As the urgency of climate change has grown, the number of ESG regulations in the European Union has risen rapidly, and more are expected over the next few years.

To navigate this increasingly complex environment, European medtech companies must understand the current regulations (including the European Sustainability Reporting Standards) and those that are being considered (such as a directive on corporate sustainability due diligence). Then, companies need to prepare to comply.

Leading medtech companies are deploying a regulatory-watch process in their value chain—a novel way to track new and upcoming regulations. They are also embedding environmental, social, and governance (ESG) and compliance policies across their value chain in innovative ways.

These actions protect companies from noncompliance-related fines, which can be quite high. Germany’s Act on Corporate Due Diligence in Supply Chains, for example, stipulates fines of up to 2% of average annual revenue. And when companies go beyond merely complying, their actions put them in a better position on several fronts: bidding competitively in procurement and creating a cost advantage, gaining access to attractive financing for green technologies, providing greater transparency for investors and customers, and making the company more attractive as an employer.

Environmental Regulation Is on the Rise

Medtech companies, like others in the health care industry, have had a significant impact on the environment. Health care greenhouse gas (GHG) emissions account for almost 5% of global emissions. If the health care sector were a country, it would be the fifth-largest greenhouse gas emitter.

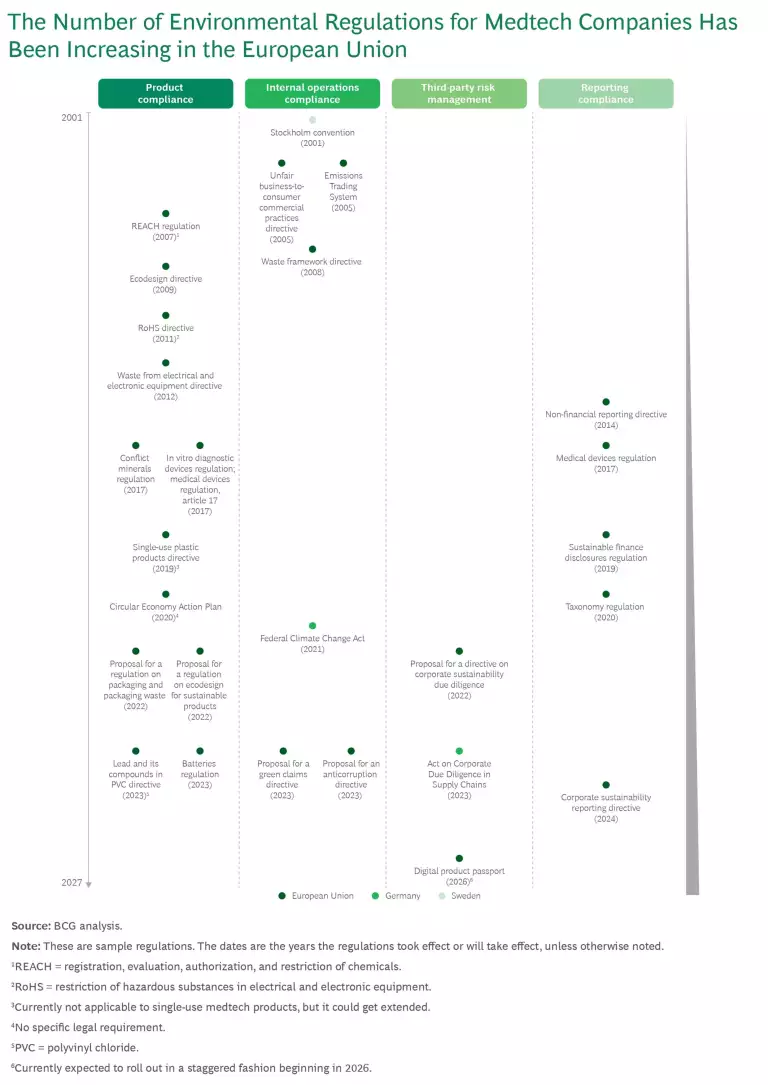

Over the past 20 years, the number of ESG-related regulations relevant to medtech companies has risen dramatically. (See the exhibit.) This increase is on top of a proliferation of product regulatory requirements to safeguard patient health—for example, by protecting them from the risk of infection—and to ensure that the products benefit patients.

