Finn graciously shared data on consumer patterns and demographics for this article.

Not so long ago, the idea of car subscriptions was, to many automotive industry observers, a passing fancy—a product in search of demand. Naysayers questioned whether the market for subscriptions could ever reach critical mass. OEMs were wary that if it did, it might cannibalize new car sales.

So far, the failures have outnumbered the successes. The fundamental challenges this business model entails—heavy assets that require significant upfront capital, big marketing expenditures—are daunting.

Even so, subscriptions have gone from a fringe idea to a legitimate, growing business—particularly in western Europe, where notable success stories include UK-based Onto and Germany-based Finn as well as more established players such as MeinAuto and Fleetpool. And while most car-subscription providers are still relatively new and modest in scale, a clearer picture is emerging of what it takes to win.

Recently, Finn shared with us aggregate data on customer patterns and demographics, which, along with our own research and client experience, sheds light on the enabling factors and key practices that lead to success. This inside look at a subscription provider also highlights the misconceptions and constraints that have held some providers back.

Why Some Providers Struggle

In its brief history, the subscription business model has evolved considerably. Consumer trends have been advantageous: the general shift from ownership to usership and from offline to online transactions; the growing interest in sustainability; and the constant pursuit of greater convenience. Direct-to-consumer selling is also becoming more commonplace.

So, what makes subscription providers stumble? Mainly, the following:

- An ambiguous value proposition. Without a clear sense of the most promising customer segments, some companies have tried to be all things to all customers. They offer flexibility and features that are economically unsustainable, such as month-to-month subscription periods or the ability to swap a vehicle.

- For some OEMs, concerns about strategic conflict. It’s not clear to OEMs where subscriptions fit in their overall strategic agenda. They worry about cannibalizing sales or jeopardizing longstanding dealer relationships. However, all OEMs and auto financing providers are currently investigating how to best integrate subscriptions into their overall consumer offering.

- Underestimating value chain complexity and vehicle life-cycle requirements. From procurement and sales to fleet management and ultimate remarketing, these requirements—and their costs—are crucial considerations for making the economics of subscriptions work.

- Overlooking the fundamentally digital nature of a subscription business. A seamless, intuitive digital user experience is a prerequisite of any online business. Many providers not only underestimate this requirement, but they also overlook the need for a well-developed digital infrastructure to support operations. It takes a largely automated platform to integrate service providers for delivery and logistics, manage customer service and car maintenance, and run such strategic and back-office functions as pricing optimization, financing, and reporting.

- Neglecting remarketing. The sale of each vehicle at the end of its subscription lifespan is essential to healthy economics and profitability. Companies need to define a remarketing strategy as early as the procurement stage—realizing that the value may differ at the end stage , especially in a volatile market environment.

In the face of these challenges, many ventures have failed, faltered, or been paused for a rethink. From our analysis, we’ve identified three important considerations that can help providers frame their approach, along with three rules to set themselves up for success.

Three Ways to Conceive of Subscriptions

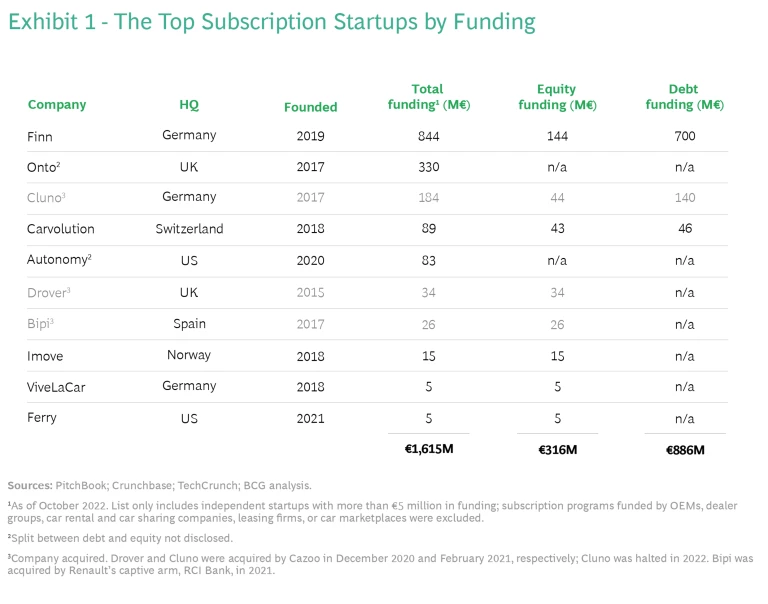

A handful of independent providers continue to attract funding, with total funding approaching €2 billion. (See Exhibit 1.) These companies have managed to ride out the turbulence caused by the pandemic and are thus far navigating disruption in the auto industry .

