Evidence is mounting that climate change is taking a toll on human health. Rising temperatures, increasing air pollution, and more frequent extreme weather events are manifestations that will continue to expose more people in more places to disease, health complications, and injury. Beyond its impact on individuals, global warming puts a strain on health care providers , causes loss of work hours, and leads to higher economic costs. It is also leading to mounting claims and costs for health insurers.

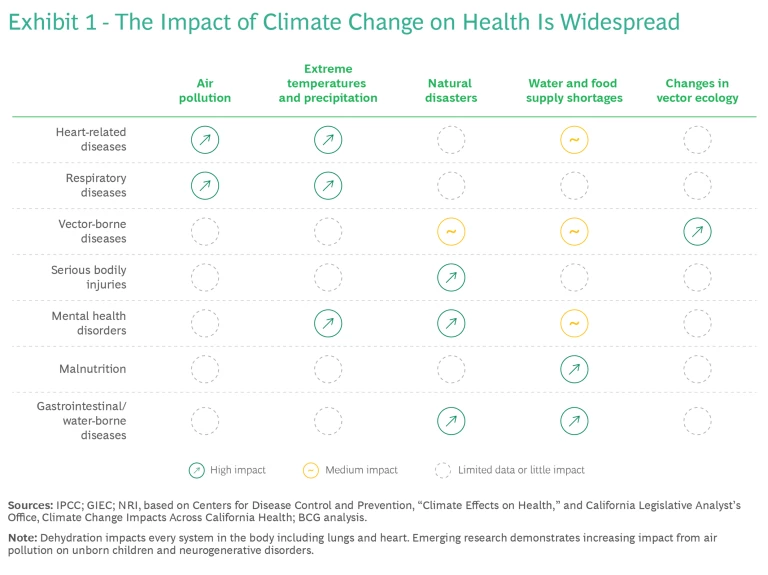

At the moment, extreme temperatures and air pollution appear to be the biggest threats, but water and food insecurity, natural disasters, and shifting disease vectors pose additional dangers. (See Exhibit 1.) Climate risks are existential threats for every country: rich or poor, north or south, developed or developing. As the WHO put it in a 2023 report, “All aspects of health are affected by climate change, from clean air, water, and soil to food systems and livelihoods. Further delay in tackling climate change will increase health risks, undermine decades of improvements in global health, and contravene our collective commitments to ensure the human right to health for all.”

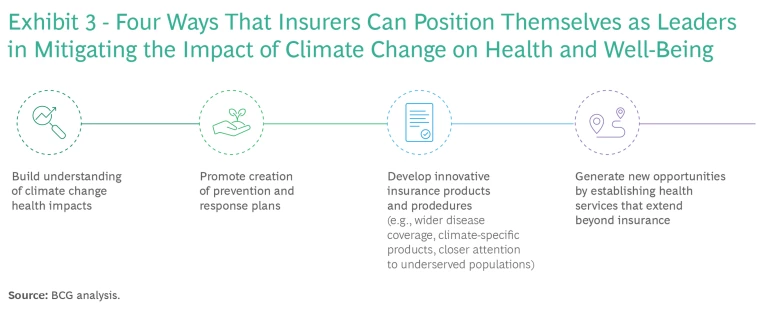

Where there is risk there is also often opportunity. Life and health insurers can lead the fight against climate change’s impact on health and well-being by taking steps in four areas: building understanding of the impacts, promoting prevention and response, developing innovative insurance products, and establishing new services that extend beyond basic insurance. In the process, they can strengthen their clients’ health and their own businesses.

Unhealthy Climate

Global temperatures are warming and weather-related events are becoming more severe. The 404 natural catastrophic events that occurred in 2022 (the most recent year for which complete data is available), represent an increase of 22% over the annual average from 2001 through 2020. Research conducted by the US government agencies NASA and NOAA confirms that the trends continue: 2023 broke many global warming records.

