The current moment may be the best time in years to pursue transformative deals that radically accelerate your strategy and strengthen your competitive advantage. Valuations are down. And while the economic environment is uncertain, historically, downturn deals have outperformed.

Consider Pfizer’s acquisition of Wyeth during the Great Recession of 2008. The addition of Wyeth’s deeper expertise in biotechnology, vaccines, and complementary businesses provided a broader footprint in key disease areas. This enabled Pfizer to create more value by engaging patients across the health spectrum. It also established a base for the company to be a leader in responding to COVID.

Of course, it’s also more challenging to put a deal together in uncertain times. The same lower valuations that appeal to buyers make the most attractive targets reluctant to sell. And today’s higher interest rates will affect deal economics.

But with so much dry powder on balance sheets—and so many companies aspiring to reinvent themselves to address critical megatrends, such as the imperative for digital transformation and the existential challenge of climate change and sustainability —deals will get done. And first movers will have the pick of the lot.

Downturn deals can be transformative. First movers will have the pick of the lot.

Ambitious deals are already in motion. Germany’s RWE has agreed to purchase US-based Con Edison’s clean-energy business for $6.8 billion to help it pivot from carbon-based energy toward renewables. And Avery Dennison has acquired Vestcom for $1.45 billion to expand its offerings in digital labeling and signage in retail.

Given that, there’s no better time to think disruptively and creatively about how to reshape your business to win in the future. But it’s essential to move quickly to develop your plans for M&A and transactions because the window for attractive valuations is likely to close quickly as the level of economic uncertainty decreases.

M&A and the Economic Environment

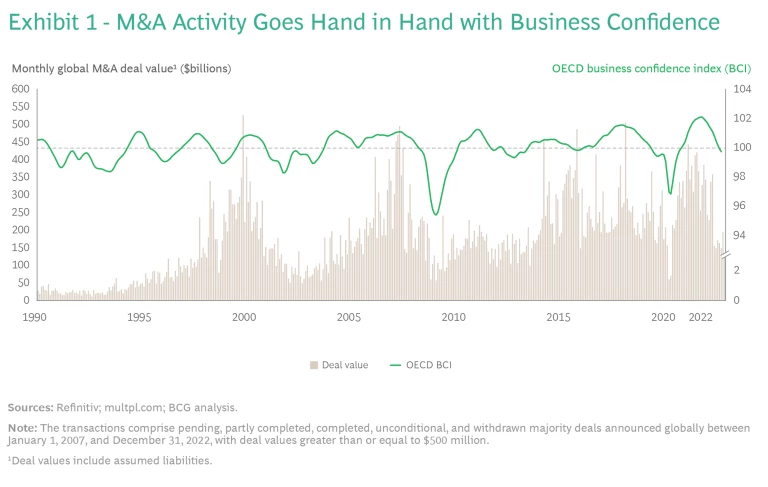

Not surprisingly, both valuations and deal volume rise and fall with business confidence. (See Exhibit 1.) But while the number of deals declines in more uncertain economic times, it doesn’t fall to zero.

And those deals that do happen outperform and create value. Prior BCG research found that two years following the announcement of an acquisition, the total shareholder return of downturn deals was 9.6 percentage points higher than that of strong-economy deals.

The current economic environment shares some of the features of past downturns, primarily a decline in business confidence and valuations. At the same time, it differs from them in important ways given that much of the uncertainty is driven not by traditional economic cycling but rather by pandemic effects and the first- and second-order impacts of geopolitical conflict. As a consequence, the economic and deal landscape varies significantly by region (with European companies facing the strongest headwinds) and industry.

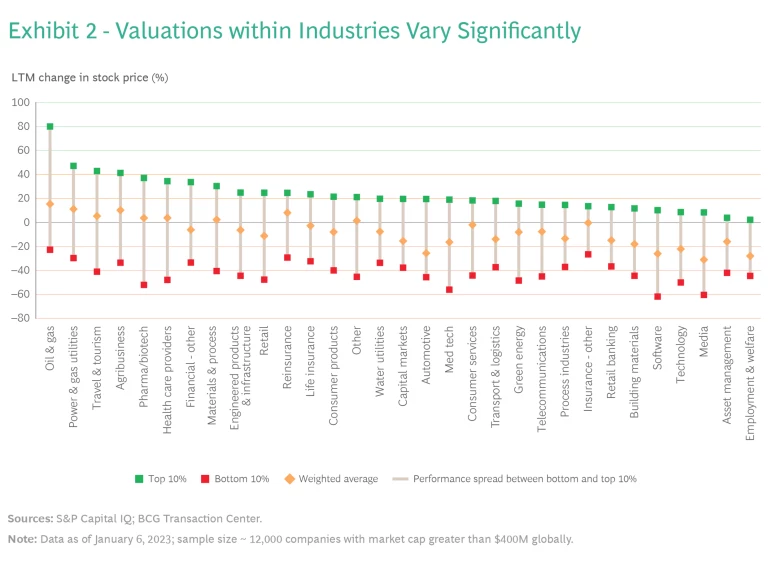

Looking across sectors, while valuations are down for the market as a whole, the performance of individual companies has varied widely. (See Exhibit 2.) While it may be possible to acquire a target at a significantly lower multiple than would have been possible a year ago, you will still likely need to pay a premium over current valuations to convince the target to sell.