Adapting to a changing environment is, of course, central to survival. Beyond that, a proactive posture is crucial to success. We believe these three fresh perspectives should inform the thinking of any subscription provider:

Subscriptions are a point on the ownership continuum. Rather than an end-all, be-all, standalone offering, subscriptions are best thought of as a point on the ownership spectrum. Conceiving of them this way unlocks constraints while opening up marketing possibilities and economic benefits down the line—for startups and OEMs alike.

Subscriptions can thus be an integrated element of a fully digital offering, alongside buying, leasing, and financing. Integrated providers specifically sell subscriptions and later turn those assets into young used cars for sale—a core business model element that drives everything from purchasing power and product offerings to

Subscriptions are a way to ignite car e-commerce. As a digitally sold product, subscriptions represent an important gateway to e-commerce for the retail auto industry. They expand retail by offering a new and convenient alternative to leasing and ownership online. They also pave the way for a scaled-up online sales market that, apart from used car sales, has yet to take hold: in Europe and the US, car sales have the lowest e-commerce penetration rate of any major industry (in the single digits for B2C sales).

For industries with high customer acquisition costs, the benefits e-commerce offers—lowering sales costs, enabling scale growth—can be game-changing. That’s not to say that car sales will or should go completely digital. But now, a reluctant buyer can sign up for a subscription; at the very least, the seller still acquires a customer, and one who may ultimately buy. Either way, subscriptions can cement customer or brand loyalty. And beyond giving vendors an expanded sales platform, e-commerce gives them a rich repository of customer knowledge in the form of digital data.

Subscriptions help promote EV ownership and sales. For existing or first-time car owners, a subscription gives the user a great opportunity to try out EV ownership, which for many is still an unfamiliar experience. At the same time, manufacturers can hedge their risks by making EVs available to subscription providers, thus reducing the uncertainty surrounding production volumes. At Finn, for example, EVs currently account for 26% of subscription sales; in contrast, EVs accounted for 13% of overall new-car sales in Germany in the first six months of 2022. (See the sidebar “Finn at a Glance.”) Subscription providers serve to promote EV adoption by lowering the barriers to entry—a particular benefit for new OEMs.

Finn at a Glance

Finn at a Glance

- Headquartered in Munich, Germany

- Annual recurring revenue: more than €120 million

- Has serviced more than 20,000 subscriptions in Germany

- Offerings run from €329 to €1,739, with an average net price for all active and signed subscriptions of €645 in Germany and about $750 in the US

- Entered the US in 2022, rolling out to metropolitan areas in 10 eastern states and Washington, DC

- Plans to expand into key European markets in 2023 or 2024, including France, Spain, Italy, Switzerland, Norway, and Sweden

- Target customers: families with heads of household in their 30s and 40s

- 78% of its customers did not drive a new car before subscribing

- 85% choose annual subscriptions

- Features more than 30 vehicle brands, based on direct OEM partnerships

- Currently offers about 40 models from 25 OEMs (availability can change on a daily basis)

- 30% of its fleet is fully electric

- Provides CO2 offsets for all vehicles in its portfolio

Three Rules for Subscription Success

Let’s consider the emerging best practices that our analysis uncovered.

Rule #1: Probe Customers’ Product Priorities

Convenience counts, but these are the most important priorities we’ve identified:

Price counts more than contract term. Short contract terms require too high a price tag, which limits profitability as well as the selection a provider can offer. As we observed in our July 2021 report , swapping vehicles and month-to-month terms were not a big selling point; 8 out of 10 consumers put price above flexibility. Among Finn’s customers, 85% go for a 12-month subscription period.

Product variety drives conversions. Choice of vehicle matters more to consumers than short-term subscription options. The ability to offer choice comes from forging direct relationships with a variety of OEMs. Multiple relationships, in turn, provide a hedge against supply risk and serve as a competitive differentiator. The greater the choice of cars they offer (especially those available on shorter notice), the higher the conversion rate.

Vehicle type outweighs brand. Customers are practical. First and foremost, they want the right kind of vehicle for the job, whether it’s an SUV for grocery shopping and family excursions or a 4x4 for weekend getaways. Most customers choose the type of vehicle before they decide on a model or brand.

Customer experience is paramount. Consumers today have high expectations for a reliable, engaging online experience. For a big-ticket transaction in particular, sharply designed websites and apps (offering visual appeal and ease in navigating) are essential. So are streamlined processes. Subscription offerings oriented around e-commerce allow customers to book a car in five minutes, reach customer service 24-7, and set up car delivery, return, and exchange easily.

Above all, a provider must have available inventory. Customers do not want to wait. Fast delivery is crucial, and during supply shortages (which, post-COVID, have become increasingly common) it’s an important selling point.

