This paper shares perspectives from BCG and stakeholders across the hydrogen value chain that will be useful as a preparation to those attending the World Hydrogen Week conference in Copenhagen. The perspectives include topics like the hydrogen equipment supply chain and the need for industry collaboration and will also be relevant to everyone involved or considering to enter or cooperate with the hydrogen industry.

Everyone with a stake in the emerging hydrogen industry understands its critical role both in decarbonizing hard-to-abate industries and in providing an alternative power source in a diversified energy security program. And indeed, the industry is growing, thanks to a combination of political and regulatory commitments to decarbonization, considerable investment from both institutional investors and private capital, and the rapidly maturing and increasingly efficient technologies needed, especially electrolyzers and fuel cells.

As electrolyzer and fuel cell manufacturers continue to improve their technology, and demand grows for low-carbon hydrogen, the necessary equipment will be sourced globally. Multinational companies will manufacture locally and deliver internationally. By 2030, the industry could produce more than 20 megatons per annum of green hydrogen, or the equivalent of +200 gigawatts of electrolyzer capacity, which could increase tenfold by 2050.

Yet despite the industry’s promising future, bottlenecks are hindering the timely delivery of the electrolyzers, and fuel cells needed. This in turn has the potential to exacerbate regional competition between Europe, the US and Asia to gain the upper hand in further developing the technology and producing the hydrogen itself. Already, Western hydrogen equipment manufacturers are losing their technological edge over the rest of the world, and particularly Chinese players.

No single player holds all the capabilities needed to excel on all fronts in this rapidly forming industry. Only by working together can the different regional players take advantage of their complementary technological and manufacturing skills to scale up this crucial industry to the degree needed, and to do so profitably. Eventually, equipment manufacturers will need to embrace this regional contest and exploit the upsides of collaboration to make green hydrogen a success.

China Is on the Rise To Become a Strong Contender to Western Markets

Considered independently, the US, Europe and China each have strong motives for capturing their share of the hydrogen market, and distinct advantages that could further their efforts. Western markets, including both Europe and the US, are looking to build and control their local hydrogen ecosystem in order to boost their energy independence and resilience and to smooth the transition to a low-carbon economy for workers and legacy companies alike.

Europe and the US have a long-standing tradition of promoting innovation in hydrogen electrolyzers and fuel cells and using it in various industrial processes. As a result, these regions have maintained a technological edge and core knowhow on the component and systems levels. In Europe, for example, Norsk Hydro began manufacturing electrolyzers a century ago. And beginning in the 1960s, the US’s NASA space programs have created a strong base and supplier landscape for fuel cell technology.

Meanwhile, China has been developing its own hydrogen industry as part of its effort to decarbonize large sectors of its economy, notably transportation, a major cause of air pollution and the resulting health risks in its major cities. The growth of the industry there could allow it to dominate yet another energy technology, much like it has in the solar panel, battery, and other energy-related industries.

The Chinese government has established concrete 2025 targets for both the production and use of hydrogen of up to 200 kilotons of hydrogen production and between 6 and 12 gigawatts of electrolyzer capacity. It offers attractive financial incentives to domestic players including tax deferments and capex support for project and plant development.

Europe has a grace period of three to five years to expand its electrolysis and equipment footprint over rapidly evolving Chinese competition.

Its technology is improving, too. China is aggressively patenting new low-carbon hydrogen and fuel cell technology, issuing more than 1,000 new patent families in the area in 2021, twice the number of patents issued in Europe and the US combined. And its manufacturing prowess, scale and ability to develop production capacity quickly is unsurpassed. The price of Chinese electrolyzers can be two-to-five times lower than European systems, thanks to lower costs for labor and components, considerable local competition and government incentives.

A Vacuum Has Formed in the Hydrogen Greentech Space

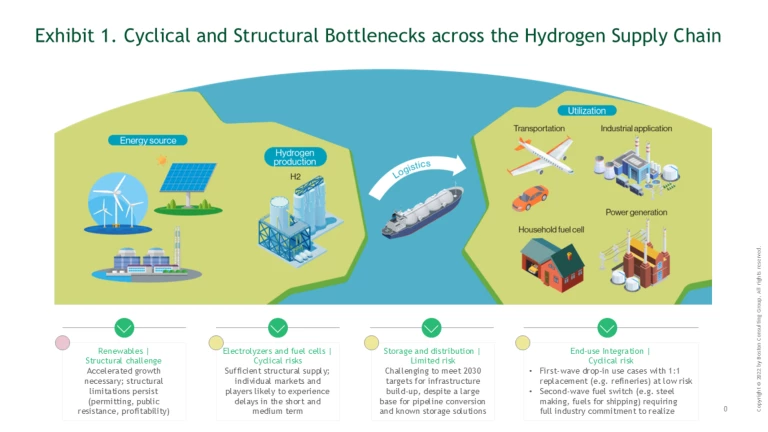

Despite the Western regions’ technological advantages and China’s growing scale and large market for hydrogen, the global supply chain of parts, components and distribution infrastructure needed to support the growing hydrogen ecosystem has not been able to keep up with the newly rising interest in hydrogen. This has created significant bottlenecks across the supply chain that must be overcome if the hydrogen industry is to meet its full potential as a key element of the energy transition.

This situation is largely the result of the low-carbon hydrogen industry’s immaturity and the need to scale up rapidly. Unlike the wind and solar panel industries, which have had decades to mature, demand for electrolyzers and fuel cells has begun to increase many-fold in just the past five-to-ten years. This is creating bottlenecks and delays that cascade throughout the supplier landscape. Some are cyclical— they can likely be relieved in the short-to-medium term. Others are structural and will require fundamental change to resolve.

