Consumers are increasingly using chatbots and search engines powered by

generative AI

to find new products and services. Brands—particularly in sectors that rely heavily on search for customer acquisition, such as autos, finance, retail, and travel—need to start preparing today for this landmark shift.

The So What

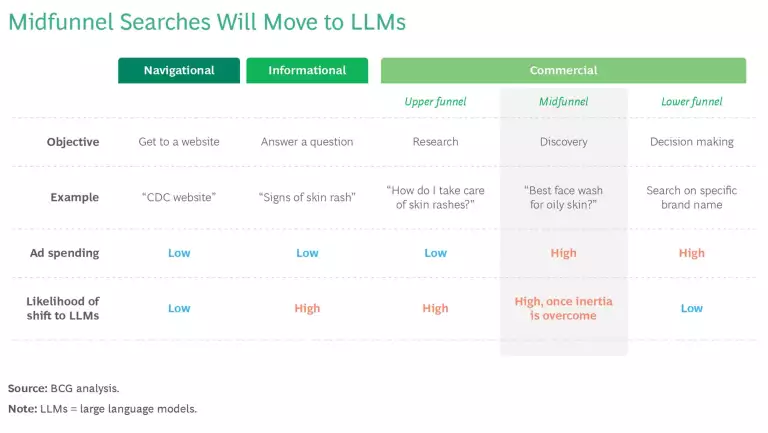

When consumers look for products online, the large language models (LLMs) that underlie generative AI provide a better experience than a traditional search engine for some queries. (See the exhibit.)

The LLM may power the traditional Google search bar, a chatbot like ChatGPT, a startup search engine such as Perplexity, a voice assistant, or a new wearable device. Whatever the platform, consumers will be drawn to LLMs’ hyperpersonalized answers and focused recommendations—plus the ability to further refine results with follow-up questions.

For consumers, this makes LLMs ideal for upper- and midfunnel product discovery searches, where customers are narrowing down their options (such as “What are the best noise-cancelling headphones”).

For brands, the result will be a shift away from the search platform, where they have accumulated decades of experience, to a new environment where the rules of engagement are very different. Today, brands have plenty of opportunities to be discovered by consumers, who often make multiple searches (possibly over weeks, if it is a major purchase) to refine and narrow their research.

With LLMs, the process is compressed, and consumers may see only two or three products or brands in the query output. Particularly affected will be companies with high midfunnel volumes (such as retail and entertainment) or those that spend heavily on search (such as finance, tech, retail, and autos).

Dive Deeper

It is unclear what kind of ad ecosystem will evolve around LLM-enabled search products. OpenAI currently charges a subscription fee for extensive access to its most advanced LLMs; Sam Altman, the company’s chief executive, has said that he prefers this to an ad-based model, but he has not ruled out advertising completely.

Other LLM-powered platforms are offering a version of traditional monetization. Microsoft’s Copilot, for instance, delivers GenAI-powered answers with display ads similar to conventional search. Perplexity, an LLM-powered search engine whose investors include Nvidia and Amazon founder Jeff Bezos, will allow sponsors to influence suggested follow-up questions.

This change comes amid other dramatic shifts in online product discovery, such as social media becoming a de facto search engine for Gen Z and the rapid rise of direct advertising on

e-commerce

sites. Amid such changes, brands cannot be sure that today’s search ecosystem will deliver the same return on investment in the future.

Now What

To ensure their flow of customers doesn’t dry up, companies must:

Optimize online content for LLMs. A brand’s website (and other sites that sell their products) must be written and formatted to make it easy for LLMs to identify unique selling points, specifications such as size and color, and key product features such as lists of ingredients. This helps LLMs decide which products to feature when asked specific questions such as “Best sneakers for HIIT workouts.”

Create a licensing strategy. Most consumer sites now augment their product information with valuable related content—sports brands that offer training and nutrition advice, for example. Such content will help LLMs generate better answers. Consumer sites also have product photos, which are helpful to systems that can process images. Licensing this content to LLM providers ensures it gets ingested and potentially incorporated into consumer searches.

This is complex, however: the terms of each deal need careful negotiation to ensure a fair exchange of value. And there may be many willing licensees—not only the big tech names, but a host of LLM-powered search startups, some of which may get traction quickly.

Test and learn. In the fast-evolving commercial environment around LLMs, brands must learn about new opportunities to be ready to scale rapidly. The opportunities include:

- Advertisements, in their various evolving formats.

- Product placement (some LLMs could become recommendation-driven storefronts with one-click checkout, for example).

- New types of commercial opportunities, including prioritized content and sponsored questions (such as a plant-based beauty company paying to suggest the follow up “What is the best face cream that doesn’t use animal products”).

Create a plan B. It is not yet clear how quickly consumers will switch to LLMs. Muscle memory will cause many of them to keep using traditional search formats, and LLMs occasionally disappoint consumers with inaccurate answers. With online product discovery in flux, companies must have at least one Plan B ready.

This may involve strengthening direct links with the consumer—perhaps even building an LLM into a brand’s own platform, such as a skin care brand offering a virtual beauty advisor. The LLM will not only drive sales but also add to the brand’s first-party customer data.

Companies must also closely track the effectiveness of their search spending as these changes unfold. If search underperforms, other channels—such as shoppable TV or social media—may begin to look more favorable. However, these alternatives are unlikely to fully make up the difference for brands heavily reliant on search today.

Brands must have a presence where and when consumers are looking to make a purchase. That means getting their products inside the multiple LLM ecosystems as soon as possible.

The authors thank Carolyn Everson and Yash Gupta for their assistance with this article.