Dealmakers across the globe face intensifying challenges in structuring and executing transactions. Regulators in major jurisdictions, including the US, the EU, the UK, and Australia are adopting more aggressive stances. At the same time, countries are implementing protectionist measures that in many cases target specific industries. Against this backdrop, dealmakers must also cope with the uncertain implications of this year’s elections. (See “A Year of Elections Heightens Uncertainty.”)

A Year of Elections Heightens Uncertainty

New governments might reassess trade agreements, impose tariffs, or renegotiate existing deals, creating a more unpredictable environment for cross-border transactions. Similarly, changes in antitrust enforcement, driven by new administrations’ potentially more aggressive stances, could disrupt established practices in the sectors of big tech or biopharma or for large companies across industries. The result could be significant corporate reorganization through divestments or spinoffs.

The political orientation of new governments could have substantial consequences for market openness. Leaders with a protectionist agenda will seek to restrict market access for foreign investors and complicate cross-border M&A. Conversely, those preferring globalization will encourage deregulation and open markets, potentially stimulating M&A activity but also introducing volatility as policies shift.

Investors are closely watching the foreign policy implications of this year’s elections, especially in light of existing global tensions. Evolving foreign policy priorities will significantly affect relationships between major economic powers, adding another layer of complexity for dealmaking.

Despite the regulatory and geopolitical risks, approximately 90% of deals worldwide proceeded to closing from 2018 through 2022. Nevertheless, uncertainty about timelines has factored into dealmakers’ financial and strategic assessments. The heightened complexity of integration planning has taken a further toll on employees and other stakeholders.

A recent BCG study analyzed how these challenges affect the timelines and complexity of closing large

M&A

deals. The study produced three main findings:

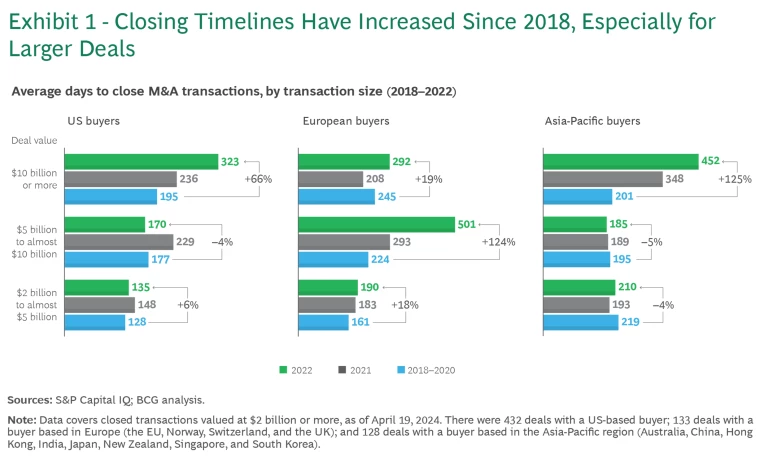

- For deals larger than $2 billion, the period from signing to closing increased in the US and Europe from 2018 through 2022. On average, deals exceeding $10 billion in value took 27% longer to close than those valued between $2 billion and $10 billion.

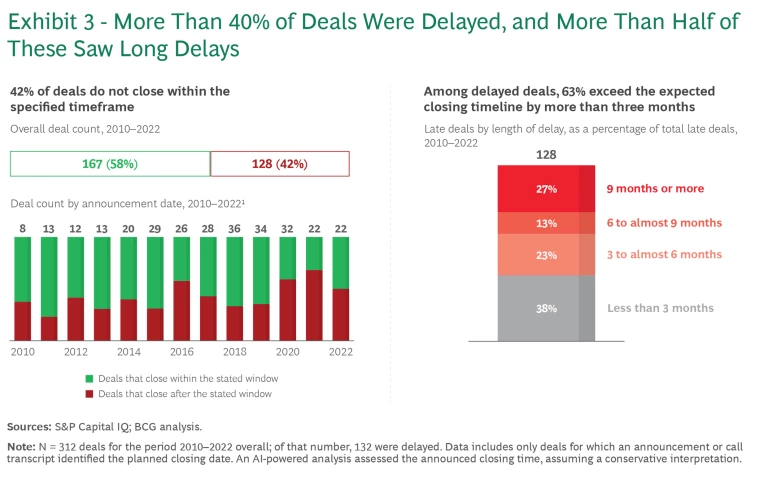

- Approximately 40% of transactions took longer to close than the timeline estimated in the deal announcement.

- Transactions with higher announced synergies, either as a percentage of deal value or in absolute terms, took 30% longer than others to close.

Dealmakers must account for timing uncertainty in order to maximize deal value and the employee experience. This entails adapting their integration planning processes and priorities during both the presigning and integration planning phases.

