The signals conflict. Occupancy rates, average daily room rates (ADRs), and revenue per available room (RevPAR) are up. New construction is down—to 2015 levels. Looking ahead, demand is expected to rise, but so may interest rates. Our latest industry survey shows that four out of five hotel owners view hotels as unattractive investments in high-interest-rate environments. Where is the industry headed?

BCG and New York University’s Jonathan M. Tisch Center of Hospitality surveyed hotel owners, management companies, and other industry stakeholders earlier this year to gauge their sentiment on the industry’s prospects. We found good news in their expectations for rising demand that will bolster key industry metrics, such as ADRs. But there is also hesitation among property owners to put fresh capital into the sector in the current economic environment. Ironically, this means they may miss out on attractive returns in the near to medium term. It also boosts the pressure on operators to show that they are pulling, and can continue to pull, all the available levers to maximize revenue growth and profitability following the prolonged pandemic-induced downturn.

Here's what the current landscape looks like. It is far from all gloom and doom.

Guest Demand: A Major Source of Optimism

More than 70% of survey respondents anticipate that demand will at least somewhat increase by the end of 2023, and 42% expect significant increases in 2024. Hoteliers are looking for nominal revenue increases of 4.6% to 5.1% in 2023. Those expecting a significant increase in demand expect revenues to rise by about 12%. Real growth rates seem likely to exceed the rate of inflation.

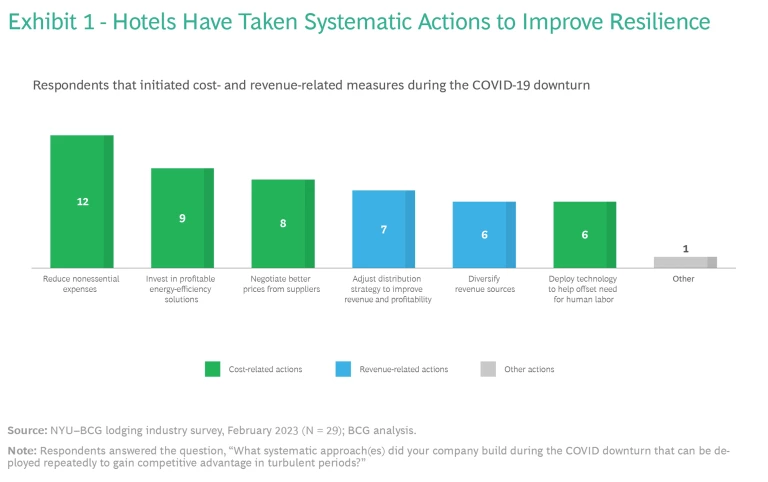

The revenue increases will be driven by both volume and price. Hoteliers indicated that they expect room rates to rise by 8.3% to 8.8% over the next 18 months, expanding gross margins by about 6 percentage points. The big boost to operating margins comes thanks to the moves hoteliers took in response to the impact of COVID-19 and the resulting variability of demand over the past several years. Most have consistently built resilience into their approaches to revenue generation and cost management. (See Exhibit 1.) For example, partly in response to the labor shortages of the past few years, hoteliers have deployed technology to help offset the need for human staff. These operators are also more likely to have adjusted their distribution strategies, diversified revenue sources, reduced nonessential expenses, and invested in energy-efficient solutions.

Interest Rates: The Biggest Threat for Investors

Even though hotel industry participants expect the inflation rate to drop below 5% by the end of 2024 (with a consequent 0.8 to 1.3 percentage point improvement in operating margins), they are nonetheless wary. High interest rates spook investors in hotels as in other commercial-property sectors. In the current environment, 82% of hotel owners view the hotel industry as less attractive than other investment classes.

The industry is approaching a trigger point. A summary of recent hotel financings shows spreads topping out at 400 basis points above the secured overnight financing rate, which itself is approaching 5%. When borrowing costs exceed 8%, hotel investors pull back. In our survey, 89% of hoteliers said they consider rates above 8% to be unacceptable for taking out a loan.

