Companies in all sectors need to build resilient balance sheets to help them survive the severe shocks that persist in today’s business environment. A resilient balance sheet improves financial indicators, giving companies more breathing room to operate under stressful conditions and withstand the scrutiny of shareholders, creditors, and regulators. It also provides a strong foundation for pursuing market opportunities, such as M&A and share buybacks.

Fortifying a balance sheet is not easy, however. Companies must take a variety of initiatives that run the gamut from improving the management of working capital and cash to defining new strategies for asset management, capital structure, financing, and risk. Capturing the value requires an operating model that enables the finance department’s treasury function to integrate steering and optimization across the company’s financial resources.

Extracting more value from the balance sheet is part of the CFO’s broader evolution to serve as a company’s custodian of performance . With a strong mandate and cutting-edge digital capabilities, the finance/treasury function can also play a pivotal role in strengthening risk management and compliance at the enterprise level.

Today’s Environment Demands a Sturdier Balance Sheet

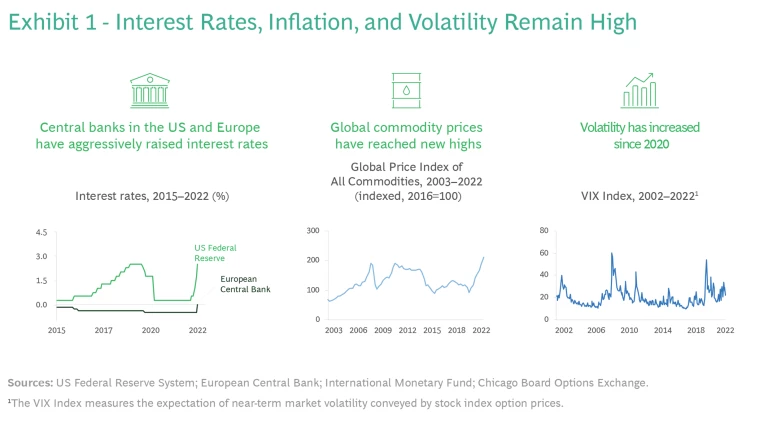

Recent challenges have brought balance sheet durability to the attention of CEOs and CFOs . Interest rates are at their highest levels in more than a decade, inflation continues to rise, and market volatility persists. (See Exhibit 1.)

Although these macroeconomic trends differ by region, all companies need to act aggressively to strengthen their balance sheet. In the US, the inflationary spike largely resulted from demand and supply imbalances relating to, for example, durable goods. To respond, large retailers are optimizing inventory (through discounts, for example) and improving cash forecasting abilities. On the other hand, Europe is experiencing higher prices for energy (up by more than 50% over the past few months) and nondurable goods (including food). This has led companies to improve their supply chain and financing structure, as well as commodity risk management.

The COVID-19 pandemic and geopolitical crises have affected liquidity across industries. For example, a major airline needed a government bailout after experiencing a liquidity squeeze during the pandemic shutdowns, and a leading energy company received a large credit line from the government when it suffered deteriorating liquidity because of the war in Ukraine.

By strengthening its balance sheet, a company gains a variety of benefits that help to fortify it against such challenges. The benefits include:

- Optimized working capital and liquidity across regions and business lines

- Transparency on its aggregated cash position to enable accurate forecasting

- The ability to manage its target debt rating and financial KPIs with minimum financial resources

- Increased capital productivity and performance

- An integrated view of financial risk-return tradeoffs across foreign exchange, commodities, interest rates, and credit

- A rapid enterprisewide perspective on liquidity status to inform strategic discussions

In BCG’s experience, strengthening the balance sheet can significantly improve profitability—potentially boosting EBIT by 10% to 20%. The bottom line improvements are driven by, for example, increasing returns on cash and assets, reducing financial losses through better risk management, and increasing the predictability of accounts receivable. A company can also improve its financial structure, including the net debt-to-EBITDA ratio and credit rating. In addition, companies pursuing transformations benefit from lower risks by reducing the overall volatility of key financial indicators. Finally, the efficiency improvements help to strengthen the partnership between finance/treasury teams and business lines.

