Many businesses are overlooking the advantages of Web3, and crypto’s recent setbacks are a big reason why. Billions of dollars in customer wealth have been lost in cryptocurrency trading, perhaps Web3’s most publicized area, with crashes like the fall of the now bankrupt FTX exchange. A “crypto winter” has set in, scaring retail companies and institutional adopters away from Web3’s considerable promise.

One of the most promising areas for Web3—the internet’s third evolution—is in customer loyalty offerings. Web3 offers a range of ways to revitalize loyalty programs. Concepts like tokenization (digital tokens that represent assets or ownership rights) support use cases linked to wholesale payments, identity management, and most importantly for retail, loyalty revenue streams. Consumers today are quite open to loyalty relationships, and Web3 is a rich setting to further boost engagement and scale partnerships more effectively.

Web3 offers a range of ways for companies to revitalize their loyalty programs.

At the same time, the wild shifts in regulatory and technology conditions are pushing brands to look at loyalty programs as reliable drivers of customer data collection . Regulators are steadily scrutinizing consumer privacy, and big tech platforms are limiting use of third-party cookies and setting up more stringent controls around data sharing. As brands peer into a cookie-less future, they are eager to construct their own loyalty programs for first-party data collection to better engage customers—a function that Web3 serves with broad versatility.

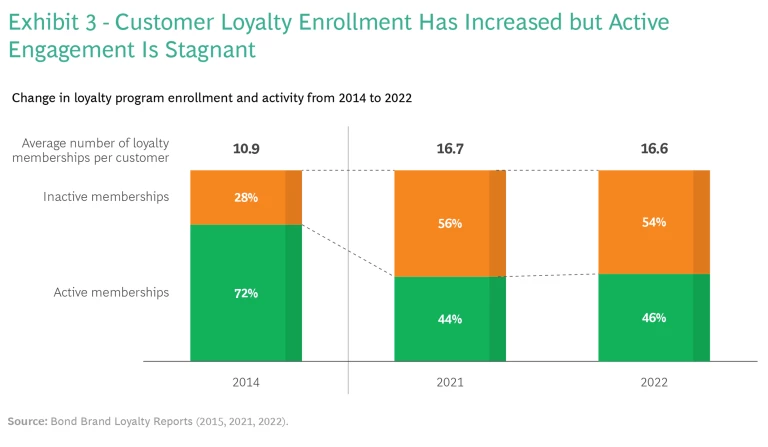

However, the answer is not always as simple as launching yet another loyalty program into an inundated market. Customers are enrolled in more programs than ever before; US consumers held upwards of 16 loyalty memberships on average in 2022, according to Bond’s Brand Loyalty Report. The activity across these memberships can be underwhelming, though; active customer loyalty engagement has been stagnant at below 50% of enrolled programs in recent years. Businesses must understand Web3 and the various options to boost engagement, because consumers will respond—but only to the right offerings.

Utility—the services and features that a customer can access along with a digital asset—is vital to the success of Web3 loyalty offerings. Businesses can tokenize customer relationships via nonfungible tokens (NFTs) to boost engagement and activate communities. There is also meaningful utility in tokenizing transactions to strengthen cross-partner loyalty collaborations. Businesses should avoid mimicking mainstream, short-sighted use cases, or worse, avoiding Web3 altogether out of caution. This article explores challenges with existing loyalty paradigms, examines how Web3 technologies can be used in loyalty contexts, and offers a framework to help companies revive or boost loyalty offerings to energize customers.

