As the world charts a course toward a net-zero future, we expect to see a fundamental shift in how energy markets operate. Transformational changes—many of which are already unfolding—will become more pronounced as the share of renewables in the global generation mix grows. According to the International Energy Agency’s Net Zero by 2050 roadmap, solar photovoltaic and wind will make up 72% of power generation by mid-century compared with 11% in 2020.

The resulting changes will have huge implications for market participants. To adequately prepare for the global energy system of tomorrow, players need to understand how power market dynamics are evolving today.

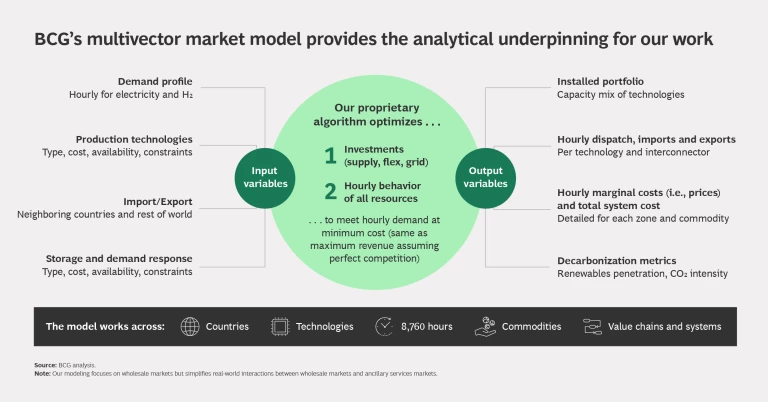

BCG’s Center for Energy Impact has developed a proprietary model to explore changes in energy markets based on different possible scenarios, and we have applied it to Europe for this publication. Two key policy initiatives form the backbone of our assumptions: the EU’s Fit for 55 pledge to cut greenhouse gas emissions by at least 55% by 2030 (from 2021 levels), and its ambition to achieve net zero by 2050. In addition, we have modeled different scenarios by varying natural gas price levels, renewables deployment, and interconnector buildouts.

We are confident that the market developments we have found will hold true in most circumstances. However, as always, several highly disruptive events could potentially throw our analyses concerning 2030 and 2050 off course. These are:

- A substantial weakening of global climate ambitions

- A crisis in energy demand or supply—as occurred with the COVID-19 pandemic and the war in Ukraine

- The widespread adoption of a new form of market design that is not based on marginal prices

- A breakthrough in low-carbon energy technologies such as nuclear fusion and long-duration energy storage

- A radical change in technological cost projections and learning curves

Furthermore, while the focus of our analysis is mainly on northwest Europe, we believe that some of these developments will also apply in most other liberalized markets worldwide.

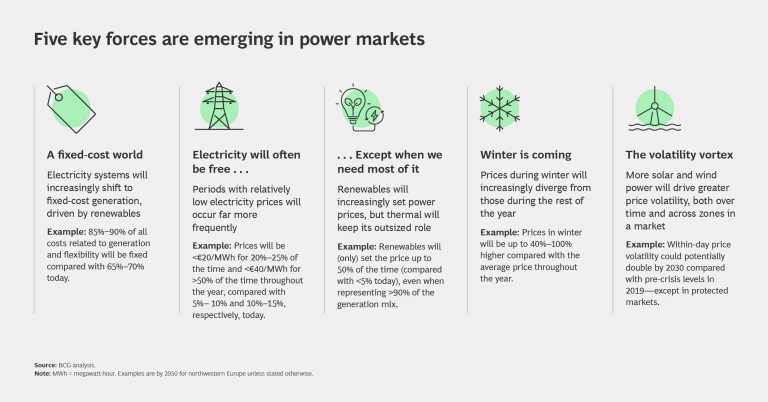

Through our work, we’ve identified the following five forces that are set to shape electricity markets through the energy transition and beyond:

