It seems like every conversation about electric vehicles starts with lots of enthusiasm for the positive impact they could have on reducing carbon emissions and transforming the global energy mix and mobility patterns. But then there’s the inevitable: “They have to fix the charging problem before I’ll buy one.”

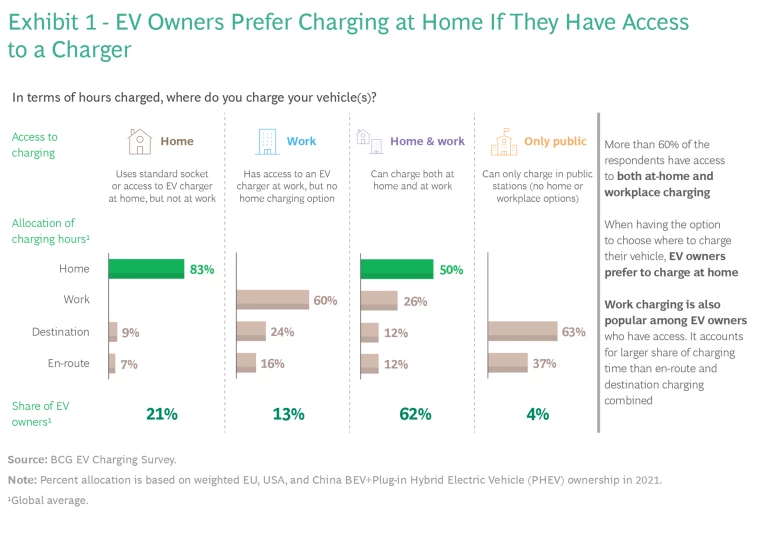

But is there really a charging problem—and, if so, what is it? BCG decided to find out by going directly to the people who would know: EV owners. We learned that the picture is mixed. More than 60% of EV owners have opportunities to charge both at home and at work, and fewer than 5% only have access to public charging stations. Yet public charging remains a highly attractive option, likely because it is perceived as being potentially faster and in some cases—such as on long trips—it may be the only alternative.

Even when home and workplace charging are available, public charging is used more than 20% of the time—and when only workplace charging is available, public charging is used 40% of the time. These are high percentages for an option that is relatively scarce. (See Exhibit 1.) Also, we found out that EV drivers are not resistant to paying top dollar for public charging, especially when it is fast. These are extremely positive signs for the public EV charging ecosystem that is slowly beginning to take shape around the world.

Our survey covered 1,000 electric vehicle owners across the United States, Europe, and China. Broadly, we sought answers to the following questions:

- Where are they charging their cars now?

- What is their willingness to pay for public charging? How does this vary in relation to the speed of charging? How do they pay for their public charging?

- What are their most important charging needs and how are their priorities evolving over time?

- Where do they want more public charging points?

These questions are important because, by any measure, EV sales are rising rapidly. This is driven by a growing number of consumers wanting to cut their carbon footprints and reduce the cost of vehicle ownership—as well as government mandates to limit the number of internal combustion engines sold over time and, in some areas, policies subsidizing EV purchases. Indeed, according to BCG’s forecasts, battery EVs (BEVs) will be the most popular type of light vehicle sold globally as early as 2028 . Moreover, on a category basis, by 2030 BEV sales will exceed sales of all types of hybrid vehicles combined and sales of internal combustion engine (ICE) vehicles.

These sales increases will only accelerate over time. The EU has already banned sales of new ICE vehicles starting in 2035, as have California and New York—and about a half dozen other states are expected to soon follow suit. China is moving a bit more slowly, calling for a mix of about half BEVs and the rest various types of hybrids by 2035.

Yet despite concerted efforts to expand BEV ownership, there are two potential significant barriers to widespread EV adoption—raw material availability (and prices) and EV charging infrastructure. This means that developing a suitable public charging infrastructure to satisfy the demand and preferences of EV consumers is essential for policymakers hoping to decrease the presence of ICE vehicles—and potentially lucrative for automotive leaders, oil companies investing in EV charging networks, utilities, charging specialists, and investors.

