portfolios; account and policy administration; as well as corresponding fee bookings, trade execution, and asset servicing. (See Exhibit 8.)

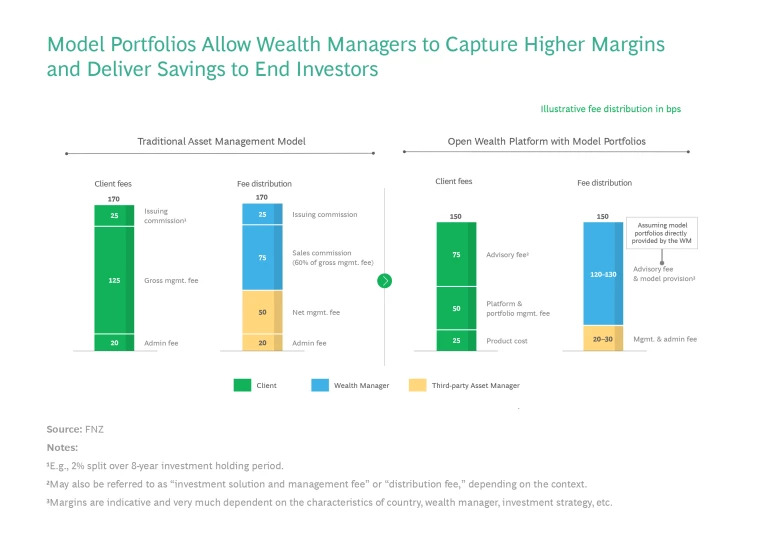

The wealth manager achieved a more streamlined operating model with a clear focus on managed portfolio solutions—allowing the organization to capture a higher share of discretionary management fees (when “house portfolios” were used). In parallel, the firm enabled a broader range of third-party asset managers and external advisors to offer their Model Portfolio Service (MPS). (See “What Are Model Portfolio Services?”)

Consequently, the firm witnessed a significant uplift in pretax profit driven by an increase of over 50% in net asset inflows per advisor in the first two years following the program launch.

What Are Model Portfolio Services?

Compared with the traditional model, MPS offer a series of advantages for wealth managers:

- End-clients pay lower overall fees, as wealth managers can rely on low-cost funds as underlying investments for model portfolios, instead of on more-expensive, actively managed funds—thus attracting higher client volumes.

- Wealth managers can provide model portfolios directly rather than rely on strategies provided by asset managers, thus keeping a larger share of client fees, even after those paid to the platform partner.

- Additional customization can be easily achieved by switching the model portfolio—such as pension asset allocation changing as a function of years to retirement.

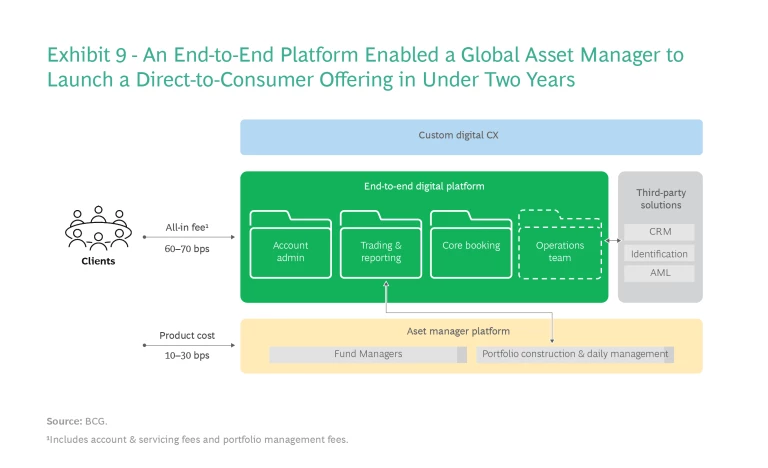

Case Study: An End-to-End Platform Allowed a Global Asset Manager to Launch a Direct-to-Consumer Offering in a New Market in Under Two Years. A US-based, global asset management firm with over $300 billion in direct-to-consumer AuM launched an app-based, digital-investing proposition to enter a new major market. The offering included both an option for self-directed fund trading as well as a managed portfolio account based on simple profiling and strategy selection. In both options, the asset manager primarily offered its in-house Exchange-Traded Funds (ETFs) with product costs ranging between 10 and 30 basis points. Additionally, clients paid transaction fees in the self-directed option, or an all-in fee of 60 to 70 basis points for a managed portfolio, covering both account servicing and portfolio management costs.

