The global tech industry faces a much tougher environment than a year ago, yet one segment has shown continued resilience and strong growth: B2B SaaS. For enterprise customers, SaaS solutions offer value by using data and analytics to better understand customers, improve products and services, and make data-driven solutions—all of which improve performance. Moreover, because they are highly scalable and generate reliably recurring revenue, B2B SaaS players have become attractive acquisition targets.

Our playbook identifies specific moves that all B2B SaaS companies can make to continue the growth trajectory.

To assess the current state of the market, we recently surveyed more than 100 B2B SaaS companies, including a subset of hypergrowth firms that are outpacing their competitors. Our analysis showed how these companies have posted such strong growth amid economic uncertainty. Based on these findings, we developed a playbook that identifies specific moves that all B2B SaaS companies can make to continue the growth trajectory—particularly in the realm of go-to-market strategies and commercial operations.

The BCG X Playbook: Winning strategies of hypergrowth SaaS champions

The B2B software-as-a-service model segment is growing about 10 times faster than any other. Here’s a playbook to continue the growth trajectory.

Outpacing Industry Growth by a Factor of Ten

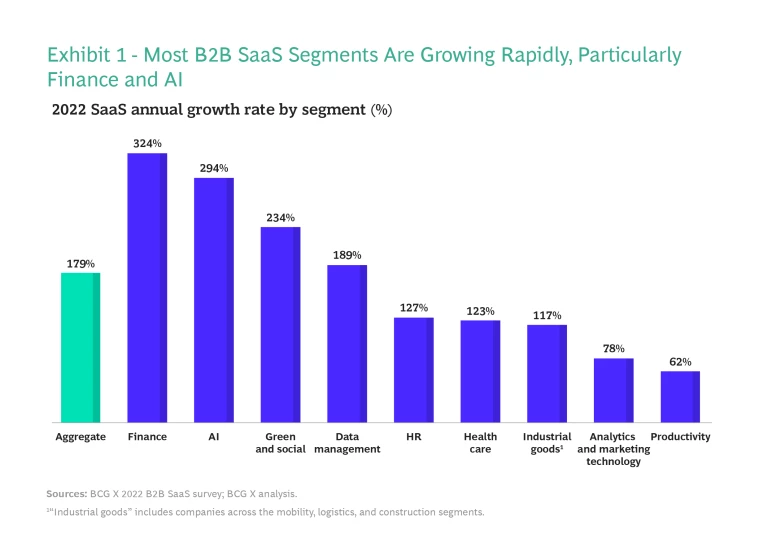

The 109 companies in our analysis are primarily based in Europe (56% of the respondents are in Germany, 11% in the UK, and 8% in France), but they are broadly representative of the global industry. Overall, the SaaS industry is growing at about 17% a year, but the B2B companies in our sample grew at more than ten times that rate, increasing revenue by 179% in 2022. The strongest segments were finance, AI, and green and social. (See Exhibit 1.)

Moreover, this growth didn’t come from a single strong year. The overall sample increased their revenue 3.3 times over in their first two to five years, and 6.4 times over the next five years—reaching an average of $35 million in annual revenue.

If that seems impressive, consider that survey participants expect even faster growth in 2023—204% overall, with the biggest increases in the data infrastructure and compliance segments (260%). Even though fintech players expect a minor dip, that segment is still projected to show the largest growth in absolute terms (317%, slightly down from 366% in 2022).

Why are these companies growing so fast? SaaS business models require little upfront investment and are extremely fast to scale due to online delivery of services. High margins throw off cash that companies can reinvest to fuel more growth.

More fundamentally, there is strong demand among enterprise customers for B2B SaaS offerings. The increasingly complex challenges that leadership teams face—including sustainability and decarbonization, digitization, the shift to remote work, relentless pressure to reduce costs, and the need to meet evolving customer demands—are all pushing companies to implement cloud-based SaaS offerings. At the same time, businesses are turning to AI and machine learning solutions to automate manual tasks and improve decision-making processes. SaaS solutions make these tools accessible to companies.

Because the B2B SaaS market is so attractive, and because these companies are relatively inexpensive to launch and scale, the competition in some segments can be fierce, with companies battling for market share as they grow. In this environment, leadership teams need some insights to determine how to navigate the current environment—and specifically where to focus their investments to generate the biggest benefits.