As Exhibit 1 shows, the more critical bottlenecks relate to upstream activities involving the supply of sufficient energy feedstocks to hydrogen and synthetic fuel production, whereas the production of electrolyzers and fuel cells, and the infrastructure equipment for storage and distribution can be scaled from known technology. Hence, it is less critical in the long term.

The fuel cell and electrolyzer space is of particular interest, as it involves a great deal of core intellectual property and innovation in materials science and manufacturing. However, the coincidental intersection between the downturn in the global economy and delays in demand for hydrogen has caused many of the first-wave electrolyzer OEMs heading into the space to abandon their efforts and created a partial vacuum in the supply chain. A market that might otherwise have become quickly saturated has now left the door open for a second wave of OEMs to fill the void—and this time it’s with a more dispersed set of players and regions.

No Single Player Possesses the Full 360-Degree Capability Set of an Industry Champion

If equipment manufacturers in the key hydrogen producing regions continue to compete directly, however, progress in opening these bottlenecks could slow considerably and delay the industry’s promising growth trajectory. Instead, manufacturers in each of the three regions will need to work together and merge their complementary skills to overcome both their individual disadvantages and the supply-oriented bottlenecks that are slowing the broader hydrogen ecosystem’s rise.

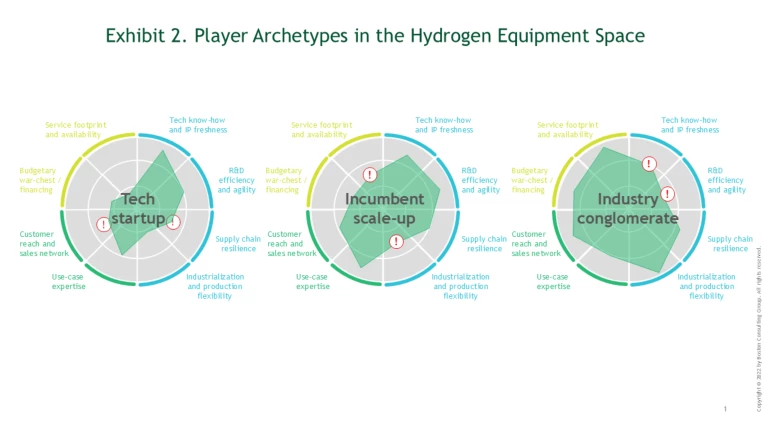

We see three types of players currently at work in the hydrogen equipment industry, regardless of geography, each one with their own strengths and weaknesses (see Exhibit 2).

- The tech startup. Often spin-offs, these players typically start from a strong and innovative technology base, but need to build a professional organization, commercial traction and predictable cashflow to grow quickly.

- The incumbent scale-up. These dedicated hydrogen equipment players have ties to customers from early pilots deployed in the field, and they are not yet hindered by organizational bureaucracy. But they are inexperienced at scaling the business and have not normally established a broad geographical service footprint.

- The industrial conglomerate. These large companies from neighboring industries (such as industrial manufacturers, solar players, engine makers and others) have extensive experience in maturing and scaling up new products, widespread customer reach, and the ability to self-finance from a healthy balance sheet. However, they are often slowed by layered internal lines of command and organizational complexity, two qualities critical for short innovation cycles.

Each type of company needs to scrutinize and sharpen the shape of its ecosystem and assess its individual strengths to make the best decisions regarding issues such as whether to insource or outsource specific tasks. This includes combining core strengths such as R&D and technology innovation with strong industrialization capabilities, including precision manufacturing and automation at large volumes. Meanwhile, they must all consider factors beyond the product itself, including deep knowhow on end-use integration and aftersales issues such as local serviceability, which will define how successfully their equipment is deployed and maintained.

Because no single player possesses all these capabilities on its own, and no one has the luxury of time to build them from scratch, forming liaisons to ensure all-around best practices is the way forward. Such liaisons have the potential to combine all the capabilities of an industry champion if done right.

Building an end-to-end hydrogen value chain can be accomplished through more or less formal partnerships across regional boundaries through risk-benefit sharing schemes among strategic suppliers, equipment manufacturers, hydrogen systems integrators, and customers. Such partnerships have been shown to be especially successful at delivering orders on time, within budget and with top quality. Other models include joint ventures between current manufacturers of electrolyzers and fuel cells and licensing agreements designed to share technologies and manufacturing know-how among players.

Equipment Players Should Aim for Co-Opetition To Shape a Successful Industry

It is in everyone’s interest to encourage the increased use of hydrogen and further develop the industry with strong players who can make hydrogen competitive.

No single player in the hydrogen industry can currently demonstrate all the industry best practices across technology innovation, manufacturing excellence and go-to-market capabilities needed to thrive in the growing low-carbon hydrogen ecosystem. The equipment manufacturers most likely to succeed are those that can successfully combine their complementary skillsets.

In the end, the guiding principle should be to build high-quality fuel cells and electrolyzers that are reliable over their full lifespan, ensuring that customers can reduce the levelized cost of the low-carbon hydrogen they produce.

The key is synergistic constellations and collaboration—working together across company and regional boundaries in a way that balances the interests of all the players in the hydrogen ecosystem and combines the individual advantages of every company and region to help build a cleaner, greener world less prone to the impacts of climate change.