The asset management industry has reached a turning point that will require rethinking the business model that has served it so well in the past. Market performance has been responsible for 90% of the industry’s revenue growth for nearly two decades. In 2022, however, rapidly rising interest rates caused both stock and bond values to plummet. The result was the second-largest single-year decrease in global assets under management (AuM) since 2005. Global AuM fell by $10 trillion, or 10%, to $98 trillion—near 2020 levels. The net flow rate of assets also fell below 3% for the first time since 2018, reaching 1.6% of total AuM at the beginning of 2022, or $1.7 trillion.

With the collapse of a built-in bull market to support revenue growth, preexisting pressures have been exacerbated:

- Central banks’ policy of engineering market appreciation has shifted to one of slowing growth to combat inflation. The result is that market growth is no longer guaranteed.

- Low-fee passively managed funds have been the primary beneficiaries of market appreciation over the past decade in the US. In addition, the share of passively managed assets in Europe is expected to grow in the next few years.

- Fee compression has accelerated, while costs as a share of revenue have increased.

- Continuous efforts to innovate have led to an abundance of new products, but investors have gravitated to products with established track records. A whopping 75% of global AuM in mutual funds and exchange-traded funds sits in products that are at least ten years old.

The Only Choice Is Change

The fundamental pressures facing asset managers make the point clear: transformation is necessary.

According to our estimates, the existing pressures and market expectations are such that if asset managers simply stay the course, their annual profit growth will be approximately half the industry average of recent years (5% versus 10%). To get back to historical levels of profitable growth, asset managers will need to cut costs by 20% overall and shift their revenue mix to generate at least 30% of their revenue from higher-margin products.

Embrace the Three Ps

In BCG’s 21st annual global asset management report, we explore three themes that should focus leadership’s approach for the future.

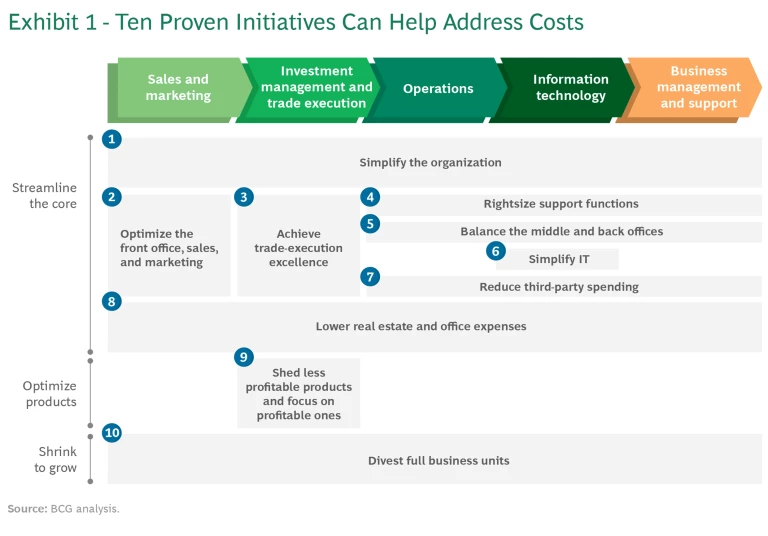

Profitability. Asset managers should transform their approach to profitability. They can do this by understanding the drivers of key costs and using multiple initiatives to optimize costs, rather than just slash expenses. (See Exhibit 1.) Such initiatives may include flattening the organization structure; rightsizing support functions; and trimming away subscale and unprofitable products to refocus the business on strong value creation.

Private Markets. Firms should pursue high-growth alternative investments and the private market opportunities therein. These continue to be bright spots for the industry. Alternatives represented more than $20 trillion of global AuM as of year-end 2022. These products also accounted for half of the industry’s global revenues, generating more than $190 billion in revenues for the firms that offer them. This strong momentum is expected to prevail with a CAGR of 7% in alternative assets over the next five years.

For firms aiming to enter the alternatives market, there are four primary pathways:

- Build in-house

- Buy multiple firms and use an affiliate or boutique structure

- Buy an alternatives firm and operate it independently

- Establish partnerships

While each path comes with its own advantages and challenges, the most important characteristics of a successful alternatives unit revolve less around a firm’s method of entry and more around its execution. What is key is that the asset manager perfect the value proposition, tailor incentives to drive growth, preserve the autonomy of the alternatives team, optimize distribution and fundraising, and assure that all parties enter the deal with their strategic interests aligned to the highest degree possible.

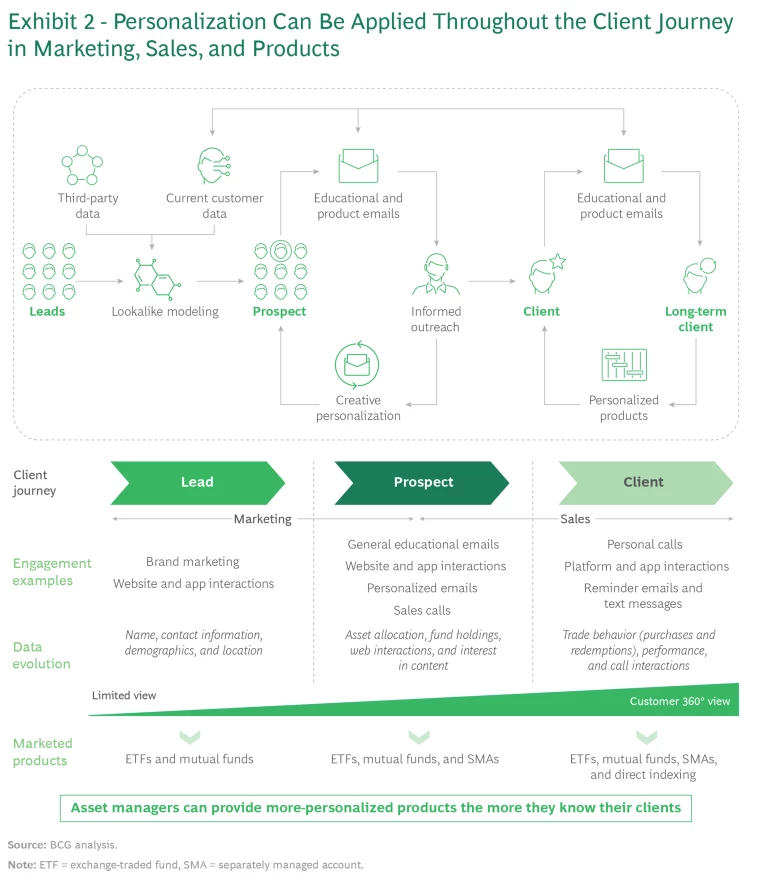

Personalization. Asset managers should harness the technologies that make highly personalized client experiences and products possible. (See Exhibit 2.) New technologies can boost personalization efficiency and effectiveness in the sales and marketing process. And if applied correctly, these technologies can lead to an increase in sales conversions of about 20% relative to traditional approaches.

A key personalization product in the US is direct indexing. Similar to the way that streaming services allow music fans to download and mix individual songs instead of buying albums, direct indexing enables advisors and their clients to buy securities one at a time and mix them into individualized portfolios.

Direct indexing technology presents risks but also opportunities. Asset managers should weigh the various strategies for accessing customers with this product: partnering with a vendor, building the capability in-house, or acquiring an existing player.

After years of record growth, the tide has turned. By adopting a transformative mindset and embracing the three Ps—profitability, private markets, and personalization—asset managers can meet investors’ demands and face the future with excellent prospects for growth amid the chaotic economic climate that lies ahead.