The sustainability movement that began sweeping the corporate world in advanced economies decades ago is now hitting emerging market companies full force. From China to the United Arab Emirates to Brazil, companies are finding that mere pledges to go green and be socially responsible and transparent are not enough. They’re under intensifying pressure at home and abroad from consumers, trading partners, investors, regulators, and employees to back their commitments with verifiable action—and they’re being punished for shortcomings.

CEOs also realize that sustainability is becoming increasingly important for their overall performance—and to building the resilience needed to manage risk and disruption in today’s rapidly evolving international business landscape. Recent BCG research has found a strong correlation between emerging market companies’ scores in environmental, social, and governance (ESG) indexes as well as key financial and valuation metrics. It is now clear that the sustainability imperative is transforming the very nature of global competition.

Companies with strong reputations for meeting ESG challenges in emerging markets are rewarded with major growth opportunities. They enjoy higher customer satisfaction. They gain better access to markets, investment capital , and coveted talent. They have greater opportunities to change the dynamics in their industries by launching new, climate-driven business models. Companies that fail to close the “sustainability gap” with their competitors, by contrast, can be at a distinct disadvantage in both domestic and foreign markets.

The sustainability imperative is transforming the very nature of global competition.

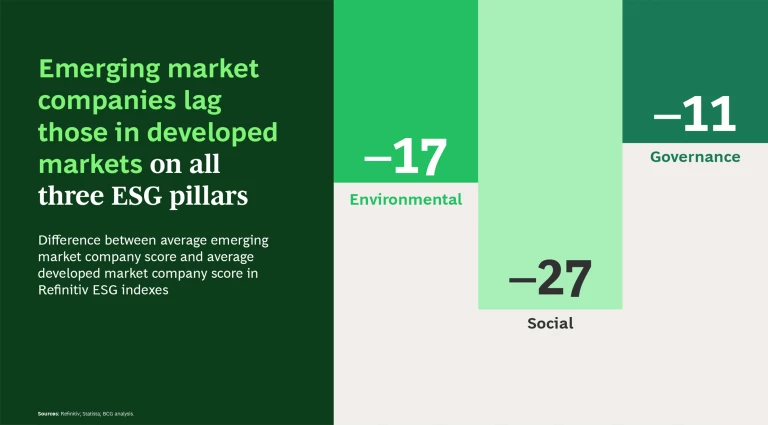

The challenge is that emerging market companies, as a cohort, significantly underperform companies in developed markets on all three ESG pillars, according to widely accepted rankings by various agencies. It’s not entirely fair, of course, to apply identical ESG criteria to high-income and low-income nations, which are at different stages of economic development and face different sets of urgent social challenges. Indeed, at the recent COP27 climate summit, developed-market governments recognized these special needs by establishing a “loss and damage fund” to help lower-income nations adapt to the impact of climate change and become resilient. But demands that companies rise to the ESG challenges in emerging markets are mounting at home as well, from investors, employees, customers, and other stakeholders. In fact, BCG research has found that emerging market consumers weigh climate change and sustainability in day-to-day decisions far more than consumers in developed markets do.

For these reasons, BCG has modified its approach to assembling its list of global challengers —the large, high-growth emerging market companies that are outperforming their peers and have the potential to reshape their industries. We continued to consider business metrics, such as revenue growth and international presence, but also looked at companies’ scores in the Refinitiv, MSCI, CSRHub, and CDP indexes for environmental sustainability—the ESG dimension now garnering the most intense and immediate attention.

We found that certain large, high-growth emerging market companies perform well on both financial and environmental KPIs. And these high performers are found across industries and regions. We then compiled a representative list of 50 companies among the global challengers that we call “climate pioneers.”

These pioneers show that companies can be first movers in decarbonization without sacrificing growth and profitability. These firms are also methodically working to gain strategic advantage in the evolving global competitive landscape by pursuing climate investment opportunities in emerging markets.

