For decades, the world of B2B procurement has remained largely unchanged. Now e-commerce is dramatically reshaping procurement—with marketplaces leading the charge.

The adoption of e-commerce has been significantly slower in the B2B market than the B2C market . The complexity of B2B procurement primarily drives this disparity. B2B transactions have characteristics that make digitization more complex. These include buyer-specific pricing or quotations, product customization, multisite or repeat deliveries, complex tax schemes amplified by cross-border trade, and a wide range of payment methods ranging from instant checkout via credit cards to pay-on-invoice. Further contributing to slow e-commerce adoption are B2B procurement’s strong, established, and complex go-to-market relationships with account managers and the entrenched use of multichannel procurement systems—such as mobile apps, procure-to-pay systems, and industry-specific procurement tools—which can be challenging to replace.

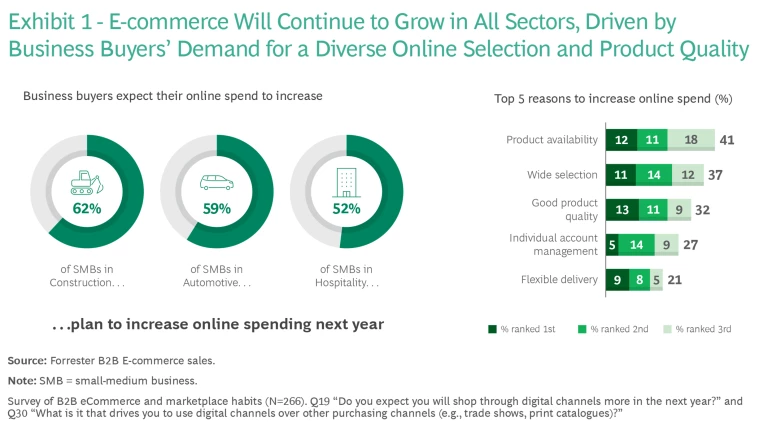

Despite these hurdles, B2B e-commerce is expanding rapidly, with global sales hitting $23.4 trillion in 2023, with a growth rate of 16% (Statista & AgileIntel Research), and sales in North America and Europe reaching $4.8 trillion in 2023. The trend towards online sales shows no sign of slowing down, with over 50% of SMBs (small-medium businesses) planning to boost their online procurement spending in the coming year—recognizing its benefits in streamlining procurement processes and reducing labor costs. (See Exhibit 1.)

Within e-commerce, the marketplace model is expanding at a rate seven times faster than traditional e-commerce, as reported by Digital Commerce 360. The marketplace model is where B2B businesses allow third party (3P) sellers to sell directly on their digital platforms, with the 3P seller remaining the merchant of record and the B2B business taking a share of the sales value as commission. Marketplaces allow B2B businesses to expand assortment to meet more customer needs in a scalable manner, without having to source, negotiate, price, promote, and fulfill the items.

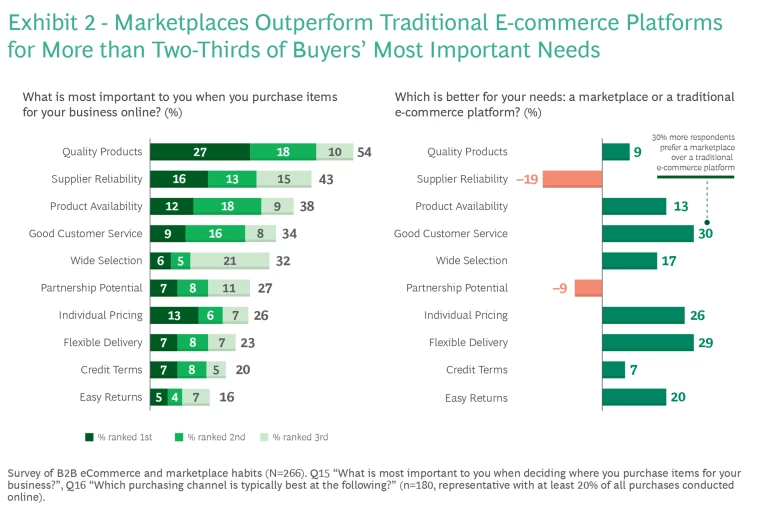

B2B buyers believe this model is superior, stating that when shopping online 8 of their 10 most important “needs” are fulfilled better through marketplaces than traditional e-commerce sites. (See Exhibit 2.) Most notably, marketplaces offer B2B buyers easier access to a wider range of quality products and better availability and visibility of inventory as well as good customer service, flexible delivery, and individual pricing.

