This article is the fourth in a series developed by BCG in collaboration with the International Air Transport Association (IATA) on the airline industry’s transition to modern retailing, which is based on legacy-free offers and orders. (See the first article Charting the Future of Airline Retailing , the second article Reshaping the Airline Organization for the Future of Retail , and the third article Successful Airline Retailing Requires Industry Partnership .)

The global airline industry is undergoing a major shift to embrace modern retailing capabilities. This change, which entails leveraging technologies such as AI and digital identification, will help airlines develop innovative products and services, streamline processes, reduce costs, and ultimately redefine the customer experience.

For several years, BCG and IATA have collaborated on a series of thought leadership publications that aim to accelerate the industry’s transition to modern airline retailing, based on offers and orders. For this year’s study, we conducted workshops with participants from two types of companies: railways, cruise liners, tour operators, and car rental services, as representatives of travel suppliers along the customer journey; and travel management companies (TMCs), as representatives of travel distributors. Our objective was to analyze the strategic implications of modern retailing on the broader travel ecosystem. In addition, we surveyed more than 150 airline employees—primarily from full-service carriers—who had hands-on experience in the offers-and-orders transformation.

Our findings indicate that airlines continue to make significant progress in advancing from fragmented legacy processes to next-generation systems on the basis of offers (new products, new services, more dynamic pricing, and more relevant bundles) and orders (a standard way to manage customer purchases that includes accounting, fulfillment, changes, and cancellations). Only a few years ago, technology posed a significant hurdle, but today it is becoming increasingly available.

Nevertheless, to reach the full benefits of legacy-free offers and orders, airlines should address several priorities: further investment in future-proof

IT systems,

increased collaboration among travel verticals, improved data standardization, and—most important—dedication to putting customers at the center of everything they do.

Strong Support for Change

Overall, the results of our survey with airline employees reveal strong support for the transformation to modern retailing, as 83% of respondents claim to advocate for it within their companies. That number is fairly consistent across the three main functions involved in the transformation: IT; distribution (including sales); and commercial (including pricing and revenue management, marketing, loyalty, digital, and e-commerce).

In addition, 8 out of 10 survey respondents believe that the modern retailing transformation is strategic and has high potential for value creation for their airline. This signals a higher level of maturity in the industry than in previous years. For example, in the 2022 IATA-BCG survey, nearly 50% of airline employees did not have a clear view of the benefits of modern retailing transformation.

Growing Opportunities from a New Sales Channel

Over the past few years, the airline industry has made significant strides in implementing IATA’s New Distribution Capability (NDC), a data exchange standard that enables greater transparency and more dynamic and complex airline offers, previously available only to airlines via their own direct channels. In our survey, 81% of respondents stated that their airline currently has live NDC channels, and in some cases the airline has already achieved NDC penetration of more than 50% of its indirect channel bookings. Those results offer clear evidence of the airline industry’s progress and commitment to modernizing distribution.

Airlines are also recognizing that NDC is both a new standard and a new sales channel. With NDC, each shopping request goes directly to the retailing airline, thereby creating a direct relationship with customers who previously interacted only with third-party sellers and distributors. NDC is also helping new players—including banks, fintechs, and other travel suppliers such as hotels, tech companies, and startups—break into the airline distribution market.

NDC progress represents a key step toward a virtuous circle of innovation in the airline industry. It lays the groundwork for the next generation of advances, such as

generative AI

(GenAI) and digital identification, which we expect to be key themes in coming years, enabling customers to search, book, and travel with minimal human intervention in the process.

The Next Big Challenge: Implementing Orders

Several airlines are already experimenting with innovative offers in direct and NDC channels, but they face technical challenges in integrating those offers with legacy systems and processes.