How ESG Became a Strategic Imperative

The ESG concept has evolved over decades. It gained traction in the 1970s, when leading multinational corporations started to adopt comprehensive “corporate social responsibility” standards, and ratcheted up in 2000 as MNCs publicly embraced the United Nations’ Millennium Development Goals. The movement has strengthened over the past decade as regulators in the US and EU established sustainability disclosure standards for large public companies and as nearly 200 nations signed on to the Paris Agreement goal to achieve net-zero emissions by 2050.

The growing attention paid to ESG ratings is making sustainability a strategic imperative for many large companies. Various organizations publish ratings of companies based on environmental factors, such as their carbon footprints, energy use, and waste management. Social factors include human rights, workplace standards, and exposure to forced labor, while governance standards refer to transparency, effective board mechanisms, and stakeholder rights and responsibilities.

ESG performance is difficult to measure, however, and ratings are inconsistent because of wide differences in the KPIs they use. Ratings based on company-supplied data often don’t accurately describe the actual business practices, resulting in allegations such as “greenwashing.” Indeed, BCG and the World Economic Forum and Allianz have been collaborating on ways to improve the ESG-reporting ecosystem .

Nevertheless, sustainability benchmarks are important to many corporate stakeholders. Financial institutions increasingly use ESG ratings when making investment and lending decisions, for example, while 85% of investors want to align their strategies with their sustainability values, according to a Morgan Stanley survey. A rising number of institutional investors are shunning or divesting from poor ESG performers.

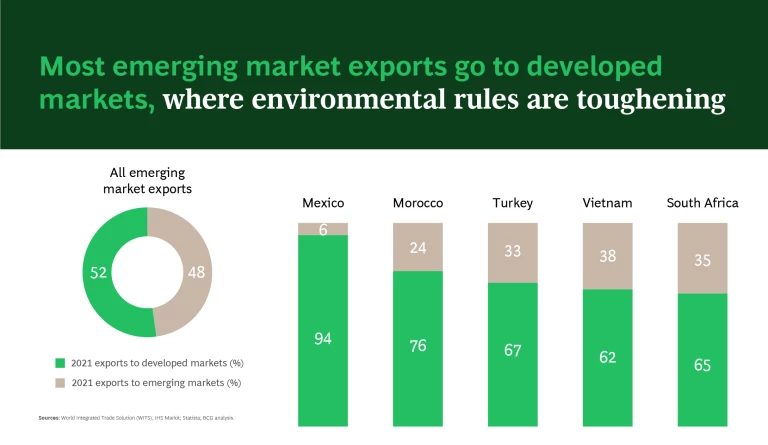

Companies are also under growing regulatory pressure from major trading partners. In 2023, for instance, the EU will begin requiring importers to report the entire greenhouse gas footprints for certain goods and materials they bring into the world’s second-largest market. A few years later, the EU will start assessing a progressively higher carbon border tax on each metric ton of emissions associated with those imports and expand the list of product categories. In addition, the EU, the US, Canada, and Australia are imposing tougher prohibitions on importing goods tied to child or forced labor. Such changes are significant because trade is the most critical growth pillar for a majority of emerging markets. More than half of their exports, moreover, go to developed markets.

Sustainability is getting more attention from consumers and talent as well, topics explored further below. This is particularly true for younger generations.

The Emerging Market Sustainability Gap

The problem is that emerging market companies significantly lag their peers in developed markets in ESG ratings. And the gaps are wide in every ESG pillar. Companies in G20 nations averaged a score of 64 in an environmental index by Refinitiv, based on an analysis of publicly available indicators. Companies in ten emerging markets we studied—Argentina, Brazil, China, India, Indonesia, Mexico, Russia, Saudi Arabia, South Africa, and Turkey—had average scores of just 48. Carbon emissions and inefficient resource usage have the greatest negative impact on environmental sustainability rates for low- and middle-income nations.

This underperformance in ESG metrics shouldn’t be surprising. Companies in developed markets had a big head start. They began launching sustainability initiatives decades earlier in response to intensifying pressure from regulators and civil society. In most emerging markets, by contrast, the policy focus has remained on growth, rather than environmental impact. Regulatory frameworks and government support for climate initiatives are less mature.