The marketplace offers time savings for buyers by allowing them to compare a wide range of products, prices, delivery times, and service quality all in one place. — Maël-Yann Le Capitaine

Tapping into the Benefits of B2B Marketplace Procurement

As marketplaces continue to grow, it’s essential for all B2B corporations to develop a clear strategy for their involvement—whether as a seller, an operator, or both. At the very least, participating in marketplaces is advisable due to the potential benefits of expanding customer reach, increasing geographic coverage, and reducing the need for a large salesforce along with associated selling costs.

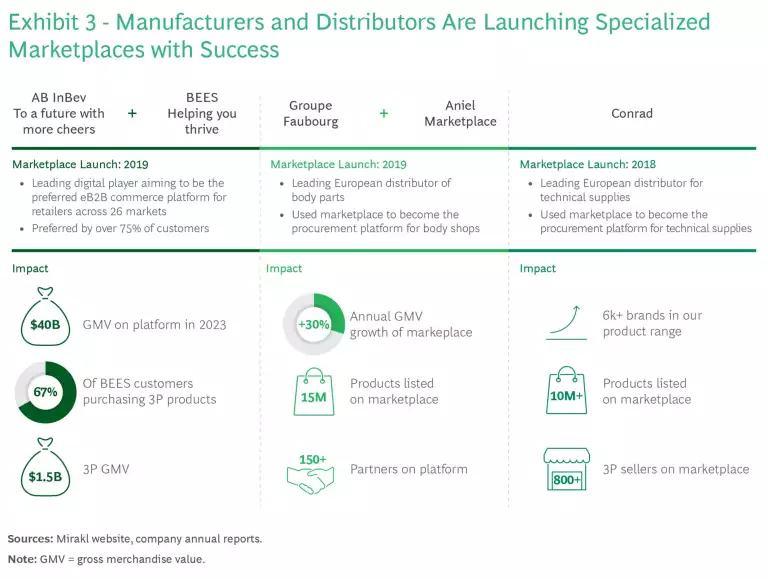

An increasing number of B2B corporations are launching their platforms and achieving success. For example, the Faubourg Group launched its marketplace through Aniel in 2019 and has since seen rapid expansion. The marketplace’s gross merchandise value (GMV) has doubled year over year. AB InBev is another case in point. Since launching a marketplace in 2019, its GMV soared to $40 billion in just five years, showcasing the substantial growth potential for suppliers in the marketplace model. (See Exhibit 3.)

The marketplace becomes an enabler to be successful, especially in the context of indirect route-to-market with a significant role played by wholesalers. It’s expected that B2B buyers will soon utilize digital platforms as one-stop shops for accessing a comprehensive array of products and services, driven by analytics and recommendations. — Vitaliy Novikov

We’ve identified four key reasons why B2B corporations are launching e-commerce marketplaces.

- Better customer proposition. The marketplace model allows B2B corporations to become the procurement platform for a customer type, acting as a one-stop shop so these customers don’t need to look anywhere else. The marketplace model makes it easy for B2B corporations to provide an expanded range to meet all of a customer’s needs. Based on a sample of over 100 marketplaces, our research found that the average marketplace launched over 100,000 active offers within 12 months of launch, with the number of offers posted on large, mature B2B marketplaces magnitudes higher.

- Operational simplicity. The solution is operationally simple: the B2B corporation can focus on the core range of their speciality through 1P while owning the logistics network. It then can use 3P to provide the full extended range without the operational complexity of directly handling the merchandising, pricing, or fulfillment of 3P products. The digitized customer journey also makes it easier for the sales teams to manage millions of B2B relationships in a much more scalable way.

- Economic benefits. Marketplaces earn steady profits through sales commissions (from 8% in B2B electronics to 20% in clothing and personal protective equipment), require low capital investment, and yield high returns, often contributing an additional 5% to 7% EBITDA margin.

- Data insights. Marketplaces provide crucial data insights into businesses’ preferences and emerging market trends outside of their core offerings. This data can be used to inform B2B corporations’ assortment strategy and personalize each customer’s experience. Additionally, marketplaces enhance retail media strategies through increased traffic and advertising bid density.

