Although the €64 billion European aftermarket auto parts business is profitable and growing, it is facing a series of challenges—some the result of big global shifts, others linked to short-term economic volatility—that will transform the industry in the coming years, threatening revenue and profits.

In 2022, BCG, in collaboration with the European Association of Automotive Suppliers (CLEPA) and automotive aftermarket consultancy Wolk After Sales Experts, held interviews and workshops with more than 600 executives, analysts, and experts across the aftermarket spectrum. From those sessions, we produced a study that provided a window into the changing dynamics and challenges that the industry faces.

BCG has built on this research with a deeper assessment of the European aftermarket, taking into consideration recent developments in the post COVID-19 pandemic years. Our current paper aims to answer two questions for European aftermarket companies: Where to play? and How to win?

The aftermarket dimensions explored in this study cover four distinct areas:

Macroeconomics and Regulations

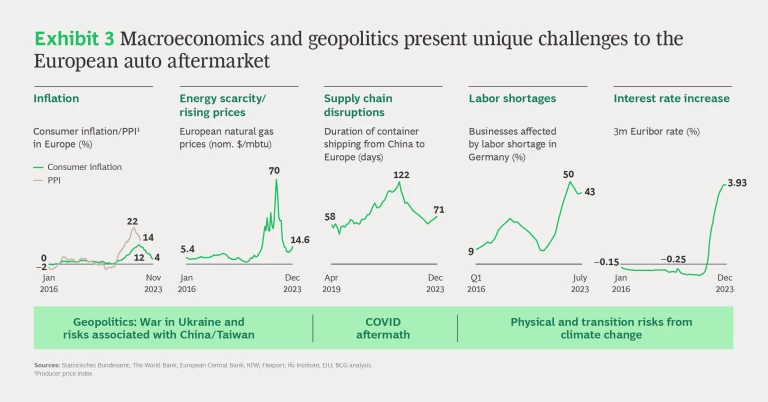

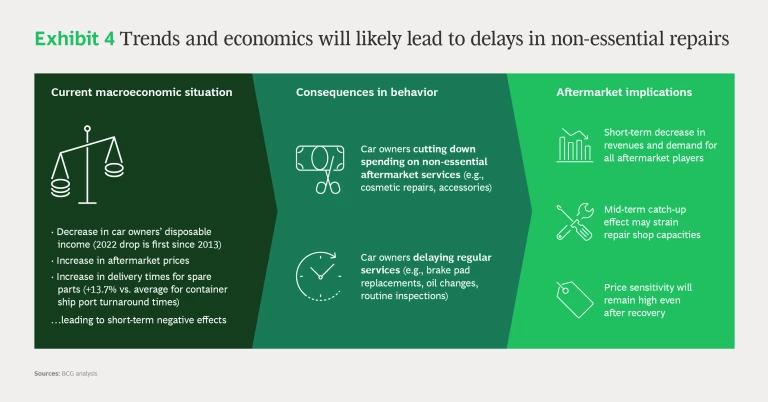

Uncertain economic conditions—including the short- or medium-term pain of persistent inflation in Europe, energy shortages, and geopolitical conflicts—could decrease car owners’ disposable income, increase prices in the aftermarket, and stretch out delivery times for spare parts. In addition, because of the economic outlook and the relatively high amount of vehicle penetration in Europe, new car registrations will likely decline in the coming years. The combined impact of these trends will probably translate into a slowing market for maintenance and repairs. On the regulatory front, requirements involving parts recycling and reuse and reducing carbon emissions in parts manufacturing, among other stricter climate-change related rules, will add new opportunities and costs to the aftermarket environment.

Technology

Rising part complexity, including the proliferation of sensors for connectivity and autonomous driving, will push aftermarket prices higher, while the emergence of electric vehicles will reduce the number of parts in vehicles and minimize the need for maintenance. Increasing amounts of in-car data will be available, giving aftermarket companies more information about driver behavior that can be helpful sales tools for businesses with sufficient digital capabilities to forge direct lines to consumers. Another, perhaps more long-term issue, is driver assistance technology reducing collisions and thus the need for replacement parts.