Understanding Web3

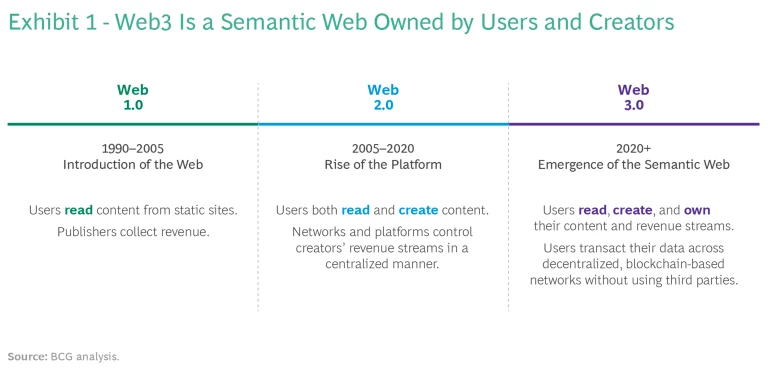

Discussions of Web3 are often clouded by misunderstandings and hype, so it is helpful to clarify how this new technology follows past versions of the internet. Web3 brings together emerging technologies —blockchain most foundational among them—to offer users more control over their activity and interactions. Web 1.0, which lasted from roughly 1990 to 2005, supported the information economy, where publishers controlled content and collected revenue and users consumed the content. Web 2.0 (2005–2020) was the platform economy, where networks and platforms enabled users to both read and create content. The platforms however still controlled creators’ revenue streams in a centralized manner. (See Exhibit 1.)

Web3 moves the world into a token economy, where blockchain-powered, decentralized applications enable direct user ownership and monetization of identity and content through tokens. Tokens allow active participants and creators to benefit economically from Web activity without intermediary platforms. These tokens are fungible assets, such as crypto or stablecoins, or nonfungible tokens, known as NFTs. (For more on Web3 technology, see “The Basics of Web3.”)

The Basics of Web3

- Blockchain: The building block for Web3, blockchain operates as a distributed database or ledger across a set of nodes to maintain a secure and decentralized record of transactions.

- Smart contracts: These programs run to complete transactions in response to several conditions; agreements are free from manual input or manipulation of the program execution.

- Fungible tokens: These tokens are made up of data on the blockchain representing assets that are non-unique and divisible (such as currency).

- Nonfungible tokens (NFTs): Data on the blockchain that represents a title of ownership to a unique and nonreplicable asset (such as an art collectible).

- Cryptocurrency: A digital currency represented as a fungible token on a blockchain and secured by cryptography, protecting it from being counterfeited or double-spent. Cryptocurrencies include tokens such as Bitcoin and Ethereum whose price is volatile, as well as stablecoins like USDC, which are pegged to a fiat currency.

- Token gating: Path for companies to monetize content or user access to their products and services through the use of digital tokens, usually NFTs.

- Decentralized autonomous organization (DAO): A community of users, free of central leadership, who make decisions in a bottom-up approach; DAOs are active in a number of online projects.

- Decentralized finance (Defi): Financial products that are programmatically managed by smart contracts without intermediary institutions.

The Challenges of Existing Loyalty Programming

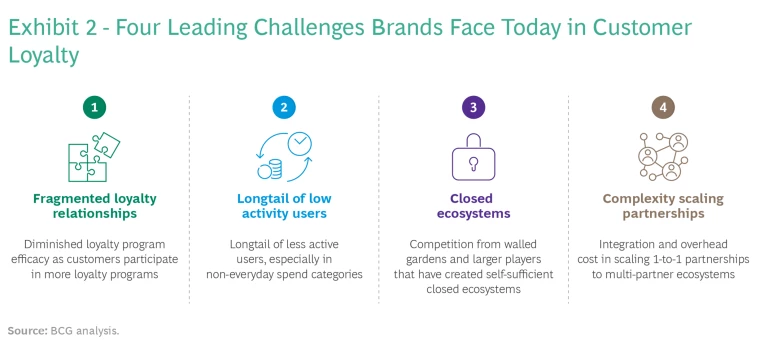

No matter how many members a company’s loyalty program may include, several challenges stand between the business and the increased customer interactions that loyalty programs are positioned to enable but so often fail to make real. (See Exhibit 2.)

Fragmented Loyalty Relationships. Though most customers are willing loyalty members, they are overwhelmed by the promotion and messaging from different programs as they manage multiple loyalty accounts. (See Exhibit 3.) More and more ads and offers fly across their screens, often less personalized. This tide of constant promotion dilutes the exposure of a single program.

To compete, brands must build a compelling loyalty offering that stands out in a crowded field, has an engaging and simple UX, and maintains meaningful partnerships with other programs.

Longtail of Low Activity Users. There is a large distribution of less active users throughout many programs, particularly in categories like travel, hospitality, and luxury goods. Interacting with this wider base of less active customers could help to convert their latent participation into more revenue.

Brands should explore various forms of incentives and rewards, with cash being the simplest option. According to Bakkt’s Loyalty & Rewards 2022 Outlook Study, 66% of the average US consumers would prefer cash back instead of earning points. The long-used practice of rewarding points or merchandise may appeal to a portion of the brand’s customer base, but not to all. Instead, fungibility of points in the form of conversion to cash, digital assets with underlying utility, or access to other programs can help engage the longtail of inactive users.