Industries that drive broad economic development, such as steel, chemicals, and transportation equipment, are emissions-intensive. Indeed, developed economies contributed to rising emissions in lower-income nations for decades by “offshoring” some of their most heavily polluting manufacturing industries. Because many large emerging market companies are still not publicly listed, moreover, they have less experience with the disclosure of ESG-related data and practices. Another reason that these companies lag in ESG indexes is that there are no widely accepted methods for assessing ESG performance that take into account the circumstances of specific emerging markets. Furthermore, companies in many low-income nations must often address special social needs in their communities, such as creating new jobs and assisting underserved populations, that are handled by governments in other countries. As a result, they may be investing less in areas that are reflected in ESG scores.

The Growing Focus on Climate

Sustainability issues are rapidly rising on the agendas of emerging market CEOs, however. Climate is receiving the greatest attention.

Hundreds of large emerging market companies have committed to achieving global net-zero emission targets. Around half of publicly traded emerging market companies indicate in their financial disclosures that climate impact is part of their overall strategies. The Chinese tech giants Alibaba and Tencent promise to be net zero by 2030. Brazilian cosmetics company Natura says it has been carbon neutral since 2007, while the Indian IT services firm Infosys reports that it became carbon neutral in 2020. The South African energy and chemical giant Sasol, the world’s seventh-largest coal-mining company, has set the ambitious target of slashing its CO2 emissions by 30% by 2030 and being net zero by 2050; it plans to achieve these goals through investments in renewable energy, recycling, and waste reduction. At least 35 emerging market governments have also pledged to make their nations carbon neutral.

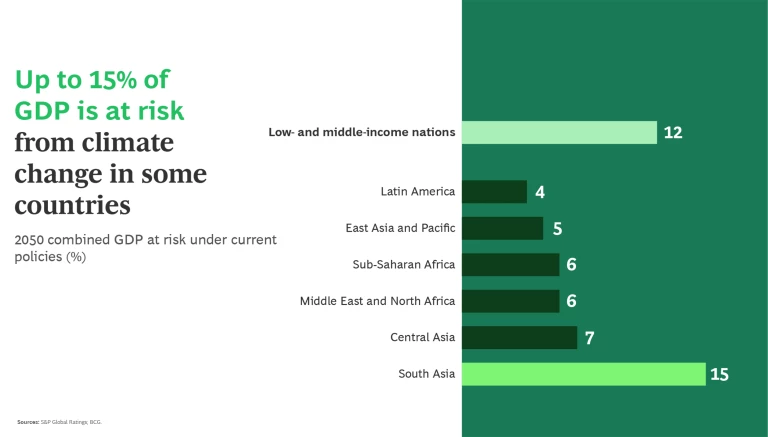

Emerging markets have an outsize stake in mitigating climate change. Even though they emit fewer greenhouse gases per capita than developed markets, the populations, economies, and natural ecosystems in many low- and middle-income nations are suffering some of the most devastating consequences of global warming. Extreme heat, flooding, severe storms, and wildfires affect industries as diverse as energy, mining, tourism, health, and finance. Climate change’s impact is manifest in lost productivity due to factory closures, the migration of talent, and declining school participation. Stricken economies also lose income as global customers shift orders in response to supply-chain or transportation disruptions.

If climate change remains on its current trajectory, the impact will grow far more severe. Up to 6% of per capita GDP in Africa and the Middle East, 7% in central Asia, and 15% in South Asia is at risk by 2050 if climate policies remain unchanged, according to S&P Global Ratings.

Emerging markets need to play a pivotal role in avoiding this scenario. The roughly 35 billion tons of CO2 equivalent that they emit annually accounts for around 85% of the global total. This share is projected to grow. By 2050, nations currently classified as emerging markets are projected to make up 88% of the global population; their share of global GDP is expected to increase from 50% today to 62%.

