Listen to this article

This audio was created using generative AI.

Environmental, social, and governance factors are fast becoming key differentiators affecting a company’s future performance. Recognizing this, leading companies and investment firms are erasing the distinction between sustainability and commercial issues when considering M&A and other investments.

This change in perspective has major implications for due diligence. Traditionally, due diligence focused on a narrow set of value-related commercial factors, while sustainability assessments emphasized compliance and risk mitigation. Today, best-in-class corporate and financial investors are integrating sustainability issues into commercial due diligence. Acquirers are exploring the connection between sustainability and value creation throughout the M&A process, and sellers are considering ESG in risk and valuation analyses to enhance their exit strategies.

Effective ESG due diligence requires a robust methodology that considers industry- and region-specific information to estimate and validate the related synergies. By combining a standardized framework with deal-specific deep dives, companies can conduct a comprehensive assessment that lays the groundwork for a discussion of sustainability strategies and potential value creation levers.

Sustainability Is Integral to Commercial Assessments

Companies and investors have many motivations for integrating sustainability into commercial assessments. For example, customers increasingly factor a company’s sustainability performance into their purchasing decisions. Moreover, transitioning to a greener business model may reduce costs both immediately and over the long term. Although compliance requirements provide some of the impetus, once companies engage more deeply in sustainability topics, they are finding strategic and operational opportunities as well.

There are many new requirements that companies must consider when evaluating acquisitions and other major investments. For example, starting in 2025, the Corporate Sustainability Reporting Directive mandates social and environmental disclosures by large companies with a significant presence in the EU or with securities listed in an EU-regulated market.

Furthermore, two proposed directives from the European Commission have significant implications. The Directive on Green Claims would regulate how companies communicate about their environmental impact and performance, with penalties for noncompliance. In addition, the Corporate Sustainability Due Diligence Directive outlines steps to identify, prevent, mitigate, or eliminate the negative impacts of a company’s operations on people and the environment. The directive includes supply chains within the scope of operations, so companies will need to carefully scrutinize their supplier base.

To create value through sustainability, companies need better data. Public companies are now disclosing sustainability data, often surpassing what regulations require. In private markets, the private equity industry recently launched the ESG Data Convergence Initiative (EDCI) to standardize sustainability data and make it more actionable. The EDCI has made strong progress, offering benchmarks that provide investment firms with first-of-its-kind guidance on how portfolio companies or potential acquisitions perform relative to their peers on sustainability topics. These insights are particularly useful for prioritizing topics for further investigation in due diligence.

Materiality Determines ESG Due Diligence Priorities

Although companies of every size and sector can create commercial value through sustainability, the priorities vary among industries. Some industries, such as steel, cement, chemicals, and airlines, face a particularly pressing need to decarbonize. (See “A Plastics Producer Assesses Sustainable Alternatives.”) However, ESG even affects companies that do not provide physical products or services. (See “A Software Company Explores ESG Risks and Opportunities.”)

A Plastics Producer Assesses Sustainable Alternatives

Approximately 65% of traditional plastics remain in the environment after one year of being discarded, and approximately 60% remain after five years. The mounting environmental impact is propelling a shift toward more sustainable alternatives. This change has been spurred by escalating consumer and regulatory pressures, sometimes culminating in outright bans.

The plastics producer’s assessment examined the environmental impact of plastics substitutes across its value chain, from upstream production (including feedstock and processing) to downstream end-of-life disposal. The review encompassed traditional plastics, recycled plastics, bioplastics, paper, and other alternatives across applications such as shopping bags, waste bags, agricultural films, food packaging, wrapping, and food service containers.

The assessment found that recycled plastics were best from an environmental perspective. However, they were not suited to the company's core applications owing to technical constraints, such as challenges in recycling film and the quality required for contact with foods.

Paper alternatives are attractive substitutes from a waste reduction standpoint, with approximately 1% of the material remaining in the environment after 100 days. But paper production is associated with higher CO2 emissions (five to seven times more than bioplastics) and increased resource usage (approximately twice the land and more than ten times the water required for bioplastics).

Ultimately, the analysis found that bioplastics would be the preferred alternative for core applications from an environmental perspective. They significantly reduce waste (approximately 7% does not degrade within a year), decrease CO2 emissions (by 25% compared with traditional plastics), and entail limited resource use (up to 95% less land and 90% less water compared with paper).

