This article is part of the 2024 European Consumer Sentiment Report series , which examines shopping habits and preferences.

French people are worried about politics and the state of the economy. According to new BCG consumer research, they also feel squeezed by the high inflation, which has impacted spending attitudes and behaviors.

France’s high inflation rate has receded since the beginning of the year. But its lingering effects combined with limited income increases have caused people to worry about their own personal financial stability—and cut spending to compensate for higher prices.

Other consumer trends:

- Consumers said they are adopting sustainable behaviors—but with a French twist that makes their efforts different from emerging practices of people elsewhere in Europe. Still, only 11% of French shoppers said they would pay more to buy green products.

- Going online has become a de rigueur part of shopping – but in this too, French consumers appear to cling to traditional behaviors. People said they browse or get inspiration or customer service help online. But across almost every product category, half or more said they mainly or only make a purchase at a physical store.

The trends are a snapshot of how consumers felt about national affairs and themselves during the first half of the year. It’s based on a BCG survey of 1,400 people in France conducted July 10-16, part of a larger survey of consumers in five European countries we did to capture people’s feelings about current issues and their personal lives and how those sentiments affect shopping habits and preferences.

To strengthen ties with consumers and stay competitive in the face of these trends, companies should consider making changes to product assortment, pricing, and promotions. For changes to be successful, they also need a strong data analytics foundation.

Consumers Fret Over National Affairs, Feel Better About Their Own

We surveyed French consumers immediately after the country’s parliamentary election and a few weeks before a successful Paris 2024 Olympics offered a temporary reprieve from everyday worries.

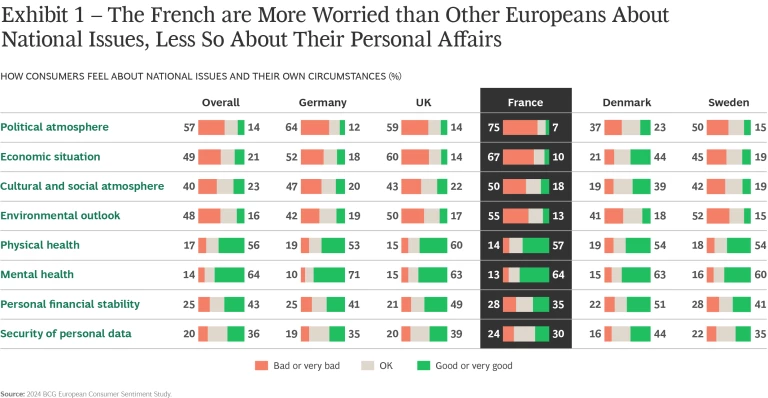

French people felt worse about national affairs than people anywhere else we surveyed, a possible result of a highly uncertain political environment that culminated in an unexpected parliamentary election that yielded no clear, absolute majority. Seventy-five percent said in the first half of 2024, they felt “bad” or “very bad” about politics compared to the 57% average. (See Exhibit 1.)

French people also felt worse than average about the economy (67% v. 49%) and the cultural and social atmosphere (50% v. 40%). More than half (55%) were pessimistic about the natural world and climate change, compared to a cross-country average of 48%.

People were more positive about their personal situation, with close to the average saying they felt “good” or “very good” about their mental health (64% each), physical health (57% v. 56%), and the security of their personal data (30% v. 36%).

However, compared to other countries, fewer people in France felt good about their financial situation–35% v. an average of 43% and a high of 51% for people in Denmark.

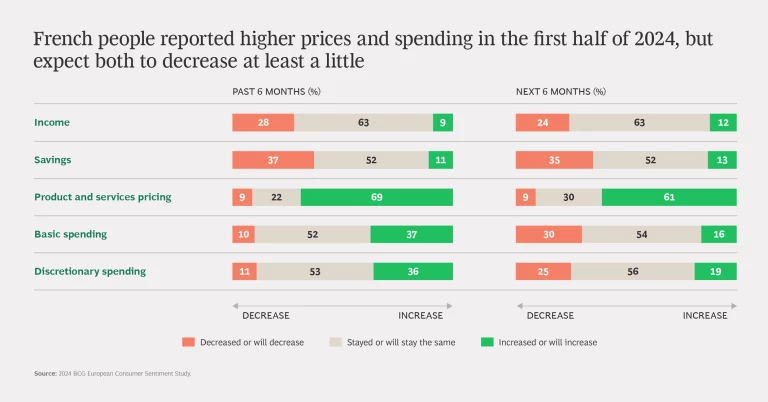

Inflation fed higher spending. Inflation has cooled since the beginning of the year, but its effects have lingered. Close to seven out of ten French consumers reported higher prices in the first six months of 2024. In the same period, only 9% reported higher income and 11% higher savings.