Rule #2: Know the Subscription Customer

Early on, people assumed subscriptions would appeal only to young, hip urbanites from major metropolises. OEMs in particular viewed subscriptions as a luxury offering, imagining that maximum flexibility and premium service would be customer priorities. These assumptions proved wrong, as Finn’s customer base suggests. (See Exhibit 2.)

Customers are younger than buyers, but the age range is broader than expected. In reality, subscriptions appeal to a far broader audience, and one largely made up of newbie owners. Half of Finn’s customers are younger than 40 (versus the average age of the new-car buyer, at 50). Younger customers are desirable because they tend to be more receptive to digital buying, new brands, new technology, and sustainable mobility. (As mentioned above, 26% of Finn's subscriptions over the past 12 months were for BEVs; another 8% were for PHEVs, although that share could shrink if gas prices remain high.)

Perhaps an even more promising sign for providers is the fact that 78% of Finn’s customers did not drive a new car prior to subscribing. Although subscriptions are a lower-margin business for OEMs than their dealer business, they offer OEMs the opportunity to acquire new, previously unreachable customers.

Customers are value-minded. While it’s important to offer a variety of vehicle options, subscription customers tend to opt for the best deal. Finn’s offerings run from €329 to €1,739, but its most popular car costs €540 a month. In customer surveys, value was cited as the most important of five key purchase criteria (by 50% of respondents), with simplicity taking second place (by 33%).

Subscriptions present a more realistic picture of ownership costs: unlike a monthly car payment, the monthly subscription fee is all-inclusive, covering insurance, taxes, licensing, and maintenance. So, when a customer compares a monthly subscription cost to the cost of purchasing a new car, the subscription becomes attractive—assuming the customer has done the math on total cost of car ownership. (See the sidebar “Cost Transparency Is a Double-Edged Sword.”)

Cost Transparency Is a Double-Edged Sword

Cost Transparency Is a Double-Edged Sword

Thus, in seeing a monthly subscription fee that’s higher than their perceived total cost of ownership, they might conclude that a subscription is too expensive. For many, this serves as a deterrent to subscriptions. On the other hand, this knowledge gap represents an opportunity: providers can educate prospective customers with comparisons that make the cost of car ownership as transparent as the cost of a comparable subscription.

In turbulent economic periods—through much of the pandemic, for instance, or as with high inflation today—consumers are more price sensitive. The need for a lower buy-in threshold for big-ticket items becomes more important. For that reason, usership models can have an advantage: €500 per month for two or three months is far more attractive than €500 per month for a year for the occasional driver.

Customers aren’t just big-city dwellers. Providers that can capitalize on digital and scale operations effectively are well positioned to reach a broader market. Finn, for example, serves customers from more than 1,000 cities and towns throughout Germany. Only 27% of its customers reside in cities with more than 1 million people, and the majority of their customers (62%) live in cities of under half a million.

They’re not just consumers. Although less oriented toward handling transactions online, B2B customers account for a fair proportion of the subscription market and are fertile ground for expansion. B2B currently represents 21% of Finn’s business, for example, and the firm is aiming to grow that share by targeting small-to-medium enterprises—companies typically overlooked by large leasing organizations.

Subscribe to our Automotive Industry E-Alert.

Be mindful of regional differences. In the US, for example, consumers are less familiar with the concept of car subscriptions, so providers need to educate and engage them. The regulatory environment is another hurdle for subscription companies looking to crack the US market: franchise law prohibits OEMs from selling directly to consumers, whereas in Europe, options exist that allow OEMS to bypass dealers and sell direct. And because insurance is regulated on a state-by-state basis in the US, providers must determine where they can offer an all-inclusive product and where they must decouple insurance.

Still, it’s a market with a huge appetite for vehicles, and the country’s advanced state of e-commerce and consumers’ general distaste for the car-buying experience both work in subscription providers’ favor. For new OEMs (those not subject to a regulated sales structure), subscriptions can be an important lower-threshold access point for US consumers, giving them an opportunity to try out their product with no risk.

Rule #3: Master the Unit Economics

Is the business model for subscriptions financially sustainable? The experience of Finn and a handful of other integrated providers shows that it can be. But while all players strive for profitability, the leading ones give themselves a deadline. Some are targeting profitability within the next one to two years.

What practices must companies adopt in order to make the economics viable?

Pursue scale. Profitability depends on scale. We now understand that sufficient scale in the subscription business amounts to roughly 20,000 to 30,000 customers for an independent, integrated provider. (The number can be lower for those with an existing infrastructure or that offer additional mobility services.)

