Access to affordable medications is a pressing challenge in the US. The cash generics market, a segment of the retail prescription drug market where patients purchase generic drugs out of pocket without the use of

insurance

, has gained traction over the past decade and has the potential to become a $10 billion to $15 billion market by 2030. To capitalize on this growing opportunity, incumbents along the value chain and new entrants need a clear strategy.

The Rise of Two Cash Generics Models

Even with available generic drugs, US patient copays for a month’s supply of prescription medications can cost hundreds or thousands of dollars. To address this problem, two cash generics models have emerged:

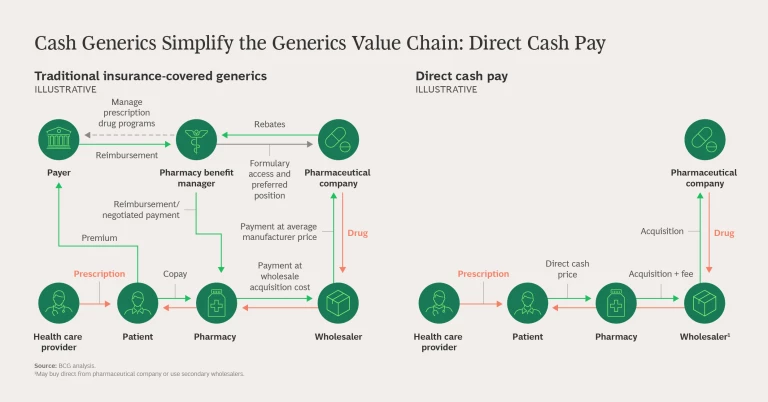

Direct Cash Pay. Patients pay for medications out of pocket at cash-only pharmacies, like Mark Cuban Cost Plus Drug Company and Amazon RxPass, or through retail pharmacy programs, like Walgreens Prescription Savings Club and Walmart’s $4 prescription program.

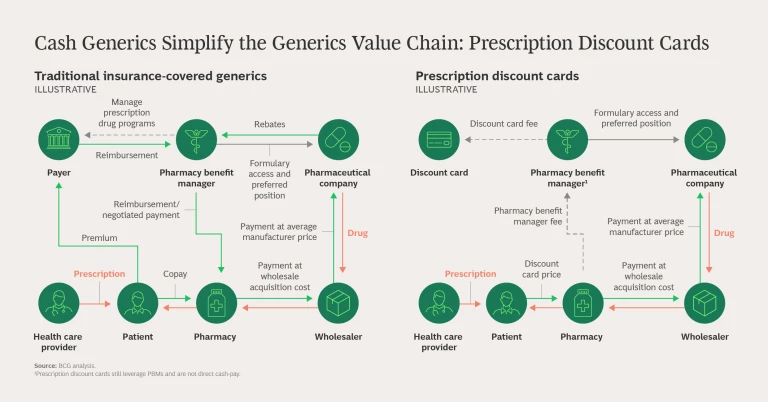

Prescription Discount Cards. Patients access discounted prices negotiated by pharmacy benefit managers (PBMs) through third-party discount cards, like GoodRx and Blink Health, or discount cards issued by PBMs and retail pharmacies, such as CVS Caremark and Optum Perks.

Cash generics offer several benefits. First and foremost, they have the potential to expand access and increase the affordability of generic medications for approximately 140 million US patients, including the uninsured and the insured with high deductibles or high copays.

In addition, cash generics increase pricing transparency and support a much more sustainable industry over the long term. Direct cash pay dramatically streamlines the flow of funds from the time a doctor writes a prescription to when a patient picks up their medication. Discount cards eliminate the involvement of payers and help with patient access, but they don’t fundamentally improve transparency in drug pricing.

Developments Driving the Growth of Cash Generics

The cash generics market has grown 2% to 3% since 2018, predominantly driven by the adoption of prescription discount cards. In 2022, cash generics represented 10% of total generic prescription volume, an estimated $6 billion in value.