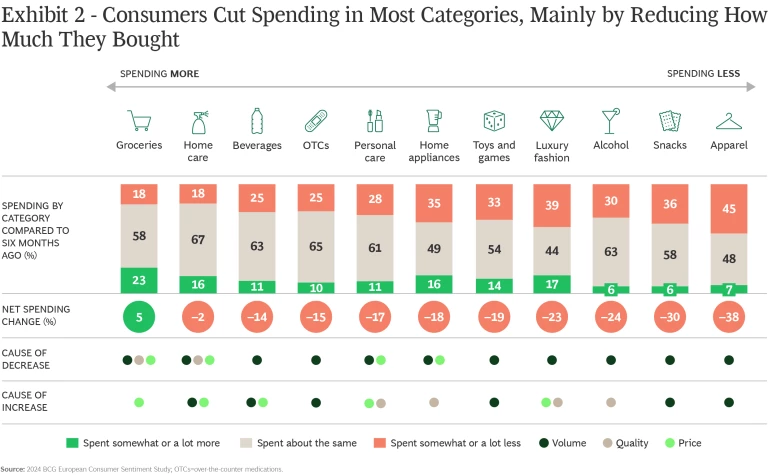

As inflation drove up prices, French consumers responded by spending more on basics (37%). Unsurprisingly, groceries was the only category of the 11 product types we studied with a net spending increase for the first half of 2024 (5%) despite the fact that people reported trying to trim grocery costs by buying less, looking for deals, and switching to lower cost brands. (See Exhibit 2.)

To compensate, consumers cut spending on most other products, primarily by buying less, but also by trading down to lower quality goods or looking for deals and promotions.

Of the product categories with major dips in spending, apparel stands out. Forty-five percent of French consumers said in the first half of the year, they bought fewer clothes or shopped for them less frequently. People also reported curbing spending on snacks and alcohol. Spending on luxury fashion was the most polarized of any category. Although net spending decreased, 17% of luxury fashion shoppers reported spending more, either paying higher prices or buying more expensive brands.

The squeeze the French feel isn’t abating. At the time of the survey, more than six out of ten people said that in the second half of the year they expected prices to keep rising and incomes and savings to continue to stagnate or decline.

But feelings about the immediate future aren’t all bad. The portion of people who expected their spending to increase through the end of 2024 was substantially smaller than the portion that felt that way about the beginning of the year - 16% v. 37% for basics, and 19% v. 36% for non-essential items. It indicates that consumers’ feelings about the economy may have hit rock bottom and could signal a rebound in coming months.

Sustainability with a French Flair

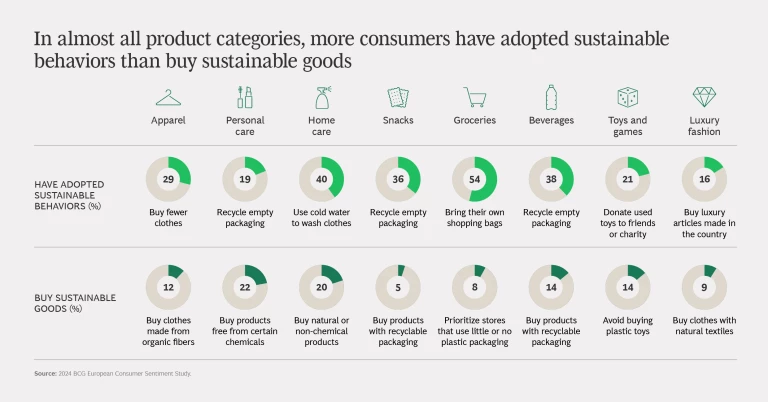

French consumers care about the environment and report adopting sustainable behaviors because of it. Some of their green practices are different from those of other Europeans. Take apparel. French consumers go green by buying fewer items of clothing (29%) while Danes recycle used clothes (30%) and Germans repair older clothes to make them last longer (27%).

But sustainability habits only go so far—especially when people are feeling squeezed. More French consumers report having adopted sustainable behaviors than buying sustainable goods. Of consumers who said they buy sustainable products, the largest portion purchase personal care or home care items made with natural products or that are free from chemicals (22% and 20% respectively).