The public and private sectors of emerging markets—particularly in middle-income nations—can change this trajectory. They must act now to slash the CO2 footprints of their supply chains, improve their water and waste management, and curb their impact on biodiversity. In other words, they need to adopt lower-emission economic development paths and business models than those historically pursued in today’s richest nations, which relied on fossil fuels and the inefficient use of natural resources.

How ESG Improvement Can Unlock Growth

There is no inherent contradiction between having a strong ESG record and strong business performance. On the contrary, being in the vanguard of sustainability can unlock the doors to new growth opportunities.

Being in the vanguard of sustainability can unlock the doors to new growth opportunities.

Strengthened Market Access. Companies at the forefront of improving their ESG standards will be in a stronger competitive position as major trading partners impose tougher conditions on the content of goods and services they import and how these are produced. First movers will also secure a “license to play” over the long term in these markets.

As the EU’s carbon border tax system goes into effect, for example, producers in carbon-intensive industries such as steel, cement, chemical, paper, glass, and energy will enjoy a big cost advantage if they lead their rivals in lowering their CO2 footprints and developing the systems to document and accurately report those emissions throughout their supply chains. The same holds true for manufacturers of everything from consumer appliances to pharmaceuticals as the new EU rules expand to other product categories. Likewise, companies that can demonstrate that their supply chains are free of human rights violations will have an edge as trading partners introduce more stringent social-sustainability standards. These factors help explain, in our observation, why emerging market companies that are significant exporters tend to have higher ESG scores.

Several top emerging market companies are taking actions that could help in key export markets. Thailand’s Siam Cement is a good example. The building-materials giant is investing heavily to develop cement, polymers, and other products that are more eco-friendly. Arçelik, a leading home appliances manufacturer, already is one of the EU’s top three suppliers of white goods. Its efforts to shrink emissions throughout its value chain could ensure that the company maintains a strategic advantage if the scope of the carbon-adjustment mechanism expands. In addition to focusing on energy-efficient product designs, Arçelik has hired an accredited auditing firm to assess the sustainability of its parts and materials suppliers and help them set their own environmental targets. The company is relying increasingly on rail and ships to handle cargo so that it can cut emissions associated with highway transportation. Arçelik is the only manufacturer in the EU to have its own recycling facilities. It also has recycling, repair, and remanufacturing facilities in Turkey, its biggest production base.

Greater Access to Investment and Lower Capital Costs. A strong, verifiable sustainability record can help companies gain access to new funding sources. Equity investors have been flocking to such companies, not only to meet their own ESG commitments, but also because these have been sound investments. While most of this money is still invested in developed-market equities, assets managed by ESG-focused mutual funds and exchange-traded funds targeting emerging markets increased more dramatically—by around 80%—from 2018 through 2021. Many ESG funds have consistently bested broader stock indexes. The MSCI Emerging Markets ESG Leaders Index, for example, outperformed MSCI’s broader Emerging Markets Index by 54% in 2021. What’s more, emerging market companies in the top quintile of ESG scores posted total shareholder returns that were 2.2% higher on average than those in the bottom quintile from 2016 through 2020, according to Refinitiv data analyzed by BCG.

Higher ESG performers are also able to command more favorable financing terms. The issuance of emerging market “green bonds,” which companies float to fund ESG activities, increased by 36% annually from 2017 through 2021 and outperformed conventional bonds in the secondary market by around 80 basis points, according to a J.P. Morgan index. The volume of loans tied to ESG targets in emerging markets soared by nearly 60% from 2017 through 2021; the market share of such loans rose from 3% to 17% over that period. As a result, the cost of capital of emerging market companies in the top quintile of Refinitiv ESG scores was 67 basis points lower than those in the bottom quintile from 2016 through

Several climate pioneers have leveraged their ESG records to secure such low-cost capital. Chinese automaker Geely Automobile Holdings raised $400 million when it issued a three-year overseas green bond, the first Chinese automaker to do so. Arçelik was the first Turkish company to float a green bond on international markets. Its €350 million issue, bearing a coupon rate of 3%, was five times oversubscribed.

Higher Consumer Acceptance. Numerous studies indicate that companies with solid reputations for sustainability have a clear advantage in the competition for young consumers and talent. This edge is becoming increasingly critical in emerging markets, given their younger populations.

