Is the European market for premium+ and luxury electric vehicles about to take another turn?

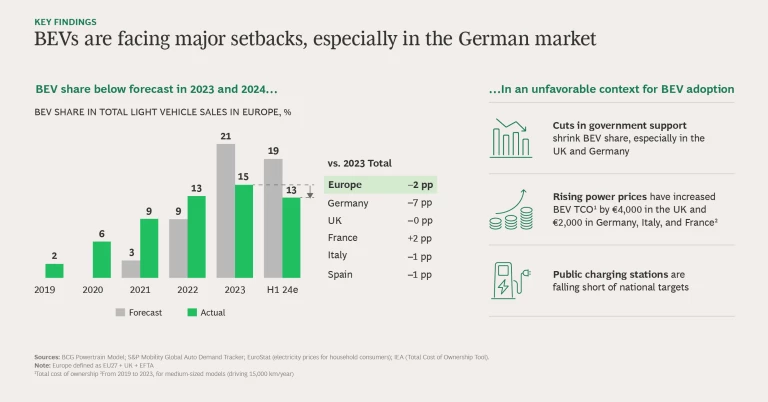

The premium (MSRPs of €50,000 to €80,000) and premium+ and luxury segments (€80,000 and up) drove the growth of battery electric vehicle (BEV) sales in Europe from 2019 through 2022. But premium+ and luxury growth backed off from 22% in 2022 to 19% in 2023, contributing to an overall BEV slowdown, which has continued in 2024 so far. A new wave of premium+ and luxury buyers may put the segment back on track—if OEMs address their needs and concerns.

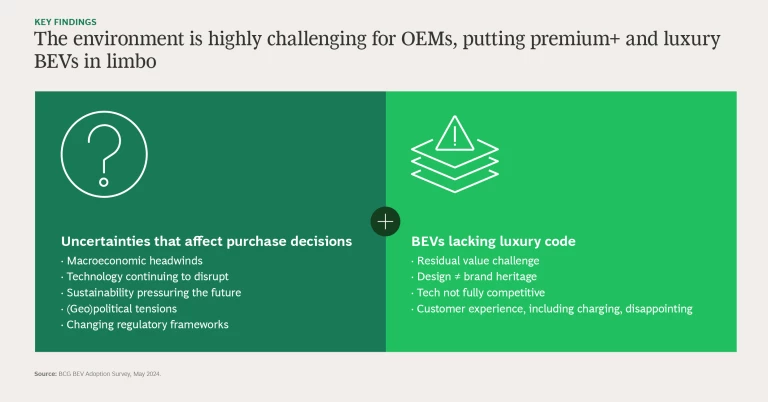

A combination of macroeconomic factors and tech disruptions slowed premium+ and luxury BEV sales. But OEMs’ product decisions contributed as well. Uncompelling tech, poor charging experience and range, low residual value, and vehicles that failed to live up to brand heritage all undermined the experience that consumers expect. Buyers voted with their feet and sent a clear message: If OEMs want to sell high-end electric vehicles, they must deliver the entire experience—including charging and acceptable range—in addition to powerful engines, extra-comfortable cabins, and sharp trim.

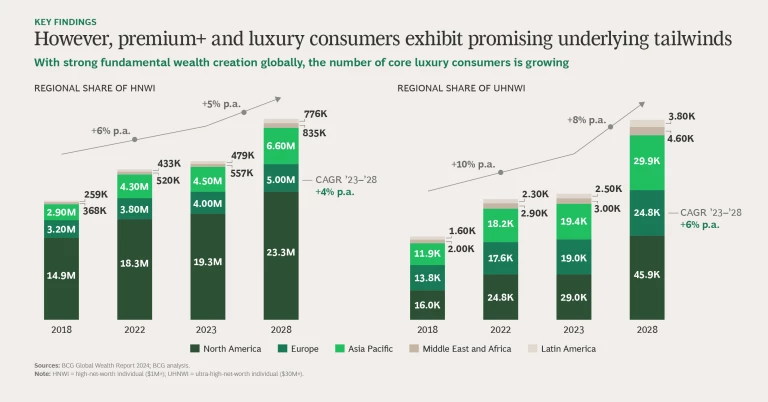

The news is not all gloomy, however. New BCG research shows that the number of potential premium+ and luxury buyers is growing, and many of these consumers, who have distinct preferences and strong views, are keen to explore BEVs. Manufacturers can (re)capture their interest—and a share of their wallets—if they listen closely to what these consumers want in a new electric car.