Closed Ecosystems. Large digital players have the lion’s share of customer eyeballs, and merchants and smaller brands often find themselves left out. Commerce giants for example have created self-sufficient, closed ecosystems for consumers across a wide array of products and services.

To reach more customers, brands must tap into such ecosystems and walled gardens, where an intermediary company or platform controls access to customers and ad space.

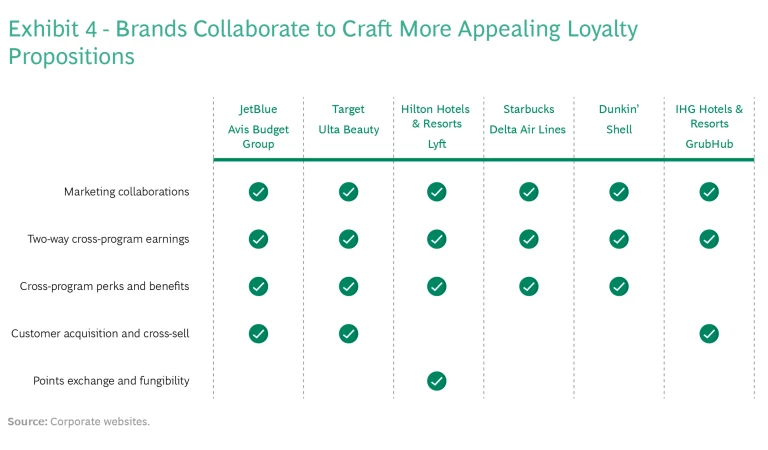

One way that brands can compete at scale is to draw in consumers with propositions involving many partners. Partnerships enable access to more touchpoints with a broader base of customers, more insights, and a wider array of rewards. The numbers are impressive; for example, the Starbucks and Delta Air Lines partnership allows Delta Air Lines to appeal to Starbucks’ 27 million plus loyalty customers—who don’t necessarily all fly Delta Air Lines. Starbucks also gains more touchpoints with their consumers throughout their travel journeys. (See examples of collaborations in Exhibit 4.)

Complexity Scaling Partnerships. Though there is strength in numbers, partnerships are hard to solidify. Brands often create “connected loyalty” partnerships to craft more comprehensive and widely appealing offerings for their diverse customer base. However, these partnerships are mostly point-to-point integrations that become harder to scale beyond one-to-one setups into multi-partner ecosystems. There’s also lots of overhead when managing the details of cross-program agreements, including legal and regulatory compliance, currency tracking and reconciliation, and marketing collaborations.

Web3 offers ways to scale partnerships and manage these intricate details—promising versatility as companies try to enhance loyalty offerings.

Web3’s Versatility in Customer Loyalty Engagement

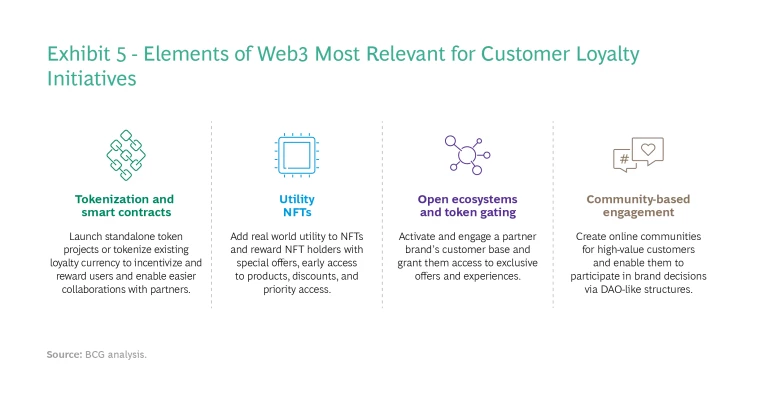

Some brands on the frontline of Web3 usage have been more methodical and strategic, looking comprehensively at how Web3 can fit into their customer engagement and loyalty strategies. Others have taken a more opportunistic route, experimenting with multiple facets of Web3 such as NFT drops, metaverse branches, or crypto rewards. (See Exhibit 5.)