Currently, ESG-related regulations fall into four key areas: product compliance, compliance of the company’s internal operations, third-party risk management, and reporting compliance. Of these four areas, product compliance is especially relevant because more than 50% of medtech GHG emissions stems from the product itself, product use, and product disposal. Moreover, medtech products contribute significantly to hospital waste through single-use products, packaging, and product expiries.

The increasing number of product regulations have a specific ESG-related goal: to reduce negative environmental impacts. To accomplish this goal, many are targeting product design and waste.

Product Design. Several EU regulations and directives regarding product design are especially important for medtech companies. These include:

- The directive on the restriction of use of certain hazardous substances in electrical and electronic equipment (the so-called RoHS directive)

- The regulation concerning the registration, evaluation, authorization, and restriction of chemicals (REACH)

- The restriction of lead in polyvinyl chloride and copolymers products under the REACH regulation

- The proposal to ban perfluoroalkyl and polyfluoroalkyl substances

However, there is no specific product plastics regulation or directive on the horizon. Rather, the EU’s plastics strategy is to transform the way plastic products are designed, produced, used, and recycled in the EU. Eventually, all plastics used in the EU will likely be recyclable, though medtech companies could be partially exempt given that some medtech plastic products become contaminated during use.

Waste and Recycling Management. The EU has also developed some important waste management regulations that companies should keep an eye on. The directive on waste from electrical and electronic equipment (the so-called WEEE directive) requires companies to prevent or reduce the impact of secondary packaging on the environment. The waste framework directive focuses on reducing manufacturing waste and the disposal of single-use products. And the proposal for a regulation on packaging and packaging waste requires that packaging be reusable or recyclable and have a label bearing the manufacturer’s name.

To comply with these different regulations and directives, companies need to start thinking about waste management and developing a strategy to produce and use reusable or recyclable packaging for their products.

Article 17 of the EU’s medical devices regulation, which took effect in 2017 and was revised in 2021, also provides guidance on the reprocessing of medtech products, postulating that companies must assume responsibility for the safety of reprocessed products. To comply with this regulation while also realizing business benefits, medtech companies need to make changes across the value chain, from product design through the end-of-life stage.

Adopting a Proactive Mindset

To ensure continuous compliance across the value chain, medtech companies need to adopt a proactive mindset to the changing ESG regulatory landscape. This means developing and implementing a regulatory-watch process that ensures agility so companies can respond.

Designing and Implementing a Regulatory-Watch Process

Staying on top of emerging regulations requires medtech companies to deploy a regulatory-watch process: a novel way to monitor new and upcoming regulations—including laws, bills, and guidelines—as well as market standards. There should be a checkpoint for identifying legal amendments on a regular basis so that there is sufficient time to respond. In addition, companies should evaluate whether there are areas where they want to do more than comply in order to create a strategic advantage in the market.

There are three key steps for ensuring that a regulatory-watch process is designed and implemented effectively.

Clarify the roles and responsibilities for different types of regulatory risk. Before setting up a process, medtech companies should conduct a holistic overview of the regulatory landscape and the relevant risk types that need to be monitored, with a focus on ESG-related regulations. Such an assessment enables companies to identify the roles and responsibilities needed to anticipate and respond to the regulations that affect them.

Develop a regulatory-screening hub. Medtech companies should develop and implement a regulatory-screening hub, comprised of external experts (usually lawyers or regulatory experts) who will monitor relevant risk types and pertinent regulations, laws, and directives.