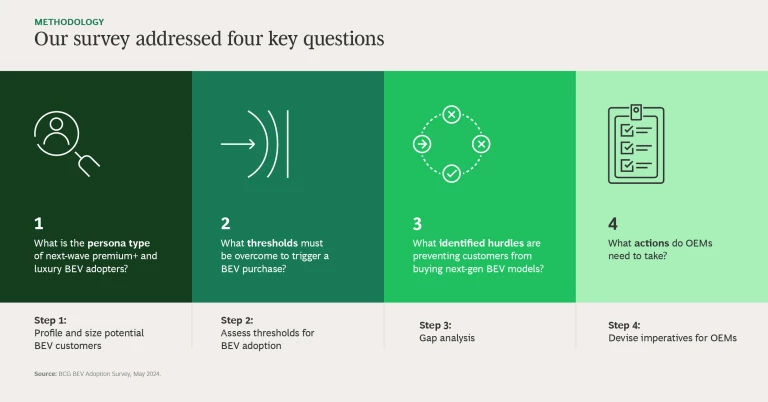

The slide show below summarizes our research. Here are the implications.

A New Buyer for BEVs

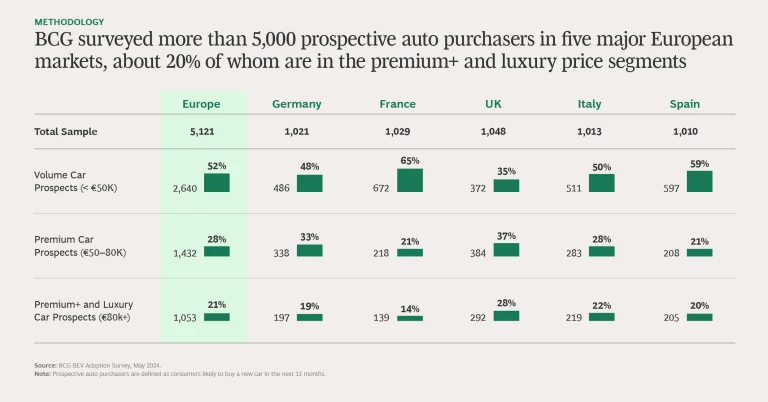

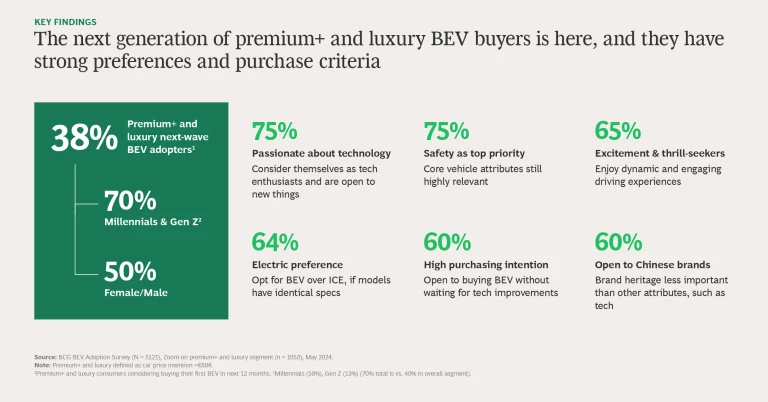

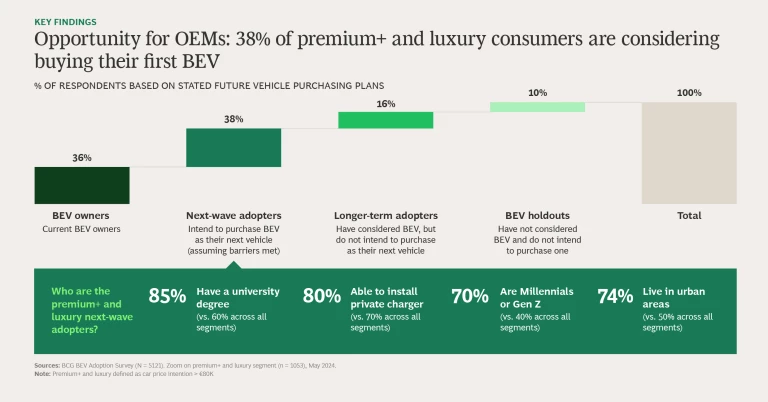

Our study included more than 5,000 consumers in France, Germany, Italy, Spain, and the UK. The roughly 2,500 respondents in the market for premium+ and luxury vehicles reveal the emergence of a new premium+ and luxury BEV buyer. They are gender-balanced (a 50-50 split, in fact). Millennial and Gen Z consumers account for 70% of prospective purchasers. These consumers are well educated (85% have university degrees), urban (75% live in cities), and ready to make a change from internal combustion engines (ICEs): 50% of all buyers and almost 40% of premium+ and luxury customers say they are likely to buy their first BEV in the next 12 months. This is an enormous opportunity for OEMs. Wealth creation is expanding, and the prevalence of high-net-worth households is increasing, in Europe and elsewhere.