This environment may prompt investors to fund investments with equity that is less expensive than debt. But debt rates that exceed equity rates raise the prospect of negative financial leverage (with the use of debt lowing, rather than increasing, the equity yield), a situation that last occurred in the early 1980s when interest rates on hotel loans soared to the upper teens.

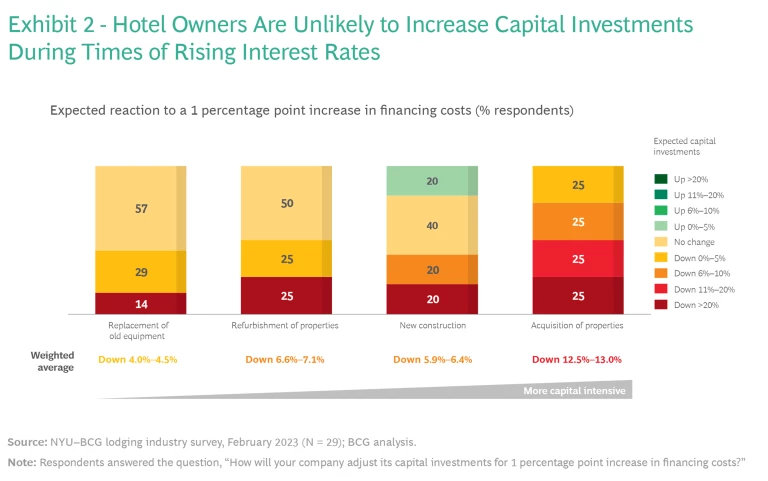

Hoteliers holding short-term floating-rate debt are vulnerable to both rising debt service and refinance risks, and rising rates affect hotel owners across the full range of their capital spending. (See Exhibit 2.)

Recent bank failures and the continued pressure on small and regional banks have the potential to undercut investment in the industry as funders reduce property acquisition, defer new construction, or abandon hotels (and real estate) altogether. A broad trend toward reduced investment is starting to show up in industry data. A 2023 study by Private Equity International found that hospitality (along with retail and office space) ranked among the least preferred investment classes for attracting capital. According to data from Cushman & Wakefield, hotel transaction value increased steadily from 2021 through mid-2022, at which point volume slowed. The number of US hotel rooms under construction in December 2022 was the lowest since 2015 and some 60,900 rooms below the construction peak in April 2020.

Much of current investment in the industry is going into renovation and brand conversion activity, which is playing catchup after lax enforcement during the pandemic. Renovation and brand conversion projects reached record levels in the first quarter of 2023 (1,953 hotels and 253,533 rooms, 38% and 37% year-over-year increases, respectively), according to Lodging Economics.

Persistent Labor Challenges Add to Investor Reticence

Prolonged staffing shortages are adding to investor concerns. Fully 70% of hotel owners view the hotel industry as less attractive if labor problems persist. In addition, more than 60% of respondents reported that they are somewhat or severely short-staffed, which we estimate is costing hoteliers about 7 percentage points of revenue and about 2 points of operating margin.

Last year , we outlined how various steps—such as increasing worker flexibility, implementing transparent compensation pathways, and fostering an environment of inclusion and belonging—can help the industry improve recruiting and retention. Hotels have been pursuing these strategies, and according to the US Bureau of Labor Statistics, February 2023 employment levels in the industry reached those of February 2019. More than 60% of respondents to our survey expect to face less attrition by the end of 2023.

