The worlds of operations technology (OT) and information technology (IT) have traditionally existed as separate domains, each with its own technologies, suppliers, and business models. But as manufacturers gather more data from their shop floors and connect it to more machines, they are unlocking troves of data and improving productivity, quality, and

availability

. To speed integration and scale the benefits so they can run their operations better, manufacturers are increasingly demanding that their traditional IT and OT providers join forces to deliver products that can be connected.

For companies that sell equipment and software to manufacturers, designing and delivering these integrated solutions is a challenge, but also an enormous opportunity to tap into new value pools worth billions of dollars. To succeed, they will need to consider how best to enter this growing field (buying, building, or partnering), how to adapt their

go-to-market

approach, and how to adjust their internal ways of working. The competitive environment includes not only established providers of automation and industrial software, but also digitally native scale-up companies.

While IT/OT convergence has been discussed and gradually implemented over the last decade, recent technology developments, most notably rapid AI advances , are finally accelerating the transformation. We expect that adoption of converged technologies for greenfield projects will pick up speed—from ~10% today to ~50% within the next five years.

The Need for a New Tech Stack

It’s no secret why manufacturers are demanding these new combined products. In many cases, hardware is reaching its physical limits, and improvements, such as sophisticated quality inspections, are possible only in combination with new software. To boost productivity, manufacturers are also looking to automate the most difficult-to-automate, time-consuming tasks (such as picking unsorted goods and assembling multiple cables to create a wire harness), which cannot be performed without a more converged IT and OT stack.

Hardware is reaching its physical limits, and improvements, such as sophisticated quality inspections, are possible only in combination with new software.

In addition, manufacturers want and need to innovate faster by moving from the traditional waterfall approach, which too often delivers fragmented data and limited agility, to a flexible production system with cross-functional collaboration and integrated data flow from product design to process engineering and line automation. Their engineers face a myriad of complex parameters. With an integrated IT/OT solution, they can accomplish two separate but connected goals: achieve more efficient (and sustainable) production through process optimization; and develop more sustainable products by simulating the environmental impact of a product design along the supply chain and manufacturing processes.

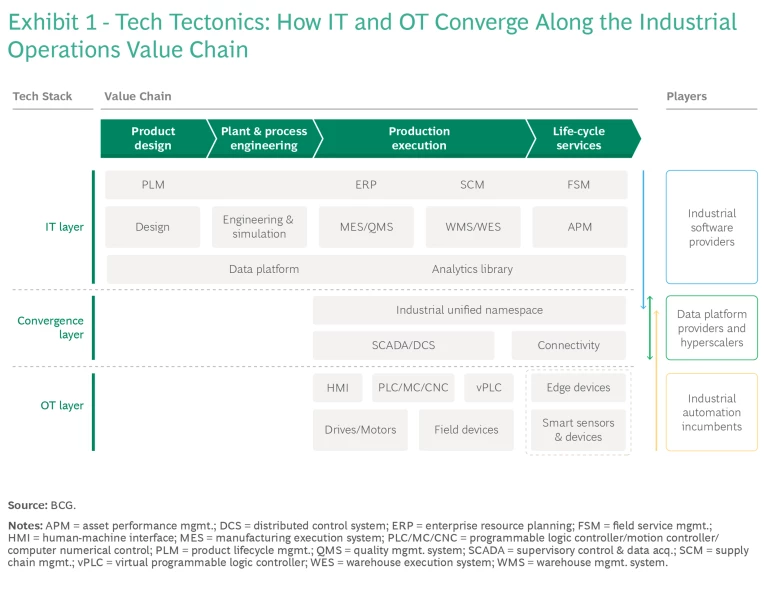

To address these needs, manufacturers must reorder their technology stack, converging IT and OT. While a fully converged tech stack is not a reality yet at scale (see Exhibit 1), there is clear evidence in many manufacturing plants that the IT and OT layers are moving closer together. Industries such as biopharma, automotive (both new Asian electric vehicle manufacturers and Western premium OEMs), and electronics/semiconductors, as well as warehousing and water treatment, are early adopters of converged IT/OT technologies. For example, Merck Group has deployed Module Type Package (MTP) for a fast and efficient interaction between production and R&D. And Audi is virtualizing its shop-floor automation for greater efficiency and increased flexibility for changeovers and upgrades.

Meanwhile, industrial edge automation, which leverages the cloud, is attracting many startups and is expected to become a $30 billion market in 2025. Startups are also focusing on the convergence layer—the glue that connects a diverse set of OT data sources on the shop floor and then enriches the data with tags from the industrial unified namespace to use the data in state-of-the-art IT solutions.