Deals Are Taking Longer to Close

Globally, the period from signing to closing for deals exceeding $2 billion increased by 11% from 2018 to 2022, reaching an average of 191 days. We see some variation in the data across deal sizes. For example, the largest deals tend to take the longest to close, with timelines increasing by double digits. (See Exhibit 1.)

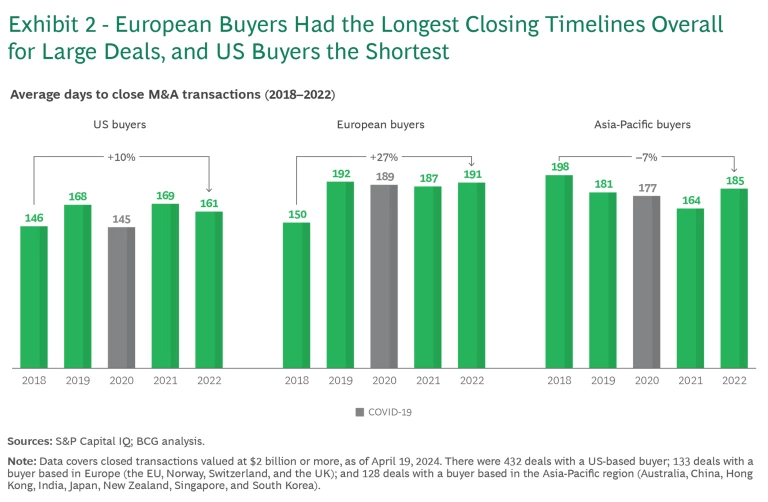

There are also regional differences . For example, on average, deals with a European acquirer have the longest closing timelines, while those with a US buyer have the shortest—although timelines are increasing in both regions. (See Exhibit 2.) In contrast, overall timelines for Asia-Pacific dealmakers are decreasing.

In addition to discerning longer closing timelines, our analysis found higher termination fees. (See “Termination Fees Are Rising.”)

Termination Fees Are Rising

From 2021 through 2023, termination fees paid by US buyers reached approximately 4% of deal value, compared with 3% from 2016 through 2020. In contrast, termination fees paid by US sellers have remained relatively stable, increasing from 2.2% in the earlier period to 2.5% more recently. In Europe, buyer termination fees have been more volatile— peaking at 6% in 2022 before returning to the pre-pandemic level of approximately 3%.

The rise in US buyer termination fees reflects growing uncertainty around deal closing. Sellers are using their negotiating leverage to secure greater financial protection in case the deal they have entered into does not close—for example, owing to regulatory complications.

Timelines Are Longer Than Expected

Our study also sought to understand how companies communicate estimated closing timelines and how these estimates align with actual outcomes. To gain insights, we conducted a generative-AI -based analysis of 175 documents published on the announcement day. These included both official deal announcements and transcripts of investor presentations. We applied a conservative interpretation of the announced closing timelines—for example, we interpreted “closing in Q1 2024” to mean closing by March 31, 2024.

We found that approximately 40% of deals did not close within the timeline specified in the documents. Almost two-thirds of these tardy deals required an additional three months or more to close. (See Exhibit 3.)

The most common reasons for the delays were regulatory issues and the complexity of deal structures. Our findings highlight the challenges that dealmakers face in accurately predicting the time frame from announcement to closing, effectively communicating this to investors, and successfully defining an integration plan.

Higher Announced Synergies Correlate with Longer Timelines

Synergies generally are crucial for dealmakers because they indicate the financial value created by merging the two companies. Similarly, publicly announced synergies provide a way to communicate the deal’s economic benefits and rationale to investors. Previous BCG research found that investors usually reward deals in which the parties include synergy estimates in the announcement because these figures provide insight into the magnitude of the potential value creation.

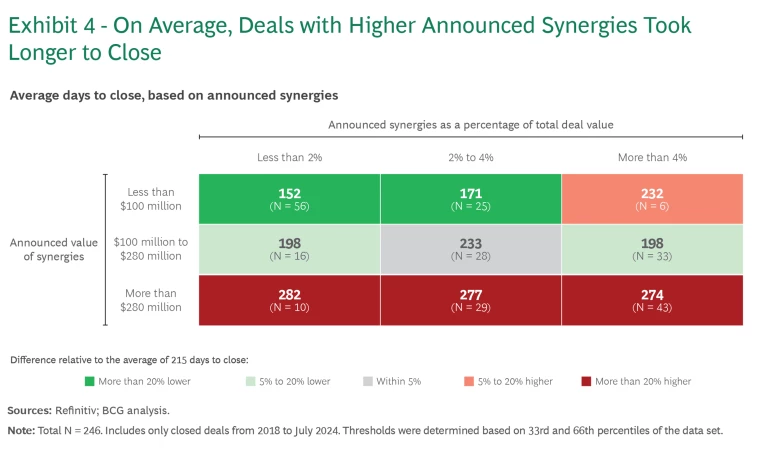

Is there a connection between announced synergies and closing timelines? Our analysis of 246 global deals confirms such a linkage. We measured announced synergies in two ways: as a percentage of total deal value and as the absolute amount of synergies estimated on the announcement day. For both metrics, we examined the top, middle, and bottom thirds of the data range.

