Many firms have invested heavily in their commercial tech stacks over the past two years, but more than half have failed to unlock sufficient value, whether through sales uplift or cost savings. To understand the root causes of this underperformance, BCG surveyed 100 chief information officers (CIOs), chief commercial officers (CCOs), and sales leaders in European companies.

Many firms have invested heavily in their commercial tech stacks over the past two years, but more than half have failed to unlock sufficient value.

The study validated our own experience, which has shown that deriving a satisfactory return on investment from customer relationship management spending is primarily a business and governance challenge and not solely a technology one. Costly maintenance, a lack of automation, and a heavy reliance on manually updated CRM data are holding companies back in the short term and over time. Smaller businesses see a drain on the resources they need to drive growth, and larger organizations lack actionable insights because of unclear data ownership, poor data quality, and a one-size-fits-all approach to capabilities.

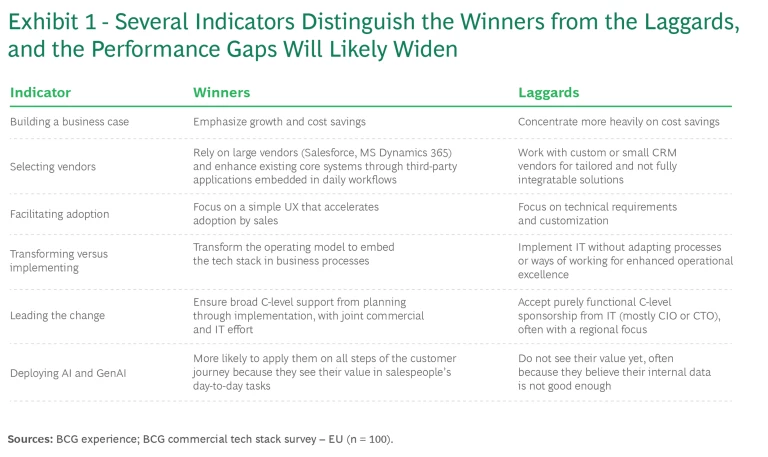

Our study also revealed specific indicators for why some firms consistently create value with their commercial tech stack (we call them the winners) and some don’t (the laggards). We expect the gap between the winners and laggards to widen as the sales process becomes increasingly digitized and companies that can quickly mobilize their go-to-market strategies meet demand with scalable, cost-efficient actions. The winners are already realizing sales growth rates of up to 5% and are locking in significant cost savings through reductions of manual labor, amounting to more than 5% in sales and marketing spending.

Only firms that invest in a state-of-the-art tech stack will be able to support an integrated data, intelligence, and activation layer to implement

generative AI

(GenAI) solutions at scale. The winners will also therefore be better positioned to capitalize on anticipated productivity improvements from

AI

and GenAI, which

could reach 30% to 50%

in organizations that reshape their functions by reimagining and reengineering their workflows. That compares with productivity improvements of 10% to 15% in companies that deploy tools without changing their processes.

What Separates the Winners from the Laggards

As we show in Exhibit 1, several indicators separate the winners from the laggards, according to our survey and experience.

Building a Business Case. The winners develop value-driven business cases with a well-defined ROI upfront, which suggests that they have a clearer view of what will drive more customer acquisition and realize higher customer lifetime value. They measure the success of their CRM investments by looking at the value created rather than cost savings alone. By creating a business case around top-line impact, they emphasize integrating the tools into the business operating model rather than treating the tools as a simple IT implementation.

Selecting Vendors. While the winners use an extensive suite of tools, they favor large CRM vendors such as Salesforce and Microsoft Dynamics 365 over custom or other CRM options. They look for off-the-shelf products they can get up and running quickly, because they are more likely to value these solutions’ ease of use as they integrate the tools into their daily workflows. They augment the products with best-of-breed third-party add-ons but prevent those investments from becoming too costly or fragmented by understanding their value, the speed of adoption, and the cost tradeoffs.

That approach helps explain why 83% of the winners rated their commercial tech stack as state-of-the art across marketing, sales, contract fulfillment, customer support, and business intelligence and analytics, which are the five key customer-related or customer-facing functions that make up the end-to-end process for driving growth. In contrast, only 13% of the laggards made the same claim.

Facilitating Adoption. The winners focus on whether individuals can use the tools easily in their day-to-day work rather than concentrating on what looks good on paper but risks being overengineered. In other words, they consider whether the experience supports the way users work versus whether it forces them to work the way the technology requires. Users sometimes find value in tools that developers might consider too simple. That explains why the winners design with the users’ value in mind, and then test and iterate the design of the user experience (UX) during deployment.

The laggards tend to underestimate the importance of UX design in facilitating adoption and the importance of change management throughout the implementation. The change management program should have a commercial focus, not just a technical one, and should have full C-level commitment with sufficient budget support.

While the winners’ deployment of multiple tools suggests a high level of maturity, it also presents challenges in processes, data, training, and tool proliferation. That is why these companies offer sufficient ongoing training and support in using the products day-to-day. This extends beyond how to apply the tool; it incorporates ways to accomplish commercial objectives and highlights the value of adopting new behaviors—and measuring the level of adoption. One respondent in our survey says their organization’s success in achieving a superior ROI depends on being “brutal with simplification during execution with the business: zero customization allowed.”