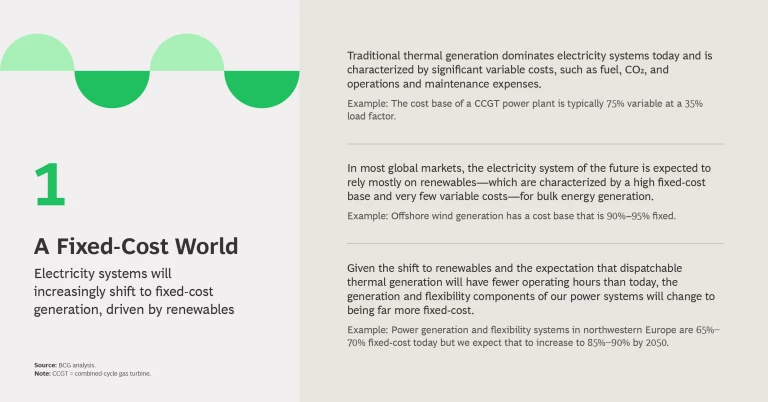

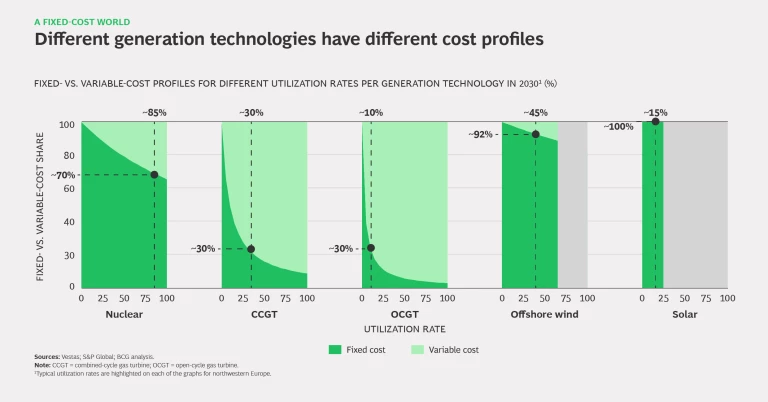

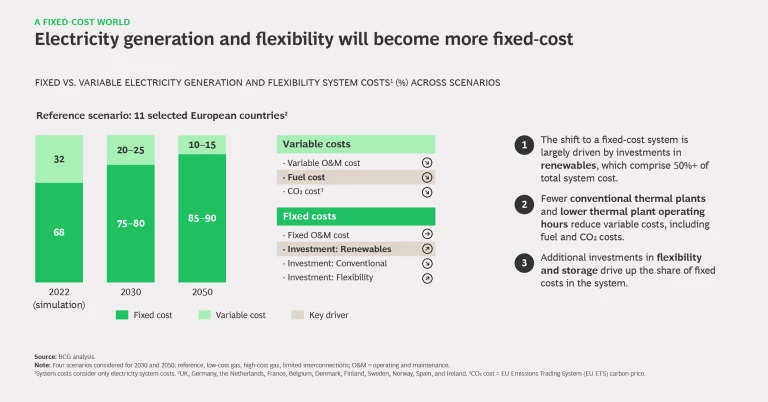

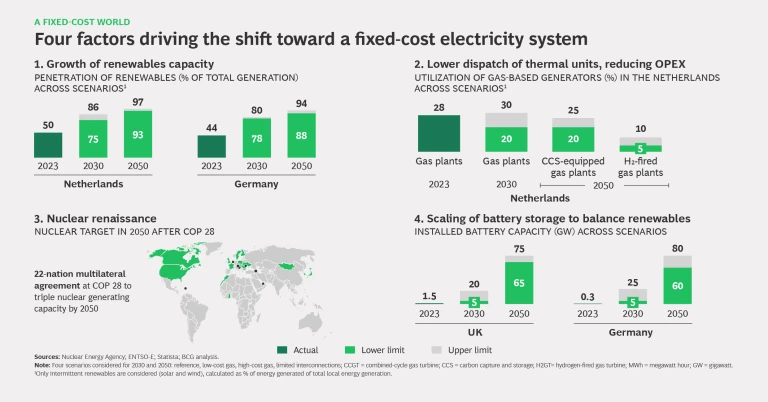

A Fixed-Cost World. Driven by renewables , electricity systems will increasingly shift to fixed-cost generation. Between 85% and 90% of all costs related to generation and flexibility will be fixed.