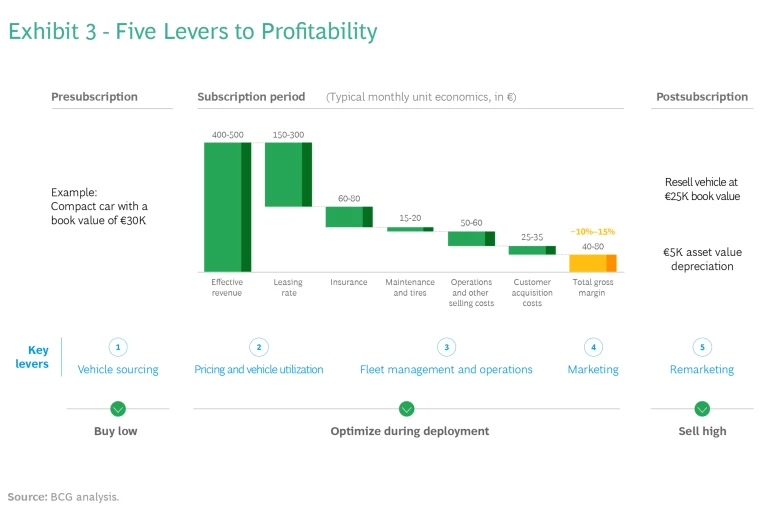

Apply key levers of profitability. Companies can activate five levers to build profitability (see Exhibit 3):

- Vehicle sourcing. Companies need to set up their purchase agreements wisely. As a new strategic distribution channel for OEMs, subscription providers can negotiate attractive discounts in their bulk purchases. Discounts are limited amid the current supply shortage, but once the current bottlenecks are resolved (most likely in late 2023), discount levels will start to recover. Ultimately, when the auto industry is back to its normal state of oversupply, subscription providers will benefit from greater availability and selection.

- Pricing and vehicle utilization. Providers must strike that sweet spot for pricing that ensures they remain competitive while reaching the right level of vehicle utilization for each model and unit.

- Fleet management and operations. Providers should seek efficiencies in maintenance (which is, after all, minimal with new cars) and tire purchase and care. With the many other operational processes—the logistics of delivering vehicles to the company’s facility and later to the customer, key replacement, and so on—companies need to be rigorous in finding efficiencies without cutting corners that ultimately devalue their assets or the customer relationships.

- Marketing. Professional online marketing tools and techniques can help companies optimize click-through conversion rates and target their spending effectively.

- Remarketing. Leading subscription providers have demonstrated that resale prices are the strongest determinant of profitability. For companies, it is imperative to have multiple elaborate remarketing sources in order to optimize earnings per sale.

Manage risks. When set up right, an integrated provider can potentially scale up to thousands and tens of thousands of cars. But preordering cars in large volumes also creates inventory risk. Companies need to have mitigation strategies in place at the front and back ends. Leading players post inventory on their website as far in advance as three months before cars arrive at their storage facility. Among leading players, more than 90% of car offerings are subscribed to before they even hit the compound.

To mitigate residual value risk—the risk that future value for later sale is not accurately forecasted—a provider can presell all of its cars early in their subscription life. It can even lock in presale offers from large dealership groups or online used car platforms before the transaction even begins. If it refines its reselling process sufficiently, this can eliminate middlemen (B2B auction platforms, for example) and help subscription providers realize an even better return. Clearly, as the volume of subscriptions grow, so does the pool of sellable cars to retire from the fleet.

Finally, there is the capital intensity risk: the need for significant capital to buy a large supply of vehicles. Credit facility is a vital tool. An ample facility, with a substantial advance rate, can reduce or eliminate the need for equity to finance the fleet.

What Will the Market Look Like in 2025?

The consumer trends we cited earlier—such as the shifts from ownership to usership and the move to EVs—have been tailwinds for the subscription business, and they will continue. For those reasons alone, we believe that subscriptions will become an important part of the market in the future. Still, subscription providers need to do their homework and offer an attractive product to consumers in a way that is sustainable.

Over the next few years, the boundaries between subscribing, renting, and leasing will become even more blurred.

Over the next few years, the boundaries between subscribing, renting, and leasing will become even more blurred. Each will be just another way of accessing a vehicle—another point along the ownership continuum. Indeed, we foresee OEMs adopting this mindset and offering a choice of subscription, lease, financing, and direct purchase in their e-commerce stores. Along with the shift toward an agency sales model (in Europe especially) and owning a bigger share of the vehicle lifecycle, OEMs will own customer data—a powerful asset.

Multibrand integrated providers such as Finn will play an important role in the subscription market—but only if they can prove their value to OEMs. Only a few will grow to scale, because few will be able to build the brand awareness, operations, and financing capability necessary. And only a few will win positions at the top of browser search pages. Consolidation is therefore inevitable. For independent, multibrand platforms, the winners will be few—and large.

The authors thank Max-Josef Meier and Pia Hösl of Finn for their contributions in providing access to data on customer patterns and demographics.