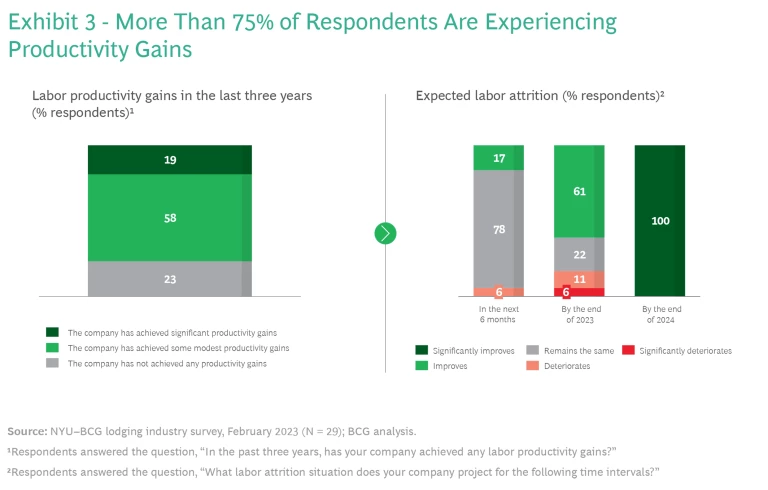

This is good news for hotel finances. More than 75% of respondents have experienced modest or better labor productivity gains in the last three years and are optimistic about improving employment going forward. More than 60% expect continued improvement in 2023 and 100% expect significant improvement in 2024. (See Exhibit 3.)

And yet, two challenges remain: large numbers of job openings and the decline in real earning potential for industry workers. Despite employment’s return to pre-COVID levels, job openings in the hospitality industry remain at an all-time high, driven by expectations for a significant increase in demand. Further, industry growth rates in hourly earnings are decelerating sharply, especially for nonsupervisory employees, and are now roughly on par with the rate of inflation, according to Bureau of Labor Statistics data for the accommodation and food service industry. Given the sharp decrease in earning potential for employees, as well as the hangover effect of job uncertainty from the events of the past several years, hoteliers still urgently need to solve labor challenges by increasing productivity gains and introducing new initiatives to address gaps in recruiting and retention.

Three Scenarios

Hotel construction fell during the pandemic, and the two- to three-year lag in bringing new projects to market will lengthen the current period of constrained supply and consequent profit growth for existing hotels. New supply may be further limited if interest rates remain elevated and undermine the feasibility of marginal projects getting off the ground.

We see three potential scenarios playing out, all of which carry benefits for investors:

- Opportunistic pricing strengthens operating margins. Improving demand and a high-inflation environment (with consumers braced for higher prices) embolden hoteliers to push room rates to historically high levels, boosting revenues and improving operating margins.

- Cost increases are generally offset by pricing increases. Price increases that offset only inflationary and labor cost increases could continue to slow investment and construction. In the near term, while demand is healthy, returns may remain stable. In the medium term, we could see positive effects on ADRs (assuming new supply remains constrained), creating a significant opportunity for rate increases.

- Cost pressures eat into margins. Pressure to add staff and restore suspended services cuts into margins but is unlikely to totally offset revenue growth, leaving some room for profit expansion.

Considerations for Owners and Operators

Against this backdrop, investors should evaluate the potential returns from acquisition, construction, and refurbishment from the perspective of improving margins based on price increases driven by rising demand. For the next few years, hotels will likely be able to push up ADRs both strategically and opportunistically as demand rises faster than supply. The main question is by how much.

Furthermore, while their earnings may be characterized by some volatility and unpredictability (owing to such factors as seasonality, varying demand over the course of a week, and higher operating and labor costs), hotels have a key advantage over other types of residential and commercial real estate. Office and retail properties face serious structural as well as short-term financial challenges, which reduces their attractiveness to investors (at least until they can make the necessary adjustments to their models). These other asset classes also are typically locked into medium- to long-term leases and are unable to adjust lease rates dynamically in real time to take advantage of pricing power. Hoteliers can build the confidence and favor of the investor community by adeptly managing key metrics, such as ADRs and RevPAR, increasing yields and returns for investors.

For the next few years, hotels will likely be able to push up ADRs both strategically and opportunistically as demand rises faster than supply. The main question is by how much.

