The past several years have been challenging ones for banks, given rising interest rates, higher liquidity costs, the lingering effects of the COVID-19 pandemic, the volatile geopolitical situation, and the effects of climate change. Rapid changes in interest rates and high market volatility have put a spotlight on the role of banks’ treasury departments in steering financial resources and aligning them with the business. In this environment, treasury departments must play an essential role in ensuring resilience while helping to generate profits in all market conditions.

Are treasury departments up to the task of managing their banks’ balance sheets and steering them forward? To answer this critical question, our seventh biennial survey of treasury executives in Europe and North America focused on the changing expectations for treasury departments and how they are responding with balance sheet optimization efforts and adjustments to their operating model.

The Macro Picture

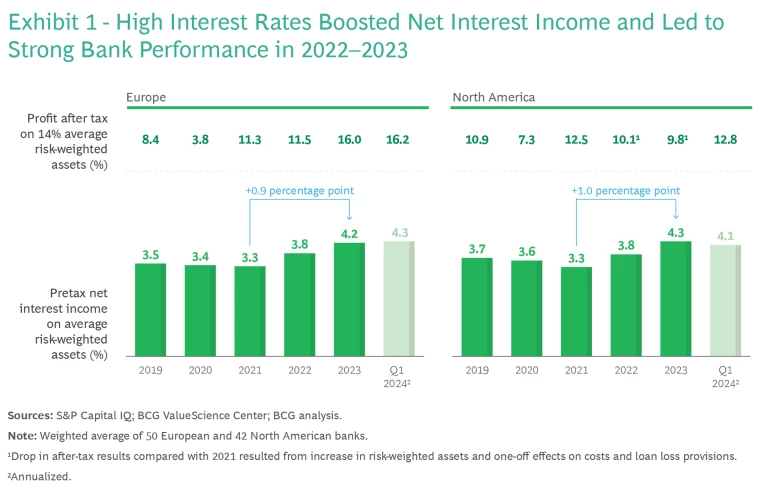

Consider the challenges banks have faced over the past two years. The rapid rise in interest rates in 2022 and 2023 proved a boon for most banks, boosting their net interest income. (See Exhibit 1.) But momentum has since plateaued , thanks to declining deposit volumes and the upward repricing of client deposit rates, and key interest rates have started to come down again. This highlights the need for banks to adequately manage interest rate risk and the impact of this risk on strategy and profitability under different interest rate scenarios. And it puts asset/liability management (ALM) in the spotlight for both senior management and regulators.

Moreover, while banks are still benefiting from the continuing historically low cost of funds on their balance sheets, those costs have started to increase owing to deposit repricing and funding rollovers, reducing net interest income. Rising liquidity spreads show the need to manage both deposit funding and capital markets funding even more carefully.

Meanwhile, the failures of Silicon Valley Bank in the US and Europe’s Credit Suisse in early 2023 have led to turmoil in financial markets and triggered discussions among regulators on potential adjustments to regulations. Among others, the Basel Committee on Banking Supervision has announced that it will examine whether to change global regulations on liquidity and interest rate risk in the banking book. In the US, supervisors have announced that targeted adjustments to liquidity rules are under consideration in response to the 2023 bank failures.

In addition, the equity valuations of many listed banks are still below book value of equity and are also below the valuations seen before the financial crisis of 2007–2008. In short, banks need to take action to fundamentally change the trajectory of their financial results —and treasury departments need to contribute to this transformation.

Two Key Topics

Banks’ treasury departments are making considerable efforts to both improve their institutions’ profitability and increase their resilience in the face of an uncertain, volatile future. Specifically, banks are working on two topics: their treasury operating model and balance sheet optimization.

The treasury operating model includes the nature and sharing of roles and responsibilities among the treasury, finance, markets, and risk departments, as well as the asset/liability committee and the risk committee. It also includes treasury departments’ efforts to improve the IT tools and data involved in building the forecasting and scenario analysis capabilities needed to dynamically analyze their balance sheets, regulatory ratios, and net interest income.

The second topic is the need to fortify the balance sheet through balance sheet optimization, with the goal of sustaining and stabilizing banks’ profitability through the effective management of financial resources, and to become an enabler for the business units through the effective pricing and use of resources.