Tokenization and Smart Contracts. The world of Web3 content creation illustrates how tokenization could enhance loyalty programming. Content creators use tokens to bootstrap projects and build a community of loyal, engaged fans who can access premium content and interact with fellow fans and the creators themselves.

In a loyalty setting, branded fungible and nonfungible tokens on the blockchain could replace or complement traditional points and tier-based loyalty management solutions. The tokens can be used to gamify interactions, track engagement with the brand, and reward loyalty with real-world perks and benefits. Tokens could also open creative avenues for the business to plug in partners and merchants more easily, with interoperability rules programmed in. Smart contracts can automate a lot of the manual overhead that goes into managing liabilities and settling cross-partner points.

In an example of a commitment to tokenization and partnerships, Starbucks announced in October 2021 its aim to explore tokenizing Stars on the blockchain to enable partners to plug in to its program more easily. A year later, Starbucks announced a loyalty partnership with Delta Air Lines.

“Utility” NFTs. Collectable, digital-first NFTs have created a lot of buzz. However, they tanked recently due to early speculative trading by consumers at large. For example, Bored Ape Yacht Club’s (BAYC) floor price peaked in May of 2022 at around $420K. By end of 2022, BAYC had dropped by almost 80%.

Customers are beginning to lean toward NFTs paired with utility to bridge the digital and physical worlds. The success of any Web3 loyalty offering is often found by pairing utility to issued tokens. Such assets can reward NFT holders with special offers, early access to products, discounts, and priority access to stores or events. NFT metadata can be used to track loyalty progress and achievements with the brand as well as with its partners, such as tasks completed or points earned.

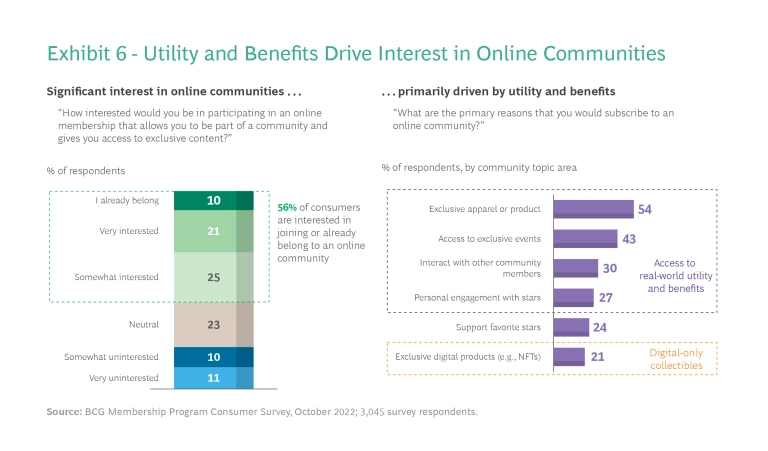

In BCG’s Membership Program Consumer Study conducted in October 2022, the majority of consumers showed interest in being part of an online community or membership, with up to 54% indicating access to utility and real-world benefits as a primary reason to join. Only 21% indicated NFTs or other digital products would be a reason for them joining. This shows the power of bridging digital-only NFTs with real-world benefits to create utility beyond the digital asset itself. (See Exhibit 6.)

Several real-world examples are at hand. Gap launched NFTs on Tezos blockchain that give NFT owners access to a limited-edition collectible hoodie. Similarly, Starbucks Odyssey offers members the ability to earn and buy NFTs that will unlock access to immersive coffee experiences and benefits. Clinique launched NFTs that its customers can win by engaging in social network challenges for access to an assortment of products on an annual basis.

Open Ecosystems and Token Gating. Token gating is gaining popularity as open and connected ecosystems become an alternative to walled gardens, enabling smoother collaboration across brands and loyalty programs. One brand can engage another brand’s token-holders and grant them access to exclusive offers and experiences. Public- or consortia-based blockchain platforms would allow more seamless, plug-and-play type collaborations across brands, bypassing complex, one-off IT integrations.

Token gating allowed Tiffany & Co. to target affluent, NFT-savvy customers with minimal complexity. In 2022, Tiffany launched the NFTiff project, where owners of NFTiffs would get exclusive rights to necklaces and pendants resembling the CryptoPunks NFTs they own.

Community-Based Engagement. Passionate communities have formed around creator-led token projects such as NFT art collectibles and emerging Defi protocols. Many of these projects aim to collect community inputs and drive collective decision making through active social media channels, special virtual and in-person member-only events, and decentralized autonomous organizations (DAOs), which are collectives of users that have no central governing body.

