If the world is to circumvent an irreversible climate crisis, reducing or avoiding emissions will not be enough. Carbon Dioxide Removal (CDR) will play a crucial role in supporting global decarbonization, with analysis pointing to a significant role in slowing of “net” global emissions in the short term and removing historical emissions in the longer term. This is especially true for high-quality, durable CDR, which is solutions that can verifiably remove and sequester emissions for 100–1,000+ years, as any reversal in CDR diminishes expected benefits.

The durable CDR methods referenced include Direct Air Carbon Capture and Storage (DACCS), Biomass with Carbon Removal and Storage (BiCRS), Enhanced Weathering/Carbon Dioxide (CO2) Mineralization, and Ocean Alkalinity Enhancement. In this report, BCG weighs the market opportunity underlying these technologies by providing a 2030–2040 outlook on demand based both on the existing regulatory landscape and CDR credit buyers’ preferences as stated today. Importantly, this forecast is not tied to any specific climate targets, including those outlined by the Intergovernmental Panel on Climate Change (IPCC) or the International Energy Agency (IEA). Instead, we forecast demand based on stated buyer preferences coupled with expected policy over the next 10–20 years.

Robust Demand Will Be Driven by a Voluntary Market in the Near Term; Compliance Markets Could Surge as Policies Emerge

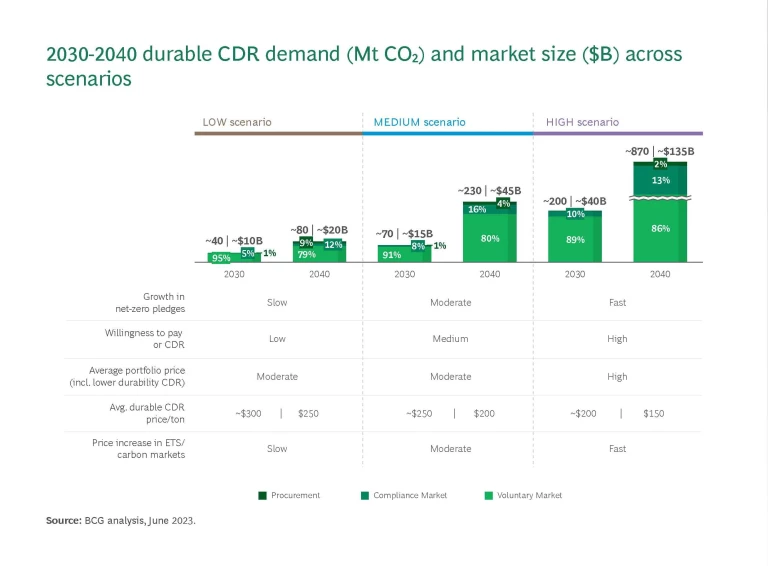

We expect a robust demand for durable CDR in 2030–2040 across both voluntary and non-voluntary carbon markets. Voluntary markets reflect demand across companies worldwide under Net Zero pledges, while non-voluntary markets account for demand across carbon compliance markets, CO2 removal mandates, and direct government procurement initiatives.

Our analysis estimates an annual demand of ~40–200 Mt CO2 in 2030, growing to ~80–900 Mt CO2 in 2040. This demand translates into a ~$10 billion–$40 billion market opportunity in 2030, with an ample runway to reach ~$20 billion–$135 billion in 2040. Demand will likely exceed projected supply at the 2030 milestone, with current announced projects only totaling ~33 Mt CO2.

Near-term demand will come primarily from the voluntary market (~90%), mostly driven by early purchases from industries with the highest willingness to pay (for example, professional services, software). As further developments lead to scaling of the technologies and lowering of costs, the demand from buyers with historically lower willingness to pay (for example, industrials) can be unlocked, filling up the upper end of this market opportunity. Broader adoption in the voluntary markets will be contingent upon cost reductions below $200/t CO2, where demand tends to be more elastic.