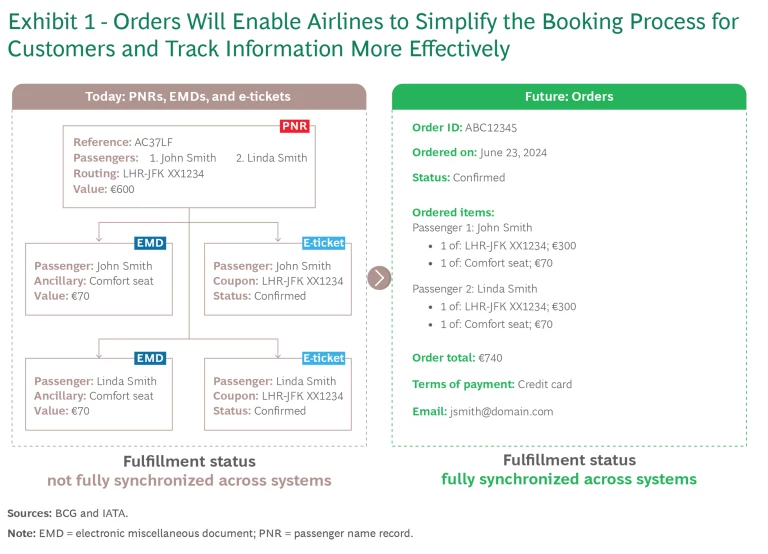

To succeed, airlines need to push harder, and they need to implement orders. The industry has several long-established ways to manage passenger trips, including passenger name records (PNRs), electronic miscellaneous documents (EMDs), and e-tickets. However, those processes are critically limited: because they amount to digitized versions of paper documents, they are difficult for travel players to interpret and exchange. Orders are a major step forward because they can record ancillary services (both air and non-air) and payment information—and track services delivery—all in a single place. Orders also record the full purchase history, and they update in real-time, similarly to the order records that most e-commerce retailers and marketplaces have already adopted. (See Exhibit 1.)

Currently, however, the airline industry is at the earliest stages of the transition to orders. No airline in our survey has fully implemented an order management system. In fact, 60% of airline respondents said that their airline has not yet defined a strategy or business case for orders, and another 20% said that it hasn’t even started to discuss the topic internally.

Members of a first wave of industry leaders, including a few large global airline groups, have recently announced plans to begin processing orders by 2026. These pioneers are paving the way for other airlines (particularly small and medium-size carriers that are not as far along in their journeys) to follow suit after the path forward becomes clearer and concrete proof of value is more definite.

In Other Travel Segments, Orders Are Business as Usual

Our study suggests that most airline partners and stakeholders will be ready to accommodate the airline shift to orders. These players already operate what are essentially order-based systems—by converting airline digital documents into internal orders. In our discussions, most airline partners agreed that there is value in using orders and that the airline industry’s goal of shifting all customer interactions to offers and orders is the right way forward.

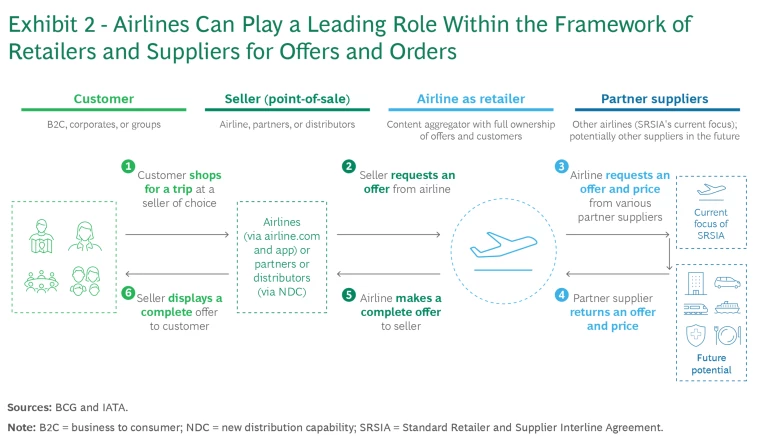

Once airlines shift to orders, they will be able to dynamically bundle and price integrated packages that include the flight and traditional airline add-ons such as extra checked baggage and seat choice, as well as non-air ancillaries such as a hotel room, a cruise cabin, or a train seat. The process will be much more streamlined than is possible with current technology. (See Exhibit 2.) Thus, orders will benefit not just airlines, but also the entire ecosystem. Airline partners will be able to create bundles containing the flight, and any changes to an order will be synchronized among all involved parties. In addition, this approach introduces the possibility of instant settlement, greater visibility of customer actions when a trip gets disrupted, and payment through a single transaction, even for multimodal trips.