Unlocking New Value Pools

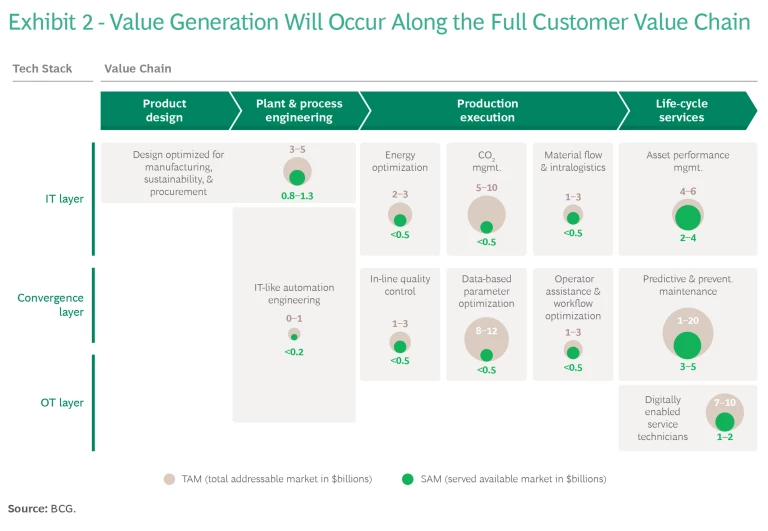

As IT and OT converge and the revamped tech stack takes shape, new use cases will emerge. Value pools worth around $60 billion will be up for grabs, suggesting that potential revenue for IT and OT players is much higher than the served available market using current business models. Most of these value pools are new, and the value of some existing value pools will shift as IT cannibalizes various OT functions (for example, using machine vision and fault detection algorithms for inspections).

As IT and OT converge, new use cases will emerge. Value pools worth around $60 billion will be up for grabs.

We have identified 11 primary value pools that IT and OT players can capture (see Exhibit 2). Some of these are well known and often implemented, such as predictive maintenance and asset performance management. But we’ve identified three in particular that many suppliers can tap into—areas where solutions are readily available and where customer needs are largely unmet.

IT-like Automation. The age of OT-specific programming languages for industrial controls and engineering tools is coming to an end. New talent entering the engineering workforce from college wants to apply IT-like development methodology, and the industry will increasingly adopt DevOps methodology and tools as well as high-level programming languages. Given that about 70% of system integration costs are labor related, we predict that IT-like automation represents a value pool worth approximately $500 million. And that figure doesn’t include the additional potential within manufacturers’ in-house automation teams.

Digitally Enabled Service. Industrial operations are highly dependent on experienced service technicians to keep production lines up and running. But these technicians, with know-how built over decades, are retiring, and available talent is both inexperienced and in short supply. Digitally enabled service can alleviate this problem in two ways: by formalizing knowledge sharing and making service technicians more efficient (by leveraging generative AI to facilitate service documentation and writing reports, for example). Since manufacturers can have hundreds of technicians at each plant, the cost savings from digitally enabled service solutions could add up quickly. We expect that this service could represent a $7 billion to $10 billion value pool.

In-line Quality Control. Quality inspections are time-consuming and often disrupt the flow of production. But they are necessary. Even with the most high-tech production equipment and highly skilled labor, quality defects will inevitably occur. New technologies, such as intelligent vision systems closely connected to the production equipment, enable quality inspections within the production process. New IT/OT systems can be synthetically trained to detect defined and specified defects as well as a large variety of deviations. We estimate that the integration of less-costly in-line quality control could represent a $1 billion to $3 billion opportunity.

