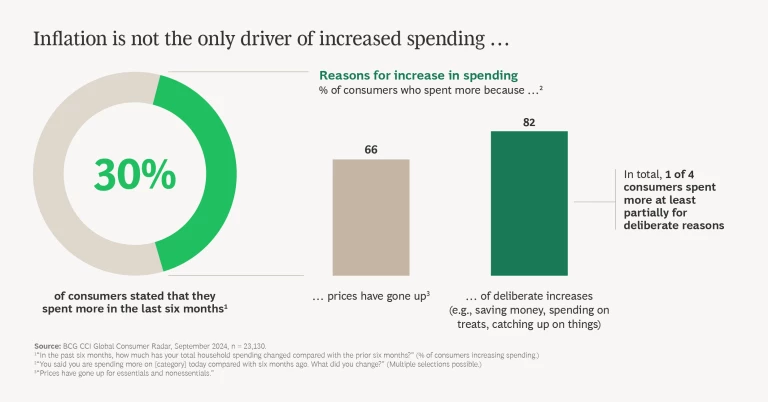

Inflation is not the only reason why consumers increase their spending. As it turns out, many consumers also deliberately choose to spend more. Why? Because they feel good about their income and savings, because they have good job prospects, because they enjoy spending on things they couldn’t previously afford, or because they just want to treat themselves.

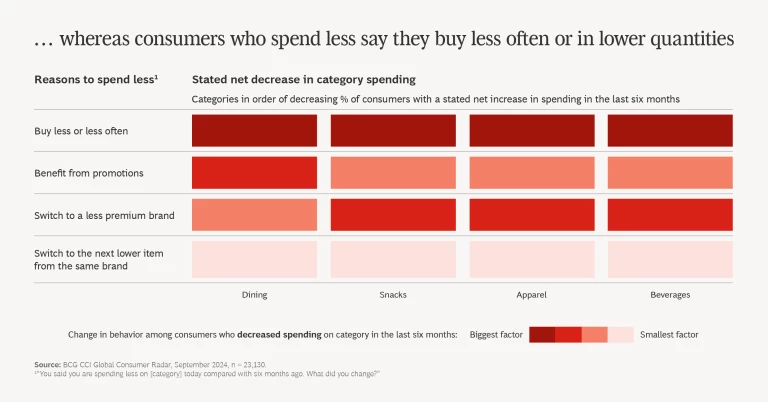

Of course, for consumers, inflation remains a very real challenge. Consequently, some people spend less on certain product and service categories as they adapt their shopping habits to counter the effects of inflation or to deliberately reduce their spending. For brands, inflation is a challenge as well: it’s hard to uncover sources of growth in such an environment.

But our research shows that when consumer spending shifts, for whatever reasons, brands can develop growth strategies. (See “