Cautious Optimism About Technology

Until recently, technological limitations have prevented airlines from accessing a system or solution that could operate legacy-free offers and orders. This is now changing, as airline IT vendors commit to developing robust offer-and-order management solutions. Multiple recent announcements from IT vendors partnering with leading airlines should reassure the rest of the industry that flexible, scalable solutions will soon be available—and that vendors will support the transition period during which legacy and modern systems must coexist.

In our survey, 87% of respondents said they believe that IT vendors are either already investing sufficiently or will do so in the near future. In addition, confidence levels among airlines are high, with 70% of survey participants expressing strong confidence in IT vendors’ readiness to deliver solutions that support legacy-free offers and orders. Among airlines with more than $10 billion in revenue, that figure is even higher, at 82%.

Despite the widespread optimism, however, many airline professionals remain cautious about the industry's ability to capitalize on the new IT solutions to deliver the desired end state of legacy-free offers and orders. Nearly 50% of the respondents anticipate that achieving this milestone will still take significant time.

The Finish Line Is Several Years Away

Despite the ongoing progress toward modern retailing and the strong support for it among airlines, our survey data shows that the expected timeline for legacy-free offers and orders has moved farther into the future. Among survey respondents, 49% say that the industry will achieve this milestone by 2030.

It is important for airlines to continue to invest heavily in upgrading their IT infrastructure, cope with a hybrid transition period in which both legacy and modern systems will coexist, and adapt internal processes—all while finding ways to create value and justify the investments. More generally, change management remains one of the biggest challenges airlines face, as many organizations have siloed departments and mindsets.

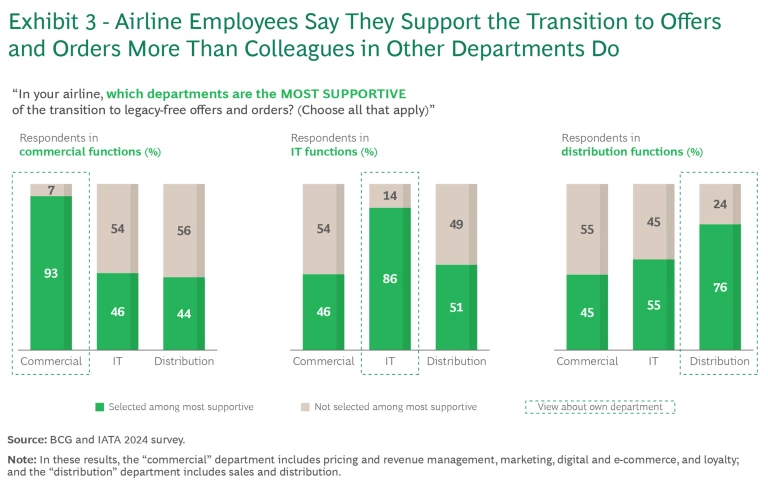

In our work with airlines, we have found that, despite some improved cooperation, most of them tend to assign a single department to lead the retailing transformation, often with limited cross-functional coordination and collaboration. The survey data reinforces that members of each department typically believe that they support the transformation more vigorously than people in other departments do. (See Exhibit 3.)

Bridging these internal silos and collaborating across departments are crucial preconditions for airlines to succeed with modern retailing. Leadership within airlines must champion the transformation and encourage interdepartmental collaboration. For example, leaders can clarify roles among departments (such as by defining who is responsible for creating and pricing new offers), set shared KPIs, and design regular feedback loops to align departmental priorities and monitor progress.