Companies with solid reputations for sustainability have a clear advantage in the competition for young consumers and talent.

Research by BCG’s Center for Customer Insight has found that consumers in emerging markets express significantly greater sensitivity to sustainability than those in developed markets—perhaps because they have more firsthand experience with the adverse consequences of climate change. Of emerging market consumers we surveyed, 77% said they care about the sustainability of the snacks they consume, for example, compared with 53% in developed markets. More than 80% indicated they care about the sustainability of leisure travel, PCs, apparel, outside dining, home care, and their electricity provider. In most categories, the portion of those expressing such concern was 15 to 25 percentage points higher than that of consumers surveyed in developed markets. What’s more, anywhere from 35% to 65% of emerging market consumers, depending on the country, reported that these concerns influence their purchasing behavior.

It should be noted that, so far, few of these consumers are willing to actually pay more for a sustainable product. When we asked consumers in emerging markets whether they would pay a premium for sustainable choices in 12 categories of goods and services, 11% of Brazilians said they would pay more for a PC. A similar percentage of Chinese consumers indicated they would pay more for sustainable home care products. But for other categories, positive responses ranged from 0% to 8%, depending on the country.

In most categories, however, emerging market consumers expressed a significantly higher willingness to pay premiums than those in developed markets. These findings suggest that there are enormous opportunities for emerging market companies that can successfully take green mainstream by better inspiring consumers who are on the threshold of making sustainable choices.

BCG research found that companies seeking to persuade consumers to act on their values must overcome public suspicion about corporate claims of commitment to sustainability. Companies must embrace causes that resonate with consumers in different countries—and back these convictions with action. In Brazil, for example, that may mean practices that protect forests and biodiversity. Local priorities vary. In some countries, consumers care most about sustainable health care products and vehicles. In others, they place a high priority on PCs and healthy, socially responsible beverages. Brands can also win by addressing consumer concerns, such as a lack of variety of certain sustainable products or misconceptions that these products are of lower quality or are more expensive than they really are.

Natura is a classic example of how a focus on sustainability can resonate with consumers. Natura, the world’s largest emerging market–based cosmetics company and among the biggest players globally, is a leader in sustainable beauty products. Its Ekos product line, for example, differentiates itself from competitors by using natural materials that are sustainably sourced from the Amazon. The company established the Natura Amazonia Program to maintain its strong innovation pipeline by identifying new natural ingredients and to preserve biodiversity.

In China, Geely has capitalized on consumers’ strong preference for sustainable vehicles by releasing several new hybrids, a new platform of all-battery electric vehicles, and a premium EV brand called Zeekr.

Increased Appeal to Talent. Strong reputations for sustainability also give companies an edge in the war for young talent. Studies by BCG and other firms have found that around 70% of Gen-Zers (people born in the mid- to late 1990s) say it’s important to work for organizations that focus on ESG. Nearly 20% of those surveyed listed ESG as among the top five factors influencing their decision to join or remain with their current employer. With a median age of 28 in emerging markets—versus 41 in developed markets—this suggests that sustainability will be even more important for emerging market companies in the war for talent.

When Top Employers Institute ranked Infosys as India’s best employer, and among the top employers globally, the company potentially gained an advantage in recruiting prized technical talent. Infosys also stands out in India for being very active in diversity and LGBTQ+ community initiatives.

New Business Models. The transition from fossil fuels to renewable energy is creating opportunities for new entrants to make their mark with disruptive business models and for incumbents to change the dynamics in their industries.

Subscribe to our Climate Change and Sustainability E-Alert.

Among the business ventures that have sprung from Siam Cement’s climate initiatives is the Zero Burn project in Lampang. It encourages farmers to transform agricultural waste into alternative fuels that the company then uses for making eco-friendly cement. Another good example is Saudi Basic Industries, a chemical manufacturer better known as Sabic. The company has a portfolio of more than 90 sustainability solutions on the market and has launched an initiative called Bluehero to deploy its expertise in innovative materials, manufacturing, and thermoplastics to accelerate the transition to EVs.