Brands can employ similar online communities among their die hard or high value customers. Leaders can use DAO-like structures to easily enable voting on brand decisions closest to customers’ hearts, such as which product to launch next or the next partnership to bring onboard. Governance can be configured through the DAO to give certain token holders’ votes more weight depending on loyalty status, history of engagement, participation in key challenges, and so on.

A Framework for Web3 Loyalty Offerings

Many institutions have started experimenting in Web3, most of them taking an opportunistic and ad hoc approach to launching initiatives. But the commitment should be much more forceful. Companies must take a structured and strategic approach to defining their Web3-anchored loyalty offering.

We’ve developed a six-pillar framework to help companies think through their Web3 loyalty proposition. (See Exhibit 7.)

Web3 Loyalty Strategy and Objectives. As a first step before diving into pilots and initiatives, companies must understand the gaps and opportunities within their current loyalty offering and explore where Web3 can help. Leaders should define the overarching strategy, guardrails, and prioritized objectives of the offering.

Subsequent Web3 use cases must answer the underlying objectives or shortcomings of the existing loyalty program. Common objectives include expanding program rewards to the wider, less active customer base; expanding and streamlining partnerships; attracting a new customer segment; and increasing frequency of customer engagement with the program or brand.

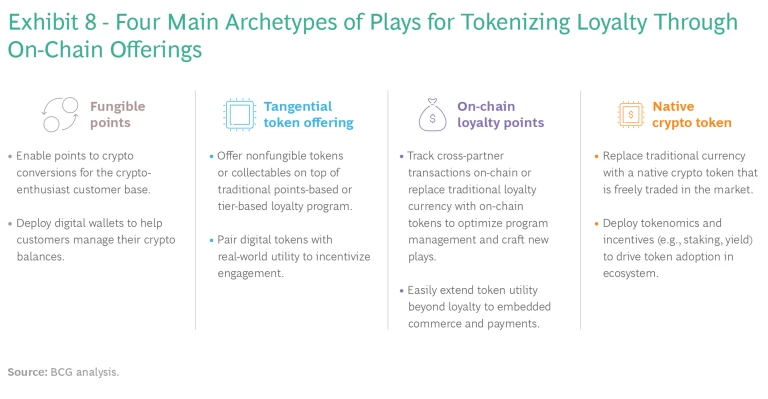

Tokenization Strategy. Institutions must then think through the tokenization strategy they’ll use to deploy, complement, or replace current offerings and help them execute against identified objectives. The options fall along a spectrum of archetypes that vary by technical and regulatory complexity. Careful financial modeling must accompany the chosen archetype to ensure that it achieves desirable financial objectives for the overall loyalty offering. Four archetypes exist (see Exhibit 8):

- Fungible Points. Some programs may opt to create fungibility in their existing points-based program. Crypto-enthusiast customers can convert points to crypto for liquidity or investment purposes. Financial institutions like SoFi and Venmo have launched crypto rewards credit cards or enabled conversion of points to crypto.

- Tangential Token Offering. Brands can explore a complementary token offering made up of NFT collectibles that offer real-world utility beyond the digital token itself. These offerings can integrate with existing loyalty management solutions and gamify the program to create new ways of engaging and incentivizing customers, especially the younger, digital-savvy base. Starbucks Odyssey members can earn NFTs marketed as digital collectible stamps and unlock access to new experiences. They chose Polygon as their primary blockchain platform, a Layer 2 scaling solution built on top of the Ethereum blockchain.

On-Chain Loyalty Points. Companies with no loyalty program or those looking to revamp their existing loyalty management solution can issue fungible loyalty tokens/points on the blockchain. This is useful for partner-heavy programs that require optimal cross-program token tracking, settlement, and reconciliation.

The airline company Emirates leveraged Loyyal to tokenize cross-party transactions on the blockchain.

Native Crypto Token. At the far end of the spectrum is a pure Web3 play centered around native crypto tokens that can be rewarded, bought, and traded in currency markets. Companies should be cautious with this approach. The complexity of this model is exponentially greater than the other plays, involving high regulatory scrutiny and complex tokenomics to drive token demand and traction across all sides of the ecosystem. Catastrophic token collapses have had serious reputational and financial consequences, such as the FTX Token fallout and subsequent FTX bankruptcy.