Customer Behavior

Fleets will play a bigger role in a new mobility landscape with expanded car sharing and app-based services—and will seek alliances with preferred aftermarket companies to get favorable prices and drive efficiency for maintenance, parts, and integrated coverage. In addition, aggregators and intermediaries who steer groups of customers to a network of repair shops will likely have a more decisive influence in the aftermarket in the last half of this decade.

Value Chain and Competition

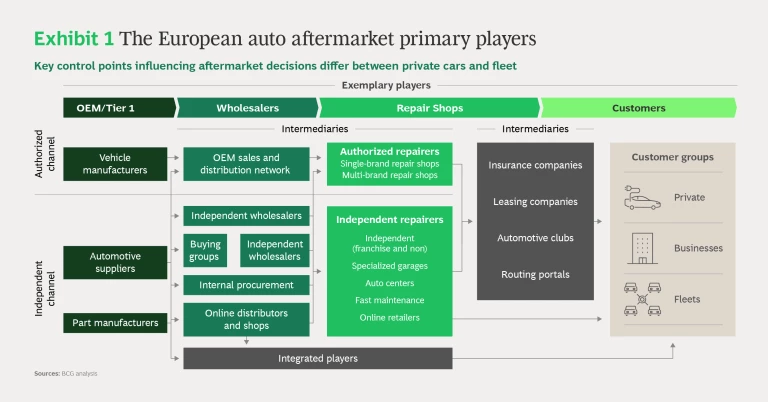

Increased competition from e-commerce aftermarket players will put pressure on parts providers. Wholesalers will also be threatened because these online companies often sidestep them and instead strike direct procurement agreements with suppliers. However, some wholesalers are trying to expand their market shares by carrying private labels, which can often be sold at a discount and are increasingly available for common maintenance parts and accessories. Private labels account for as much as 50% of basic parts sales. Tier 1 suppliers must pay close attention to private labels and formulate dedicated strategic responses. Meanwhile, OEMs will eye possible partnerships to further widen their overall aftermarket presence, in both new and existing segments.

Within these four categories, several major trends will have the most significant and evident impact on the European aftermarket in the immediate future:

- GenAI-driven smart solutions will provide new and more knowledgeable ways for aftermarket players to connect with customers.

- Data-driven pricing and inventory management will support revenue and cost management strategies.

- Circularity of raw materials through recycling and remanufacturing will become increasingly important.

- Fleet owners will play a bigger role in aftermarket activities.

- Applications, parts, and traditional profit pools will shift markedly as EV market share expands.

Combined with the other changes in macroeconomics and regulations, technology, customer behavior, and value chain and competition, these trends threaten to slow growth and reduce profit margins in the European aftermarket ecosystem through the next decade. Consequently, companies must start to design new strategies to protect their profit margins now so they can maintain their market positions in the future. (See Exhibits 1–5 slideshow.)

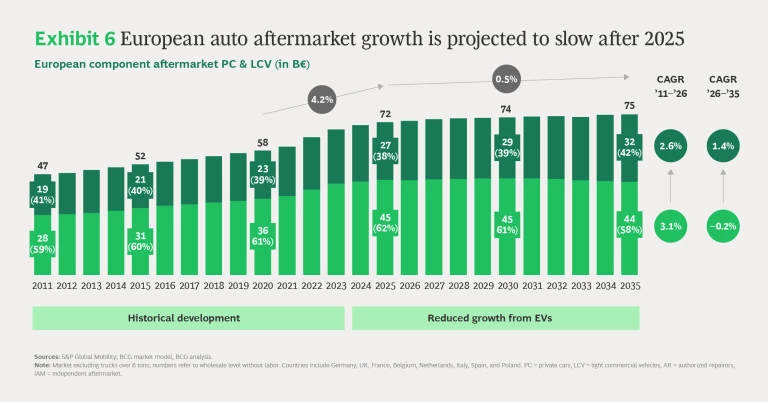

Overall, the European automotive aftermarket has enjoyed steady growth of about 2% per year since 2011. By 2022, the independent aftermarket (IAM)—companies without contractual ties to a single vehicle manufacturer and offering multi-brand solutions—had garnered a 60% market share, driven largely by an increase in aging cars still on the road and budget-conscious customers. Through 2026, we expect both IAM companies and authorized repairers (AR)—the repair and maintenance sales networks exclusively linked to OEMs—to enjoy a healthy growth rate of 3% per year.

