The machinery and automation sector is at a pivotal point. The post-COVID investment surge has ebbed, and the era of low-cost financing has ended. Companies must now adapt to a climate of stalling growth and increased competition. These shifts make one capability more critical than ever: commercial excellence.

Defined as seamless orchestration across marketing, sales, and pricing, commercial excellence typically correlates with above-average growth rates. Yet a new study by Boston Consulting Group found that, while most machinery and automation companies view commercial excellence as key to success, only a small number have mastered this capability and gained the competitive edge that comes with it.

We set out to understand why differences in maturity exist across the various dimensions of commercial excellence, shedding light on the reasons behind the performance gap between leaders and laggards.

Defined as seamless orchestration across marketing, sales, and pricing, commercial excellence typically correlates with above-average growth rates.

This article walks through our findings and brings in lessons from our client work to show what high-performing companies are doing to prevent lead loss, drive better retention and realization, and capitalize on service opportunities.

Many Desire Commercial Excellence, but Few Enable It

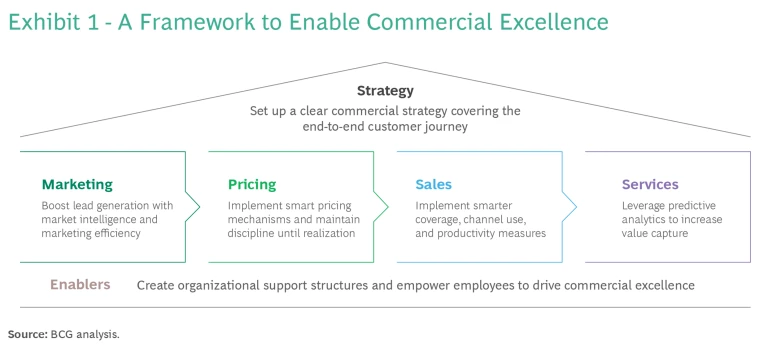

Over the last several months, BCG surveyed more than 20 machinery and automation companies—many of them major global players—examining each dimension of commercial excellence and approaches to strategy development, services, and underlying enablers. (See Exhibit 1.)

We found that an overwhelming majority of machinery and automation companies view commercial excellence to be critical for strong financial performance. And it’s easy to see why. There can be a 15% to 20% difference in revenue between companies operating at an advanced or optimized level and those operating at an initial or basic level. Leaders also gain a 3% to 5% difference in margins on earnings before interest and taxes (EBIT) as well as nearly double the rate of sales productivity.

But only 20% of machinery and automation companies have achieved the advanced level of commercial excellence to derive these benefits. When asked to rank their marketing, sales, and pricing performance based on perceived maturity, 30% of respondents say that their business is in the initial consideration stages, and 50% are in the basic deployment stages.

Only 20% of machinery and automation companies have achieved the advanced level of commercial excellence to derive the benefits.

A key reason for the lag has to do with the unique characteristics of the machinery and automation sector, including the following:

- Technical prowess is a competitive differentiator. Because many machinery and automation products are highly specialized, customers want to engage with individuals who can speak knowledgeably about how a product’s technical attributes can meet their specific needs. As a result, companies generally hire for technical expertise and not for marketing, sales, and pricing expertise per se.

- Companies need scalable approaches that can grow with them. Machinery and automation is a diverse sector and ranges from large, publicly listed companies to small- and medium-size businesses that are often family owned over generations. As a result, best practices in marketing, sales, and pricing can only gain traction if they are accessible to businesses at different stages of growth.

- Services drive a significant share of revenue. Most machinery and automation companies sell products that require substantial capital investment and need ongoing service and maintenance to keep equipment in optimal running condition. During periods of economic volatility, service becomes even more important as customers seek to prolong the life of existing equipment and defer new capital expenditure investments.

- Knowledge of the installed base is essential. Given the significance of service revenues, machinery companies need a complete picture of their installed base. They need to know how many machines and components are in the field, when and where they were installed, and which are due for maintenance.

Companies Can Attain Commercial Excellence with These Steps

With interest rates sharply higher and many customers having already invested in critical equipment replacements, many machinery and automation companies expect a slowdown in revenue growth. That prospect makes it more important than ever for companies to master commercial excellence. Our research and client experience show the following steps can help.