About Our Research

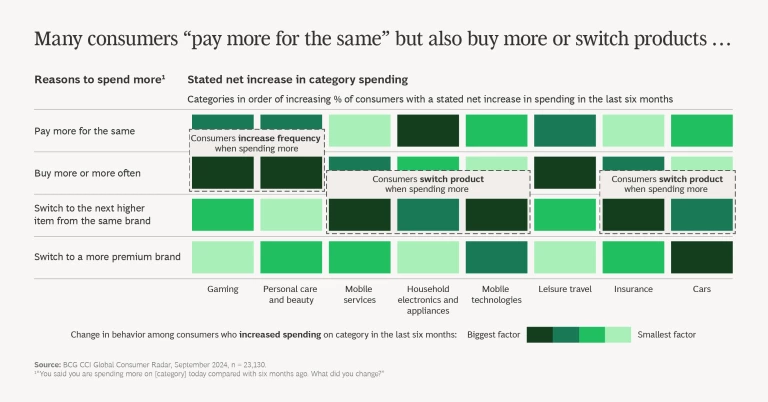

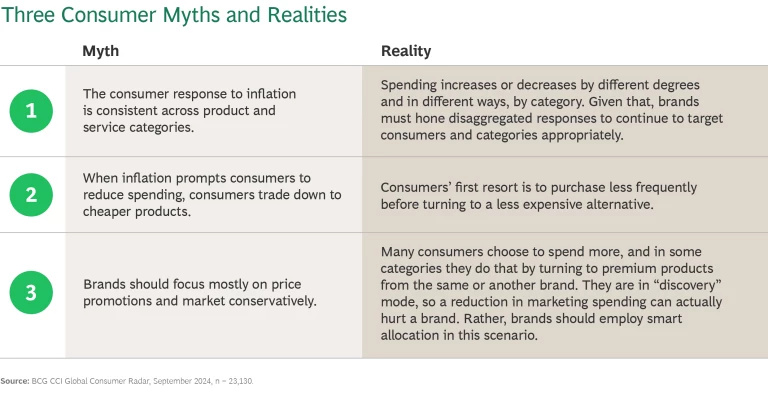

.”) The key is to understand those reasons: What motivates consumer behaviors? Changes in consumer behavior involve shifts in purchase frequency and willingness to explore new products—trading up, within the brand or beyond it. Brands can respond by finding ways to maximize uptake of their products and tailor touch points to encourage the most relevant purchases.

How Spending Differs

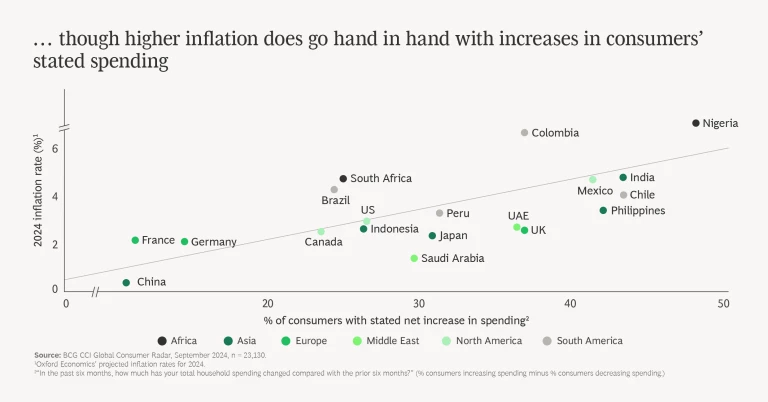

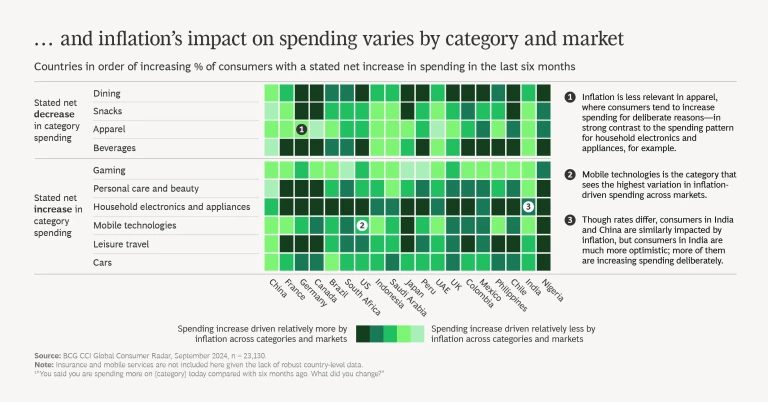

Inflation impacts consumers around the world. It correlates with higher spending but differs across categories and markets. For example:

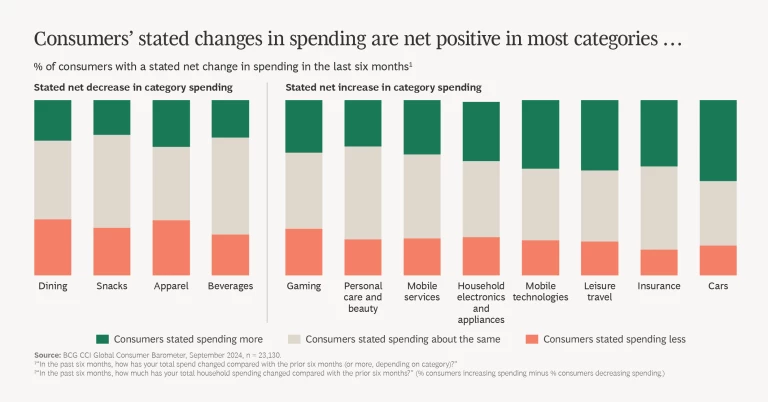

- For those who increased their spending on apparel, inflation is not the strongest driver; rather, consumers increase spending in this category more for deliberate reasons—in strong contrast to, say, household electronics and appliances.