Optimizing the Balance Sheet Across Six Categories

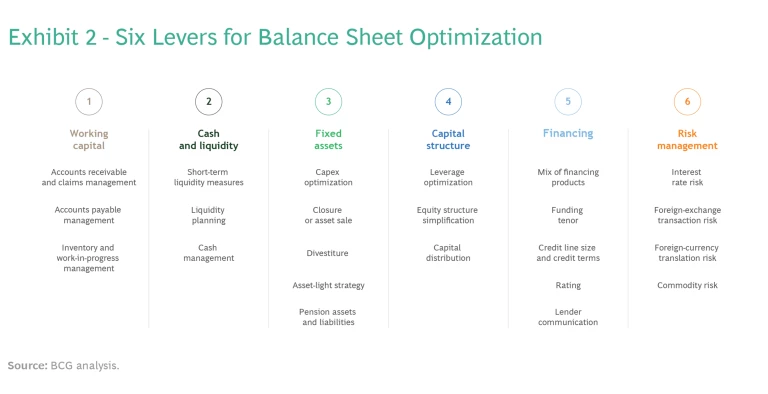

To strengthen the balance sheet, companies need to make improvements across six categories. (See Exhibit 2.)

- Working Capital. Companies free up cash by improving how they manage accounts receivable and claims, accounts payable, and inventory and work in progress. For example, a global steel company sought to fortify itself against increasing raw- material prices and volatility by optimizing its working capital cycle. Its actions included standardizing customers’ payment terms. To reduce late payments, it sent early reminders and used an artificial-intelligence tool to predict accounts that were likely to be overdue.

- Cash and Liquidity. Improving cash management, implementing short-term liquidity measures, and planning for longer-term liquidity help extract value from cash on the balance sheet. For example, a European automotive company freed up cash for investments by improving its cash forecasting and stress testing abilities.

- Fixed Assets. Companies can benefit from a structured approach to planning and prioritizing new capital expenditures as well as asset sales and divestitures. They can also apply innovative asset-light strategies. For example, a European steel producer identified assets that were good candidates for sale and leaseback transactions, creating opportunities to improve the company’s leverage and credit rating.

- Capital Structure. Companies can improve their capital structure by optimizing leverage, simplifying equity structure, and designing better share and dividend programs. For example, a European energy company established a methodology to calculate its weighted-average cost of capital (WACC) and created monitoring tools to manage it. Its enhanced understanding of WACC enables the company to improve performance reporting internally and determine the value of assets in M&A transactions.

- Financing. Companies can improve their credit rating and overall management of financial resources and costs by ensuring the right financing mix with respect to instruments, terms, and duration. For example, a global food company built a rating management tool to estimate how certain financing decisions—such as increasing short-term debt or reducing the number of revolving credit facilities—would affect its credit rating.

- Risk Management. Management of risks related to interest rates, foreign-exchange transactions, foreign-currency translation, and commodities can be a source of value. For example, a global energy player faced declining operating profits and higher liquidity needs because of rising natural-gas costs. Its responses included improving its scenario analysis capabilities, deriving the best hedging position for foreign currency and commodities, and reducing its liquidity reserve.