Improving the Treasury Operating Model

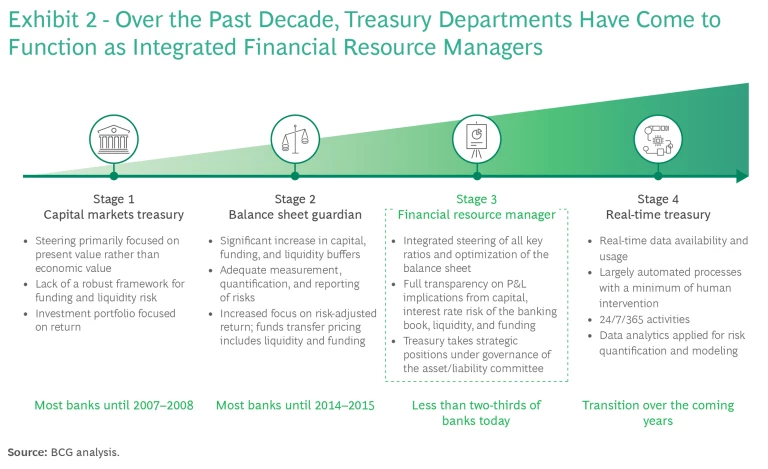

How bank treasury departments operate has changed dramatically over the past 20 years. Two decades ago, they focused largely on capital markets, cash management, and the execution of transactions across the bank’s various departments. Since then, that role has expanded, and treasuries have become key players in guarding the balance sheet, many functioning as financial resource managers as they move toward becoming real-time treasuries. (See Exhibit 2.)

The role of financial resource manager is the third stage in the treasury department’s ongoing evolution. But only 56% of treasuries have reached that stage, according to our survey results, while 38% are still on the way and just 6% are moving toward becoming real-time treasuries. Moreover, progress has stagnated over the course of the past two surveys, since 2018.

The Stage 3 Challenge. There are several reasons for the lack of progress. First, multiyear IT programs, such as the implementation of “golden” data warehouses, take time and resources. IT budget constraints can also limit advances in key elements of the operating model, such as comprehensive front office and ALM systems, the transfer of data and risk to treasury, and advanced capabilities for analysis, forecasting, and simulation of the balance sheet.

Second, bureaucratic inertia can sometimes inhibit internal reorganization and governance efforts. This can be the case, for example, when risk, markets, or finance departments do not want to give up responsibilities that historically resided within their organizations.

Third, the recent market environment has distracted some banks from further upgrading their operating model. The uncertainty surrounding the failures of Silicon Valley Bank and Credit Suisse has increased the volatility of funding and shifted the focus of many banks toward stabilization and away from upgrading efforts. Further stalling progress is the interest rate environment, which has led banks to focus more on retesting interest rate models with regard to stickiness of deposits and sensitivity to changing interest rates than on updating their treasury operating model.

The role of financial resource manager is the third stage in the treasury department’s ongoing evolution. But only 56% of treasuries have reached that stage.

The urgency to reach stage 3 is underpinned by supervisors’ recently increased focus on banks’ ALM practices. As noted, supervisors in the US are currently discussing adjustments to liquidity regulations, while the European Central Bank has announced that shortcomings in ALM frameworks are among the key supervisory priorities for 2024–2026.

The Stage 4 Imperative. As the regulatory bar rises further, treasuries must begin looking ahead to stage 4, when they will function as real-time treasuries. For example, the EU’s instant-payments regulation will require banks in Europe to offer real-time payments to their clients. This will have implications for how treasuries manage the bank’s liquidity position, increasing the importance of intraday liquidity metrics, changing the parameters for liquidity stress scenarios, and, potentially, requiring changes in the composition and size of liquidity buffers—all key elements of the stage 4 operating model for liquidity management.

The rise of new technologies —notably generative AI —could help banks automate a wide variety of standard processes and speed up the move toward stage 4, but it could also make that transition even more difficult. Already, supervisors are skeptical of any kind of technological “black box” that withstands analysis and oversight. Banks therefore need to build robust models that they can explain, both internally and to supervisors.