Benchmarking the Fastest Growers

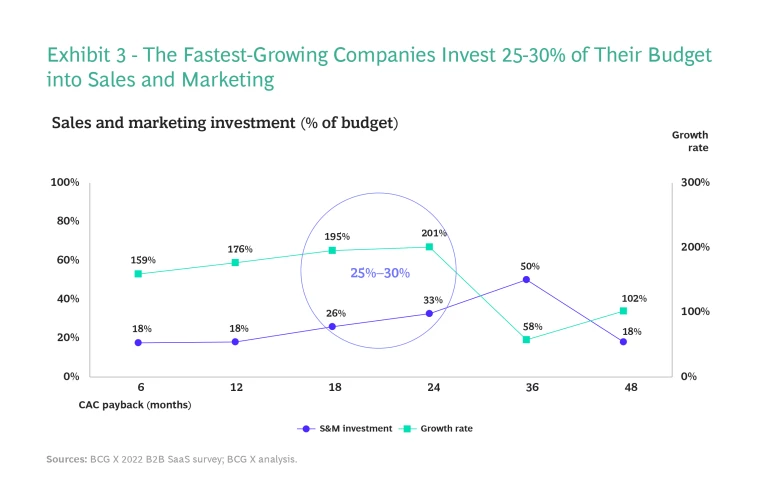

Investing in sales and marketing is critical for the growth of a SaaS business—but what’s the right level of investment? When asked about the biggest challenges they face, survey respondents pointed primarily to aspects of their commercial operations. For example, 28% identified targeting the right segment (more than any other issue), followed by customer acquisition costs (19%), and customer retention (10%). In a fast-growing, competitive market where companies are battling for share, a critical determination is how much companies should spend on go-to-market efforts to win and retain customers.

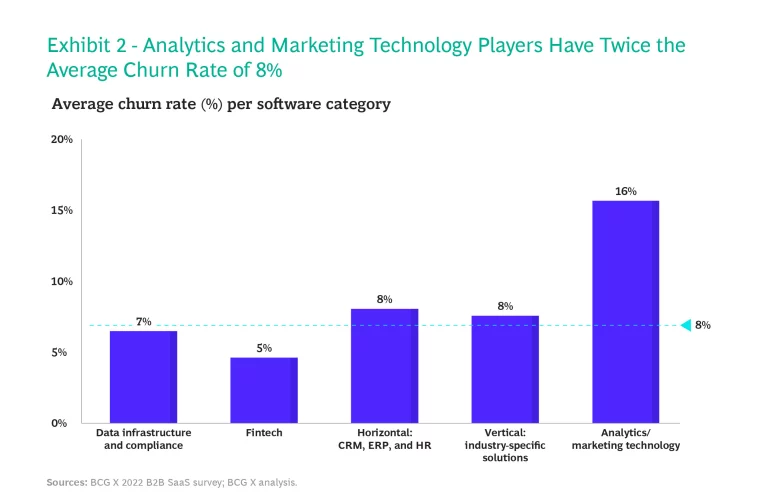

By comparing capital burn rates to growth rates, we determined the investment sweet spot for companies to support growth. Specifically, we looked at the payback period for customer acquisition cost (CAC) and the churn rate at which customers need to be replenished. The average CAC payback period for the companies we surveyed was 11 months, and 84% of our sample had a payback period of less than 18 months. Nearly one-third had a payback period of less than six months.

Among specific segments, data infrastructure, compliance, and industry-specific solutions tend to have quicker payback periods, while two others—fintech and analytics for marketing and advertising technology (martech/adtech)—show slower CAC payback periods.

Turning to customer churn, the average annual rate for the overall sample of companies was 8%. As Exhibit 2 shows, analytics and martech/adtech companies have twice that rate of customer turnover (16%), driven by stronger competition and an increase in plug-and-play solutions. Conversely, fintech had the lowest churn rate, just 5%—potentially because of the friction involved in switching providers.

Balancing these dimensions—growth rates, CAC payback periods, and churn—our analysis found that the fastest-growing companies typically invest about 25% to 30% of revenue into their go-to-market (GTM) strategy. This group has slightly longer CAC payback periods (18 to 24 months in 2022) but also above-average growth rates of approximately 200%. (See Exhibit 3.) Of this total GTM investment, roughly four-fifths is spent on sales (as opposed to marketing). Over time, as companies mature and solidify customer relationships, the share spent on marketing increases and the share devoted to sales decreases.

The Playbook for Continued Growth

For the foreseeable future, capital will be harder to access, as VC investors become selective and face higher return thresholds. On the demand side, companies expect ongoing innovation. In some of the most competitive markets, consolidation is likely. Customer success and retention will become even more critical, and companies will shift from a pure growth mindset to efficiency and profitability.

To navigate these dynamics, all B2B SaaS players can act on the lessons learned from the fastest growers.

Invest in Lead-Scoring Systems

Given the imperative to win new customers, companies need more mature capabilities in segmenting sales leads. In our sample, companies that invested in advanced lead-scoring systems grew 75% faster than companies with basic technology. These systems use current customer data and AI to better understand customer segments and enhance CRM data—leading to a range of benefits.

