The insurance industry has long relied on automation to enhance operational efficiency and accuracy, from underwriting to claims processing and customer service. Generative AI , powered by machine learning and data analytics, promises an entirely new level of technological enablement.

GenAI’s transformative potential in insurance is especially prominent in the finance function. Finance professionals’ activities—such as actuarial risk modeling, financial reporting, and regulatory compliance—are critical to an insurer’s ability to fulfill its obligations to policyholders and maintain financial viability. Insurers can tap into GenAI’s transformative potential to perform specialized processes more effectively, support decision making, and boost operational performance.

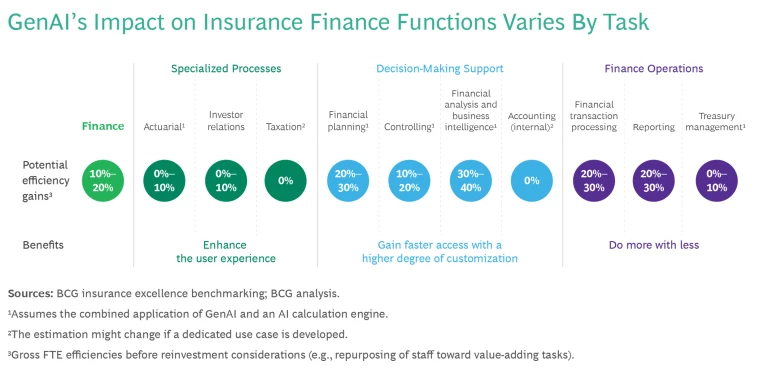

GenAI can help insurers capture efficiency improvements of 10% to 20% in the overall finance function.

To adopt GenAI in their finance functions, multinational insurers must overcome challenges on multiple fronts. These include managing several accounting standards, ensuring group-level data availability, and navigating the complexity of actuarial calculations. Implementation at scale also requires sizing the potential improvements, identifying the most relevant uses, establishing strong data and risk controls to support safe and responsible applications, and selecting external partners.

These are considerable challenges. But the prize for successfully implementing GenAI tools is significant. BCG’s insurance excellence benchmarking suggests that GenAI can help insurers capture efficiency improvements of 10% to 20% in the overall finance function. (See the exhibit.) Moreover, insurers can build a foundation for innovation within the finance function—which, in turn, can promote enterprise-level steering and operational efficiency and support profitable growth.

Managing the Complexity of Specialized Processes

GenAI offers innovative solutions for a variety of complex tasks in insurers’ specialized processes:

Reserving. GenAI can aid actuarial reserving processes by enhancing the accuracy of loss-reserve estimates. Through analyses of historical claims data, pattern identification, and simulation of future claim scenarios, GenAI assists actuaries in more accurately forecasting future liabilities. The technology can also automate the calculation of reserve amounts, reducing manual errors and providing more robust and data-driven insights into an insurance company’s financial stability.

The greater precision of reserving processes enables insurers to allocate appropriate capital, manage risk more effectively, and ensure they have adequate funds to cover future claims. These capabilities ultimately enhance their financial health and optimize regulatory compliance.

Financial Hedging. The technology can support strategic hedging processes by providing advanced predictive analytics and risk assessment tools. It can analyze a wide range of financial market data, policyholder information, and macroeconomic factors to identify potential risks and opportunities for hedging against adverse financial events.

By simulating various market scenarios, GenAI helps insurers make informed decisions about their investment portfolios and risk mitigation efforts. This enables companies to optimize their hedging strategies, manage their exposure to market fluctuations, and enhance their financial stability.

Investor Relations. GenAI can support investor presentation processes by automating the generation of data-driven reports and presentations for shareholders and potential investors. It can analyze financial and operational data, extract key insights, and create visually compelling and easily understandable presentations. This not only saves time, but—with finance professionals reviewing and refining all outputs to ensure accuracy—it ensures that investor materials are based on valid, up-to-date information, enhancing transparency and trust. However, finance professionals will need to review and refine all outputs to ensure accuracy.

GenAI can also assist in scenario modeling, allowing insurers to showcase different financial projections and strategies to investors. The enhancements to communicating their financial performance and growth potential can be crucial for attracting investment and maintaining stakeholder confidence.