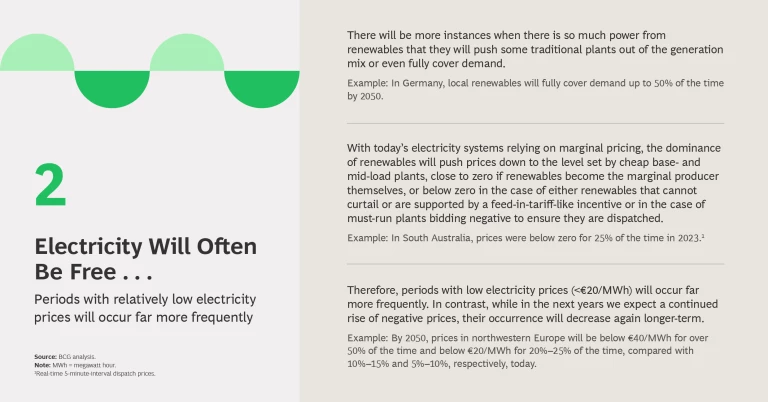

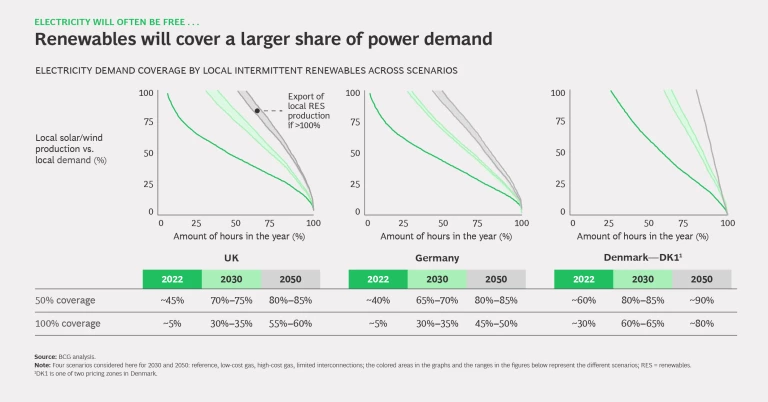

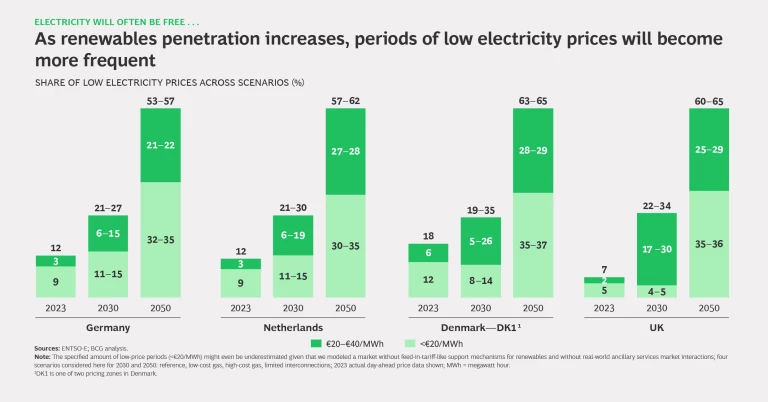

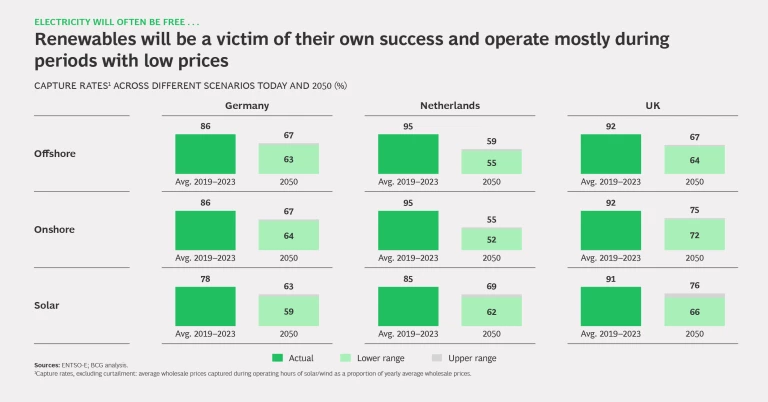

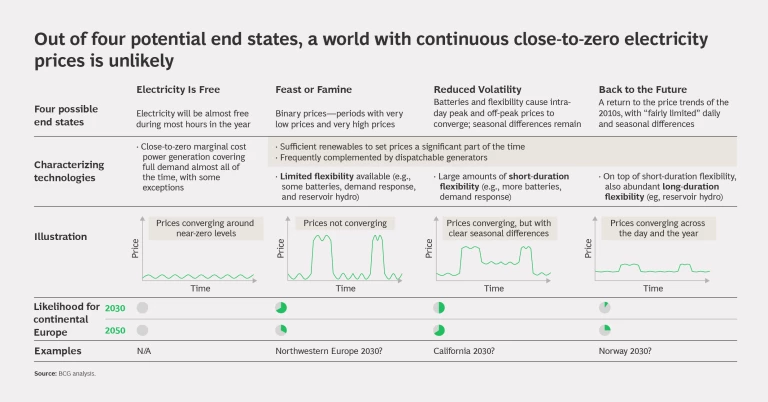

Electricity Will Often Be Free . . . Periods when electricity prices are relatively low, and even near zero, will occur far more frequently. Prices will be below €20 per megawatt-hour for 20%–25% of the time throughout the year, compared with 5%–10% today.