This is not a foregone conclusion, especially if we head into a recession in 2023 or 2024. But an analysis by Skift Research indicates that an upcoming recession might be different from the downturns in 2002, 2009, and 2020, when occupancy, ADRs, and RevPARs cratered. Thanks to demand in multiple travel classes (such as business, group, and international) that has not yet recovered fully from COVID, combined with the pricing power that hotels still have, this recession could be the first in the US to see industry metrics increase rather than decline.

A disaggregated approach to pricing increases, therefore, is well advised. Hoteliers should be focusing on both the pockets of demand with the highest willingness to pay and the products and services for which they can effectively charge more. For example, should a recession occur, large luxury hotel chains are expected to suffer least because they cater to international travelers, and several markets, such as the US, China, and other Asian countries, have sizeable pent-up demand.

Multiple indications point to business travel picking up. For example, a December 2022 Morgan Stanley survey of 100 large corporate travel managers found that almost half expect their companies’ 2023 travel budgets to exceed 2019 levels. Hoteliers have an opportunity to both serve this demand and tap into a related emerging market of business-plus-leisure trips. Leading hotel executives have indicated that demand for Sunday- and Thursday-night stays in traditional business markets has been strong. Hoteliers may want to rethink the traditional definition of the “weekly warrior” travel pattern and adjust revenue management strategies (and add-on amenities) to reflect changing behavior.

This environment incentivizes hotel revenue management and distribution leaders to improve their ability to capture increased demand with the right products at the right price. Reservation and property management systems continue to advance, and hoteliers are much better able to price individual rooms, features, and services to the level of the individual customer. The importance of access to good data-as-a-service and business intelligence solutions will increase as real-time demand forecasting models take in more information—such as short-term rental data, hotel transactions, renovations at the market level, neighborhood-level market data, news headlines, and currency exchange rates. One large hotel management company has already seen good success using a combination of these tools to improve its demand forecasting. It’s the job of hotel operators, however, to rigorously test new revenue management practices and the pricing elasticity of new features (such as the incremental ADR of suite versus standard-room rates or the incremental rate for adjoining rooms) so that the ability to capture rate premiums is not limited to luxury offerings or customers with the highest willingness to pay.

Hoteliers should be focusing on both the pockets of demand with the highest willingness to pay and the products and services for which they can effectively charge more.

If a version of the third scenario comes to pass and hotels cannot fully offset rising cost pressures or raise prices as much or as quickly as they would like, it will be incumbent on owners and operators alike to ensure that brands and properties still deliver value. This is the only way that hotels will remain an attractive asset class for investors.

Branded operators must make sure that their brands, services, and offerings remain relevant to travelers’ needs so that customers are not enticed away by other forms of lodging. These companies must also have the right technology in place so that those making day-to-day decisions at individual hotels and properties have access to data and insights that can optimize ADRs. Branded companies and operators are well positioned to determine how to unlock value from the supply chain by providing owners with efficient at-scale solutions. Extracting procurement savings with products that both meet brand standards and deliver value to owners, for example, will allow operators and hotel brands to share in value creation and take a piece of the pie.

One opportunity may lie in the substantial structural changes that owners have made in the last several years to improve energy efficiency. These changes can reduce real estate financing costs. In Europe, financing for new construction that meets stringent energy efficiency standards has become very attractive, with access to favorable terms as well as subsidized rates. Creative thinking by operators and owners may allow them to build on the advances hoteliers made during COVID.

As we move forward in uncharted waters, value creation may need to come from sources other than higher prices and lower costs. Just as they did during the darkest days of the pandemic, operators need to consider the owner’s perspective in building a mutually beneficial cost-value relationship.

Uncertainty, inflationary fears, and elevated interest rates are likely to be with us for a while. All can have a chilling effect on investment. But strong demand for rooms should be another constant. Hotels may be one of the few sectors that enjoy pricing flexibility in a broader economic downturn and, as such, one of the few asset classes that shrewd investors can turn to for comfort.