Since 2022, we have seen a pivotal turning point for cash generics:

Lawmakers and regulators are pushing for greater transparency in drug pricing. In 2022, the Federal Trade Commission initiated an inquiry into the PBM industry, and the Senate Finance Committee advanced a PBM reform bill in 2023, aiming to enhance transparency and eliminate spread pricing.

Payers are re-evaluating their relationship with PBMs. In 2023, Blue Shield of California shifted from an exclusive partnership with a major PBM to partnerships with a range of companies. Their goal is to provide members with transparent access to medications while lowering costs.

Tech giants and high-profile entrepreneurs entered the cash generics market. Mark Cuban launched the cash-only pharmacy Cost Plus Drugs which has a transparent pricing model. Amazon Pharmacy also entered with RxPass, a $5/month subscription program offering access to more than 50 generics.

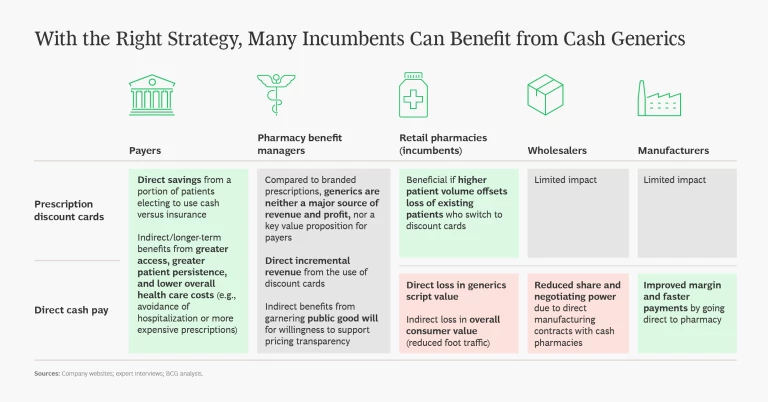

Cash generics not only benefit patients, they also benefit nearly all players across the value chain without disrupting their core businesses.

Seizing the Opportunity

New entrants in direct cash pay should adopt the classic tech playbook: prioritize growth in the near term, rapidly scale, reduce per-patient acquisition costs, and extract greater lifetime value from patients. Their value proposition will need to be compelling both financially and practically. While new entrants are constantly adding new drugs to their offering, they do not offer the same breadth of the drugs as incumbent retail pharmacies. Patients may view it as an inconvenience to split their prescriptions across multiple pharmacies; therefore, a seamless patient experience will be critical.

Incumbent retail pharmacies should refine their cash generics offerings and look to capture new value. For high-cost generic drugs, retail pharmacies typically achieve higher profit margins with insurance-covered patients versus those using discount cards, or they may lose patients to cash pharmacies. To make up for lost value, retail pharmacies would need to bring in approximately four to five new patients relying on cash generics for every existing patient who switches from insurance (or possibly fewer if you take into account indirect revenue from increased foot traffic). In addition, retail pharmacies have the opportunity to capture a greater share of the value pool by bringing third-party discount card provider offerings in house.

Third-party discount card providers should act quickly to enhance their value proposition for retail and PBM partners. Otherwise, there is a high risk of being disintermediated as vertical integration becomes more prevalent.

Generics manufacturers should have a clear strategy on how to participate in the growing market, even if, for now, cash generics represent a small part of the business in terms of volume. In the direct cash pay model, manufacturers can eliminate administrative and other costs to achieve a better margin on products purchased through direct cash pharmacies—and they can create open dialogues with customers about pricing transparency. However, this window of opportunity will not last forever. Today there is significant imbalance between customers and suppliers. Three large purchasing alliances control more than 90% of the total generics volume in the US. But more than 100 generics manufacturers supply that volume. If a few new entrants in direct cash pay grow to scale, it will not fundamentally shift the customer concentration. Therefore, having a high-quality product at a competitive price will still be the winning ticket. This may not be as acutely felt in the near term as new entrants focus on growth above all else, but when profitability becomes a higher priority, the competition among generics manufacturers will be just as fierce as today’s traditional retail pharmacy channel.