Omnichannel, omnichannel, omnichannel. That’s been the mantra for most companies over the past decade, and for good reason. But while companies have created useful bridges between some channels, such as “buy online, pick up in store” and “research online, purchase offline,” most customer journeys have remained standardized, linear, and tied to a specific channel. That’s about to change.

Instead of go-to-market constructs centered around distribution, the new era of customer engagement will center on touchpoints—the chatbots, kiosks, robo-advisors, and other physical-digital-and-virtual interactions that customers have with companies as they navigate their purchasing journeys.

Today, a customer can scan a QR code and pull up basic product or pricing information while shopping in a store. Soon, however, that same QR code could allow customers to connect with a sales agent, purchase a good, and join a community of users—all from a single interaction.

The shift is a result of maturing technologies that give touchpoints greater functionality and connected networks that feed them continually refreshed insights. Rather than acting as a node on a predefined distribution path, touchpoints are becoming full-blown portals.

These advances will reset the rules of engagement, allowing leaders to attain true omni capabilities. Getting there, however, will require orchestrating even more data and analytics and managing the massive leap in complexity that will result.

Touchpoints Have Reached a Tipping Point

Purchasing journeys contain exponentially more touchpoints than they did just a few years ago. In 2014, for example, Google research found that the average journey had nine customer-company interactions. Now companies provide anywhere from 20 to 500, depending on the offering.

One reason for the leap in touchpoint-centered engagement is declining costs. Just a few years ago, the tools for next-generation interactions were either not commercially viable or too expensive for companies to deploy at scale. But capabilities and price points have both improved markedly. It now costs about 33% less to create an artificial-intelligence-based image-classification system than it did four years ago, and training times have improved by 94%. Likewise, the median price of robotic arms today is 46% lower than it was five years ago.

Another reason is that critical capabilities are easier to access. Use of the cloud has grown dramatically. So, too, has a burgeoning array of services to make use of cloud-based data. That combination has allowed companies to engage with customers in increasingly sophisticated ways.

Third, investment in next-generation engagement has continued to soar. Funding of in-store tech has more than quadrupled since 2017, surging from $2.4 billion to $10.7 billion, and AI initiatives attracted $93 billion in 2021, up from $40 billion in 2019.

Declining costs and tech advances have expanded the number—and robustness—of touchpoints.

These forces are making touchpoints not only more numerous but also more powerful. And we’re still only at the cusp.

Touchpoints Will Enable Full Omni Engagement

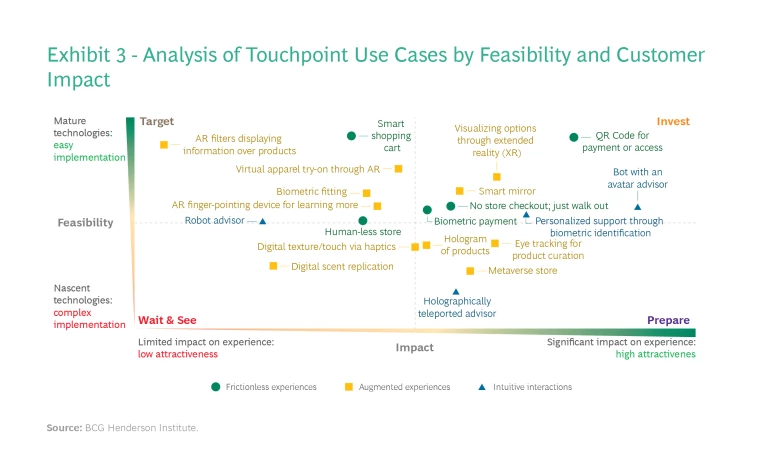

Over the next few years, we expect to see touchpoints play an increasingly central role in customer journeys. Rather than serving as a waystation along a linear, channel-specific path, touchpoints are becoming an omni gateway. (See Exhibit 1.)

This evolution is being fueled by three powerful enablers:

- Massive amounts of real-time data. Each physical, digital, or increasingly augmented and virtual interaction will serve as the outer face of an interconnected network, one that has streams of continually refreshed, often real-time data coursing through it.

- Continuous two-way conversations. Information-rich networks will recognize customers as they glide along the purchasing path. This will allow companies to provide more-relevant offers and content and give customers a say in co-creating what they receive, resulting in ever-more-personalized experiences.

- Boundary-less transactions. Any touchpoint can serve as the point of sale, greatly extending a company’s reach and opening up significant new opportunities for revenue generation.

Together, these advances will allow customers to take the reins of their purchasing experiences fully in their own hands. Through a turbocharged touchpoint, customers can access whatever buying stage they like over whatever medium and channel they wish in whatever order they prefer—creating the potential for true omni engagement.

Touchpoint advances are empowering customers, and giving companies new opportunities for revenue generation.