Post 2026, shifting automotive market dynamics—especially increased penetration of autonomous driving features and EVs as well as a heightened importance of software repairs—will minimize demand for more traditional parts, repairs, and maintenance. As a result, aftermarket growth will slow to about 1% per year. In this tightened environment, ARs could increase market share by claiming (rightly or wrongly) higher levels of expertise in new technologies and by using their existing customer relationships and databases to spur greater aftermarket sales. This should allow the authorized channel to increase its market share to 42% by 2035.

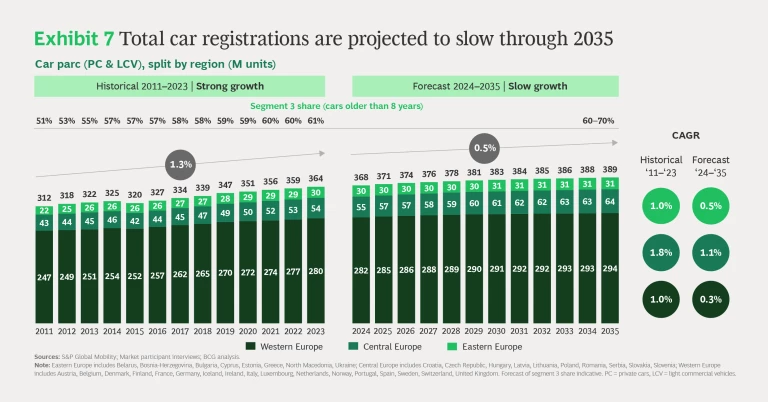

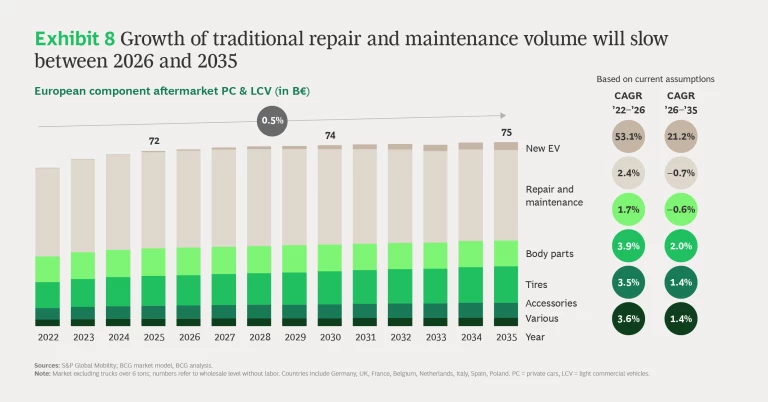

The EU automotive aftermarket will also be weighed down by slowing vehicle registrations. Historically, new car purchases have supported aftermarket expansion. But with increasing vehicle saturation in Western countries, the individual driver will contribute less and less to aftermarket gains over the next ten years. The annual growth rate of total registered vehicles will decline from an average of about 1.3% between 2011 and 2023 to only 0.5% from 2024 through 2035. From 2026 on, EVs will have a disparate impact on the aftermarket sector. As these cars become more prevalent, less vehicle complexity will reduce the need for repair and maintenance work. At the same time, the demand for complex new parts will spur supplier manufacturing growth, and the additional weight of EVs will drive tire sales. (See Exhibits 6–8 slideshow.)