BEV manufacturers need to re-establish their credibility with these consumers by delivering the total ownership experience they expect from luxury goods companies. OEMs must stay true to traditional luxury values, such as timelessness, high-quality craftmanship and attention to detail, consumer centricity, and brand heritage. But they must also understand how premium+ and luxury consumers are evolving. Today’s buyers skew younger and are digitally savvy and value driven. They see themselves as fashion-forward, modern, and ahead of the times. They expect a new rhythm of brand and product engagement, one that features exclusive experiences and direct digital outreach. Corporate purpose (how the company seeks to serve customers and society) is important, but like the powerful engine and well-appointed cabin, premium+ and luxury buyers see purpose as a basic attribute that car companies need to have, not as a differentiator.

Priorities for Premium+ and Luxury EVs

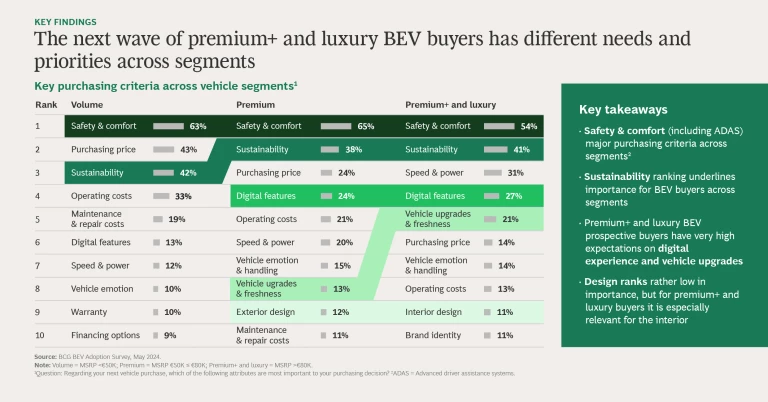

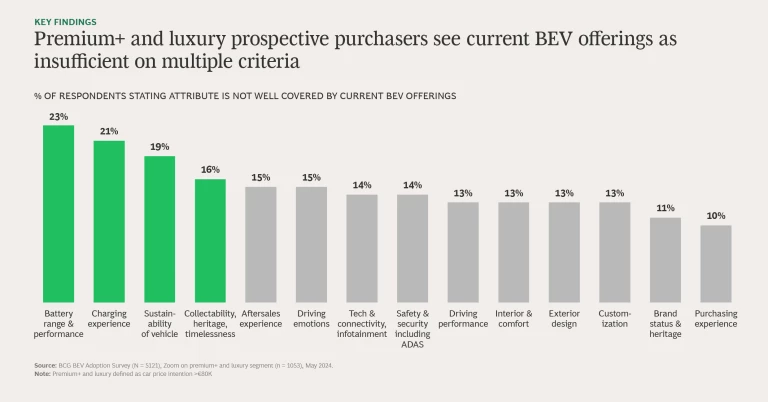

Like consumers in other segments, premium+ and luxury purchasers place high priority on several attributes, such as safety and comfort (including advanced driver-assistance systems) and sustainability. However, speed and power—along with digital features, regular vehicle upgrades, and staying current with technology advances—are much more important to these consumers.