- Though consumers in India and China are similarly impacted by inflation (inflation rates in the two countries differ but the responses by category follow the same pattern), those in India are much more optimistic, with more consumers saying they are increasing spending deliberately.

Thirty percent of survey respondents told us that they are spending more across the categories we researched. They cite higher prices as one reason for the uptick in spending, yet 80% actually opt to spend more. Overall, this means that one of four consumers across markets increase spending because they choose to do so.

Lessons for Brands

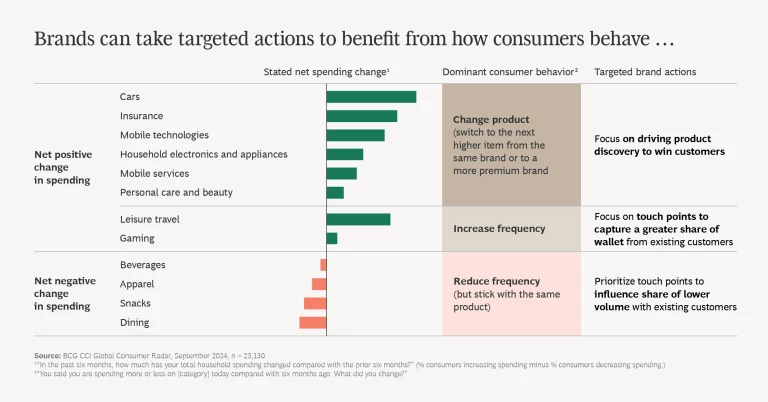

Brands can capture opportunities from nuanced shifts in consumer spending, especially when they rely on true consumer patterns rather than conventional (but sometimes erroneous) wisdom, as our research shows.

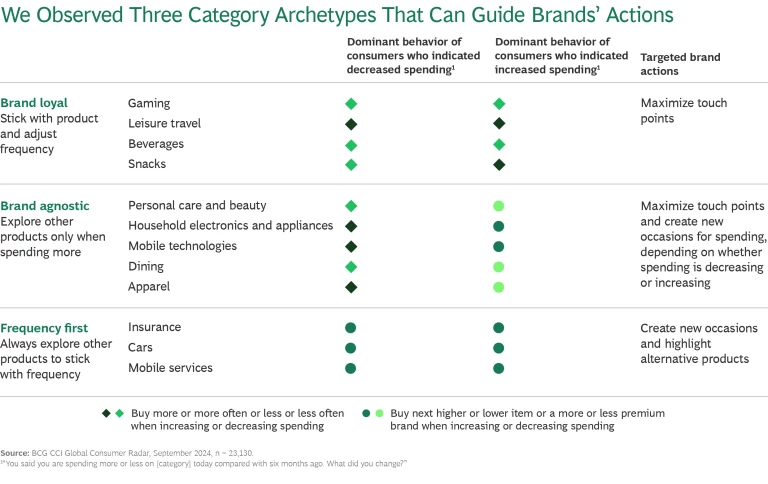

Our look at category differences allowed us to develop several actionable category archetypes. (See “Three Category Archetypes.”)

Three Category Archetypes

Brand Loyal. In some categories, consumers want to keep buying the same product but spend more or less by adjusting purchase frequency. To tap these consumers, brands can focus on maximizing share from existing customers and creating new occasions to attract new buyers.

Brand Agnostic. In some categories, consumers will explore other products when confronted with the opportunity or need to spend more or less. In these scenarios, brands can focus on devising occasions for consumers who will spend more and increasing touch points with those who will spend less.