Developing a public charging infrastructure that satisfies consumer demand is essential to efforts to decrease the presence of ICE vehicles.

Thus far, there is a big vacuum to fill. Currently, only a tiny percentage of charger capacity worldwide comes from public facilities, although that number is growing. Nearly 500,000 public charging points were installed in 2021, more than the total number available in 2017, according to the International Energy Agency. Clearly, the market for charging stations will grow dynamically, but opportunities for the public and private sectors will only be realized by quickly understanding what consumers want and delivering it to them on time.

How Often Do EV Owners Drive Their Cars?

To provide insight about consumer preferences and attitudes, our survey first focused on EV owner driving patterns and, more importantly, their charging behaviors. We learned that our respondents—who tended to live in urban areas (64%) and were on average about 40 years old—depend on their EVs for mobility about as much as ICE vehicle owners rely on their cars. In other words, the EV is more necessity than luxury. Indeed, about 65% of global EV owners in our survey said they only have one car and did not own a second combustion-engine vehicle for longer trips.

As for frequency of use, 84% of EV owners drive their vehicle daily (more than five times per week) to commute to and from work. Their average weekly mileage is 227 kilometers (141 miles), while only 10% of respondents drive more than 400 kilometers (249 miles) per week.

Where Do They Charge?

At this point, home charging is the top choice of EV owners, even among the 62% of respondents who also have the option of powering up at work and in public charging points. Among respondents who have home and workplace chargers available, about 50% of charging time occurs at home, while work and public charging stations each account for about 25% of charge time. If no workplace charger is available, 83% of charging hours occur at home. This indicates that EV drivers with workplace options are more conditioned to seek out charging opportunities away from home.

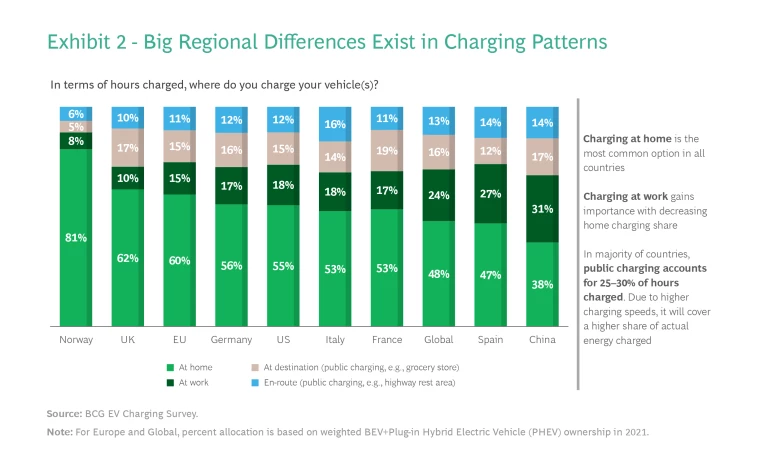

These results vary greatly by country. Norway leads with 81% of charging hours at home, while in China this number falls to 38%—and the US is in between with about 55% of charging done at home. (See Exhibit 2.)

More importantly, charging patterns differ by the make-up of local communities. In regions with high home ownership, such as suburban and rural areas, people are less reliant on public charging infrastructure because they find it easy to charge their cars at home. In more densely populated areas, where vehicles are predominantly parked in the street and apartment buildings usually do not have EV hookups, this picture looks different. For instance, in Germany nearly 90% of rural and suburban dwellers have access to home chargers, while in urban areas that figure drops to about 77%. Many parts of heavily urbanized China also lack home charging availability. This data indicates that plans for public charging infrastructure should be drawn from a close examination of social and demographic dimensions at the community level. Otherwise, massive capital investment sums may be spent inefficiently without a sufficient return.

Are EV Owners Willing to Pay More for Faster Charging?

Currently, 75% to 95% of EV owners can charge their vehicles at home, sometimes, though not often, using extremely slow standard sockets. China and France are on the lower edge of this range, and Norway and the US are at the upper end. We expect that these percentages will drop as EVs become more prevalent among larger groups of individuals in wider economic strata, including more people living in flats without their own parking spaces or renters who would prefer to not invest in a home charger. Hence, public charging demand will increase over time.