Building a Stronger Operating Model

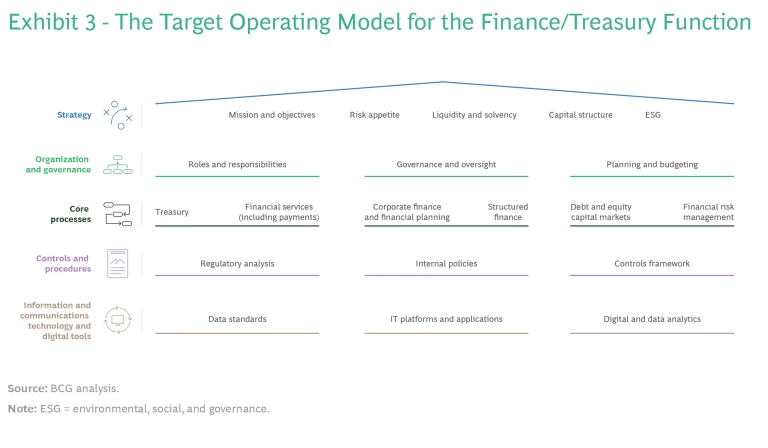

Finance/treasury functions need an operating model that gives them the mandate and capabilities required to optimize their balance sheets. In BCG’s experience, the target operating model should cover strategy, organization and governance, core processes, controls and procedures, and information and communications technology systems and digital tools. (See Exhibit 3.)

A robust operating model enables the enterprise-level improvement of financial resources, drives efficiency, and lays the foundation for digitizing operations . It helps the function become nimbler and better equipped to address macro trends, such as regulatory changes, sustainability, and market volatility. It also allows the function to help the business units accelerate go-to-market efforts and increase competitiveness—for example, by fully capturing the potential of digital payments to reduce costs, promoting customer engagement, and developing new revenue streams. The improved governance and control system provided by a best-in-class operating model gives regulators greater confidence, decreases criticism, and reduces regulatory findings.

The model’s success is underpinned by digitization. Companies can use big data, analytics, and machine learning to improve transparency and generate insights to enhance the forecasting and management of liquidity and financial risks. They can also use scenario simulations to adapt financial planning to changing circumstances.

To support the operating model, companies need to develop the skills of the function’s staff, with a strong focus on the capabilities needed to implement new technology and digital applications. They also need to redefine the interfaces with adjacent functions (such as risk and technology) and establish a stronger partnership with the business units. Finally, it is essential to improve the corporate culture regarding the use of financial resources and promote the sharing of ideas across organizational units.

Subscribe to our Business Transformation E-Alert.

The Key Success Factors

To extract value through balance sheet optimization and a new finance/treasury operating model, companies need to take the following measures:

- Design a tailored solution. Address the challenges of the company’s unique starting point with respect to its industry context, global footprint, and existing technology and data infrastructure. Consider the dynamic regulatory landscape and its requirements and the implications of sustainability compliance and reporting.

- Align stakeholders and improve governance. Gain the support of the organization’s leaders so that the transformation is championed from the top across business units, functions, and markets. Proactively engage regulators to earn their support. Establish a dedicated team to lead the initiatives and prioritize management capacity to deliver the greatest impact. Design for function (that is, concrete and proven solutions), followed by form (that is, organizational setup). Apply the levers to improve the operating model and balance sheet globally, and then cascade the model down to the legal entity or subsidiary levels.

- Make the right investments in data and technology. Assess existing data and technology from the perspectives of risk and return on investment. Apply the insights to develop the transition to an advanced state, bearing in mind that replacing rather than upgrading technology will be a major cost driver. Understand the challenges to becoming a more data-driven function. For example, teams will need to tackle the technical complexity of integrating external and/or internal datasets and different enterprise resource planning and treasury management systems. Focus on building a solid foundation of data and analytics to support forecasting, stress testing, and scenario planning. But learn to walk before you run—it’s possible to capture considerable value without overburdening teams at the outset.

Building a resilient balance sheet is a critical component of the finance/treasury function's growing mandate to create value at the enterprise level. With a strong operating model to support its efforts, the function will have the capabilities, tools, data, and technology it needs to help the company counteract volatility. Although full-scale implementation requires a carefully planned transformation that is rolled out over one to two years, companies can apply specific levers to create economic value in three to six months. By initiating the transformation today, companies can fortify themselves against the inevitable disruptions that lie ahead.