New Ways of Running the Business

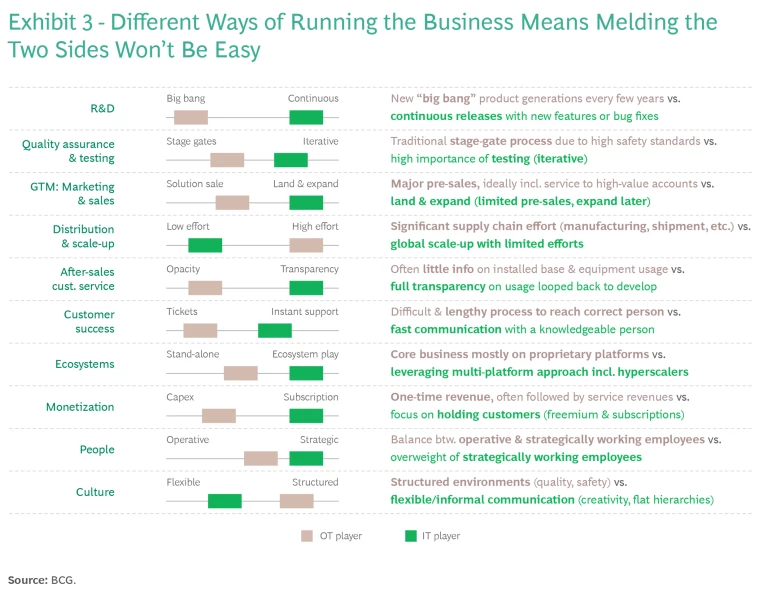

To properly serve their manufacturing clients and tap into these value pools, IT and OT players will need to work together as never before since both sides have capabilities critical to the effort. Melding the two won’t be easy, and it is important to understand that convergence involves not only a change in the technology landscape but also in how to run the business (see Exhibit 3).

For example, in the realm of R&D, OT players typically deliver a “big bang” product upgrade every few years while most software players (especially SaaS) deliver bug fixes and new features every few days or weeks. Going forward, OT will need to work harder to stay continuously connected to the customer to understand usage better and gain insights into how to improve products more frequently.

In terms of revenue, OT players still mostly rely on a one-time, “sell and forget” sales approach followed by service revenue. In contrast, software players usually leverage subscription models and a “land and expand” sales approach with a small solution followed by continuous upselling. In the near future, OT will need to emulate the IT model—to lean more on subscription renewal and upselling for revenue.

The bottom line is that convergence will transform the way companies innovate, build and sell products, and incentivize the workforce. These changes pose something of an “innovator’s dilemma”: how to manage the portfolio mix shift from software controls embedded in hardware and monolithic operations software to virtualized controls and a modular SaaS offering that connects to third-party software through open APIs—without losing revenue and market share.

Accessing the Opportunity

Looking forward, there are a few next steps that IT and OT players should take as they consider how to better serve their manufacturing customers and access the value pools that convergence will make possible.

Define the playing field. First, each company needs to decide where to focus—based on the customer segment it wants to target and its own capabilities—and then set the direction of its IT/OT convergence.

Define the strategic approach. Each player must decide whether to build, buy, or partner to access value pools. The latter two are generally the best way to accelerate change (see the sidebar). As part of this calculus, every organization needs to understand which elements of the tech stack and go-to-market it must own to protect its right to play and customer relationships. While many of these tie-ups have failed in the past, they can be enormously successful when the ground is carefully prepared.

Overcoming Contractual Barriers

The IT/OT convergence can also be mobilized from the IT side. Autodesk, founded in 1982 with a focus on CAD software, moved steadily toward the manufacturing space by acquiring multiple smaller players (including Delcam, Prodsmart, CIMCO, and FlexSim). In addition, Autodesk partners on its platform with third-party IT (Cadence, Ansys) and OT (Mazak, Haas) players to achieve an “open horizontal toolchain” for engineering and manufacturing.

A partnership is also an efficient way to accelerate access to emerging value pools. For example, in 2019, DMG MORI, one of the top three machine tool manufacturers globally, partnered with Tulip, a digital native that founded a no-code platform for manufacturing data and app development. DMG MORI customers can customize Tulip apps to orchestrate the entire production process on their DMG MORI machine tools, monitor and increase the productivity of their legacy machine tools, and optimize production outside the machining area. Tulip has become a core pillar of DMG MORI’s digital offering, and the companies have a joint go-to-market strategy, leveraging DMG MORI’s global sales footprint.

Define how to run the business. Players are typically experienced in developing and selling either OT or IT, but not both—yet convergence requires that each side adapt to fundamentally different customer expectations and revenue models. Given the dissimilar skill sets and cultural backgrounds in these different functions, not all of the changes can simply be implanted into existing structures and teams. Companies need to run a “dual track” with dedicated OT and IT teams, but with new structures and principles to foster collaboration, trust, and transparency across organizational units.

IT/OT convergence can address the major challenges that manufacturers face while also unlocking new value pools for IT and OT players. As we’ve noted, we expect more than 50% of the greenfield projects over the next five years will leverage the evolving IT/OT tech stack. Now is the time for incumbent players to begin securing their share of business and shaping the emerging ecosystem—or risk losing relevance.