Set a unified strategy. Many manufacturing and automation companies suffer from weak strategic alignment between the business and the commercial organization—and often within the commercial organization itself. Across our clients, it’s not uncommon for marketing to have one set of plans and sales another, each based on its own specific needs and often with only a loose connection to the overall business strategy . As one senior executive we spoke to said, “Distinct commercial strategies often miss the link to the overall strategy.”

Companies that lead in commercial excellence set a unified strategy and prioritize collaboration. They also ensure that sales and support encompass the entire buying journey, from initial purchase to service. In addition, leaders are more likely to segment customers based on value rather than their projected spending or company growth. They then adjust their channel strategy to these segments to ensure company resources are used most effectively. That might mean, for example, providing a dedicated rep to high-value, high-growth segments and self-service options for lower-value segments.

A multinational crane manufacturer increased its EBIT margin by more than three percentage points by creating stronger orchestration with marketing, sales, and pricing. They formed a cross-functional steering group to translate desired business outcomes into specific actions across the commercial organization. The effort led to improved customer segmentation, funnel management, and pricing management .

Companies that lead in commercial excellence set a unified strategy and prioritize collaboration.

Leverage digital marketing and lead generation. Most machinery and automation companies practice the marketing basics. Almost all benchmark their market offerings against competitors on a regular basis. While many feel their companies are successful at product and brand management, the leaders stand out in key areas.

Leaders are more likely than laggards to employ digital marketing techniques to target desired customer groups, increasing their efficiency. They then funnel these insights into their lead generation and next-best-action engines, allowing marketing and sales to be more predictive and proactive.

A manufacturer of material handling equipment, for example, recognized that it was underusing three potential sources for high quality leads—its customer purchasing and maintenance data; its construction databases; and its marketing campaign analytics—as a result of weak digitization and integration. The company therefore overhauled its lead-handling process, expanding the role of inside sales and acquiring new service analytics, lead screening, and marketing automation capabilities. The improvements have allowed them to sync and score leads more effectively—and have already led to EBIT gains of $15 million to $20 million.

A manufacturer of material handling equipment recognized that it was underusing three potential sources for high quality leads.

Create tailored production and sales incentives. Determining the right number of “feet on the street” can be a struggle for all machinery and automation companies. But leaders find ways to effectively allocate resources. Compared with the median company, these organizations are more likely to invest in inside sales functions and data-enabled sales—capabilities that provide more reach and flexibility.

Leaders shine most in creating tailored incentives to ratchet up sales performance. These companies go beyond basic bonus schemes to create individual and team-based development plans that tie performance to the business’s strategic goals. This is where we observe the largest gap between leaders and laggards among our survey respondents.

The most effective plans are holistic, encompassing, tailored development strategies, including financial rewards as well as other forms of recognition such as a dinner with the CEO for top performers. As a senior executive told us, “The incentive scheme and bonus system need to drive desired behavior in line with business objectives and strategy.”

