Scores of consumer-packaged goods (CPG) companies have set net-zero commitments. The problem? Extensive interviews with executives across the CPG industry and a BCG survey of their downstream customers in the retail sector indicate that most companies are not on track to meet their pledges to nearly halve their greenhouse gas (GHG) emissions by 2030.

Although companies are deploying decarbonization technologies to reengineer their existing products, services, and business models, they are not yet reimagining their business. They have not yet pushed the boundaries of what is possible by further innovating their business models, even within the existing technology landscape. Undoubtedly, technological advances that create significant new opportunities will emerge. But companies can scale existing solutions on the basis of existing technologies over the next eight years by embracing new sustainable business models and building new markets, thereby meeting their 2030 net-zero goals. This article explores the broad principles that CPG companies must embrace to achieve their 2030 goals.

Companies can accelerate their journey toward net zero and create advantage by taking a transformation lens to sustainability, by looking holistically at the system they are trying to change in order to focus on what matters, and by collaborating across the value chain. Although it may seem counterintuitive, partnering, even with competitors, is critical to driving change at scale and achieving advantage.

In an environment characterized by disrupted supply chains, high inflation, and major geopolitical uncertainty related to the war in Ukraine, companies may find it very tempting to focus primarily on addressing near-term challenges. But inaction on the climate front carries a steep price. Companies that do not move aggressively now may have trouble accessing critical green resources later. They will also cede the lead in burgeoning markets to others and will miss out on capturing significant efficiencies. In contrast, those that seize the lead will establish meaningful competitive advantage.

The Risk of Delay

GHG emissions have continued to rise over the past two decades, and global CO2 emissions rebounded in 2021 first to match and then to surpass their highest previously recorded level. To limit global warming to an increase of 1.5°C above preindustrial levels, global emissions must peak during the next three years and then fall by 45% by 2030. The CPG industry will play a central role in the ultimate success or failure of that effort because the agri-food supply chain—in which CPG is a prominent player—currently accounts for an estimated 31% of annual global GHG emissions.

Despite the urgency of the situation—and some promising initial steps that industry leaders have taken—most CPG companies are not yet moving aggressively to deliver on their climate ambitions. For example, a BCG survey of nearly 1,300 large companies in nine industries (including CPG) conducted in 2021 found that while 96% had set a goal of reducing emissions, only 11% had successfully cut emissions in line with those targets over the previous five years .

For CPG companies, decarbonization must be part of a true sustainability transformation. Those that move slowly on this front face increasing risks. For one thing, companies that fail to secure the green resources needed for a sustainability transformation will likely find that those assets are in short supply in the near future. For example, according to BCG estimates , 45% of demand for recycled PET is likely to go unmet in 2025 as a result of supply shortages. In addition, companies that lag on sustainability will miss out on a major value creation opportunity and the chance to generate significant efficiencies. In six industries, including fast-moving consumer goods, BCG research found that the compound annual growth rate was 4 to 25 percentage points higher for green products than for nongreen products. And companies that fail to deliver on their net-zero promises will undermine their credibility with consumers and investors.

Reimagining the Business for Sustainability

A sustainability transformation starts with a clearly defined ambition, strategy, and roadmap. Building from that foundation, companies must integrate sustainability throughout the existing business, including by establishing sustainability KPIs and embedding them in business reviews. In our work in the industry, we see many companies with a focus on sustainability that have set their strategy and begun to integrate sustainability into the core of the business. But progress is still too slow.

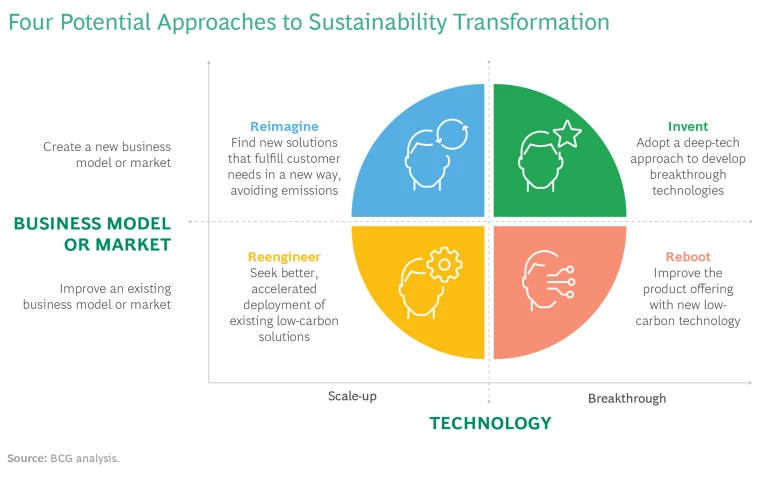

The problem is particularly evident in decarbonization work. Efforts to decarbonize can be understood as a matrix based on technology and business model or market. (See the exhibit.)

To reach net zero, companies today are focusing on reengineering. This involves leveraging current business models and markets to deploy existing solutions that are based on proven, scalable low-carbon technologies. Such moves are necessary to make progress, but will not deliver the dramatic reductions in carbon emissions needed by 2030. And some promising new decarbonization technologies that may be capable of rebooting the existing business or supporting the invention of entirely new models and markets will not be scalable in time to help drive sustainability in CPG and reduce emissions over the next eight years.

That’s why CPG companies working toward sustainability must reimagine their business, creating new business models or markets to help them scale novel solutions based on proven low-carbon technologies. Such efforts will be critical to reducing Scope 3 emissions—which are quite difficult to address and account for the bulk of CPG companies’ carbon footprints—along the entire value chain.

Reimagining a business can drive accelerated decarbonization in critical Scope 3 areas—especially in inputs and packaging, where many efforts are currently in the pilot stage and have not yet scaled. To move promising efforts forward at scale, companies must be willing to adopt new business models that rethink the product and the way it is used, as well as the supply chain, procurement approaches, and partnerships that enable scale-up. Partnerships, including those with smaller players that offer innovative technologies or complementary capabilities, will be particularly important. New business models may also affect product pricing, placement, sales methods, and consumer engagement. This is the next frontier .

Featured Insights: BCG’s most inspiring thought leadership on issues shaping the future of business and society

Companies across the CPG industry are trying to reduce emissions and embrace sustainability. And that is good news. But many do not fully appreciate the need to accelerate their efforts, instead focusing on matters that may momentarily seem more urgent and assuming that sustainability in CPG can evolve gradually. Many are also trying to go it alone.

That is a mistake for business and for the planet. The window is closing on the world’s ability to avert the worst impacts of climate change , and the time that companies have available to transform successfully is growing short. Companies that push for speed by reimagining their business will be the winners in a world where sustainability drives advantage.