The asset manager was able to realize a time to market of under two years, despite having to both apply for a new license in the launch country and build the entire operation from scratch. The initiative was partly enabled by building a technology stack on a digital end-to-end platform, with the aid of an operations team provided by the vendor. Ultimately, the asset manager was able to integrate its existing capabilities in portfolio management, build a fully customized digital experience, and leverage several third-party solutions for non-differentiating capabilities such as client identification and anti-money-laundering monitoring. (See Exhibit 9.)

Taking the Bold Step

Continuous margin pressure, ever-evolving regulatory and cyber-security requirements, as well as growing investor demand for personalization make it imperative for wealth and asset managers to pursue digital and operating-model transformations with the most efficient use of resources. Given a mixed track record with regard to large in-house digital initiatives, often hampered by slow delivery and budget overruns, many industry players are looking for new alternatives to achieve these goals.

Moving significant, non-differentiating parts of the tech stack to an end-to-end platform is one such alternative, supported by the emergence of vertically integrated platform providers that cover substantial parts of the value chain. With some of these providers also offering outsourcing for middle-office and operations functions, wealth and asset managers now have more options than ever in their quest to gain operating leverage and focus on core activities. Such platforms can yield benefits ranging from serving hundreds of thousands of end clients with mass-customized mandates to operating direct-to-consumer models at low cost—potentially realizing operating cost savings of up to 30% compared with more-traditional setups.

Meanwhile, for institutions with diverse client segments and significant existing capabilities, pursuing a “best-of-breed” approach remains a viable option—one that allows for the selection of specific solutions from different vendors depending on the use case and layer of the technology stack. This approach gives institutions a higher degree of strategic flexibility and reduces dependence on a single vendor. Yet, it also reintroduces some of the risks associated with the traditional in-house model, especially regarding the ability to deliver within time and budget.

Ultimately, CEOs, CTOs, and COOs need to consider their own individual starting points and strategies when deciding which path to follow, guided by the following topics and questions:

- Strategic Flexibility: Does the new setup simplify the firm’s current application landscape and allow for quicker reactions to new market opportunities and requirements?

- Geographic and Product Coverage: Does the solution work for all markets covered, and does it potentially provide access to new markets?

- Return on Investment: Is there a convincing business case for switching approaches, either through cost savings or access to new revenue streams?

- Track Record: What is known about the vendor’s history regarding security, reliability, innovation, and ability to deliver—and is the company likely to be around for the long haul?

- Alignment of Incentives: Is there sufficient trust to support a long-term vendor relationship with high switching costs?

- Migration Requirements: Can the migration of current applications and business processes be achieved without jeopardizing the overall benefits of the project?

From our perspective, wealth and asset management leadership teams should consider this new wave of alternative business and operating models as an opportunity to create competitive advantage—even if these options run counter to certain long-established practices.

About FNZ

With over 6,000 employees in 21 countries, FNZ’s mission is to use cutting-edge technology to open up wealth, helping everyone, everywhere to invest in their future.

FNZ removes friction from wealth management by integrating a modern adviser and end-investor experience with sophisticated investment administration and business operations. By combining technology, infrastructure, and investment operations into a single state-of-the-art platform, FNZ frees its partners to create personalized and innovative products and services that are seamlessly aligned with the needs of their end clients.

To date, FNZ has administered more than $1.5 trillion in client assets and enabled over 20 million people, from all wealth segments, to invest in an effective, simple, and transparent way.