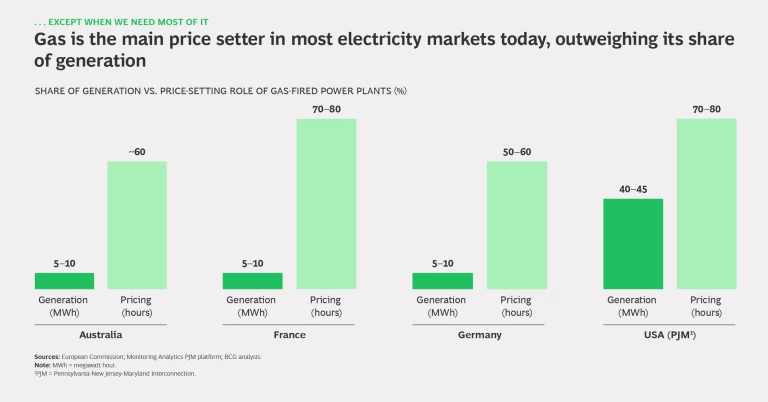

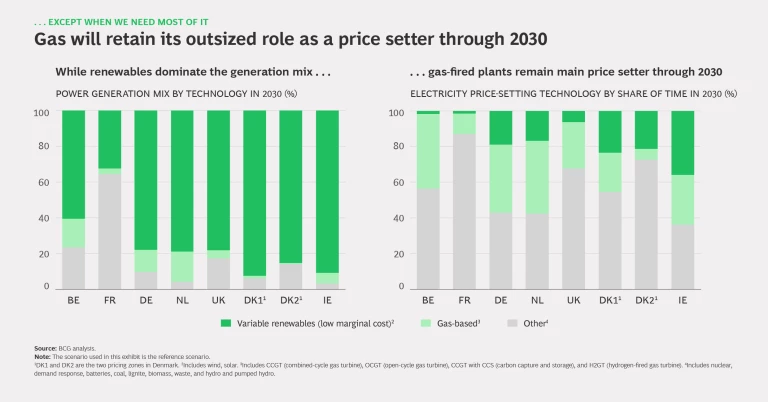

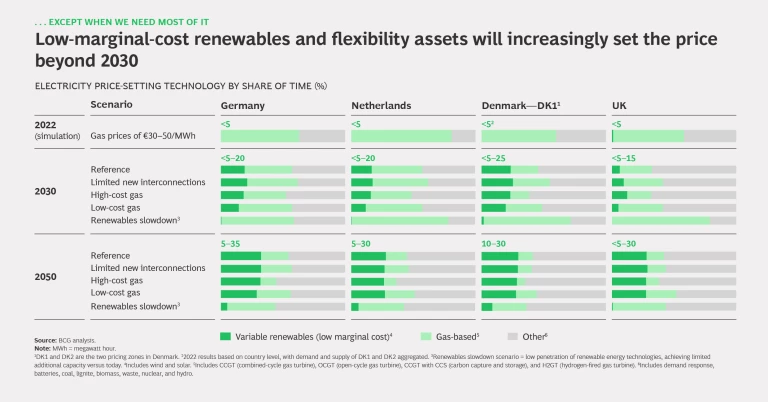

. . . Except When We Need Most of It. Although solar and wind generators will increasingly set electricity prices, thermal generation will retain its outsized price-setting role, leading to higher prices at critical times, and we will see a new generation of price setters emerge—flexibility assets.