Most companies experimenting in this space have stuck to the first two options, with a few venturing into on-chain points tokenization to realize cross-program settlement efficiencies. Some native Web3 businesses operating under more crypto-friendly regulatory regimes launched a native crypto token as part of a broader ecosystem strategy that requires loyalty utility and incentives. One example is the Basic Attention Token (BAT), which is funded by advertisers and earned by users and creators for participating in an ad ecosystem.

Partner Ecosystem. A third and critical dimension to think through is to align the partner ecosystem with the brand’s loyalty partnership strategy. Would the company’s objectives be better met through closed networks of one-to-one or one-to-many partnerships, with fungible tokens being minted and used within that network as a form of reward or payment?

For example, a financial institution can help power a closed loyalty network. The business can offer merchant-funded loyalty tokens to customers at point-of-sale across a preprogrammed network of merchants and partners.

An example of a more open ecosystem strategy is a brand issuing a tangential, collectable NFT offering and choosing a public blockchain for minting these NFTs. If the brand chooses, it could enable customers to transfer or sell these NFTs on marketplaces. Partners can also leverage token gating to engage with certain NFT holders.

Tech + Us: Monthly insights for harnessing the full potential of AI and tech.

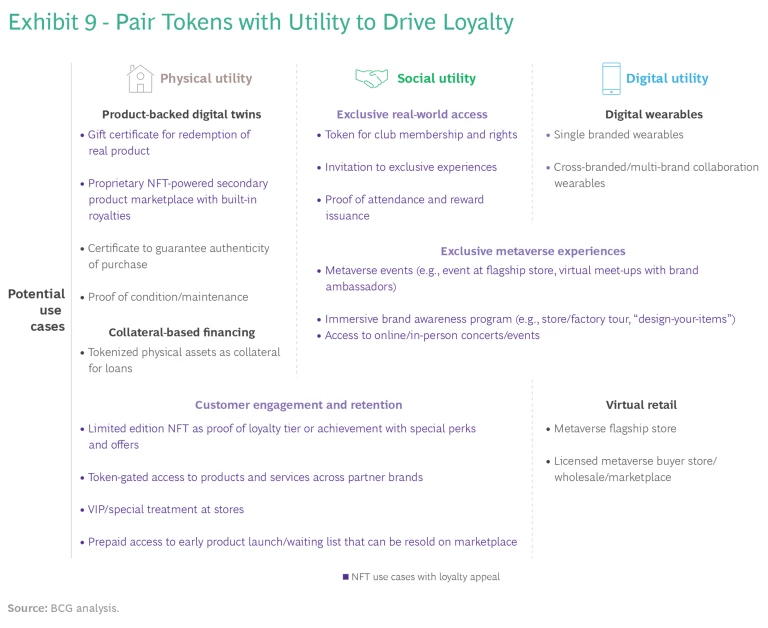

Token Utility. As we outlined earlier, the success of any Web3 loyalty offering will entail pairing utility to issued tokens. The utility spectrum can span physical, social, or pure digital utility. Physical utility involves coupling access to real products and services to the digital asset, such as an NFT that grants access to a redeemable product. Tokens can also have social utility in the form of access to community events, VIP benefits, or exclusive brand voting rights. Digital utility extends privileges and access to the digital world in the form of metaverse events, virtual meetups with brand ambassadors, or in-game use of tokens.

Loyalty utility can span all three worlds, where companies can use NFTs as a form of engagement and retention. The utility can be gamified as well. For example, if a customer collects three rare NFTs, they can burn them to mint one exclusive NFT that gives them access to priority shipping for one year. Exhibit 9 provides examples of utility applications for NFTs along this spectrum.

Engagement and Rewards. Beyond the traditional rewards proposition consisting of offers and benefits, companies can leverage other engagement tools that have gained traction in the Web3 world.

One option is to use DAO-like structures to enable the loyalty elitists or a gated subsegment of the customer base to participate in select brand decisions. Promotional efforts like “what color hoodie should we launch next?” or “what band would you want to see at the virtual concert?” all give customers a voice in shaping the company’s products or the loyalty program itself. Companies can choose to target specific token holders or specific customer accounts or wallets, from those holding exclusive NFTs to those that have collected a certain number of tokens in their wallet or reached a certain loyalty tier.