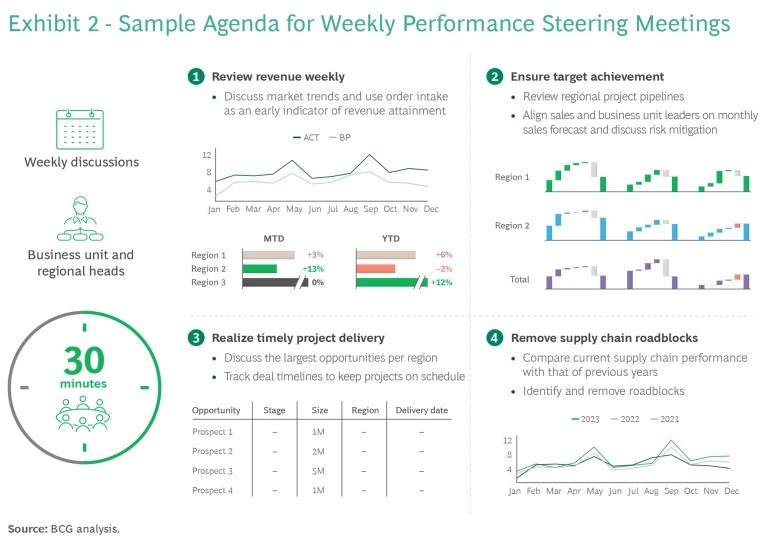

Leaders pair strong incentives with strong performance management within their companies and across their partner networks. Maintaining a regular review cadence or “sales drumbeats” can help machinery and automation companies create a performance culture. A hydraulics manufacturer instituted a year-long “sales push” program. Managers set up weekly drumbeats for each region and business unit where they reviewed revenue and order intake and other KPIs, refreshed targets and account priorities, and resolved roadblocks. (See Exhibit 2.) Distributors and resellers were included in the drumbeats and seen as an extended sales arm. This weekly cadence increased accountability throughout the sales funnel and resulted in significantly more leads, quotes, and revenue. In our experience, a best-in-class setup can increase inbound leads by 10% to 25%, improve lead-to-opportunity conversion rates between 1.5 and 3 times, and reduce sales cycle times by 10% to 20%.

Lastly, leaders also improve their seller productivity significantly by allocating resources based on quantitative opportunity analysis. They optimize coverage based on a clear view of their market share growth potential across territories and segments, and they help new sales staff hit the ground running quickly by equipping them with specific business cases.

Boost your pricing game. Across machinery and automation, companies told us they struggle to align their pricing models with their commercial strategies or with changing macroeconomic conditions . Nearly all respondents, including leaders, rated pricing governance as among their weakest capabilities. “We are good at updating list prices regularly,” a chief sales officer said, “but poor when it comes to tracking realization.” Our analysis shows that companies that give salespeople broad pricing freedom significantly underperform those that rigorously and promptly track the implementation of new price levels.

These self-inflicted wounds can be fixed, however. As leaders in other industrial sectors have shown, tracking price realization can help companies acquire greater pricing discipline. One fast-growing B2B in the mobile hydraulics sector integrated its customer relationship management system into its discount matrix platform, which requires that sales reps enter information such as conversion probability and lead stage into the system before they can obtain pricing approval. This integration creates a “push” and “pull” for sellers, mandating data inputs that help leaders minimize discounting disparities while providing sellers with the pricing insights they need to achieve their targets more effectively.

In the simplest cases, companies can use basic spreadsheets to identify realization outliers. More advanced initiatives can employ AI-based web-scraping tools (many available from third-party vendors) that can track competitor prices on the internet.

Maximize service revenue from your installed base. Many machinery and automation companies fail to exploit their service businesses to their full potential. One senior executive told us, “While most of our service revenue originates from customer requests, we are struggling to sell services proactively.”

Leaders use targeted sales campaigns to grow top-line revenue systematically—even if they are starting from a very small base.

Building an installed base is often viewed as a technical exercise, but leaders approach it as a strategic exercise. They use targeted sales campaigns to grow top-line revenue systematically—even if they are starting from a very small base. For example, a specialty gear manufacturer built an installed base from scratch during an intensive four-week effort, using purchasing data and other information to map out the number of components in the field and the lifetime and service histories of various parts. That investment paid off—improving sales rep efficiency by 20% and service revenue by 5% to 10% over previous levels.

Digitization and AI are key levers to build an installed base and increase service revenue by connecting customers’ assets and maximizing their value. A major manufacturing and automation company grew its services sales by 17% in 2022 after a concerted push to deploy telemetrics across its base of connected assets and provide customers with condition-monitoring tools. Such leaders use data from their installed base to identify which customers and segments to approach with specific service levels and warranty extensions.

It's Time to Close the Excellence Gap

This is the time for machinery and automation companies to accelerate their commercial excellence journeys. Here are some questions to help senior management kick-start necessary conversations within their organizations:

- Where do we stack up relative to our peers in commercial excellence—are we in the 20% that lead or the 80% that lag—and what can we do to start earning materially higher revenue, EBIT, and productivity?

- How can we forge tighter integration between the business strategy and commercial strategy? What two or three steps could we take today to improve how we prioritize opportunities and work collaboratively?

- What digital marketing techniques are we employing today, and what difference could generative AI make in enabling more predictive and automatable lead generation?

- Where is our pricing discipline breaking down, and what practices could we implement to improve revenue and sales efficiency?

- What near- and longer-term initiatives could we pursue to exploit the full potential of our installed base?

Our research shows that commercial excellence is both imperative and attainable. Machinery and automation companies that lean into the necessary marketing, sales, pricing, and service capabilities can gain measurable competitive advantage now and secure their long-term success.