Extreme heat, which the US Centers for Disease Control defines as “summertime temperatures that are much hotter and/or more humid than average,” is now a global problem. During the summer of 2023, almost half of the world’s population experienced extreme heat for 30 days or more. Extreme heat overcomes the body’s natural defense mechanisms and increases people’s risk of dying from cardiovascular disease by 12%—a rate that is expected to escalate as the planet continues to warm. It is believed to be leading cause of heat-related fatalities, One study estimated that extreme heat could be responsible for nearly 235,000 emergency-department visits and more than 56,000 hospital admissions each summer in the US, adding approximately $1 billion to health care costs.

Extreme heat reduces worker productivity and increases the incidence of workplace health issues. More than one-third of all of employees in France were affected by extreme heat at some point from 2015 through 2022. The Lancet Countdown estimates that extreme heat resulted in a loss of 490 billion potential labor hours globally in 2022, an increase of 42% over the annual average from 1991 to 2000. Projections show that 2.2% of total working hours in the US will be lost because of high temperatures by 2030—the productivity equivalent to 80 million full-time jobs.

Air pollution, another global problem, leads to 7 million premature deaths a year, according to the UN Environment Programme. Almost everyone at some point breathes air that is polluted above the WHO’s safe levels. In 2022, the World Bank highlighted the link between climate change and air pollution in its call to measure, monitor, and disseminate air quality data to the public. The Environmental Defense Fund ranks air pollution as the number one environmental risk for early death. Although further medical research is needed on the links between air pollution and cardiovascular and respiratory disease mortality, the American Lung Association says that “particle pollution and ozone are a threat to human health at every stage of life, increasing the risk of premature birth, causing or worsening lung and heart disease, and shortening lives.” A 2021 study by NRDC and Wisconsin Health Professionals for Climate Action found that US health-related financial costs due to air pollution and climate change exceed $820 billion a year.

Some 4 billion people live in conditions of severe water stress for at least one month a year. Water and food security is not just a developing-country problem, either. Strained water supplies have affected approximately 30% of Europe's population in recent years. In addition, climate change exacerbates disease vectors. Almost 4 billion people in 129 countries are at risk of mosquito-borne dengue fever, which caused some 40,000 deaths a year.

The Chance to Lead

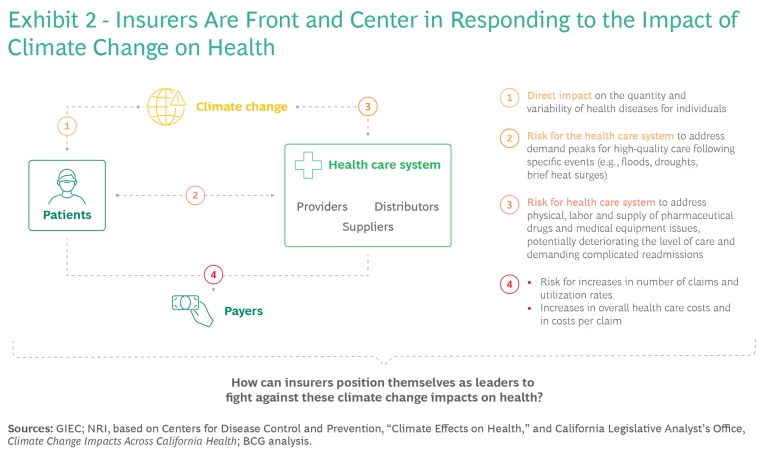

Climate change puts the life and health insurance industry front and center in coping with the resulting health effects. (See Exhibit 2.) Demand for care spikes in the immediate aftermath of climate change events. Global warming has a direct impact on the health care system through more frequent and severe illness and injury, disaster-related damage to health care facilities, labor shortages, and interruptions to the supply of drugs and medical equipment. Health insurers must deal with more claims as well as higher overall costs and costs per claim. In addition, climate change tends to increase both short- and long-term inaccessibility to health care, heightening policymaker and regulator attention to rising health inequity and the industry’s response to it.

To serve customers better and to maintain its own health, the life and health insurance industry needs to jump ahead of the problem before the situation progressively worsens. Doing so will enable it to lead the response to climate change’s impact on individual health and well-being and on the resilience of the health care ecosystem.

Four sets of initiatives are central to this task. (See Exhibit 3.)

Understand the Health Impacts of Climate Change

So far, property and casualty insurers have borne the brunt of climate change, while life and health companies have not had to adapt as quickly. This situation is now changing, but limited understanding of the direct impacts of climate change events on insurers’ portfolios adds to the complexity of companies’ risk assessments, mortality analyses, and tailored protection provisions.

