After a challenging 2023, conditions in the European road freight industry have slightly improved, with load demand and truck supply in the market coming more into balance. But shippers relying on road freight services should not relax just yet. A variety of localized and more broad factors are creating a dynamic market that shippers will need to manage for the foreseeable future. The good news? Those that successfully navigate the challenges can improve their supply-chain performance, with a measurable impact on operations and the bottom line.

BCG recently partnered with Alpega, a leading logistics software company offering end-to-end solutions that cover all transport needs, including transport management services and freight exchanges. Using Alpega’s data, we analyzed the spot and contract European road freight market from 2019 through early 2024. The results give shippers and other road freight players in the value chain a snapshot of current market conditions.

Key results of our analysis include the following:

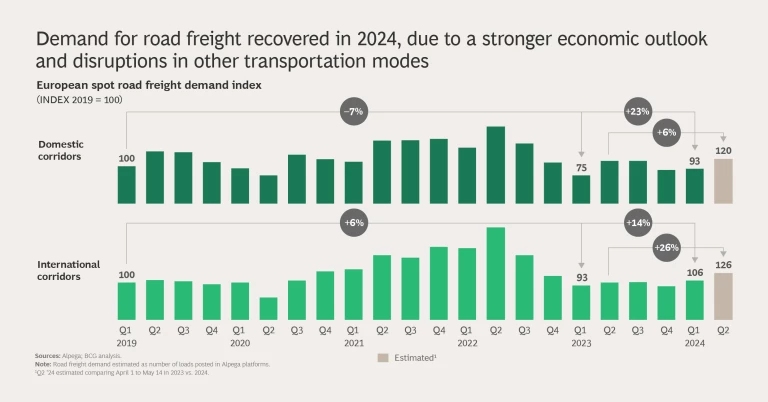

Demand for road freight is increasing. For both international and domestic routes, road freight demand grew in the first half of 2024, fueled by improved economic conditions. In addition, major regional disruptions—for example, a rail strike in Germany (now resolved) and ongoing attacks on cargo ships in the Red Sea—have pushed shippers to use road freight over other channels.

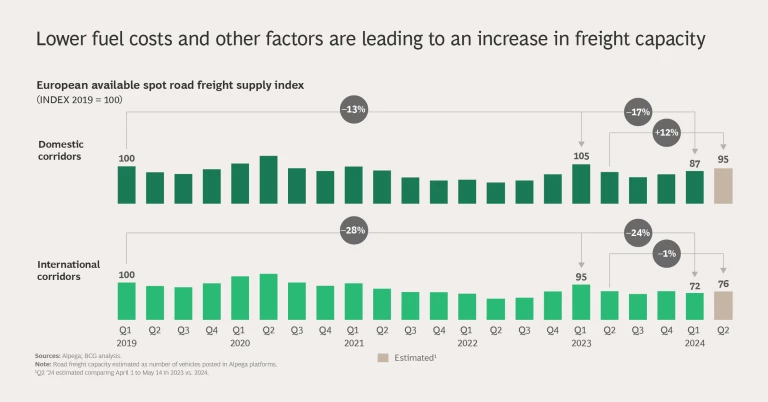

Capacity has slightly decreased but will likely recover soon. Available spot capacity decreased in the first quarter of 2024, due to short-term factors such as a driver shortage, still-elevated inflation and interest rates, and regional transportation strikes like the ones in Poland and Spain. Additionally, lower fuel prices are reducing operating costs for operators, leading to an increase in available spot capacity.

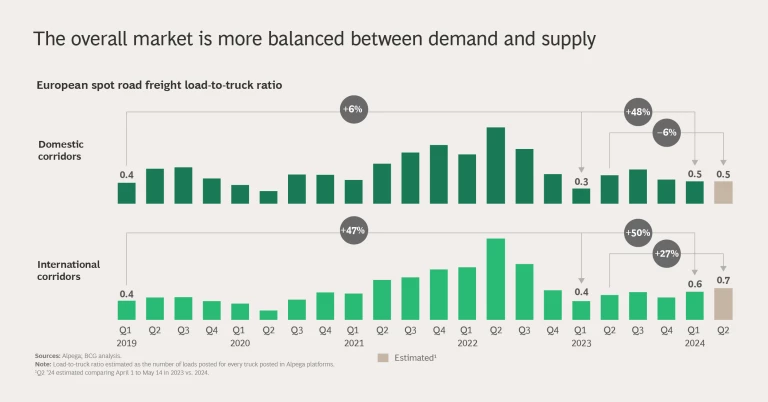

Overall, the market is growing more balanced in the short term. Over the last several quarters, better alignment between supply and demand is leading to a more balanced road freight marketplace. The load-to-truck ratio—which measures the number of loads for every truck posted on Alpega freight exchanges—is moving closer to 1.0 for both international and domestic routes. Currently the ratio is still less than 1.0, suggesting excess capacity, but as that gap closes, spot trucking rates could rise.