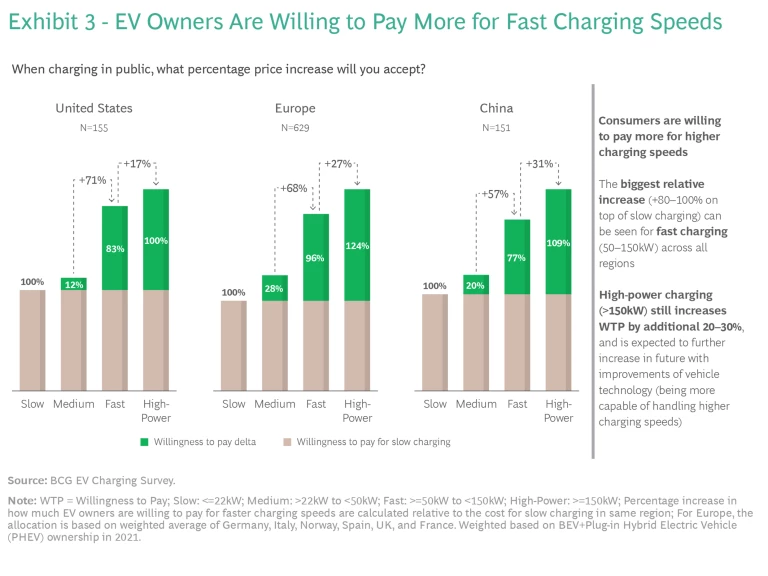

A clear message emerging from our survey is the willingness of EV owners to pay a lot more to power up their cars at fast-charging public facilities. Indeed, the price increase they deemed acceptable rose as the speed of the vehicle charge increased. (See Exhibit 3.)

This sentiment may be short-lived, though. Most EV owners today are relatively wealthy—the cars tend to be costly—and are not overly price sensitive. Thus, for them the convenience of a fast charge likely more than outweighs the expense. But in the coming years, as EVs drop in price and reach mass adoption, less well-heeled drivers may balk at the increased expense of fast charging and lean more toward slower public charging facilities. However, it is worth noting that most fast-charging facilities today are located en-route in areas where it would be inconvenient for drivers to interrupt their trips for a slow-charging stop. Also, as EV infrastructure is built out and provides drivers with more public charging options, pricing for fast charging could vary more than it does now. Some charging stations may offer discounts to attract customers, while others may turn to time-of-day pricing with lower fees on off-peak energy use hours.

Fast charging is the sweet spot now for EV owners, but companies planning to build or maintain charging stations should weigh the additional costs of next-level high-power charging equipment against the anticipated increase in revenue. One key point to consider is that currently few EVs are equipped to accept high-power charging. In addition, some locations are less suitable for fast-charging facilities. For instance, there is little need for fast charging at a shopping mall where people usually spend sufficient time to power up even if the charging equipment does not operate at top speed.

We also found in our survey that the way people pay for EV charges is not uniform across the globe. This becomes another consideration for companies setting up EV charging sites. Aligning payment options to local consumer preferences is critical. While EV owners use mobile apps as the main payment method in the US, Norway, UK, and China, people in Germany and France mainly rely on charge cards linked to accounts with individual charging providers. Paying by credit card is common across all markets, accounting for one-third of payments in the UK, Italy, Spain, and France. Given the universality of credit cards, terminals that accept them are likely to be ubiquitous at charging stations even as these facilities evolve. Moreover, some regulators are encouraging this. For instance, in the UK, all new public fast-charging stations must include a contactless bank card payment option.

What Are EV Drivers’ Primary Concerns?