Specialization Is the Key to Success for Marketplace Operators

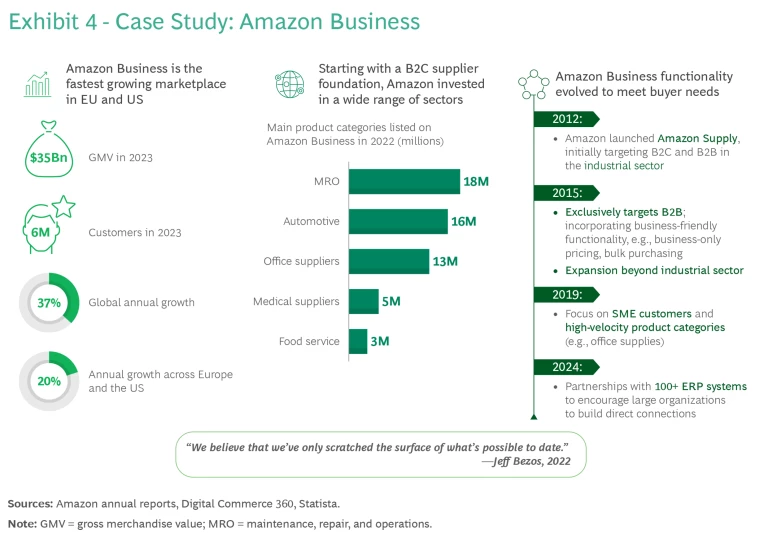

Initially, B2B marketplaces started out focusing on simple, lower-cost transactions that didn’t require customization, mainly competing on price. They made it easier for buyers to reorder familiar items, simplifying logistics and everyday procurement. Amazon Business, for instance, chose to focus on “Class C” products like office supplies and small tools. (See Exhibit 4.) This choice was driven by two factors: an existing customer base from its B2C platform, and the difficulty in earning trust for more expensive items due to early issues with counterfeit or low-quality products from sellers.

However, achieving success as a generalist in the marketplace requires immense scale, a feat attainable by only a select few.

We are now seeing B2B corporations pivot towards launching specialized marketplaces that provide customized solutions and products catered to specific sectors like food and hospitality, healthcare, and automotive. These marketplaces offer a much broader range of “smartly curated” sellers to ensure they are high-quality and trusted. Additionally, they offer a user experience tailored to the needs of that buyer type.

The food and hospitality, healthcare, and automotive sectors stand out in the B2B sales landscape because they are large (>$1 trillion in sales), more fragmented with a large number of B2B corporations (~4m collectively), and have relatively lower product complexity, making them particularly well-suited for a digital marketplace model versus other sectors.

Approximately 50% of B2B buyers would actively prefer to shop on a manufacturer’s marketplace vs. a general purpose B2B marketplace, with another ~30% indifferent and 10% to 20% showing a preference for a general purpose B2B marketplace.

—Customer survey

Strategies to Successfully Launch—and Grow—Your B2B Marketplace

Creating a successful marketplace isn’t easy; it requires the right business foundations and brilliant execution. We believe there are five critical factors for coming out a winner in B2B e-commerce.

See the marketplace as a long-term strategic bet, and get support from the top.

Launching a marketplace is a strategic, long-term endeavor. This is particularly true in the B2B sector, where the path to profitability takes time due to the need to change entrenched buying behaviors and customize experiences to address complex needs.

Commitment to running an e-commerce marketplace is essential; you cannot merely test the waters. Because B2B buyers typically prefer to use just two or three platforms, the market only has room for a few specialized marketplaces per vertical. Believing that you can be one of the winners in this competitive landscape is vital. Having advantaged access to buyers or sellers is a significant asset. These privileged connections not only provide an initial user base but also likely endow your organization with “relevance and trust” that can be used to accelerate your growth.

Launching a marketplace impacts many aspects of your business and requires sponsorship at the CEO level to champion it during the journey to profitability.

Double-down on seller growth to stock the full product range that will meet customer needs.

An e-commerce platform is most successful when it becomes a buyer’s exclusive and trusted procurement option—meaning it has everything a buyer needs and enough choice to trade-off between price, delivery speed, and other considerations. Key to achieving this is having multiple high-quality sellers. Enlist three or four cornerstone wholesalers to win over the first tranche of sellers and buyers.