Countries with relatively flexible policies on the uses of health data have seen the emergence of research institutions dedicated to relevant topics. For example, academics at Harvard University’s T.H. Chan School of Public Health have set up the National Studies on Air Pollution and Health (NSAPH), which uses data science, machine learning, and other advanced technologies to examine the interrelationships between climate change and health. NSAPH’s purpose-built data platform combines Medicaid and Medicare health data with data on air pollution and climate change to support faculty and student research.

Such institutions are eager to collaborate with health care stakeholders. Insurers should collaborate with climate research and university institutions and should assist governmental and academic institutions in climate-health policymaking discussions. They can also collaborate with civil society organizations (CSOs) that directly link communities and governments on specific topics. The WHO launched the Civil Society Commission in August 2023 to channel advice and recommendations from CSOs on health priorities and related issues. The European Observatory on Health Systems and Policies brings together partners from multiple sectors, including insurance industry groups, to develop information and recommendations for policymakers.

Some industry participants are already active in furthering the understanding of the interplay between climate and health. Research by Belgium’s Mutualités Libres showed that reducing air pollution to levels found in the least-polluted 25% of places in Belgium could save €43 million in doctor and emergency-room visits and that creating more green neighborhoods could increase the savings further.

Promote Prevention Measures and Response Plans

Insurers have successfully created programs to incentivize customers to live healthier lives through more exercise, better diets, and regular health checks. They can apply a similar strategy to climate-related health issues, with programs that include personalized notifications, education campaigns, and apps with live warnings and information.

For example, in the UK, the Heat-Health Alert Service, run by the Health Security Agency and the Met Office, helps health care professionals deal with periods of extreme temperature by issuing alerts when temperatures are dangerously high. In 2023, the system also introduced impact-based notifications that provide users with information on the specific likely effects of rising temperatures.

A Boston-based pilot program run by the not-for-profit Climate Central and Harvard University’s Center for Climate, Health, and the Global Environment alerts health care providers at 12 community-based clinics in seven states when temperatures exceed certain thresholds. The system sends email notifications advising clinicians which patients to prioritize (such as older people or people with certain illnesses), depending on conditions.

Develop Innovative Insurance Products and Procedures

Health insurers need to rethink their core businesses in the context of climate change, developing products and customer-related procedures to address climate risks. Here are a few examples.

Climate-Specific Insurance Products or Temporary Waivers. In response to an increase in extreme heat events in Japan, two of the country’s biggest insurers, Sompo Holding Inc. and Sumitomo Life Insurance, created a heatstroke insurance plan that costs as little as 73 cents for a day’s coverage. Customers can opt in to the plan each morning after checking the day’s weather forecast, and the plan covers hospitalization and other medical costs for conditions caused by exposure to heat and sun. The plan has proved popular, with 6,900 policies sold on a single day in June 2022.

In Australia, health insurers have sought to provide premium waivers for up to two to three months for eligible clients during natural disasters or unpredicted catastrophes. Medibank offered waivers during serious brushfires in the summer of 2020, and Bupa made similar waivers available during summer 2022 flooding in New South Wales.

Wider Coverage for Diseases. Health insurers can widen coverage for specific diseases to address emerging needs caused by the changing climate. One example involves dengue in Europe, where the disease has not historically been a problem. This may be changing because of climate-influenced disease vectors. There were 71 reported cases in the EU and EEA in 2022, according to the European Centre for Disease Prevention and Control, and 116 in 2023.

Another notable example is mental health, which is affected by extreme heat and air pollution. Research has linked high temperatures to increases in suicide, violent crime, and emergency-room admissions. Boston University researchers noted an 8% increase in psychiatric urgent care visits during the 5% of hottest days during the ten years of their study. An analysis of existing studies by researchers at the UK’s BioAirNet programme found that exposure to pollutants can lead to multiple mental illnesses, especially among children and adolescents exposed at critical stages of their mental development.