Better Prioritization of Leads. By segmenting leads according to engagement level, overall interest, fit with a company’s product or service, or other metrics, sales teams can focus their efforts on the most promising leads, improving efficiency.

Improved Customer Experience. Rather than overwhelming customers with excessive or irrelevent marketing, companies can use lead-scoring systems to tailor their outreach to the needs and preferences of their customers.

Data-Driven Decision-Making. By adding more information to their leads, companies can make better-informed decisions about how to reach customers and how to allocate resources across sales and marketing teams.

Automate the Sales Funnel

Sales automation solutions use predictive analytics and AI to offer personalized recommendations on the next product or service that customers are likely to purchase, as well as identifying strong cross-selling and upselling opportunities. The SaaS companies in our survey that utilize these automation tools grow 89% faster than competitors that lack such tools. As with lead-scoring, automation tools deliver benefits in several areas.

Attracting New Customers. Companies can deliver relevant content and offers to each stage of the funnel to potential customers, increasing their engagement and interest for the product or service.

Retaining Current Customers. By staying on top of customers’ needs and predicting what they want and need, companies can improve customer retention.

Leverage Word-of-Mouth Referrals

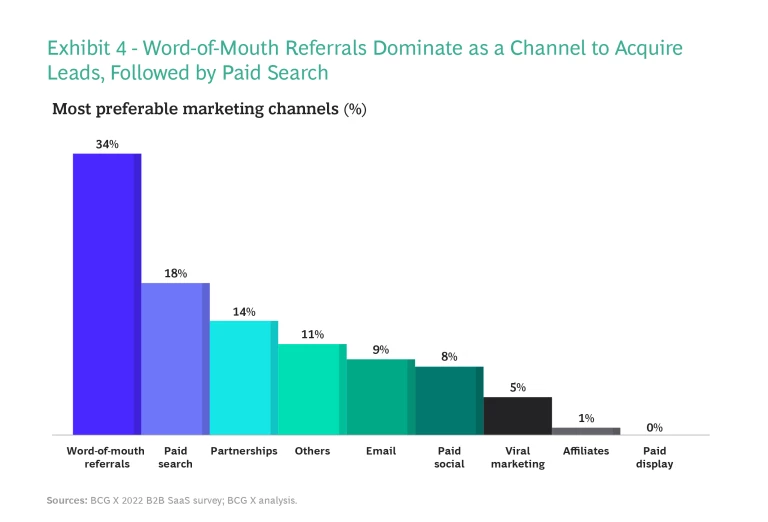

Somewhat surprisingly, given the strong digitization push across most industries, SaaS champions still rely traditional channels. More than one-third of respondents (34%) pointed to word-of-mouth referrals as the most popular channel for generating new business, followed by paid search (18%). (See Exhibit 4.) One explanation is that implementing SaaS tools can be complex and time-consuming, requiring a good level of trust before companies are willing to move forward. Positive recommendations among peers and colleagues go a long way in building this trust. In addition, word-of-mouth is highly cost-effective.

Segment the Channel Strategy Based on Contract Size

Our survey participants offered SaaS solutions across the board, targeting enterprise customers in addition to mid and small sized customers. But it’s critical to use the right channel for the right contract size. Field sales and inside sales—which are more costly—correlate to larger-size contracts of $100,000 per year. Enterprise-level offerings are more complex and require a hands-on approach to sales and implementation. In contrast, smaller contracts are typically—and most efficiently—accessed through self-serve channels such as online portals. Companies need to ensure they invest in the right channel for their particular customer mix.

Capitalize on Insights from Customer Usage

Unlike on-premises software, SaaS models offer a unique advantage—the ability to track customer usage remotely. Companies can analyze this customer data to identify potential issues, patterns, and preferences, yielding advantages in two key areas.

Customer Success. First, SaaS companies can determine whether customers are getting the maximum benefit from the software. For example, if a specific tool is being overlooked or minimally used, companies can proactively contact the customer to offer suggestions and support.

New Product Development. Second, companies can use the insights from customer feedback to refine products over time—and to develop new solutions. When products are being desinged, close proximity to customer needs can identify unmet needs and lead to smarter and more effective offerings.

In both cases, AI can be a powerful tool to help companies gather usage data, synthesize it to specific insights, and translate those insights into winning new designs and features.

The B2B SaaS segment has benefited from a highly attractive business model and strong demand for its products, leading to impressive growth even as many other aspects of the tech industry have started to contract. Yet it’s not enough to simply ride this wave of positive market conditions. As our analysis shows, a subset of fast-growing companies has grown faster than the pack. Their actions offer a playbook for other B2B SaaS players to follow.