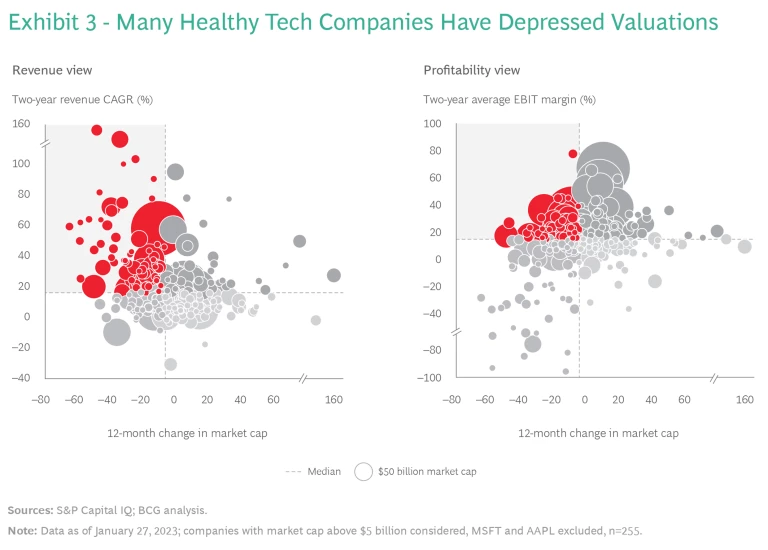

And that premium may need to be richer if your target is one of the many companies that is delivering strong financial performance even as its stock is taking a hit with the market as a whole. Exhibit 3 offers a finer-grained view of the global tech sector. The shaded upper-left quadrant of the charts contains historically strong performers that have seen significant declines in valuation, suggesting that this may be an exceptional time to acquire critical technology capabilities.

Beyond paying a premium, it may be helpful to explore innovative deal structures—for example, partnerships or minority stakes—that give the seller or its investors an opportunity to share in the deal’s future upside.

There’s ample cash on balance sheets to make deals happen. Today’s approximately $12 trillion of corporate cash and equivalents is up 68% from 2017. And over the same period, private-equity dry powder nearly doubled to about $2 trillion.

While interest rates remain high, corporate buyers may have an edge over private equity to pursue transformative, strategic deals given their ability to use cash and equity to finance their transactions. This is especially relevant for companies that have opportunities to accelerate their strategies and digital transformations through M&A but have held back because of exorbitant valuations, especially for technology targets. Now some of those moves are much more plausible.

There’s plenty of cash on hand to make deals happen.

Setting Your Action Agenda

Of course, not every company is in the same starting position in terms of financial health, strategic clarity, and readiness. The most experienced acquirers are already poised to make the most of this moment. Other companies still have a chance to take advantage of today’s more accessible asset values if they move quickly. The objective should be to radically accelerate your strategy and enable

new business models

and offerings. We recommend four key moves to get started:

Review your portfolio and resources. Lay the foundation for success by building a shared understanding across the full management team and your board of your starting position, strategic priorities, and freedom to operate. At the portfolio level, it’s essential to de-average your total shareholder return to understand which parts of your business are adding—and which are subtracting—value. Which are “on strategy” versus not? Which have tailwinds at their back—and which face headwinds from megatrends, such as decarbonization or geopolitical factors? What’s your cash on hand and borrowing capacity? Even for companies that need to improve their performance, this portfolio view can provide a valuable lens for transformation planning.

And also focus on what’s missing—what lack of capabilities, technologies, market access, scale, or other factors is keeping you from realizing your strategic ambitions and potential?

- Prepare and plan for your divestitures. Where you’re a seller, or at least open to being one, what is each business worth? What impact would selling it have on your core business in terms of lost scale, stranded costs, and capabilities? Is it currently marketable or does it need a makeover to maximize interest and value creation? What is the most attractive strategy and business plan to drive its future success? What is its equity story for buyers or investors? What financial or strategic buyers would be natural owners for it? Most divestitures in this environment will be by companies that need to sell. But even strong performers should use this time to prepare for the sale of attractive non-core assets when the market starts to bounce back.

- Identify and prioritize potential targets. Where you’re looking to make acquisitions to fill strategic gaps, which pools offer the most attractive fishing opportunities? Within each, which candidate companies are the most attractive? What would you be willing to pay? How would you integrate the acquisition into your business? Then, systematically approach each potential target with a clear, compelling story outlining the strategic and financial benefits of the combination. Best-practice acquirers maintain a radar function that enables them to continually scan for opportunities in their priority sectors.

- Prepare the organization to move rapidly. Is your board ready to act? Do you have advisors lined up? Have you identified a top-notch due-diligence team? And beyond closing, are you up to speed with current best practices for post-merger integration and clear on who will be responsible for driving the successful integration?

Subscribe to our Business Resilience E-Alert

With so many sectors facing disruption, the current environment offers leaders an exceptional opportunity to reimagine and reinvent their businesses. For non-tech players looking to boost their digital capabilities, carbon-intensive players seeking to pivot, or any company seeking a step-change in scale via industry consolidation, this could be an inflection point.

And investors are in favor of smart M&A in this environment. The latest installment of the BCG Investor Perspectives Series finds that 68% of investors—near the series high of 72%—believe that management should actively pursue acquisitions to strengthen the business at current valuations.

Leveraging the current uncertainty to accelerate strategic transformation requires thinking differently about potential targets, deal terms, and financing structures. But most of all, it demands the courage to act decisively before valuations rebound.