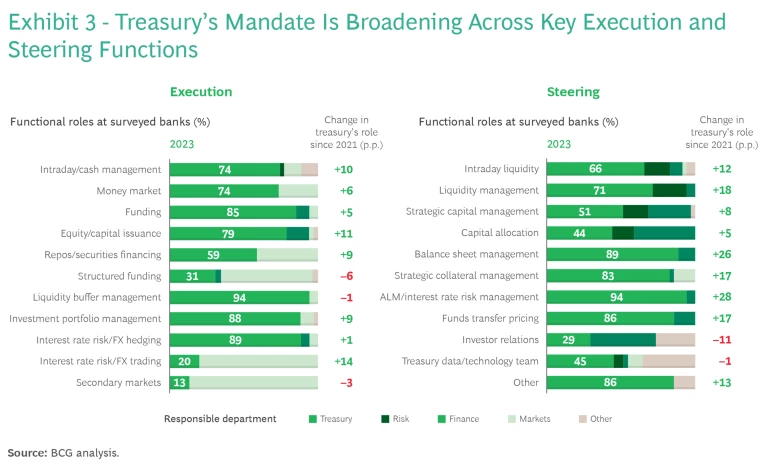

Expanding Mandates. Efforts to evolve the treasury operating model are especially important given the expansion at many banks of the treasury department’s mandate across both execution and steering. (See Exhibit 3.) While some execution functions—such as funding (a treasury responsibility at 85% of banks in our survey) and the management of liquidity buffers (94%)—remain a central mandate, others have grown considerably in importance. These include intraday/cash management (the share of banks in our survey where this is the responsibility of treasury departments has increased from 64% to 74% since the 2020–2021 survey), equity/capital issuance (an increase from 68% to 79%), and investment portfolio management (an increase from 79% to 88%). The broadened scope of treasuries’ mandate inevitably increases the complexity involved in managing resources across the bank’s departments and requires both clearly defined interfaces and responsibilities and strong cooperation among departments.

The treasury department’s mandate in terms of steering functions is moving toward the integrated steering of the entire balance sheet for all financial resources; it also includes capital management. Among the critical steering issues that have gained in importance are balance sheet management (the share of banks in our survey where this is the responsibility of treasury departments has increased from 63% to 89%), liquidity risk (an increase from 54% to 66% for intraday liquidity and from 53% to 71% for liquidity management), management of both assets and liabilities and interest rate risk (an increase from 66% to 94%), as well as capital management (an increase from 43% to 51%) and funds transfer pricing (an increase from 69% to 86%).

A further indication of the growing importance of steering is that, on average, about 60% of full-time treasury employees now work in steering functions (up from 53% in the 2020–2021 survey), leaving 40% of employees to carry out execution activities.

Boosting Balance Sheet Optimization

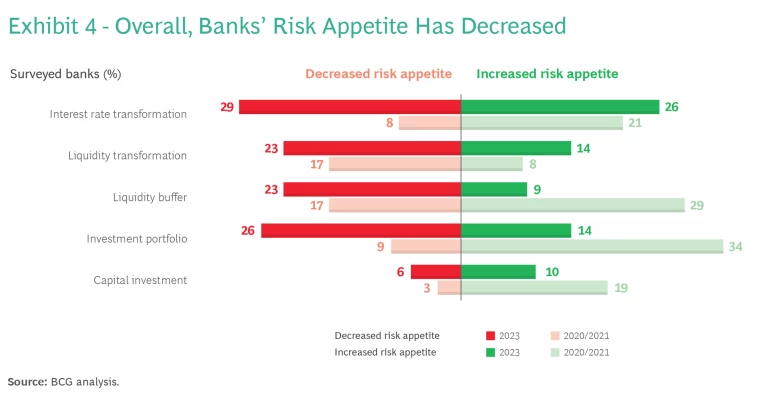

In addition to enhancing the operating model, treasury departments continue to focus on strengthening and optimizing their balance sheets. The steps they have taken show the diverse ways in which banks are handling their risk appetite. There has been a slight overall decline in risk appetite since the 2020–2021 survey, a trend most noticeable in banks’ investment portfolios. At the same time, the percentage of banks in our survey that have increased their interest rate risk is almost equal to those that have decreased it. (See Exhibit 4.)