Ask premium+ and luxury consumers where BEV manufacturers fall short, and they cite four areas where products need an upgrade:

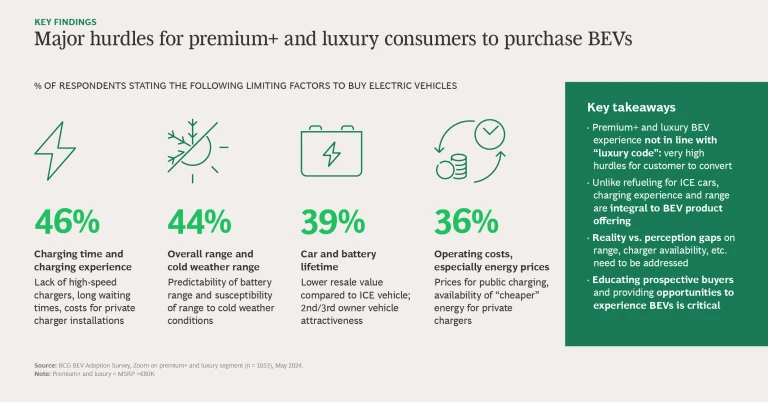

- Charging time. Almost half of prospective buyers (46%) see current charging time and charging experience as impediments to purchase. They point to a lack of high-speed chargers, long wait times, and costs for private charger installations as issues to address.

- Battery range. How far a battery will go on a charge, and the effect of cold weather on driving range, are limiting factors for 44% of premium+ and luxury buyers, who expect longer driving range between charges: 500 km compared with 470 km and 450 km for premium and volume buyers, respectively.

- Longevity. Almost 40% cite car and battery lifetime as issues affecting the attractiveness of BEVs to second and third owners and leading to lower resale values. In addition, they want their new BEV to possess an element of timelessness in product design, like classic jewelry or luxury watches.

- Cost. Operating costs, particularly prices for public charging and availability of “cheaper” energy for private chargers, are roadblocks for 36% of premium+ and luxury buyers.

Priorities for OEMs

Premium+ and luxury consumers know what they want, and they are confident in their opinions, which are already reshaping the market for premium+ and luxury cars in Europe. The top three brands for 43% of consumers come from traditional European manufacturers. But when people talk about BEV preferences, only 32% cite traditional manufacturers while 20% point to native BEV makers. Tesla makes it into the top three brands, and native BEV brands from China are attracting attention.

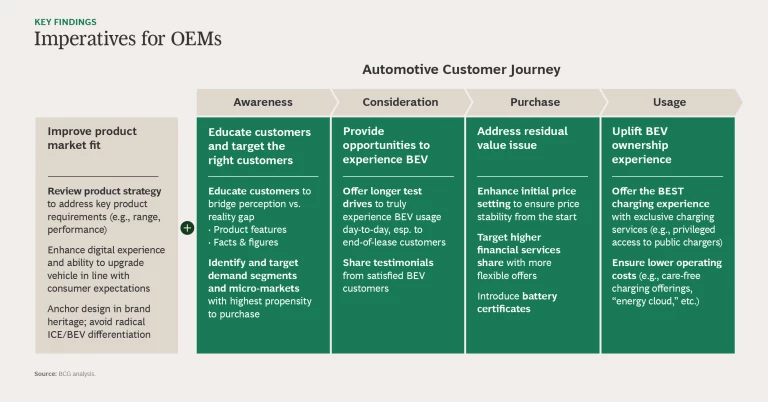

Premium+ and luxury consumers have always had expectations for products and services they purchase, and the new generation of this segment—while having additional considerations—is no different. To grow premium+ and luxury BEV sales, manufacturers must upgrade the customer experience and their interactions with these demanding purchasers. In addition to addressing the overall product-market fit, manufacturers can take steps at each stage of the purchase journey—awareness, consideration, purchase, and usage. We summarize each point below.