A Software Company Explores Esg Risks and Opportunities

The assessment encompassed three elements:

- Identifying Material ESG Dimensions. The due diligence identified nine material ESG dimensions. The company is now addressing the associated potential risks, making the residual risk level relatively low.

- Benchmarking ESG Performance Against Top Peers. The company compares favorably with the roughly 50% of peers that publicly report their ESG performance, excelling in most reported dimensions. To elevate its ESG performance to best-in-class status, the company needs to enhance transparency regarding governance and policies, increase the representation of women in management, accelerate its transition to renewable energy, define science-based targets, and disclose emissions information.

- Assessing Opportunities in the Transportation Sector. Although there is substantial interest in sustainable products and services, many potential customers are unwilling to pay for these solutions. However, new regulations taking effect over the next five years will generate market demand. The company’s significant opportunities include solutions that facilitate the following:

- Carbon Visibility: Providing transparent emissions management across all transportation modes and logistics flows

- Carbon Intelligence: Defining sustainability targets based on industry benchmarks and insights

- Green Procurement and Assignment: Enabling environmentally conscious sourcing and task assignment

- Capacity and Route Planning: Optimizing, for example, reverse logistics and CO2-equivalent offsetting

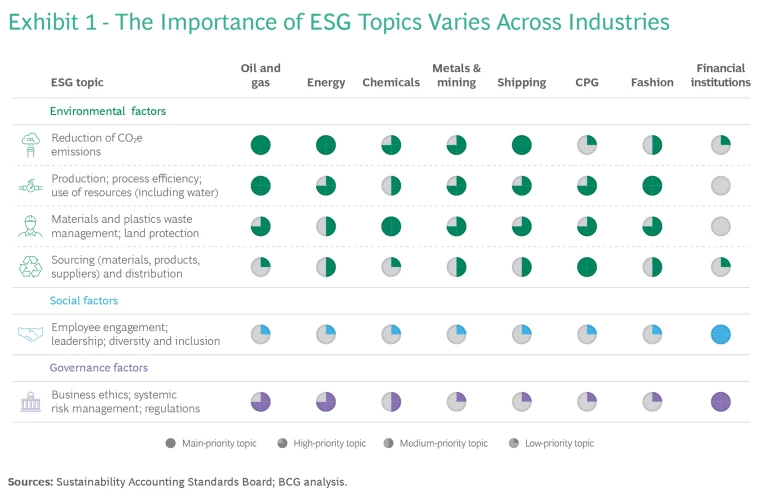

Exhibit 1 shows how the materiality of each ESG topic varies across selected industries.

To identify and activate relevant value creation levers, a company needs to determine the ESG factors likely to affect its financial performance, benchmark itself against peers, and prioritize improvement initiatives. A well-designed materiality assessment strikes the right balance between the time and effort expended and the benefits derived. Although comprehensive assessments can be conducted as a standalone project, integrating them into commercial due diligence will have a bigger impact on commercial outcomes. For example, both sustainability and sourcing teams should participate in identifying opportunities to create value by decarbonizing the supply chain.

A Three-Step Approach

The standard approach to ESG due diligence consists of three steps that provide a comprehensive perspective on performance and value creation opportunities:

- Assess the company’s material factors. Start by determining how profit pools in the company’s industry are evolving in response to major sustainability trends. An initial assessment entails evaluating the company’s material ESG factors using frameworks such as the materiality maps provided by the Sustainability Accounting Standards Board. These tools assist in estimating the specific effects of ESG—including risk factors—on financial metrics, such as future cash flow.

- Conduct a competitive benchmarking. Next, ascertain how the company is strategically positioned relative to peers to benefit from these trends. The EDCI’s sustainability benchmarks are valuable starting points. It is often advisable to augment these by selecting a comparable peer group of companies based on region and industry against which to benchmark the company’s position and identify opportunities to improve its ESG competitiveness.

- Understand company-specific ESG-related risks and value creation levers. Obtain a deeper understanding of any substantial ESG-related risks identified in the assessment of material factors. At the same time, identify and quantify value creation levers, such as innovations in adjacent products or services, operational improvements, or other initiatives to achieve best-in-class ESG performance. Prioritize levers by considering their impacts on sustainability performance, EBITDA, and multiples, as well as ease of implementation.

If climate factors are significant for a given investment or divestment, buyers or sellers should expand the standard three-step approach by conducting a detailed analysis of these topics. This may entail developing and assessing an asset-specific decarbonization fact base that encompasses improvement levers, CO2 abatement potential, and possible revenue streams.