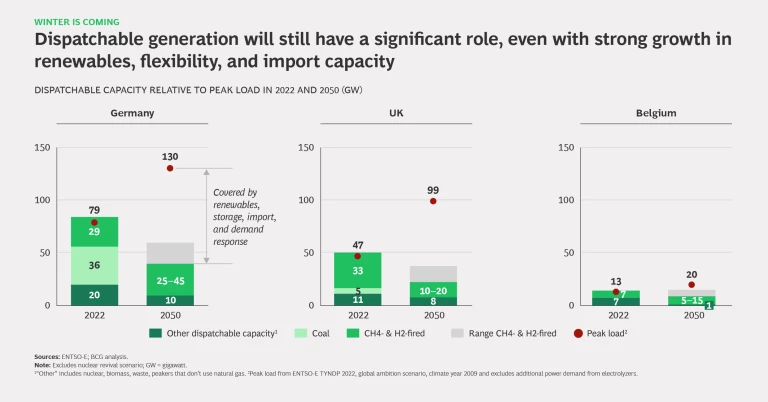

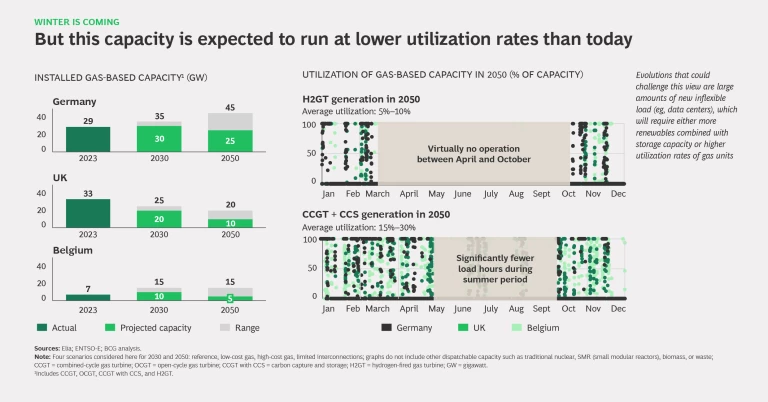

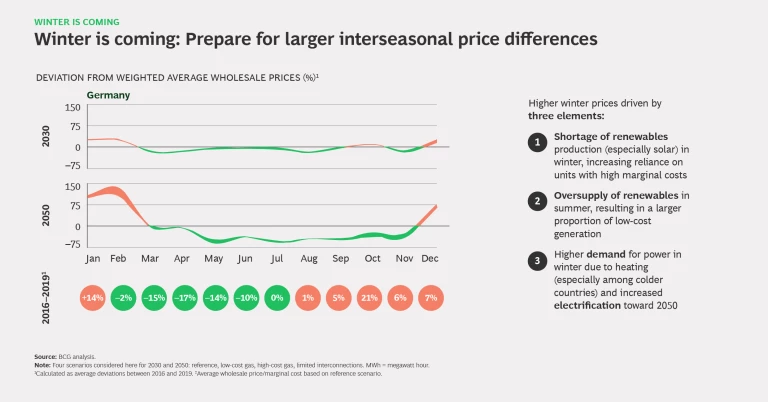

Winter Is Coming. Electricity prices in one season (for northwestern Europe, the winter period) will diverge more and more from those during the rest of the year. Prices in winter will be up to 40%–100% higher compared with the average price throughout the year.