Mechanisms May Help Accelerate the Transition

To expedite the transition to modern retailing, the airline industry as a whole can explore mechanisms such as phasing out legacy standards and setting target dates for implementation of offers and orders. Given the interdependencies within the industry, no individual airline can capitalize fully on modern retailing unless the industry moves relatively in sync. Moreover, industries such as banking and mobile telecommunications have successfully used these mechanisms to achieve broader industry goals.

In our survey, 69% of respondents said they support such mechanisms in principle, and many participants highlighted the mechanisms’ potential to drive focused efforts and industry accountability. Notably, big airlines—those with revenue above $10 billion—are even more strongly in favor, reflecting these companies’ willingness to move fast.

Nevertheless, no consensus exists on the specific type of mechanism:

- 59% of respondents support dropping some legacy standards such as PNRs and e-tickets.

- 42% support setting target dates for full implementation of offers and orders.

- Only 29% believe that requesting support from governments and regulators might help.

Respondents who are opposed to accelerating mechanisms have some strong arguments. One participant noted that any measure that regulators adopt in an effort to force the industry to take a specific action is likely to lead to bad transitions. Another industry insider highlighted the reduced investment capacity and slower pace of change among smaller carriers, saying, “We cannot neglect the airlines that are less advanced and less eager for the transition—pushing something through at the expense of their business.”

Critical Next Steps for Airlines

Our analysis points to five key steps that airlines can take to accelerate the transition to modern retailing:

- Make a strategic choice regarding the airline’s role as a retailer. Airlines must strategically define the role they want to play as a retailer, from selling their own products to becoming a one-stop-shop for end-to-end travel needs. The implications of this strategic choice are numerous and deep, and they include such factors as which target customer segments the airline views as key, what companies the airline will compete against, how the airline will service its new offers, and what kind of investments and partnerships it needs.

- Identify key use cases to deliver customer value. As technology hurdles cease to be the primary obstacles to progress, airlines must focus on improving the customer experience. Specifically, airlines should define a clear plan to implement use cases that promise to deliver the highest impact in improving customer value. They should apply a mindset of testing and experimentation, learning from direct experience along the way. Once the airline role and priority use cases are clear, airlines should define a roadmap to realize the ambition.

- Determine target strategic alliances, and select partners carefully. By working together, airlines, technology vendors, and travel partners can create a cohesive ecosystem to implement modern retailing capabilities. These stakeholders should actively participate in industry-wide initiatives, share best practices, and commit to the adoption of industry standards. A collective effort can lead to greater and faster progress across the entire travel industry, to the benefit of all.

- Define ways to exploit new disruptive technologies. As emerging new technologies such as GenAI and digital identification continue to emerge and disrupt the industry, airlines can’t afford to take a passive stance. Forward-looking, proactive players that master new technologies will have a significant advantage. Embracing innovation is therefore crucial for staying competitive and meeting the evolving expectations of travelers. Transforming to offers and orders is a key aspect of that innovation, and airline leaders should fully commit to it.

- Create the right organization context for modern retailing to succeed. Siloed organizational structures and institutional inertia remain critical roadblocks at some airlines, underscoring the need for more direct, active CEO involvement in creating the proper context for modern retailing. Key elements include more agile and cross-functional ways of working to accelerate the journey, and potentially creation of a new role of chief retailing officer, with CEO sponsorship, to be responsible for integrating and aligning the various functions within the airline.

The transition to modern airline retailing is a transformational journey that promises to reshape the industry landscape, redefine customer experiences, and drive operational efficiencies. By committing to the actions that our research identified as especially rewarding, airlines can realign themselves to modern digital practices, moving away from costly workarounds and outdated processes and positioning the industry at the forefront of innovation, ready to meet the evolving demands of today’s travelers.