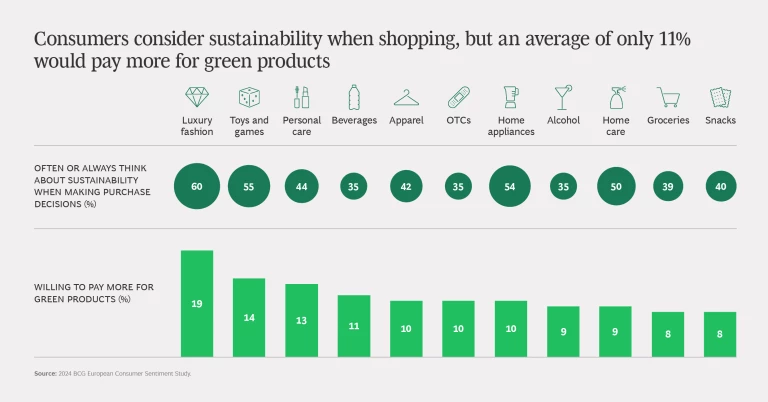

However, an average of only 11% of French consumers said they would be willing to pay more for green products. The portion of the population who would pay a green premium is lower than the 19% average for all the countries we surveyed. The difference illustrates divide that exists between what people say they are concerned about and their willingness to act on those concerns, or what we often refer to as the sustainability say-do gap .

One reason that sustainability isn’t a bigger factor is the higher worth that consumers still place on more traditional purchase criteria, including good value for the price, functionality, and convenience. (See Exhibit 3.)

Although sustainability isn’t a top purchase consideration when people buy something, it outranks other characteristics they think are important, including uniqueness, recommendations, premium-ness, or loyalty programs. When evaluating all key purchase considerations, French consumers are more willing than shoppers in Germany and the UK to compromise on other features to get sustainable products.

People Still Like Buying from a Physical Store

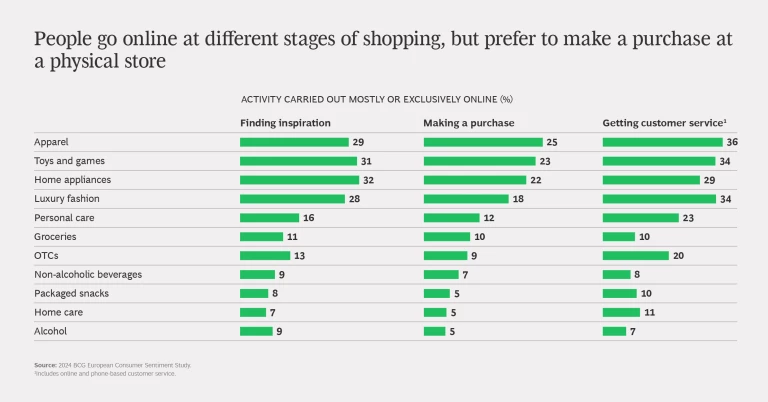

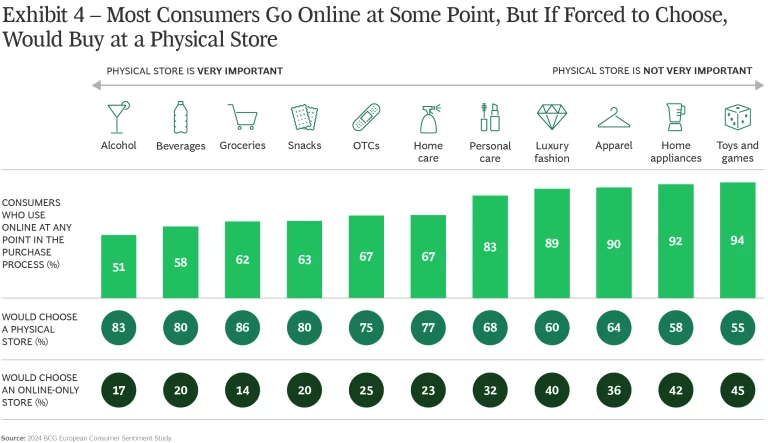

In the quarter century since the dawn of e-commerce, going online has become an accepted, integral part of shopping. The majority of the decisions French consumers make about the products they want to buy are influenced by going online at some point in the consumer journey. They browse, research information, or look for inspiration before a purchase and get help with a delivery or return after the fact.

However, fewer than 50% complete purchases online. If forced to choose, more than three out of four would pick buying something at a physical store with no online presence over patronizing an online-only vendor. (See Exhibit 4.)

People are least likely to go online to buy groceries, alcoholic and non-alcoholic beverages, and over-the-counter medications—items that are frequent purchases or smaller, impulse buys. They’re most likely to buy apparel, home appliances, toys and games, and luxury fashion from an online store.