In the Voluntary Market, Quality Will Drive Purchases, with Buyers Taking a Portfolio Approach

CDR quality is defined primarily by parameters of permanence, additionality, and measurement, reporting, and verification (MRV). Buyers indicate the importance of these factors in their purchasing decisions, with over 75% optimizing for credit quality over quantity. Seeking quality, companies with climate mitigation commitments report an expected willingness to pay up to a ~3.5x price premium by 2030 for high-durability removal credits (for example, direct air capture) over lower durability removals (for example, reforestation). The size of this price premium will vary for each technology, given differences across the quality dimensions.

Additionally, buyers indicate a preference for a portfolio approach to purchasing durable CDR, balancing costs and ensuring quality while hedging for risks by diversifying across removal technologies. For buyers outside the early-adopters segment, which mostly includes high-margin and low-emissions volume industries, achieving reasonable prices across their removals portfolio is a non-negotiable priority. Assuming durable CDR reaches a certain price point, surveyed buyers aim for durable CDR to make up a larger percentage of their portfolio over time (~35% by 2030 and up to ~48% by 2040). Beyond managing financial and technological risks, diversifying purchases across suppliers and types of durable CDR will be unavoidable, as no single CDR solution will be able to meet projected demand by 2030.

Increased Commitment From Policymakers Could Transform the 2030–2040 Market

While the estimated demand is meaningful, it is well below what is needed for global decarbonization, according to IPCC (5–16 Gt CO2 of removals p.a. by 2050, intended to limit global warming to 1.5°C/2°C). As a result, governments may take increasing actions to stimulate demand over time, leveraging mechanisms such as removal mandates and procurement models to meet specific climate goals. This could likely shift the durable CDR demand from the voluntary markets to non-voluntary carbon markets.

However, existing regulations have thus far focused on supporting durable CDR through supply-side policies aimed at lowering costs of investment and production, including research and development subsidies and tax credits. Demand-side policies, such as market-based schemes and direct government procurement, are either in their infancy or at the legislative proposal stage.

To enable durable CDR demand in carbon compliance markets, eligibility of durable CDR credits will be a precondition. Today, only one compliance scheme (South Africa’s carbon tax) allows for durable CDR to account for some portion of regulated emissions. That could soon change with active discussions around the passing of standard-setting regulations (for example, EU Carbon Removal Framework) and integration of durable CDR into compliance schemes (for example, UK ETS). However, eligibility alone is insufficient for broad market adoption. In aggregate, carbon prices will also need to grow ~10% annually through 2040 to make durable CDR credits a financially feasible option to meet compliance obligations.

Even if all these conditions are met, compliance market demand will still be dwarfed by the voluntary side. Governments, by using the removal purchase mandates and direct procurement initiatives at their disposal, are positioned better than almost any other stakeholder to fill the gap. While demand-side proposals are currently under consideration at the state and federal levels in the US, even the most ambitious of projections would still fall short of climate needs.

An Opportunity Not to Be Missed: A Call to Action to Stakeholders

Given the projected supply constraints, buyers that limit or delay their credit purchases may have to pay a premium in the future or ultimately fail to secure durable CDR to meet their commitments. Companies also face growing pressure, from both regulators and increasingly aware customer bases, for their responsibility in fighting climate change. Securing access to durable CDR today is not only a risk management strategy but also a sensible investment.

For investors’ part, investments today could be deemed as high risk. But demand and supply dynamics, and positive signals coming from both early buyers and government incentives, demonstrate long-term market potential. If done right, serving as early investors could be beneficial, as winning suppliers of 2030 are being determined today.

CDR suppliers can help accelerate overall development of the durable CDR ecosystem by supporting mutual learning and collaborating on the procurement of commercial inputs, increasing efficiency without exposing intellectual property.

Carbon accounting and standard-setting organizations, by adjusting their durable CDR protocols, are well-positioned to encourage the procurement of high-quality carbon credits alongside meaningful emissions reduction measures.

Finally, governments must accelerate support for durable CDR to enable further cost reductions and market development, including both supply- and demand-side mechanisms. The scale of this support will need to grow above and beyond existing legislative proposals. Governments will also enable broader markets by advancing official guidelines on what constitutes “high-quality durable CDR” and by adequately supporting the development of robust MMRV methods.