Frequency First. When purchase frequency rules, consumers will change products to meet their desire or need to spend more or less. Brands can focus on creating new purchase or consumption occasions and emphasize alternatives for trading up or down.

Accordingly, brands can take action:

- For categories where consumers say they are spending or are likely to spend more on a higher-priced product, such as personal care and cars, brands can find ways to create new purchase or consumption occasions to win new customers.

- For categories where consumers say they spend more or are likely to spend more by buying more frequently, such as leisure travel and gaming, brands can focus touch points to win a greater share of wallet as customers satisfy their increased demand and embrace new occasions for spending.

- And for categories where consumers say they are spending less or are likely to spend less, such as snacks and dining, brands can also rely on increasing and tailoring touch points, such as offering rewards and loyalty programs, in this case to influence the continued spending of existing customers.

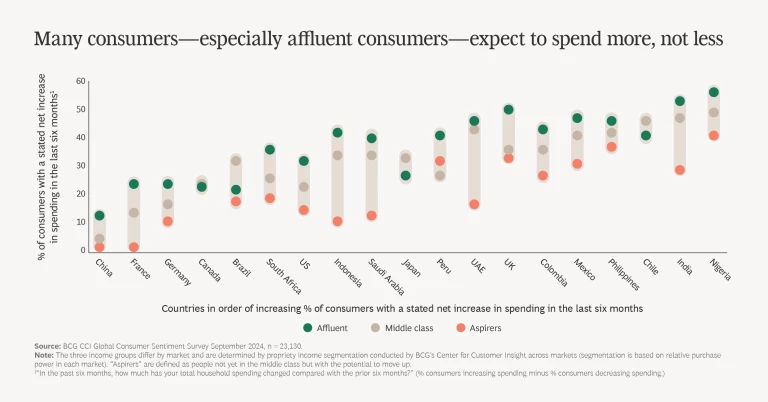

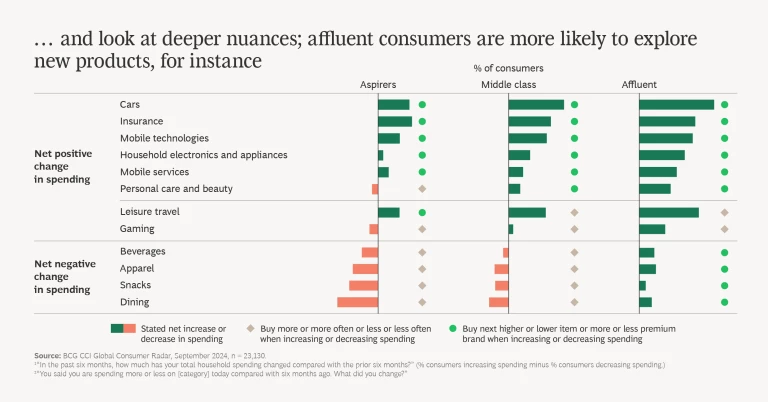

From there, brands can look at greater nuances. For example, a deep dive into the affluent segment reveals that these consumers spend more on snacks and beverages and are more likely to explore other products, whereas middle-class consumers and aspirers spend less and buy less often when it comes to this category. Higher-income consumers are going to buy potato chips more often and are more likely to buy, say, artisanal, premium-brand chips. Middle-class consumers and aspirers will buy less often. Brands are thus vulnerable to losing sales from affluent customers who opt for other brands and other customers who opt to purchase chips less often.

Of course, inflation and other global trends will continue to have ongoing effects on consumers and how, where, and why they spend their money—or don’t. Our global consumer sentiment surveys and analyses will continue to track sentiment across markets, categories, regions, and income segments.

About Our Research

- Brazil

- Canada

- Chile

- China

- Colombia

- France

- Germany

- India

- Indonesia

- Japan

- Mexico

- Nigeria

- Peru

- Philippines

- Saudi Arabia

- South Africa

- UAE

- UK

- US

We focused on 12 categories:

- Apparel

- Beverages

- Cars

- Dining

- Gaming

- Household electronics and appliances

- Insurance

- Leisure travel

- Mobile services

- Mobile technologies

- Personal care and beauty

- Snacks