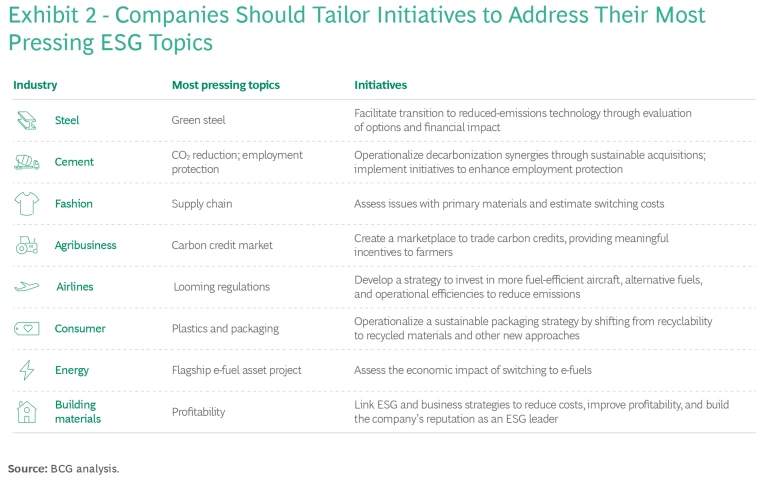

Companies can apply the results of their due diligence assessments to identify concrete, granular initiatives and actions, including adjustments to the business plan and implementation roadmap. Exhibit 2 highlights initiatives that companies can take to address a selection of the most pressing ESG topics by industry.

Buyers and Sellers Gain Valuable Insights

Both buyers and sellers can apply the insights gained from due diligence to more effectively align their strategies with evolving standards and industry-specific sustainability topics, ensuring balanced and informed decisions.

Buy-Side Evaluations Pinpoint Risks and Rewards. Prospective buyers should ensure that they are fully aware of the ESG-related risks and opportunities tied to a potential acquisition target. In the initial stages, they can use publicly available data for a materiality assessment. As the due diligence progresses, they can use the target’s available data to probe more deeply into materiality and evaluate synergies and direct impacts, such as the acquisition’s effects on ESG ratings, risks, or financing requirements. This may entail assessing the acquisition’s impact on the buyer’s own sustainability strategy and transformation needs, including goals for decarbonization or net zero emissions. (See “A Steel Maker Assesses the Challenges of Adopting Emissions-Reducing Technology.”) The assessment should also consider the enablers and a roadmap for harmonizing the parties’ strategy execution. Such an assessment should be carried forward to support the realization of synergies and post-merger integration efforts.

A Steel Maker Assesses the Challenges of Adopting Emissions-Reducing Technology

The acquirer conducted a due diligence assessment to determine the feasibility and financial implications of adopting emissions-reducing technologies:

- Identifying Alternatives. The assessment identified natural gas, green electricity, and green hydrogen as potential technology alternatives.

- Benchmarking Costs. A detailed benchmarking pinpointed the most economical technology alternatives considering operating costs and capex. This was complemented by a scenario analysis covering the next five years, for base- and best-case cost projections, with ROI calculations for each scenario.

- Assessing Feasibility. The company’s experts assessed the operational feasibility of the alternative technologies, considering each technology’s maturity and compatibility with the existing infrastructure. The assessment also looked at potential risks, such as the local supply of green energy sources and the need for additional construction.

- Understanding the Financial Implications. Financial analyses revealed that adopting these technological alternatives could lead to a double-digit reduction in EBITDA and a period of negative cash flow in 2029 and 2030.

Sell-Side Assessments Support Valuation. For sellers preparing to divest a business, ESG due diligence can provide essential information for the equity story presented to potential buyers. Sellers should identify whether ESG has a significant up- or downside for the business, as well as investments that could improve performance. They should integrate a sustainability strategy into the sale process, ensuring its alignment with the commercial strategy. The sustainability strategy—whether existing or developed in preparation for a divestiture—should include quantitative data (such as KPIs) and qualitative information that highlights the risks and opportunities for acquirers. If sustainability does not present a significant advantage, sellers should address it on a limited basis in standard due diligence to preempt questions or valuation discounts.

Sustainability is not a compliance checkbox but a crucial consideration for creating value. M&A and investment decisions must therefore consider the integral link between a company's commitment to sustainable practices and its commercial strengths. Buyers and sellers in private equity and the corporate realm need to rigorously assess industry-specific ESG themes and adapt their strategies to the evolving standards. Integrating ESG into the commercial due diligence agenda is crucial to meeting this imperative.