Tax and Regulatory Reporting. The technology can assist in compliance management by monitoring regulatory changes, interpreting regulations, and automating compliance-reporting processes. It can also support the interactions of tax and regulatory experts with the rest of the organization by developing chatbots and interfaces that reduce time spent providing basic and intermediate training to nontechnical functions. This ensures that finance professionals can meet regulatory requirements efficiently and effectively.

Empowering Decision Makers

GenAI supports decision makers in a variety of ways by analyzing vast amounts of financial data, market trends, and economic indicators:

Financial Planning and Budgeting. GenAI algorithms can create accurate forecasts and scenarios for financial planning and budgeting by analyzing historical financial data and market trends. This feature is especially important for insurers, because small differences in financial scenarios can significantly affect both the P&L statement and balance sheet. The insights help finance professionals make informed decisions about resource allocation, budgeting, and financial goal setting while expediting responses to managerial inquiries.

Sensitivities and What-If Scenarios. The technology can analyze large volumes of historical data and simulate different scenarios to assess sensitivity. It can use machine learning algorithms to identify key variables and their potential impact on outcomes. By simulating changes in variables such as interest rates, claim frequencies, market conditions, and policyholder behaviors, GenAI can provide insights into the sensitivity of different parameters and their influence on financial projections and risk assessments.

This is especially important in insurance, where performing sensitivity analyses is intricate and cumbersome owing to the many complexities of insurance contracts and high dependency on external factors, such as macroeconomic variables (particularly in life insurance).

Uncovering Hidden Patterns and Relationships. GenAI’s data analytics capabilities go beyond traditional analysis techniques. By analyzing large and complex datasets, generative AI can uncover nonlinear relationships and dependencies that may impact sensitivity analyses. This enables insurers to gain a deeper understanding of how variables interact with each other and the potential consequences of changing assumptions in different scenarios—developments in the financial markets, for example.

Streamlining Finance Operations

GenAI is transforming insurance finance operations by automating repetitive and manual tasks, streamlining processes, and improving efficiency. While these advancements are evident in many industries, they are particularly valuable for insurers. The complexity of managing different accounting standards across jurisdictions, including the global International Financial Reporting Standard (IFRS) and risk-based valuations such as Solvency II in Europe, add to the challenges of managing finance operations.

Examples of the benefits include the following:

Data Quality Controls. GenAI can bolster data quality controls in finance by automating data validation, cleansing, and enrichment processes. It can analyze vast financial datasets for inconsistencies, errors, and discrepancies, allowing for prompt corrective actions. Additionally, GenAI can fill in missing data, standardize formats, and verify the accuracy of financial records, which is crucial for reliable financial reporting and compliance with regulatory standards. By consistently monitoring data quality and implementing corrective measures, generative AI promotes more informed decision making, reduces operational risks, and improves overall financial performance.

Transaction Processing. GenAI can automate transaction processing tasks, such as data entry, reconciliation, and verification. By utilizing machine learning algorithms, it can learn from historical data and accurately process financial transactions, reducing errors and accelerating the overall process.

Financial Reporting. The technology can automate the generation of financial reports by analyzing complex financial data, interpreting accounting standards, and producing accurate reports in real time. This automation reduces the manual effort required for report preparation, improves accuracy, and ensures compliance with regulatory requirements.

Cash Flow Management. GenAI algorithms can analyze historical cash flow patterns, market trends, and customer behavior to predict future cash flows. This helps finance professionals optimize cash flow management, make informed decisions about liquidity, and improve capital management. Insurers, as typically cash-rich companies, have ample opportunities to improve cash management to extract additional value.

Navigating the Challenges

To move beyond experimenting with GenAI in finance functions, companies across industries must manage critical challenges to implement the technology at scale. These include data accuracy and security as well as hallucinations; GenAI tools can struggle with calculations, for example, and sometimes produce incorrect responses in a highly convincing manner. Biased outputs are also a significant risk. In addition, as participants in a highly regulated industry, insurers must be able to explain outputs and results produced by AI systems to maintain accountability.