Leading companies are already beginning to pounce on the opportunities enabled by these advances. L'Oréal, for instance, has created a connected device that allows users to print custom lipstick, incorporating shades from the company’s Yves Saint Laurent line. Customers can take a photo of their outfit, and a YSL app will generate a few lipstick colors to go with it, which customers can try on using augmented reality (AR) filters. Once they find a shade they like, they can hit a button, and the device will print a few drops of the lipstick that the customer can then apply. L'Oréal captures data on all of these interactions and funnels that information to product development, marketing, and other functions, allowing them to see what works and what to refine.

In addition to creating multiple new touchpoints, L'Oréal has packed more functionality into existing ones. The company gave the humble QR code a facelift, for example, expanding the use of these codes to 19 brands and 5,000 products. The goal is to be more transparent with customers about product sourcing and development, providing them with information about ingredients, manufacturing location, and environmental and social performance.

B2B companies are also using connected touchpoints to deliver new offerings that add customer value. John Deere, for instance, has created an ecosystem of smart equipment and data intelligence to help farmers improve yields, profitability, and sustainability. In the field, farmers can use farming equipment, like a sprayer, that is equipped with computer vision and machine learning, to kill weeds with hyper-targeted applications of herbicide instead of spraying the entire field, cutting the use of chemicals by up to two-thirds. The company also created the John Deere Operations Center, a digital farm-management system, allowing farmers to monitor their equipment, share information with partners, and manage infield work to do more with less.

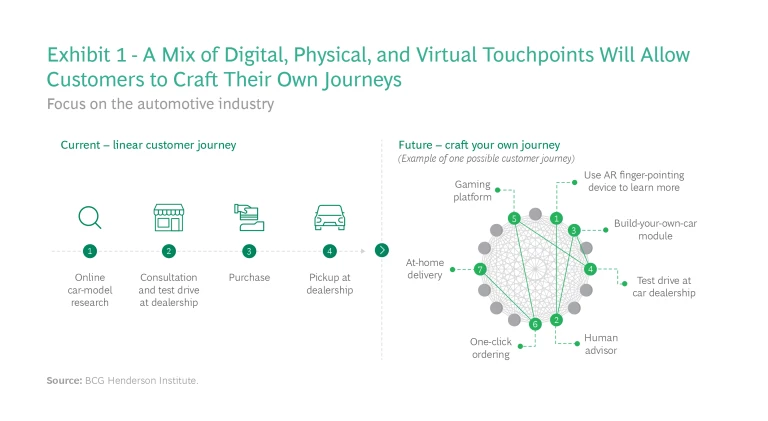

As innovation continues, we expect use cases of touchpoints to fall into three main categories. (See Exhibit 2.)

Frictionless experiences that employ touchpoints to simplify purchasing steps. Amazon Go stores are the apotheosis of this type of experience today, with the store itself serving as a unified, uber-integrated touchpoint that allows customers to complete their entire shopping journey by doing nothing more than striding in, grabbing whatever items they like, and walking out. QR-enabled payments and smart carts that scan items automatically are just some of the many technologies that will enable this type of journey.

Augmented experiences that allow customers to access integrated information in a multisensory way, “seeing” or “feeling” things in one place, which would otherwise be impossible to do. Smart mirrors that allow customers to try on outfits virtually are one example. Today, for instance, H&M is equipping some of its fitting-room mirrors with radio-frequency identification (RFID) technology capable of recognizing the size and color of clothes customers bring in with them, then displaying personalized product and styling information on the mirror. Over the next few years, as AR/virtual-reality tools become more mainstream, we’re likely to see significant innovation in how these capabilities are embedded into the purchasing process.

Intuitive interactions that leverage real-time insights to enable curated content and empathetic engagement. Nike’s flagship stores allow customers to try out gear in activity centers equipped with basketball hoops, treadmills, and other fitness options. Cameras capture a customer’s gait and movement, allowing sales staff in the store to make more specific recommendations. Digital assistants then keep the empathy going—through apps that allow customers to view and share footage of themselves playing basketball, bots that provide tailored communications, and automated push notifications that send individuals special offers designed just for them.

Stay ahead with BCG insights on marketing and sales

What Companies Should Do Now

Touchpoint-centric engagement has the potential to unleash massive value for customers and businesses. But that potential comes with a price: an equally massive increase in data and process complexity. Such complexity was already high as companies orchestrated the shift to omnichannel. The increasing use of touchpoints will make that orchestration challenge significantly greater.

With the right roadmap, however, these issues don’t have to overwhelm. The following strategies can help companies begin capturing the true potential of omni.