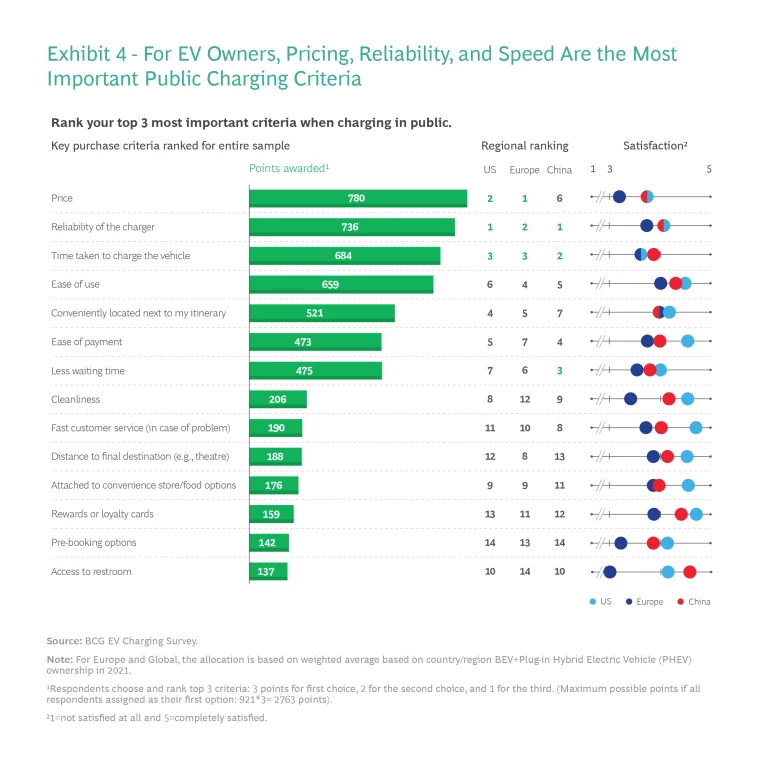

Interestingly, although EV drivers said that they are willing to pay more now for access to fast-charging equipment, the notion that this may be only a temporary sentiment gained credence when we asked them to name their three most important criteria when choosing public charging. Price was in fact the first consideration—at least in the US and EU. (See Exhibit 4.) However, in China, where electricity is relatively cheap and EV charging is subsidized, price did not even land in the top five.

Still, in all three regions, charger reliability and the time it takes to charge the vehicle are pressing concerns. Survey responses indicate that we are still at the beginning of the EV charging evolution. Drivers want basic, no-frills features—affordability, dependability, and ease of use. And at the bottom of their wish lists are extras like pre-booking, loyalty cards, and attached convenience stores. We suspect that this will change in the future as EVs and charging stations become prevalent. At that point, reliability and user friendliness will be table stakes. Charge point providers will then need to differentiate themselves by offering a re-imagined “EV charging station 2.0” experience.

Across the countries covered in our survey, EV owners were on average satisfied with the reliability of public chargers that they use—although there have been reports that in some countries as many as one-third of chargers are out of service at any one time. To a lesser degree, they were happy with the price for charging and the time it takes. However, European EV drivers generally expressed a lower level of satisfaction than US and Chinese electric vehicle owners. This is likely due to the more fragmented and somewhat inconsistent European charging landscape, which has a raft of providers that vary in pricing and performance.

Where Do EV Owners Prefer Charging in Public?

One thing is clear: Customers want more public charging stations. This point came up frequently in our survey interviews. It is also clear that public charging will play a crucial role in the transition to electric mobility. But as with any major infrastructure investment, developing its contours and features and siting it appropriately to serve the greatest number of customers is imperative. For companies building and operating charging stations, this is pivotal for getting the best and fastest payback and for realizing sustainable profits. And for involved government entities, smart upfront planning of the charging infrastructure is necessary to drive the shift from ICE to EVs.