Insurance companies also face distinctive challenges relating to accounting, data availability, and actuarial complexity:

Accounting. Multinational insurance companies must ensure that GenAI applications are customized to enable compliance with a plethora of accounting standards. IFRS 17 is the main global standard for insurance contract accounting, and IFRS 9 regulates the accounting of the financial assets held on balance sheets. In addition, insurers must adhere to country-specific Generally Accepted Accounting Principles for public reporting. Other relevant standards are capital requirements found in Solvency II in Europe and local risk frameworks across other jurisdictions.

GenAI systems must be flexible enough to switch between these standards, ensure correct application, and remain up to date with evolving standards and interpretations.

Data Availability. The broader the data set available for training AI, the better the results it delivers. However, data in multinational insurance companies is often fragmented across multiple systems and departments in different countries. For GenAI to be effective, this data needs to be centralized and accessible in a common format. This poses a major challenge for many insurers that still store data locally and do not support data sharing and pooling centrally.

Actuarial Complexity. Actuarial models are highly complex, involving intricate mathematical and statistical calculations to estimate financial risks related to uncertain future events. To enable actuarial applications of AI, insurers must convert complex actuarial rules to simple algorithms. Addressing this challenge requires significant engineering efforts to codify approaches and methodologies closely guarded by the most skilled actuaries. By overcoming the obstacles, insurers can develop innovations that enhance their risk-management techniques.

Getting Started

Implementation of GenAI at scale requires a multifaceted approach:

Estimate the size of the opportunity. Evaluate the potential efficiency improvements offered by GenAI use cases. Communicating the potential improvements helps mobilize the organization and underscores the importance of the transformation. Off-the-shelf tools and best practices tailored to insurance finance functions are available to support the evaluation.

Identify the most relevant use cases. Select the first use cases to pursue by considering ease of implementation, data availability, and potential benefits. Some tasks might require minimal changes to the existing infrastructure, while others necessitate a major overhaul.

Starting with tasks that are easier to automate or support with GenAI can build momentum and provide quick wins. Similarly, while some GenAI applications can offer significant cost savings, others might enhance accuracy or speed. Prioritize use cases that align with strategic objectives—whether improving customer experience, enhancing operational efficiency, or reducing errors.

Establish safeguards. Establish controls to ensure the accuracy of figures and results produced by GenAI and set the acceptable risk level for errors in AI outputs—for example, by requiring a higher frequency of controls when figures are shared with external stakeholders and lower controls when AI is used for an initial draft circulated among a few internal team members. Controls could include automated cross-checks or rigorous manual reviews, depending on the sensitivity of the information provided by the AI. For instance, if GenAI is used to predict future financial performance, a separate analytical tool can validate these figures against historical data and flag anomalies. In other situations, manual reviews by experts may be required to ensure that GenAI's outputs align with business realities.

Implement responsible AI. To safely experiment and scale GenAI applications, define an overarching responsible AI strategy with clearly defined ethical principles, risk tolerances, and a risk taxonomy. Implement the strategy by integrating it into existing governance and risk-management practices and designing and applying new controls across the finance value chain and processes. To ensure that the organization adheres to the strategy, implement supporting technology and foster a communicative, value-based culture that embraces the importance of responsible AI.

Select partners. Embedding GenAI into finance processes entails a complex transformation. It is thus crucial to choose external partners that can provide support across strategic, business, technological, and operational topics. Strategic partners can offer insights into how GenAI can align with and advance the company’s long-term vision and mission.

From an insurance business perspective, partners can guide companies on best practices, industry benchmarks, and how to achieve competitive advantage using GenAI. For technology, partners can advise on the right algorithms, data infrastructure, and integration strategies. Finally, from an operational perspective, experts can help redesign workflows, train staff, and optimize processes to ensure that the company captures the benefits of GenAI tools.

Insurance companies can unlock significant value by integrating GenAI into their finance functions. They can gain a competitive advantage by enhancing specialized processes, making better-informed decisions, and streamlining operations. Although multinational insurers face substantial challenges in adoption, a comprehensive approach encompassing strategic, business, technological, and operational aspects can place them at the forefront of this significant transformation.