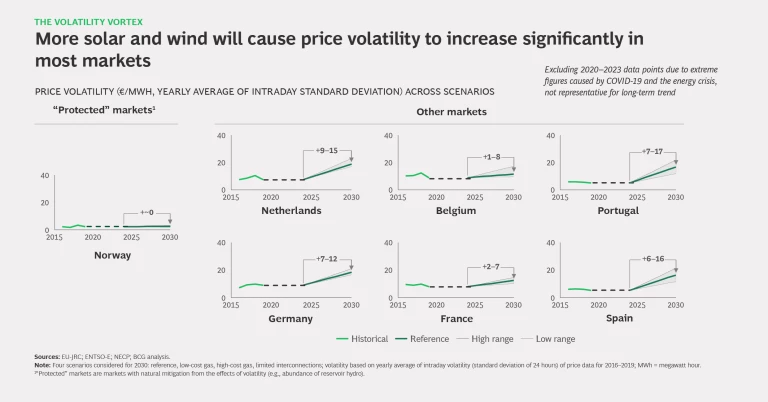

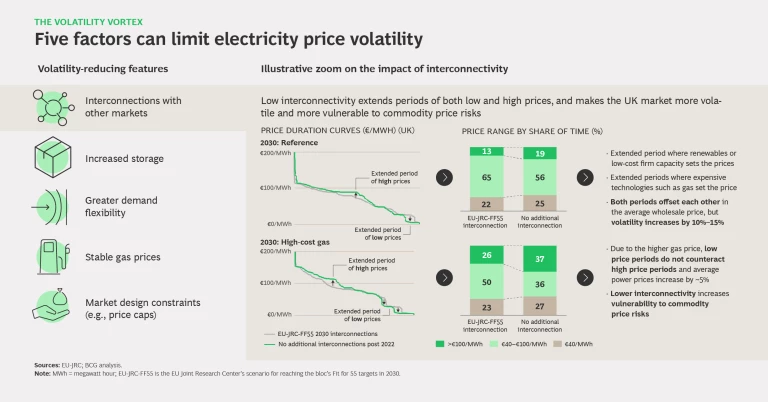

The Volatility Vortex. More solar and wind power will drive greater price volatility . Within-day price volatility could potentially double by 2030 compared with pre-crisis levels in 2019.

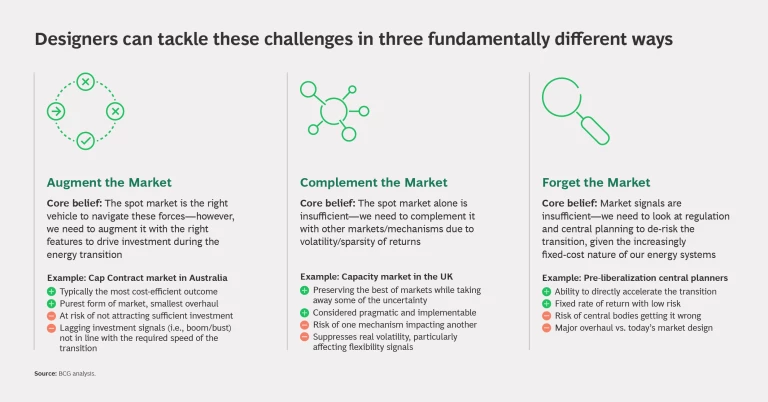

As a result of these five forces, market designers will need to solve challenges relating to investment signals, dispatch and pricing, system costs, and maintaining an efficient and equitable market. In addressing these, they will need to select approaches that either augment, complement, or go beyond the market. The five forces will impact not only designers but other stakeholders such as renewable and thermal generators, hydrogen producers, end-consumers, and large industrial companies.

The authors thank Jarne De Nies and Pieter Ediers for their support in research and analysis.