Define response and escalation processes. Companies need to define and implement a process for assigning compliance responsibilities—that is, a way that clarifies which function or role will be accountable for complying with new regulations, laws, and directives. For example, if a regulation will impact the materials used in products, the responsibility needs to be assigned to product development so that accountability is clear. In cases where compliance responsibility is not clear, such as when the regulation pertains to end-of-life handling of devices, organizations need to have an adequate escalation process for assigning responsibility.

Responding to New and Upcoming Regulations

After a new or upcoming regulation, law, or directive has been identified, companies need to adapt their operational processes across products’ life cycle, consider product and packaging innovations, and revise their business models. These are key for companies that want to leverage ESG as competitive advantage.

Improve operational processes. Medtech companies should focus on making improvements across production, logistics, procurement, and other core processes. Some improvements will not only have a positive ESG impact but also generate a positive business case for change. For example, increasing efficiency in production, such as by reducing scrap or energy demand, creates cost savings while it reduces GHG emissions and waste. The same holds true for adopting green logistics practices, which include changing transportation modes from air to ocean and using more efficient packaging.

Pursue innovative products and packaging. Companies should be innovative when it comes to making their products and packaging compliant with ESG requirements and fit for customer requirements in the future. (Current customer requirements already cover the product’s carbon footprint and product-related waste.) There are various ways to do this.

Medtech companies can optimize input materials by considering more sustainable materials for both products and their packaging. Bio-based materials are beginning to be used for products, while recycled materials are more commonly used for packaging. Consider the following examples:

- Swedish medtech Mölnlycke, which specializes in wound care and surgical supplies, has launched a set of surgical drapes and operating gloves made of bio-based plastics instead of virgin plastic. This innovation has reduced these products’ carbon footprints by 20% to 25%.

- In its orthopedic division, Johnson & Johnson is using boxes made of postconsumer recycled paperboard, in place of 100% virgin paperboard, to package more than 250 items.

In addition, companies can rethink product design to extend a product’s lifetime, improve its recycling potential, and reduce the amount of material and energy used. For example:

- Medtronic designed its insulin infusion sets to be worn for seven days instead of three. This change reduced plastic waste by more than half, approximately 1.9 kilograms per patient per year.

- Siemens Healthineers has enabled energy efficiency in two ways: First, it has designed new products such as the Magnetom Free.Star MRI scanner, which requires 30% less energy than conventional MRI machines. Second, it provides upgrades, such as the BioMatrix Fit Upgrades, to improve the energy efficiency of existing products.

Revise business models. Companies can revise their business models to establish a new logic around how they generate value while improving sustainability. Some companies are adding a service and maintenance offering, an upgrade, or a product-as-a-service business to expand a product’s utilization and extend its lifetime. For example:

- Philips Remote Services provides remote support and AI-supported predictive maintenance for Philips’s MRI and CT machines. This service increases the machines’ capacity for the end customer, while reducing costs for the company.

- Siemens Healthineers is refurbishing medical equipment to sell to customers in developing countries. This strategy not only maximizes product use but also increases access to health care and opens new markets.

Key Next Steps

ESG regulations are a fact of life for European medtech companies. To ensure that their companies are prepared for upcoming and new regulations, medtech CEOs need to take the following five steps now:

- Define and create a regulatory-watch process to enable a proactive mindset.

- Clarify the roles and responsibilities for each risk type or regulation, law, and directive for those on your team.

- Set up a cross-functional team with business, sustainability, and legal skills to support the regulatory-watch process, and drive innovation beyond the minimum that is required.

- Establish targets and define initiatives to achieve compliance via process improvement and product and packaging innovation, as well as by leveraging new business models.

- Determine the potential strategic advantages and the type of regulatory risk that is involved if your company wants to do more than meet the minimum regulatory or legal requirements.

Companies that adopt a proactive mindset today will gain a competitive advantage tomorrow.

This article represents a joint effort with CMS, an international law firm.

The authors thank their colleagues in the BCG Center for Climate & Sustainability Policy & Regulation for their contributions to this article.