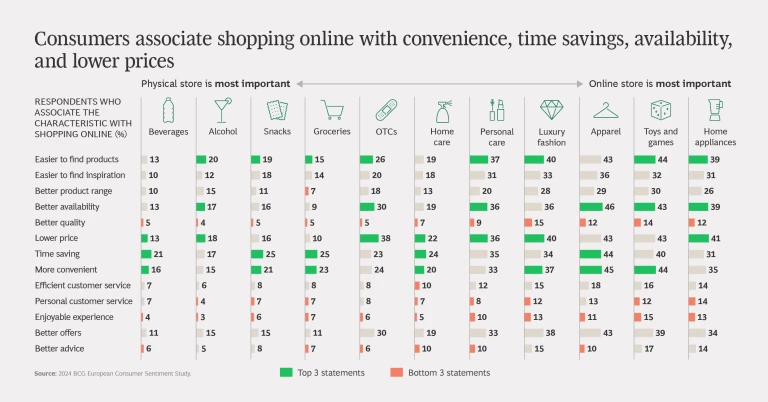

Consumers in general still view offline shopping as easier, better, and more efficient. In product categories such as groceries, beverages, and apparel, they believe it’s easier to be inspired and get recommendations or advise on the purchase at a physical store. On the other hand, consumer said that shopping online is better for convenience, saving time, availability, finding products, and lower prices.

How Companies Can Address These Trends

To strengthen ties with French consumers and stay competitive, companies should consider taking action in three areas--product assortment, pricing, and promotions. We've found that the impact is greater when companies launch changes in all three areas simultaneously. Due to the time and resources needed, however, most companies choose to address one area at a time. In addition, for changes to be successful, companies need a strong data analytics foundation.

Localize product assortment. French people are spending less, especially on non-essentials. They have different preferences for where they like to shop, and many still like buying in a physical store. To adapt, companies could customize what they offer in their physical locations to meet local demand and offer a broader, global range of products on their e-commerce platform, which could appeal to shoppers who go online to browse or be inspired. In addition to increasing customer satisfaction, such changes minimize excess inventory.

A typical example of adjusting product assortment is adding goods that appeal to local consumers' preferences or customs, such as halal or kosher foods. Companies also could offer products from vendors who promote a local terroir to cater to consumer preferences and reduce their environmental footprint. French consumers have different tastes and preferences depending where they live—for example, residents in the north prefer butter while residents in the south prefer olive oil. Because French consumers value the uniqueness of hyperlocal products, those items are ideal candidates for companies to stock in local stores as well as online. Part of the success of French independent retailers such as E.Leclerc, Coopérative U, and Intermarché has been this ability to adapt product assortment by store, and to source local brands in order to cater to the specific local needs of their customer base.

Adopt dynamic pricing. French consumers have become more price sensitive. Companies could use data-based dynamic pricing strategies to counter shifting consumer preferences while improving their ability to respond to fluctuating volumes, local market conditions, commodity prices, and competition.

Amazon is renowned for repricing electronics, wine, and other items multiple times a day based on inputs such as competition pricing, inventory levels, and consumer demand.

A leading European furniture retailer adopted dynamic pricing as part of a strategy to sell lower-cost items in order to respond to inflation and consumers' desire for more affordable home furnishings. To manufacture lower-priced goods, the company intensified its cost focus across the board, including for design, material development, production, and marketing. To make good on its promise to make the new items affordable, the company used an advanced pricing engine to adjust prices dynamically across sales channels and regions. The changes enabled the company to increase sales despite continued challenges in the furniture industry.

Subscribe to receive the latest insights on Consumer Products Industry.

Make promotions hyper-personalized. In addition being more price sensitive and reluctant to buy non-essentials, French people show less interest in loyalty programs relative to other shopping factors. Companies can counter such sentiments by individualizing loyalty programs and promotions.

Companies with successful programs use advanced analytics —including AI—to offer a level of personalization across sales channels that other personalized promotions cannot match. The exclusivity that analytics-based promotions offer keeps consumers engaged and meets their need for good value and quality, making it more likely that they will keep shopping.

Nike's membership program is a prime example of an AI-powered, hyper-personalized loyalty experience. People who download the free Nike membership app receive special access to exclusive products and experiences, free shipping, and more lenient return policies. In exchange, Nike collects consumer data from both the app and offline channels that the company uses to improve the company's highly targeted, relevant promotions. A Nike loyalty program member who typically buys outerwear during the winter may get related promotions before the season starts.

Enhance data collection. To successfully launch initiatives in product assortment, pricing, and promotions, companies must improve their ability to collect rich data on consumer behaviors and preferences across sales channels. Rich data includes consumer demographics, interests, and motivational drivers; what people buy, when, how, where, and why; and how they engage with sales channels, including through promotions or loyalty programs. If they revamp their digital presence and loyalty programs, companies can use the access they have to first-party consumer data to capitalize on customer relationships in ways that in the past were not possible.

Acknowledgements

The authors would like to thank Mary Patrikiou and Martina Scrocco for their helpful comments and suggestions. The authors would also like to thank Megan Moore for conducting the research upon which this report is based.