Touchpoints keep multiplying, and effectively connecting with consumers keeps getting harder.

The So What

Expectations are rising for CMOs , who face three big challenges as they set their strategies for marketing activation:

More Complex Consumer Journeys. Generative AI will produce waves of personalized content for consumers, adding yet more touchpoints to measure. Companies already struggle to track results for their full range of commercial investments.

Shifting Behaviors in Unsettled Economies. With consumer demand buffeted by inflation and geopolitics, companies want clarity and rapid responses. CMOs are expected to work with CFOs on faster, data-supported allocations of commercial spending to drive business growth in dynamic markets.

Stricter Privacy Practices. The industry trend away from personal data collection continues as US states adopt privacy laws inspired by the EU’s General Data Protection Regulation.

Most companies use measurement approaches that can’t meet these challenges. They have not been extended to all touchpoints and sales channels, and they are too slow to react to market and consumer dynamics. Many CMOs rely heavily on marketing mix models (MMMs). These aggregation-based methods pass the privacy test, but their insights aren’t actionable—and as a result, rarely drive decisions.

Dive Deeper

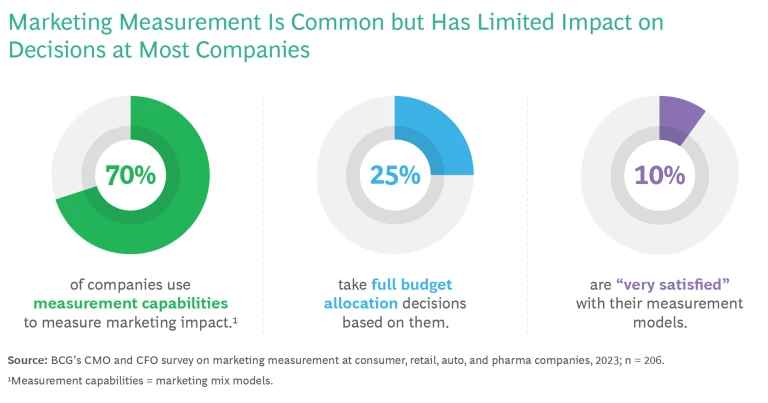

A recent BCG survey of more than 200 European and US companies found low satisfaction with their marketing measurement. (See the exhibit.) Yet aspirations are high.

In the survey, 70% of the companies employed marketing measurement or were planning to. But fewer than half said that finance or sales were involved. And only one in four use the outputs to allocate investments across all touchpoints: most settle for making directional adjustments.

Two major shortcomings keep marketing measurement siloed:

Lack of Substance for C-suite Partners. Coverage gaps and black-box analytics make it hard for CMOs to engage with finance and sales leaders. Data that’s hard to get or integrate leaves models with blind spots across brands, touchpoints, and sales channels.

- Only 14% of respondents say their models cover away-from-home sales like those in restaurants.

- More than 70% say better coverage would widen adoption.

Lack of Actionable Conclusions. Most marketing measurement emphasizes return on investment (ROI) for past spending. Survey respondents would welcome forward-looking simulations of re-allocation scenarios across touchpoints and brands.

- 80% of respondents say simulations would widen model use.

- But two thirds of respondents rely on reports from outside vendors and lack direct access to simulation capabilities.

- Only a third of respondents currently track the long-term impact of investments on brand equity.

Best-in-class simulations use a variety of effectiveness metrics. They can isolate the impacts of investments with short- and long-term goals and provide a view on consumer behaviors like recruitment response and loyalty.

For example, Smart Allocation by BCG X enables companies to optimize commercial spend allocation in an integrated manner. Users can balance short-term and long-term goals and compare various allocation scenarios to determine the most effective strategy.

To improve modeling and build trust outside the marketing team, two thirds of the companies that don’t model internally are considering moving the work in house. But as leading companies have shown, that’s just the first step.

The Idea in Action

Pernod Ricard, the world’s second-largest producer of wines and spirits, owner of brands like Jameson, Absolut, and Chivas, began a transformation of its marketing function in 2020, aiming for a step-change in the company’s skill set. Building an internal modeling capability was key to the effort. Known as Matrix, this capability now supports Pernod’s top 10 brands in 22 of its biggest markets, covering three quarters of the global marketing spend.

In addition to building the analytical components in house, Pernod Ricard has:

- Created a new organization, fully dedicated to scale and maintain Matrix, including data engineers, data scientists, and measurement experts.

- Developed a scenario-simulation capability that provides actionable spending recommendations for brands and touchpoints, factoring in short-term financial impact and long-term impact on consumers.

- Developed cross-functional processes to coordinate marketing and point-of-sale investments.

- Formed a central marketing performance team, coaching local marketing teams on measurements and supporting them in spend allocation.

Pernod Ricard’s executive committee members championed the transition, pushing teams toward the new marketing investment North Star.

Now What

Set a four-part agenda to generate more complete and relevant insights and drive the business transformation needed to turn the insights into action. The goal is a collaborative hub where marketing, sales, finance, and other functions use consistent KPIs to set the spending mix that best supports the company strategy.

- Build holistic and actionable measurement capabilities. Covering all channels and touchpoints means going after new data sets and partnering with new types of providers, such as retail distribution networks. Along with improving the analytics, better, fresher, and more transparent data builds trust with partners. It also lays a foundation for the company’s AI journey.

- Build best-in-class decision-support capability. Timely decisions require specific knowledge of how company strategies and brands relate to different touchpoints, which no off-the-shelf tool can offer. Both marketing and nonmarketing analytics should connect in a single decision platform. Scenarios should not only simulate the short-term sales gains a spending mix might produce but also provide insights into how brand investments can support future growth.

- Champion close collaboration among marketing, finance, and sales leaders to de-silo decision-making processes. The C-suite needs to define governance, de-silo decision-making, and oversee development of a new, data-powered iterative process tied to the complete budget allocation cycle. The new setup must integrate all commercial levers (price, promotion, and all forms of media) and incorporate input from agencies and analytics vendors (if any). Both partners and internal teams should be incentivized to use data and insights in decision-making. A transparent mechanism for tracking value achieved will support continuous improvement.

- Foster a commercial-effectiveness culture within marketing. Marketing teams need training and assistance to meet the new expectations and move beyond default allocations. They also need to develop a continuous improvement capability, establishing a feedback loop between decisions and their impacts, and integrating these learnings into subsequent action plans.