The BCG Global-Challenger Climate Pioneers

To assemble our list of 50 global-challenger climate pioneers, we first selected emerging market companies with a minimum of $750 million in annual revenue, revenue growth at least equal to the industry average or their nation’s GDP growth for the past five years, and positive earnings before interest and taxes. They also needed to have international revenue of at least $500 million or 10% of their total revenue.

We then analyzed their ESG and environmental-sustainability scores in the Refinitiv, MSCI, CSRHub, and CDP indexes, depending on which were available. (See “Methodology” and “Disclaimers.”)

Methodology

- Companies based in rapidly developing economies in Asia, Eastern Europe, the Middle East, Latin America, and Africa

- Companies with more than $750 million in revenue and at least 10% of revenue, or a minimum of $500 million in revenue, coming from international markets

- Companies with five-year (2016 to 2021) revenue growth at least equal to the average growth in their corresponding industry or their home country’s GDP growth

- Companies with positive profit margins in the most recent reported fiscal year of analyses

- Companies with ESG scoring or grading in the Refinitiv, CSRHub, or CDP databases and acknowledged as having an above-average performance in environmental sustainability and overall ESG2

2. Companies received ESG and environmental sustainability scores or grades of about 50 on Refinitiv and CSRHub, and ESG and environmental scores or grades above 50 or at least a B by CDP Climate Change.

Disclaimer

This document has been prepared in good faith on the basis of information available at the date of publication without any independent verification. BCG does not endorse the companies for any particular purpose. BCG does not guarantee or make any representation or warranty as to the accuracy, reliability, completeness, or currency of the information in this document nor its usefulness in achieving any purpose. Readers are responsible for assessing the relevance and accuracy of the content of this document. It is unreasonable for any party to rely on this document for any purpose and BCG will not be liable for any loss, damage, cost, or expense incurred or arising by reason of any person using or relying on information in this document. To the fullest extent permitted by law (and except to the extent otherwise agreed in a signed writing by BCG), BCG shall have no liability whatsoever to any party, and any person using this document hereby waives any rights and claims it may have at any time against BCG with regard to the document. Receipt and review of this document shall be deemed agreement with and consideration for the foregoing.

This document is based on primary qualitative and quantitative research executed by BCG. BCG does not provide legal, accounting, or tax advice. Parties are responsible for obtaining independent advice concerning these matters. This advice may affect the guidance in the document. Further, BCG has made no undertaking to update the document after the date hereof, notwithstanding that such information may become outdated or inaccurate. BCG does not provide fairness opinions or valuations of market transactions, and this document should not be relied on or construed as such. Further, any evaluations, projected market information, and conclusions contained in this document are based upon standard valuation methodologies, are not definitive forecasts, and are not guaranteed by BCG. BCG has used data from various sources and assumptions provided to BCG from other sources. BCG has not independently verified the data and assumptions from these sources used in these analyses. Changes in the underlying data or operating assumptions will clearly impact the analyses and conclusions.

This document is not intended to make or influence any recommendation and should not be construed as such by the reader or any other entity.

This list of global challengers is geographically diverse and represents a wide variety of industrial sectors.