Another tactic that brands can explore is the “x-to-earn” model, where they can gamify experiences, create hurdles and milestones across one or more partners, and reward achievements. For example, a customer earns tokens with their tenth purchase. The power in this lies in expanding the aperture of gamification across multiple partners to create relevant and personalized hurdles.

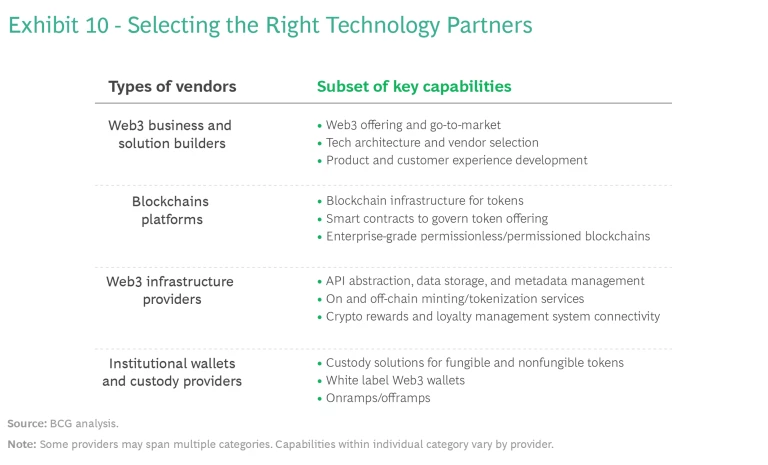

Technology Partners. Navigating the Web3 technology landscape is no straightforward feat. Specifications vary by blockchain platform and Web3 infrastructure players are emerging that are trying to address the complexity through APIs and SDKs. (See Exhibit 10.) As a starting point, companies must make four considerations:

- Which Web3 business and solution builder will the company partner with to drive the overall Web3 strategy, business case, product vision, customer experience development, and provider selection? BCG together with BCG X, the firm’s tech build and design unit, are well-positioned to support companies on this front.

- What blockchain platform will the company deploy its tokens on? Does it go with a public or private blockchain? In selecting a platform, the business must factor in environmental considerations; platform reliability and uptime; ticket sizes/volumes; developer community activity; institutional capabilities; and whether the platform is supported by Web3 infrastructure providers that can help accelerate the development efforts.

- Which Web3 infrastructure provider, if any, will the company leverage? These providers can offer the Web3 tooling through SDKs/APIs, from smart contract management and connectivity to the various blockchain platforms; KYC providers; transaction monitoring systems; and royalty management workflows. Working with such a partner can help accelerate go-to-market efforts.

- What institutional wallet and custody infrastructure will the company select to manage its loyalty tokens? Will it take the self-custody route, where it manages its own keys or will it work with a provider to custody its digital assets? Some Web3 infrastructure players may also provide custody capabilities.

Looking Ahead

With the emergence of capabilities such as on-chain fungible tokens, NFTs, smart contracts, and DAOs, Web3 can complement or completely reshape companies’ existing customer loyalty propositions. Institutions and brands must not ignore this space.

With the emergence of capabilities such as on-chain fungible tokens, NFTs, and more, Web3 can completely reshape companies’ existing customer loyalty propositions.

Companies should take a more strategic approach to defining how they can advance their loyalty offerings. It’s OK to start small, but companies must make sure to devise their target Web3 strategy/vision and define their objectives up front. The initial pilots that companies choose to kick off must be sustainable and help them get to their vision and ROI targets. Customer engagement and loyalty must be at the root of any Web3 strategy. Otherwise, customers may be left disappointed with one-off efforts.

There’s no one-size-fits-all solution. Companies can get inspired by what others are doing but should avoid “copy and paste” offerings and plays. A company’s Web3 strategy will be dictated by its current loyalty program specifications, performance, customer base, and objectives.

Web3 is still quite complex for both institutions and end users. Companies must make sure to avoid Web3 terms and replace terms such as NFTs with “collectables” or “badges.” They should focus on wrapping the underlying technical complexity and workflows in the best Web 2.0-native customer experience possible.

Companies must spend time understanding the technology landscape. There is no sense in rebuilding infrastructure that is already available. Don’t make this journey alone. Invest in selecting the right technology partners, but make sure to build and own the wrapper customer experience around it. Work together to craft viable commercial structures and ensure the program generates the necessary ROI—and keeps customers engaged and loyal.