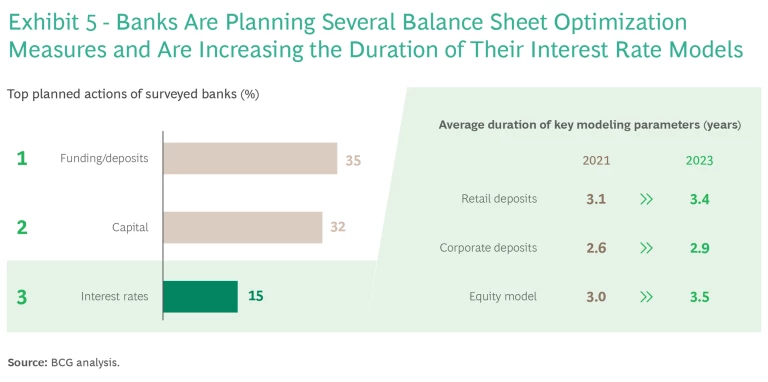

The top priority in balance sheet optimization is funding and deposit management, cited by 35% of respondents. This reflects the current “war for deposits” among banks. The second most common measure is capital management , cited by 32%, while 15% of banks are working to improve their modeling of the duration of both deposits and equity to improve interest rate risk management. On average, banks are modeling retail deposits over more than three years’ duration and corporate deposits for just under three years, a slight increase from past years. The duration of their equity interest rate models has also increased, from three to three and a half years. (See Exhibit 5.)

When asked whether their balance sheet optimization efforts could increase their net interest income, roughly 75% of respondents said yes. Of those, 22% said the potential is greater than €100 million in net interest income, and 44% said it is more than €10 million. Looked at another way, 55% of respondents said that further optimization has the potential to increase net interest income by more than 1%.

The top priority in balance sheet optimization is funding and deposit management.

Overall, respondents cited three key levers for improving their balance sheets: balance sheet levers (43% of respondents), funding/deposits (31%), and liquidity/collateral (29%). When asked what is keeping them from further optimization, respondents mentioned three factors: the macro environment (26%), lack of time and resources (26%), and IT/data quality (23%).

No matter how treasuries plan to optimize their banks’ balance sheets, senior management should be involved in the discussion. Engaging these executives in the decision-making process will ensure that they are fully aware of the potential benefits and risks under different scenarios.

Unlocking Treasuries’ Full Potential

Our survey results suggest four ways in which treasuries can enhance their operating models and fortify their balance sheets going forward:

- Expand treasury’s mandate as central resource manager. Most banks continue to see considerable value in putting the steering of financial resources into the hands of their treasury departments. Yet most treasuries’ operating models are still missing key pieces needed to support central steering. Every element of the model, including governance, steering principles, reporting, IT tools and data, and people and skills, must fit together consistently. And it is critical to engage senior management and the board on decisions about the treasury operating model.

- Upgrade analytics, IT infrastructure and simulation, forecasting, and scenario capabilities. Treasuries must upgrade their IT and analytics infrastructure, boosting the ability to forecast and simulate various interest rate and liquidity scenarios. To this end, many banks are abandoning vendor-provided systems in favor of building their own in-house solutions.

- Continue to review asset/liability management models. If it has not been done already, now is the time to comprehensively review all ALM models, including interest rate risk and liquidity risk models, models for deposits, and prepayment models, especially in light of past challenges such as interest rate volatility and the collapse of Silicon Valley Bank and Credit Suisse. Balancing risk and return will not be easy, especially given uncertainty surrounding the future direction of interest rates. Here, scenario planning is a must in analyzing whether rates stay “higher for longer” or retreat to the lower levels of the past.

- Cooperate with the business to optimize funding strategy and pricing of resources. To win the war for deposits, banks need to collaborate closely with commercial departments to understand how much repricing deposits and adjusting product offerings are required to stabilize the funding mix. This should also include a review of the funds transfer pricing framework and incentive structures.

In an increasingly complex and volatile economic environment, treasury departments at banks of all sizes have much to contribute to the stability and profitability of their banks. Further optimizing their balance sheets and improving their operating models will ensure that they contribute the maximum possible.