And while you want to start strong out of the gate, continuous recruitment of sellers is critical. Doing so drives flywheel growth: more sellers means more buyer choice. In turn, buyers have a more positive experience, which grows traffic and GMV. According to Mirakl, 96% of the variation in GMV can be explained by the increase in the number of sellers over the first five years of a marketplace.

This doesn’t mean opening the flood gates to sellers; the top two needs of B2B buyers in procurement are access to quality products and seller reliability. Consequently, seller expansion must be pursued thoughtfully and strategically. To maximize impact, prioritize sellers based on product relevance and reliability, as the top 10% of sellers often generate more than 80% of third-party sales. To protect your brand, implement stringent criteria for seller inclusion in the marketplace, and run regular due diligence to ensure that sellers adhere to the brand’s parameters. For example, Walmart requires that their sellers have a <2% order defect rate, and they must respond to customer emails within 24 hours. Connecting your buyers with quality sellers, products, and service will enhance your brand equity—a key point of differentiation of specialized marketplaces over a general purpose B2B marketplace.

Train your salesforce to drive buyer adoption of the marketplace.

Launching a marketplace will significantly change your business and, notably, the role of your sales organization. It’s essential that the sales team fully understands and appreciates the benefits of this new platform so they can effectively promote it to customers. The primary advantage to communicate is that buyers can compare various types of parts, prices, delivery times, and service quality, saving them time and providing them with products that optimally meet their needs. Over time, this will also alter the nature of the sales team’s role within the business, helping buyers understand and expand use of the platform versus selling products.

To make sure the sales staff are fully onboard with the program and to maximize the benefits, it’s important to manage this transition carefully and provide ongoing training to help them shift toward a more strategic and value-adding role.

We’ve significantly invested in sales team training, deploying an entire sales enablement process to ensure our team fully understands the marketplace concept and how to effectively pitch it to customers, particularly those familiar with traditional distribution channels. — Maël-Yann Le Capitaine

Tailor the customer experience to meet B2B requirements.

Creating an outstanding customer experience is crucial to retain business buyers on the platform. Just as in B2C e-commerce, having effective navigation tools, capabilities for faceting and sorting, and personalization to drive engagement and conversion are essential to ensure that products are easy to find—and to maximize conversion/basket size.

Incremental functionality is also necessary to solve businesses’ specific needs. For example, since over 80% of B2B purchasing decisions are made by teams rather than individuals, integrating quoting workflows and ERPs is critical for business buyers. Another major piece of functionality required in the business space is supporting differentiated pricing based on volumes and individually negotiated terms. Once these capabilities are implemented there is an opportunity to lock in customers through additional value-added services, such as payments, credit services, and logistics propositions.

Balance build versus buy in standing up a scalable and differentiated tech platform.

Marketplaces require a dynamic, cutting-edge tech architecture that integrates with existing systems and supports integration with third-party suppliers’ systems to display prices and inventory in real time. This capability is even more critical in B2B than B2C because sellers are onboarding more complex products, buyers expect integration into their ERP systems, and functionalities required on the platform (e.g., price negotiations) are more complex.

Deciding between developing technology in-house or partnering with an external provider involves balancing technical capabilities, budget, time to market, and overall strategy. Building from scratch allows potential to differentiate, but typically drives a much slower speed to market and a large investment versus partnering with specialized marketplace providers.

Corporations often take a balanced approach across these two, building and owning areas critical to maintain competitive edge (such as the buyer front end) but outsourcing commoditized components (such as the underlying marketplace platform) to specialized providers who bring significant off-the-shelf functionality, making them more scalable and quicker to deploy. Creating a marketplace can be a complex project, so it’s important to have access to B2B platform expertise, whether internal or external.

To remain competitive, e-commerce retailers also need to keep up with technology changes and incorporate advancements such as generative AI . For example, eBay recently adopted AI to improve product descriptions on its website. And Walmart has recently explored using the metaverse with its Realm platform to help users understand and explore new products.

After conducting B2B procurement the same way for many years, changes are happening quickly. The bold bet of becoming an e-commerce marketplace operator has huge potential for returns; however, it requires careful strategy and full commitment. It also demands embracing the model’s intricacies and acting decisively to leverage its advantages.

If you don’t have a strategy to participate in a marketplace as a B2B corporation, now is the time. Early movers will find it easier to “win” both sellers and buyers. This can lead to significant network effects, creating a positive feedback loop where initial growth fuels further expansion.