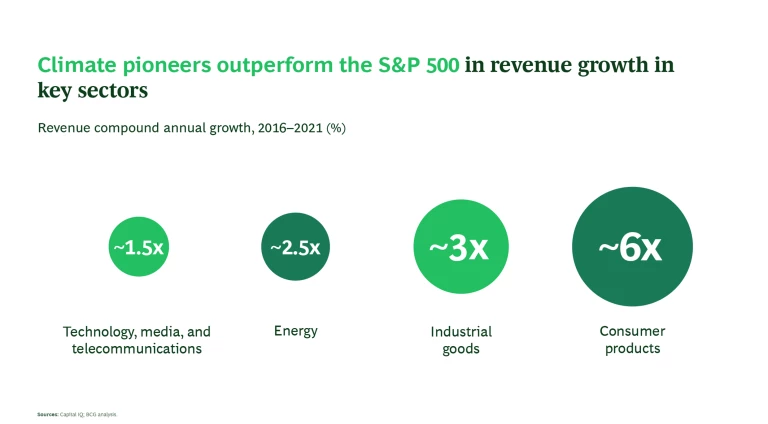

By our analysis, global-challenger climate pioneers, especially those in the industrial goods and consumer product sectors, significantly outperformed companies on the S&P Index in revenue growth. They also surpassed their emerging market peers in most sectors. We compared the financial results of climate pioneers with those of more than 4,000 other emerging market companies that had annual revenue of over $1 billion. Climate pioneers in the consumer sector reported 14% compound annual revenue growth from 2016 through 2021, for example, compared with 11% for their peers. Climate-pioneer energy companies outperformed comparably sized emerging market companies in revenue CAGR 20% to 14%, while industrial goods companies bested their peers 22% to 15%.

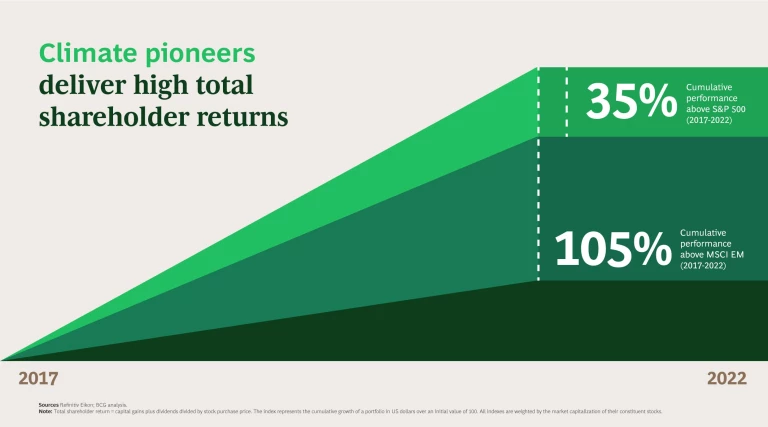

Global-challenger climate pioneers also generated total shareholder returns for investors that, cumulatively, were nearly 35% higher than the S&P 500 Index and 105% higher than the MSCI Emerging Markets Index from 2017 through 2022.

These findings confirm that being in the vanguard of climate sustainability is no drag on financial performance. In fact, it will significantly enhance it.

Seven Key Success Factors

On the basis of our analysis and interviews with global-challenger climate leaders, we identified the following success factors that can enable emerging market companies to win with sustainability:

- Embed sustainability into the company’s purpose, business strategy, and goals.

- Acknowledge the immediate profit impact of ESG initiatives while outlining the long-term returns for the company.

- Closely collaborate with local policymakers and mobilize as an ecosystem that includes industry peers, suppliers, research organizations, startups, technology vendors, and other partners.

- Make resilience and change a priority of the organization’s core operations through ESG initiatives.

- Leverage and accelerate technological innovation to reach sustainability while considering new sustainable business models to capture emerging opportunities.

- Ensure a rigorous transformation of the organization by enabling and incentivizing leaders (such as by establishing KPIs), engaging employees through activities like skills training, and designing a roadmap for execution.

- In addition to having science-based—and publicly stated and reported—targets, continually communicate and engage with stakeholders to demonstrate that the company is keeping its promises.

Emerging market companies may have gotten off to a slower start than their counterparts in developed markets in terms of joining the sustainability movement. Pressure to meet the growing expectations of investors, customers, employees, civil society, and their own governments have forced them to set high ESG standards—and back up their promises with action. The true leaders, however, are raising the stakes further. They are putting to rest the notion that being in the vanguard of environmental sustainability means sacrificing strong financial performance. Instead, it is becoming a powerful source of competitive advantage.

The authors thank the following people, without whose contributions this article would not have been possible: Ali Riza Sancar, Berfin Varol, David Zong, Adeline Ishimwe, Sonja-Katrin Fuisz-Kehrbach, and Kilian Smith.