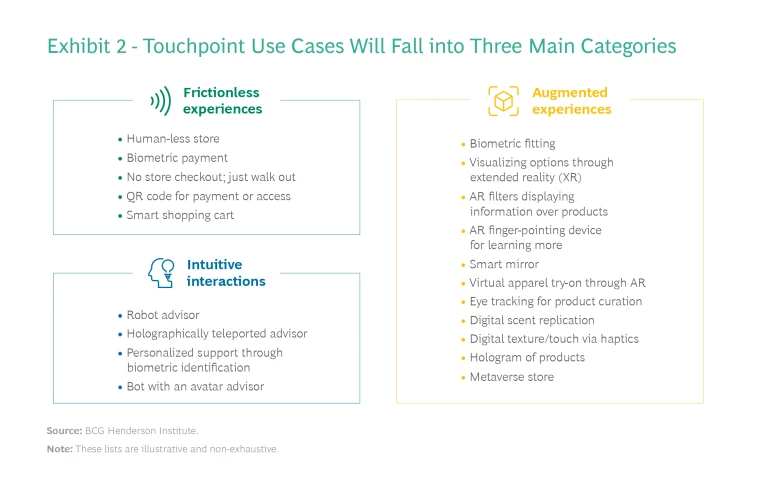

- Focus on the “must-haves.” Innovation is seductive. It’s easy to diffuse investment on exciting initiatives and hard to maintain focus and discipline. We recommend that companies focus on two or three touchpoint initiatives at most to get started. Those initiatives should be strategically aligned with the company’s brand and market position and target a specific high-value customer segment. For example, a company might choose to be a “convenience leader” or an “experience leader” and focus on touchpoints that can best deliver on that ambition. (See the sidebar “Which Touchpoints Are Ready to Invest in Now?”)

Which Touchpoints Are Ready to Invest in Now?

Which Touchpoints Are Ready to Invest in Now?

Leaders can use this exhibit to identify a set of “no-regrets” moves to make now based on their business’s strategy and positioning and begin actively testing and learning other use cases. This process ensures that companies will have initiatives that are primed and ready to go when the commercial and investment conditions align for them to launch.

- Test, learn, and adapt. As with the metaverse, we can’t know exactly what the full expression of omni engagement will look like or how long it will take for that future to manifest. But companies should not hesitate to experiment. As Jeff Bezos once said, “Our success at Amazon is a function of how many experiments we do per year, per month, per week, per day.” Companies don’t have to spend large amounts on experimentation, but they should set an annual budget for incubating new use cases and for refining, expanding, and scaling existing ones. The direct-to-consumer company Interior Define, for example, has grown its experimental budget from 5% to 15% of its total digital marketing budget. Not knowing which platforms and technologies might hold sway in the years ahead, the company wanted to be ready for whatever bears fruit by testing different propositions now. Especially during downturns, experimenting with new ways to excite and engage customers can pay off handsomely. During the 2008 and 2009 recession, for instance, Walmart redesigned its stores to enhance the in-store experience, widening aisles and introducing a new color palette to make wayfinding easier. Sales jumped by more than 5%, and customer ratings referencing how “clean,” “efficient,” and “friendly” the stores were skyrocketed.

Testing new forms of customer engagement can pay dividends down the road.

- Bolster your data architecture and AI. Companies may pursue two or three touchpoint use cases in parallel, but until they build the right data-and-analytics core, they should not move on. Recognizing that its customer data was becoming unwieldy, for example, a large telco built a unified master customer database in the cloud. Doing so allowed the company to gain a single source of truth for each customer and access powerful cloud-based AI applications—ingredients that enabled hyper-personalized campaigns. One of the first campaigns focused on the prepaid SIM card segment. Using its customer data and AI analytics, the telco learned that customers were more likely to top up their cards on the days they received their paychecks, so that’s when the telco sent its offers, using cloud-based marketing automation tools to help execute. Over time, the self-learning capabilities of the AI engine refined outreach further, enabling the telco to issue communications during the hours individuals were most likely to be responsive and using the touchpoints and formats these customers preferred. The telco also funneled customer analytics to the company’s call center, giving agents insights into an individual’s risk of churn and next-best actions to take. The agents’ interactions in turn were tracked and fed back into the AI engine, allowing systems to deliver ever-more accurate and predictive guidance.

- Adapt the organization. To execute in touchpoint-centric omni environments, companies will need to experiment with different go-to-market structures that provide the necessary nimbleness and knowledge sharing. Examples include hub-and-spoke constructs that feature a shared knowledge and analytics center and a mix of touchpoint-centric teams. Strategies should also factor in the enhanced role that human assistants can play. With digital and virtual interactions able to automate many routine tasks, companies can reimagine value-added ways to elevate the human dimension of the customer journey.

Enabled by maturing technologies, accelerated by customer demand, and inspired by the pioneering examples of native tech businesses, the future of retail isn’t omnichannel; it’s about everyday interactions with an array of digital, physical, and virtual touchpoints.