Shippers are increasing their contracted shipping volume. Given the currently favorable conditions, shippers are contracting more of their overall freight volume to limit their exposure to the spot market, lock in favorable rates, and avoid potential disruptions.

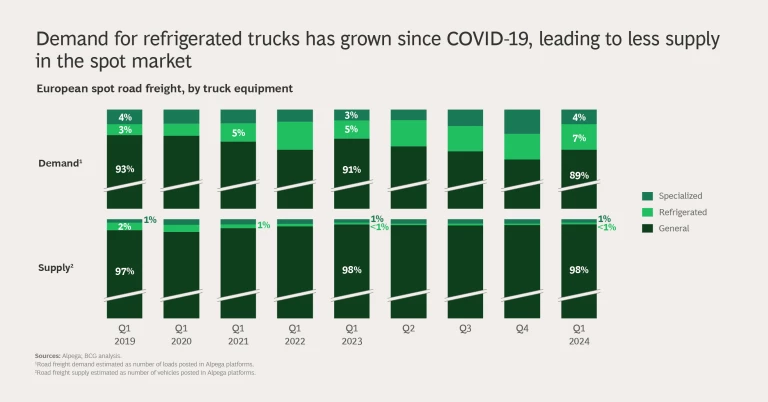

Refrigerated trucks are in greater demand. A range of factors is leading to increased demand, including growth in the pharmaceutical and online grocery segments (both of which ship products that must be kept cold in transit), an increase in food safety and quality concerns, and growing international trade. Collectively, these factors mean that there is less refrigerated freight capacity available on the spot market which can lead to regional equipment shortages.

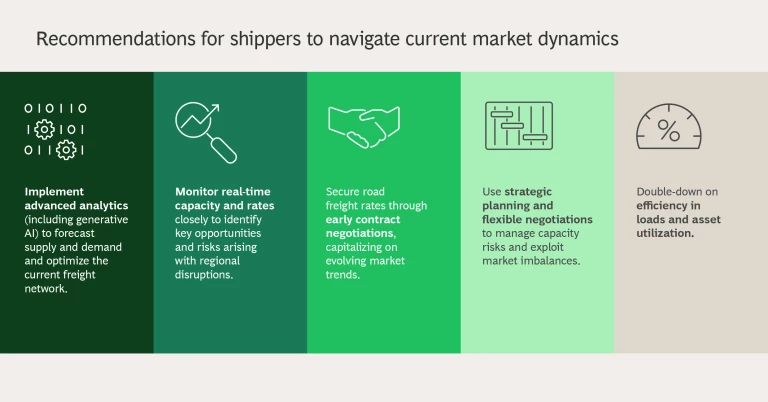

Five Ways to Respond to a More Volatile Market

Despite the relatively positive state of the market, shippers in Europe should not sit back. The market remains highly fragmented, with roughly 1.2 million active companies, the vast majority of which operate fewer than five trucks. Driver shortages are an issue as well, with more than 220,000 unfilled positions in Europe (and high turnover among those currently in the role). Strikes and geopolitical conflicts, route imbalances leading to significant empty miles, and even lagging and expensive green solutions are all upending global and regional supply chains.

Given these conditions, we believe that road freight shippers should take five steps to improve their supply-chain performance.

- Implement advanced analytics, including generative AI, to forecast supply and demand more accurately.

- Monitor real-time shipping capacity and rates closely to identify opportunities and potential risks due to regional disruptions.

- Lock in favorable shipping rates through early contract negotiations with road freight operators.

- Use strategic planning and flexible negotiations to manage capacity risks and exploit imbalances in the market created by disruptions.

- Double down on efficiency in loads through smart routing and load consolidation to maximize truck capacity.

Europe’s road freight market is challenging, but shippers that understand the underlying dynamics in the industry can take specific steps to succeed despite these issues—today and into the future.

The authors thank Carlo Castelli at BCG and Natasha Adams, Michael Böckle, and Gardiner von Trapp at Alpega for their contributions to this article.