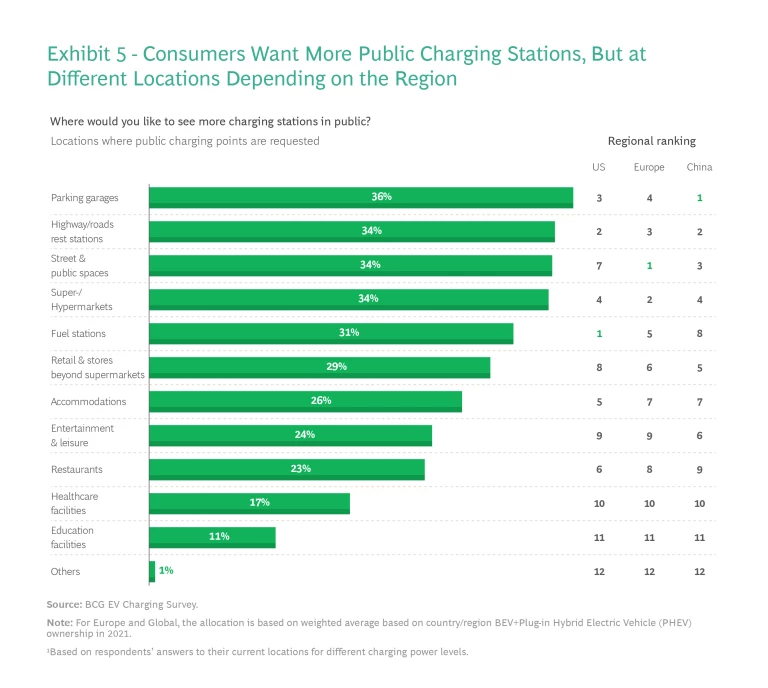

Deciding on locations is a key facet in the planning stage. Our survey found that EV drivers differed by region on the question of where they wanted to see more public charging stations. (See Exhibit 5.) In the US, about 40% of respondents chose fuel stations and along highways, where there are currently relatively few public charging options. European EV drivers felt that more were needed in streets and public spaces, as well as at super- and hyper-markets. Chinese EV owners expressed more interest in having charging facilities in parking garages, primarily as a way to mitigate the lack of charging sites in urban apartment buildings where many Chinese electric vehicle drivers live.

For all of the regions, other, less obvious charging locations—such as restaurants, entertainment venues, healthcare facilities, or educational centers—were not a priority. This is likely because visits to these locations are infrequent and not part of normal day-to-day routines. In the future, however, when EVs enter the mainstream, these locations may become more attractive for charging, particularly as EV owners adapt to new charging routines that differ from fueling.

Paving the Way Toward Customer-Focused EV Charging Infrastructure

It is clear from our survey that EV owners in different regions have diverse preferences that are evolving, just as the EV market itself is. For instance, home charging is still the main way to power up an EV, but its popularity differs by geographies and demographics. Moreover, in all regions, reduced home charging accessibility will give way to additional public charging facilities. As a result, policymakers and the EV charging ecosystem must carefully consider how demand will shift for public charging in different regions—and the best way to satisfy this demand.

EV drivers want more of what would be expected from public charging networks: reliability, robust infrastructure, convenience, and speed.

The clamor for more charging infrastructure is loud, but a big, uncontrolled build-out is not the answer. As we have seen when working with companies to build analytics-based site-selection, the question of where they should be placed is a paramount concern. Urban apartment dwellers might have one answer; people that commute long distances to work may have another. If charging points are not located where drivers want them, the result would be a “ghost infrastructure”—underutilized or out of service before long.

Subscribe to our Automotive Industry E-Alert.

Simply put, EV drivers want more of what would be expected from charging networks: reliability, a built-out robust infrastructure, convenience, and speed. And at least the first generation of EV drivers say that they are willing to pay more to spend less time charging, indicating that fast and even faster high-power charging (HPC) will play a big role in the future. Moreover, as the infrastructure evolves, charging station companies will have to think carefully about how to increase attraction and stickiness—for instance, by developing loyalty programs, forging relationships with fleet providers offering bundled solutions that encompass private and public charging facilities. In addition to consumer preferences, country differences such as home ownership and payment methods should be taken into account when designing charging infrastructure.

All of these issues only make the point that the EV market is about to take off—and the uncertainties and concerns involving what the charging infrastructure should be are the growing pains of a potentially lucrative market. Visualizing this market may be difficult now, but as more EVs hit the road, the opportunities will certainly come more keenly into focus.

The authors thank Alejandro Mayoral for his assistance in the development of this publication.