Not surprisingly, in cases where the percentage of deal value and the absolute value of announced synergies were low, the average closing time was lower than the overall average. But as the relative and absolute synergy values increased—whether for each metric individually or in combination—the closing times rose to significantly higher numbers than the overall average. (See Exhibit 4.)

Several factors explain the relationship between synergies and closing timelines. Larger deals often have larger amounts of expected synergy, and such deals naturally take longer to close owing to their complexity and scale. In addition, higher absolute levels of synergy attract greater regulatory scrutiny, as authorities examine the sources of these advantages to test for compliance and feasibility. Feasibility inquiries may include evaluating whether the merger’s perceived benefits are likely to outweigh the regulators’ concerns. This more thorough examination creates the potential for delays, making close timelines uncertain.

Addressing the Uncertain and Prolonged Timelines

The delayed closing timelines that our study confirms introduce several risks that affect integration planning and execution. Chief among these are the slower pace and smaller magnitude of synergy capture, resulting from planning constraints, changes in deal parameters, or developments in markets over a longer time frame. Other common risks include higher costs for legal counsel and integration planning, inefficient resource use, and damage to employee morale during prolonged periods of uncertainty.

Although the challenges are complex, dealmakers can navigate them effectively through early and thoughtful planning—both before signing the deal and during integration planning.

Presigning Phase. Dealmakers should develop strong internal processes and a clear M&A strategy through four critical activities:

- View deals through a regulatory lens. As they identify opportunities, dealmakers should aim to gain an early understanding of which deals may face regulatory or geopolitical obstacles. This is particularly important for the largest deals (those with a value of $10 billion or more). However, other deals could also face scrutiny from regulators in the current environment.

- Build a diverse pipeline. Companies can create options by building a deal pipeline that encompasses transactions across a range of likelihoods for regulatory scrutiny, avoiding overreliance on any single type of deal.

- Specify options when challenges arise. Deal participants should identify and detail possible remedies, and clearly define go or no-go scenarios for abandoning deals. For example, they might consider selling parts of the business that are likely to generate high regulatory scrutiny.

- Plan for a more conservative financial model. When modeling a deal, dealmakers should account for slower realization of synergies due to planning constraints and higher costs related to legal fees, integration planning, and other aspects of the deal that heightened scrutiny may affect.

Integration Planning. Companies should “go slow to go fast,” emphasizing meticulous planning to prepare for rapid and successful integration:

- Set clear priorities early. Dealmakers need to articulate clear integration priorities, coordinating the activities of the buyer’s and seller’s teams. They should launch integration teams in a strategic sequence to maximize value while avoiding excessive costs and preventing deal fatigue among participants as the work progresses. For example, they can prioritize teams that focus on technology integration planning and realizing quick wins on synergies. It is wise to approach the integration as a marathon, not a sprint.

- Take a conservative financial stance. To avoid overreliance on early synergies, companies should adopt a more conservative public financial stance than businesses typically observe in deal announcements. They should strive to ensure that internal targets, while aggressive, allow for the possibility that the business environment may evolve in ways that could reduce synergy opportunities, particularly for revenue.

- Communicate frequently with employees to maintain morale. Companies should keep employees who are involved in the integration informed about priority topics and the program’s evolution. They should explain any planned work stoppages that are necessary to comply with regulatory requirements or to facilitate regulatory reviews and approvals. They should also regularly remind all employees of the deal’s benefits, the future vision for the combined entity, and the importance of collaboration between the buyer and the seller.

Recent and proposed regulatory changes highlight that policymakers are significantly revising their approval standards and altering the playing field for future deals. We are seeing longer closing periods, greater uncertainty about approvals, and a need for additional remedies. Dealmakers will feel the impacts of these changes throughout the M&A life cycle and must respond accordingly, from rethinking how they build a deal pipeline to negotiating and planning execution. These challenges are likely to intensify as new guidelines come into effect. In this rapidly evolving environment, successful dealmakers will be more persuasive in pitching deals to target companies and more skillful in navigating the risks and complexities of heightened scrutiny.