Transforming Versus Implementing. The winners unlock more value because they see an advancement in their tech stack as a business transformation that starts with redesigning processes and ways of working and then builds the technology around users’ needs. The laggards focus more narrowly on IT implementation and view integration as an end rather than a means. One respondent expresses this difference by saying that “a CRM integration is not the integration of a tool but the redesign of an organization.”

The winners combine new tools with new processes by focusing on how sales and marketing work both individually and collaboratively. This means they tend to involve users such as sales and marketing practitioners directly in the transformation, rather than working primarily with sales operations. A transformation also leaves them better prepared to tap the potential value of AI and GenAI applications, which continue to evolve rapidly.

The winners combine new tools with new processes by focusing on how sales and marketing work both individually and collaboratively.

Leading the Changes. Most companies believe that their leaders are the best promoters of digital tools, but this is even more pronounced among the winners. They often have a growth-oriented business leader as the sponsor instead of relying on the IT organization, which tends to focus more on time and cost management. We recommend an ownership approach that is business-led and IT-driven, with strong involvement from the business side of the C-suite.

The IT team is necessary to implement the new tools, but the business needs to set the objectives, prioritize the value levers, define the capabilities and requirements to serve the business, manage the speed of the transformation, and own the value realization. This focus ensures adoption and prevents conflicting priorities as the company progresses through the transformation.

Deploying AI and GenAI. While most companies agree that AI and advanced analytics help to accelerate value growth, the winners are more likely than the laggards to see the value of AI and advanced analytics in salespeople’s day-to-day tasks. This is where the gap between the winners and laggards may widen the fastest. Organizations with a high level of AI maturity test and scale use cases more rapidly and efficiently and therefore achieve significant benefits faster. They are more likely than the laggards not only to apply these tools on all steps of their customer journey but to integrate them into their core processes.

Companies that view their CRM as a key enabler of go-to-market agility, instead of an IT-owned system of record, are also more likely to understand that technology is only a small part of how a firm derives value from AI and GenAI. In line with BCG’s 10/20/70 rule , organizations seeking to harness GenAI’s full potential should dedicate only around 10% of the effort to algorithms and 20% to data and the tech backbone, but 70% to a full-scale operational transformation.

Subscribe to our Marketing and Sales E-Alert.

The CRM Transformation of a Global Tech Company

The indicators we described can serve as a tool for gap analysis and goal setting as a company seeks to increase its revenue efficiently. One large tech firm with a vastly superior product had expanded so rapidly that it felt little pressure to invest in its tech stack. By the time competitors caught up and revenue growth stagnated, the now 20-year-old tech stack had become an impediment to sales and revenue growth.

Because it no longer had a product that sold itself, the company needed to transform its business operations quickly with tools and processes that salespeople would embrace, that laid a foundation for another long phase of growth, and that could flex and adapt as the firm increased its application of AI and GenAI.

The transformation started with a business case that laid out the rationale for growth. The ambition called for a new tech stack to help the company achieve higher growth rates, support faster time-to-market for its products, and free up the salesforce for more value-added work. In addition, the new tech stack needed to work in unison with structured sales processes and guidelines, which the firm had seen no need to put in place during its initial phase of rapid growth.

Making that successful transformation required the right vendor selection, broad C-level support, and sufficient training and attention to users’ needs to facilitate adoption. The company chose a Salesforce solution that was 80% out of the box and 20% customized, and then supplemented it with third-party tools to make its salespeople more efficient. The seven product teams were divided up—according to their needs and the desired capabilities—under the joint leadership of a product manager and IT team, which ensured that the business owned the process.

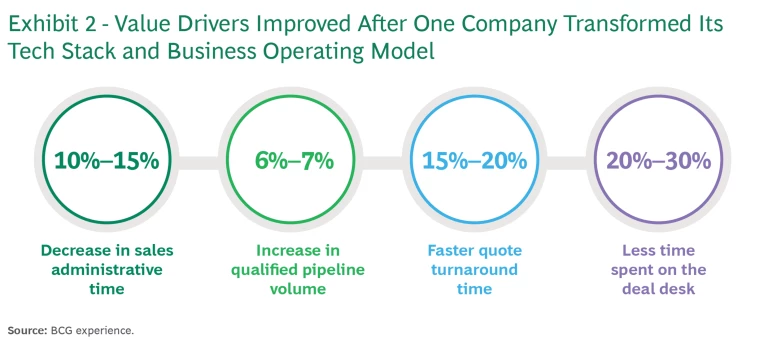

Exhibit 2 shows the outcomes the company achieved through its transformation. The quick and seamless integration of tools and processes that salespeople actively used enabled the organization to turn its tech stack from an impediment into a competitive advantage.

Given the accelerating speed of tech and data innovations—many of them enabled by GenAI—we recommend that companies take a step back to formulate their future vision for tech-enabled sales, marketing, and service functions.

Once they have clearly defined their strategic objectives and value levers, companies need to assess how well their commercial tech stack capabilities are aligned with those value drivers. The key question is whether the existing roadmap for future investments addresses critical enablers such as front-line commercial practices and ways of working from a user-centric perspective. On the basis of that assessment, the company should prioritize the highest-value opportunities, which are the ones that will create the excitement that facilitates faster adoption and drives a higher ROI.

That lays the foundation for transforming the operating model to drive continuous innovation and advancements in the commercial tech stack and related business practices, in line with the principles we described above—led by the business, driven by the user experience, supported at the C-level, and measured against a business case focused on value creation, not only on efficiencies.