Health insurers have already begun to address this largely uncovered area of illness with prevention measures, apps, and new products. In Portugal, Fidelidade’s MultiCare created an innovative form of coverage that provides consultations, hospitalization, and complementary service options for mental illness. It also offers mental health screening, consultations, and wellness services on its online platform, along with a rewards program that encourages participants to adopt a healthy lifestyle. The company has set up a partnership with the Portuguese Psychologists Association to promote mental health literacy through digital solutions and through coverage of half the subscription cost of mental-health-related apps.

Addressing Underserved Populations. Health equity is a growing problem. The insurance industry needs to demonstrate that it is a critical part of the solution. In the process, companies can benefit from opening new market opportunities, improving their reputation and trust, and boosting employee morale.

One solution is to develop inclusive insurance programs for underserved people with low financial literacy. Another is to offer micro-insurance products for low-income groups that have few, no, or fluctuating financial reserves. In India, for example, insurance technology firm Blue Marble, the Arsht-Rock Foundation, and the Self-Employed Women’s Association are working with local insurer ICICI Lombard to pilot a micro-insurance product designed to cover lost wages when it is too hot for people to work. The program targets workers in the informal economy, and the pilot involves 21,000 women in five districts in the state of Gujarat. Arsht-Rock subsidizes premium payments. A sophisticated algorithm triggers payouts on the basis of satellite-assessed temperature data customized to each of the five districts.

Establish New Services

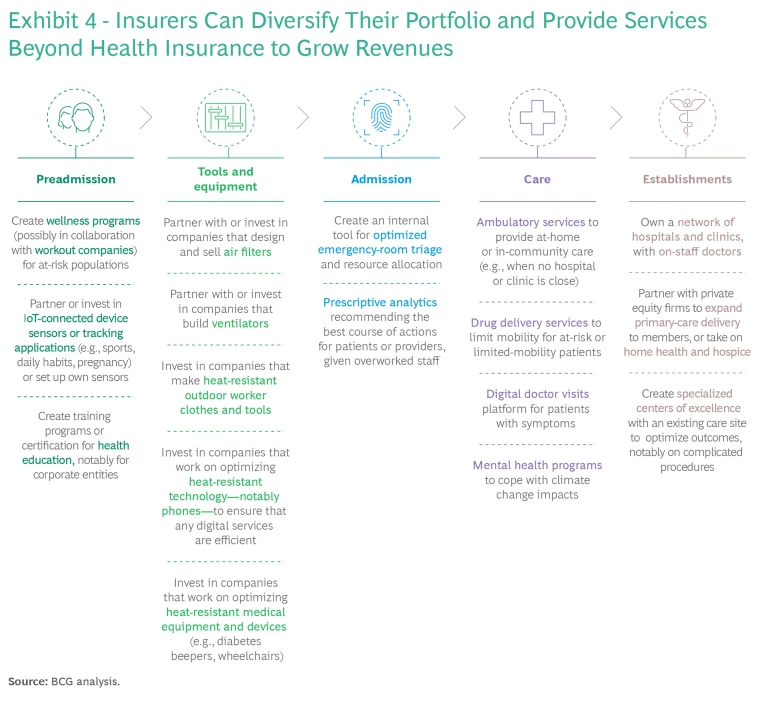

Health and life insurers can diversify their revenue streams by providing additional services to clients along the entire health value chain. (See Exhibit 4.) Going forward, services that broaden access to health care for climate-related illnesses or conditions are likely to be highly valued.

Some insurers have already begun to investigate or implement such initiatives. In the US, UnitedHealth Group subsidiary Optum connects members to “Centers of Excellence” programs that it has identified as offering high-quality, cost-efficient care. The centers address complicated diseases and treatments, including cardiovascular and respiratory diagnoses and procedures. They have been able to reduce the average length of stay at hospitals by 39% per case and the number of complications (compared with other centers) by 37%.

Climate change is already having an impact on life and health insurers’ portfolios. By adapting to the changing environment and developing innovative solutions to deal with the challenges it presents, insurers can protect—and even expand—their businesses while helping their clients live healthier lives and receive higher-quality care from a more resilient health care system.

The authors would like to thank Francesca Dominici, professor of biostatistics at the Harvard T.H. Chan School of Public Health and director of the National Studies on Air Pollution and Health Group, for her valuable contributions to this article.