Improve the product-market fit.

When it comes to ICE vehicles, OEMs have become very effective at offering the right product with the right specifications and features at the right price point in major markets. They need to hone similar skills with BEVs, especially high-end BEVs, where consumers are looking for specific requirements such as range and performance. For example, UK consumers find 400 km to be an acceptable maximum BEV range, while in Germany the acceptable maximum is 490 km, and (according to another study) in the US it’s 577 km.

The next wave of BEV adopters has high expectations for the digital in-car experience and vehicle “freshness”—a car with the latest operating system that evolves, receiving new features from its manufacturer, over its lifespan. OEMs need to keep pace in the digital race as BEV-native manufacturers raise the bar. But these factors are not sufficient in themselves. Safety and comfort as well as interior design remain important. OEMs therefore need to anchor vehicle design in their brand heritage, maintaining performance and comfort and avoiding radical differentiation between ICEs and BEVs.

Educate customers and target the right buyers.

As OEMs improve their products, they also need to correct holdover misperceptions—such as limitations in range—about their BEV models from earlier years. In addition, OEMs must come up with clever, assertive, but non-intrusive ways to educate customers on the changes they’ve made and continue to make in product design and features. Reaching prospective purchasers in the channels they use and follow, such as social media, is also important. This starts with identifying the demand segments or micro-markets with a high propensity to purchase and targeting them with the right products and features.

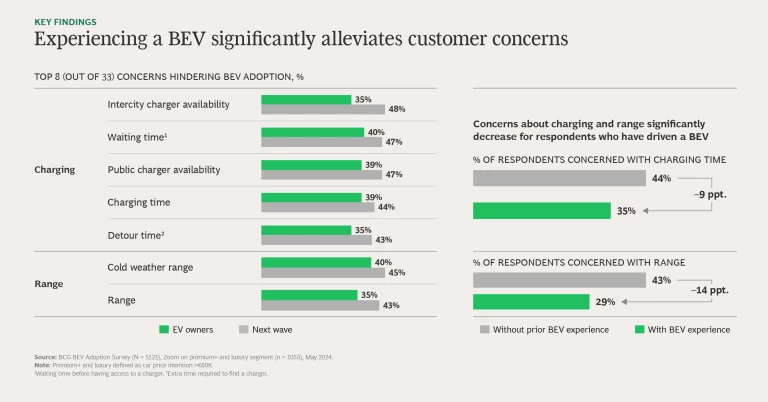

Provide opportunities to experience the brand’s BEVs.

Tactics such as offering longer test drives to targeted purchasers (such as end-of-current-lease customers) so that drivers can experience true day-to-day BEV usage are key to building demand. Testimonials from satisfied BEV customers (delivered through the right channels) can also help.

Address the resale value issue.

Manufacturers can help address price stability problems from the start by improving how they set initial prices. They can target higher financing or leasing share with more flexible offers, and introduce battery certificates that guarantee product lifetime.

Uplift the BEV ownership experience.

Unlike petrol brands and stations, which are not differentiated or associated with car brands, BEV charging is different. OEMs should own the charging experience—both at home and on the road—and they need to ensure the best experience. Some OEMs are already addressing buyers’ dissatisfaction with the current state of charging by offering dedicated services, such as route planning with destination charging, privileged access to high-powered charging networks, care-free charging packages, and access to an “energy cloud.” There is still room for improvement, however, that makes these services more seamless, widely available, and efficient.

It’s still early days in the European BEV markets. Consumers are building substantial interest in BEVs. And OEMs have an opportunity to rebound from recent setbacks and demonstrate that they can meet customers’ preferences. But they need to show progress quickly. Once buyers’ perceptions start to set in—in a marketplace filling with native new entrants—they will be difficult to reverse, even by the most traditionally prominent brands.