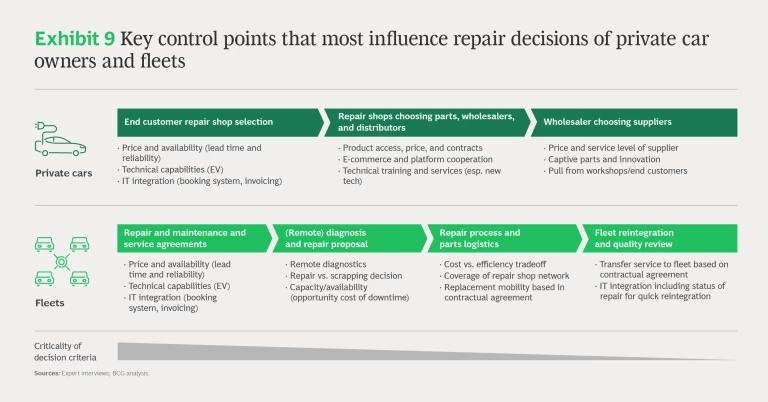

With the aftermarket in turmoil and facing increasing pricing and sales pressure, individual players will have to adopt their best strategic reactions, in large part based on anticipated customer behaviors as they seek vehicle repairs. In our analysis, we identified the control points that will likely influence these customer decisions. We believe that the success of aftermarket players in the coming years will depend on how well they target and address the control points that are most closely related to their segment of the marketplace. (See Exhibit 9.)

For example, private car owners will be increasingly influenced by digital platforms and remote diagnostics in their choice of repair shops. This should give OEMs and ARs a leg up, allowing them to increase market share through direct data access to customers, existing customer relationships, and the ability to provide integrated solutions. Meanwhile, repair shops will choose parts wholesalers based on product lines and prices as well as additional services, such as training in new parts or direct computerized communications for digitized garages. And wholesalers will seek suppliers that manufacture price-conscious private labels and also offer new proprietary and innovative parts, particularly for EVs.

Fleet operators—as well as insurance companies and aggregators—often contract with a network of aftermarket players and mandate that their customers patronize their aligned repair shops. Among the features that fleet operators will look for from ARs and IAMs are remote diagnosis using telematics and vehicle connectivity, real-time parts availability and reliably fast logistics, and quality guarantees ensuring the swift reintegration of vehicles into the fleet once repairs are completed.

As part of our analysis, we offer specific recommendations for each type of player in the European auto aftermarket to adopt in order to thrive, even as the landscape shifts around them. (See Exhibit 10.)

- Repair shops must improve internal efficiency through digitization and prepare employees and equipment for new repairs related to electrification. They also must increasingly connect with customers digitally and integrate fleet and aggregator needs and requirements into their own IT systems. IAMs have a potential opportunity to forge exclusive or semi-exclusive arrangements with fleet customers if they can offer cost-effective and updated services.

- Intermediaries need to work on two strategic directives: building up scale and achieving integration with IT systems of other aftermarket players. They need to evaluate the implications of changing repair types on their business so they can accurately identify parts needed and where to find them as well as match customers to properly equipped shops.

- Wholesalers are well-positioned to be central facilitators and partners in the aftermarket space. To do this, they need to create digital platforms and develop technical proficiency with parts for new vehicles so they can service both repair shops and fleets efficiently and in an up-to-date fashion.

- Tier 1 suppliers should strengthen their marketshare through direct supply models to repair shops and e-commerce players. Moreover, they should widen and cement their relationships with OEMs by enhancing their capabilities in software and data technologies, particularly those involved with the growing number of EV components.

- OEMs/ARs can harden customer loyalty through targeted measures such as subscription-based services. In addition, by proactively developing repair and maintenance business models specializing in new technologies, chiefly autonomous vehicles and EVs, they can position themselves with consumers and fleets as trusted technical experts. For some OEMs, an investment in an IAM business can be an aggressive pathway to increase revenue and profit in their aftermarket business.

We believe that the European automobile aftermarket will continue to provide opportunities for companies, but to take advantage of them companies will have to be nimbler and more clued into shifting market conditions than before. Players across the spectrum will have to tap into new data streams created by the digitalization of automobiles and aftermarket processes. Vehicle electrification will require new and more innovative parts while sales channel competition, particularly online, will likely heat up. Traditional roles and relationships will be in flux and fresh alliances will be necessary. As is often the case, this level of turmoil is challenging—yet it can be rewarding for the fortunate few that act early to set a course to navigate the volatility.