Although inflationary pressures are gradually ebbing and reduced federal rates have offered some relief, consumer perceptions are not expected to shift quickly. So where and how are consumers cutting spending? Two spring 2024 surveys by BCG found that spending habits vary significantly depending on the category and demographic.

- Consumers are far more likely to trim their budgets in discretionary areas like electronics, while essential purchases—such as groceries and pet food—remain relatively untouched.

- Even within the grocery category, there are nuances: shoppers are willing to pay more for quality in areas like meat and fresh produce, but are more likely to cut costs on pantry staples and cleaning products.

- Higher earners are sticking to the same products (though are more likely to discount hunt than before), increasing promotion participation, and consolidating trips to big box retailers as long as they can buy the same products.

- Middle- and lower-income shoppers are hunting for deals, opting for store brands, and switching retailers in search of savings.

This evolving economic landscape is forcing retailers to rethink everything—from pricing strategies to promotional tactics—to remain competitive and capture market share. Historically, retailers that adapted their pricing and promotions during downturns were better positioned to retain those advantages even when consumer spending rebounded. Success in today’s complex environment will hinge on precision-driven, data-backed strategies applied at the item- and individual-store level to outpace the inflationary squeeze .

Pinpointing Consumer Spending Shifts

In the current climate, two-thirds of US consumers are buying less, opting for cheaper alternatives, or delaying purchases, as our research shows. Unsurprisingly, midtier luxury goods and apparel are taking the hardest hits, while grocery spending has held firm as shoppers shift their attention to mass-market brands. Competitive players have the tail winds now, but can also double down in the items and categories that matter most to consumer to disproportionately gain share.

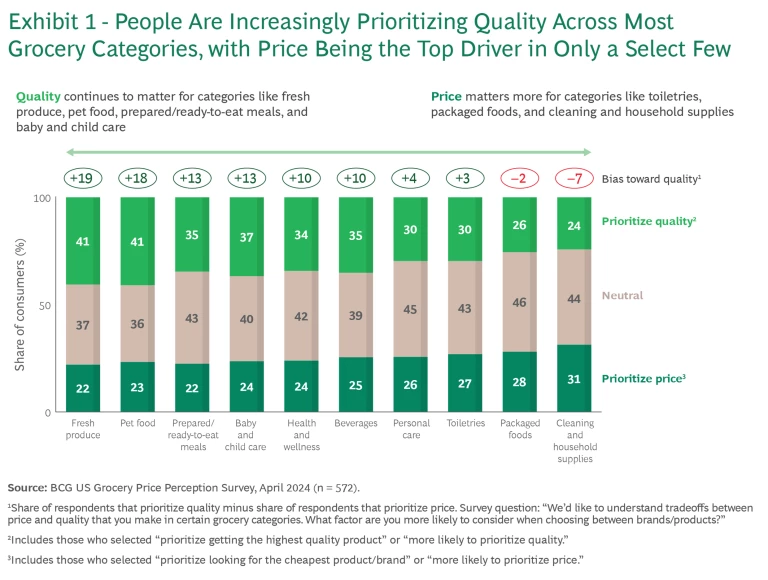

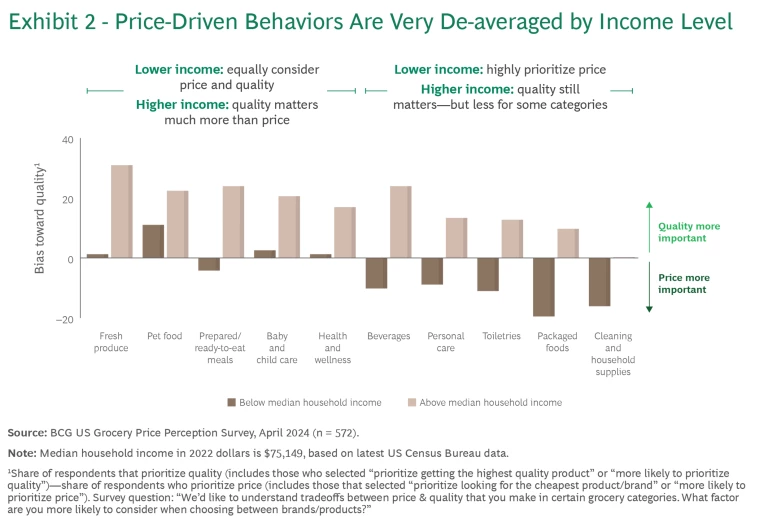

While grocery spending remains stable, not all categories are equally insulated. Price is a key driver of retailer choice for toiletries, packaged foods, and household and cleaning supplies, with a notable percentage—between 27% and 31%—of consumers willing to substitute quality for savings. (See Exhibit 1.) Meanwhile consumers of fresh produce, pet food, and baby care products are more driven by quality despite rising prices of these essentials. This nuance in price vs. perceived quality decisions also hinges on the purchaser’s income group—for example, while 35% of consumers prioritize quality in beverages, lower-income purchasers still anchor on price when choosing a beverage product. (See Exhibit 1 and Exhibit 2.)

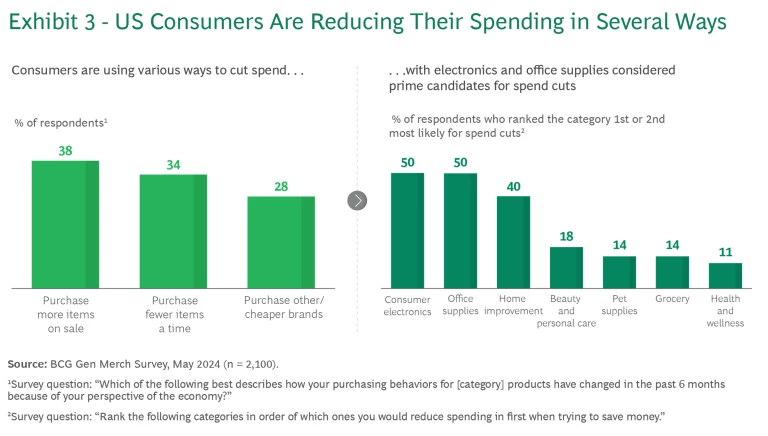

Shoppers are employing various strategies to manage their expenses, from buying fewer items to timing their purchases with promotions. The sharpest contrast is evident in the categories where consumers are most willing to cut back—electronics and office supplies top the list, while essentials such as groceries, pet supplies, and health products have largely escaped the chopping block. (See Exhibit 3).

The Price Sensitivity Surge

Inflation has heightened consumers’ sensitivity to price fluctuations and competitiveness. Among our survey findings:

- Some 30% of shoppers who switched from their preferred retailer cited price increases as the primary reason, choosing instead to explore more value-focused alternatives.

- Notably, 44% of consumers are investing more time in comparing prices online or using deal-hunting apps—a figure that rises to 60% in the electronics sector.

Price is the kingpin of switching behavior.

- A full 30% of consumers said they would jump ship to another retailer for better prices.

- Only 18% would switch for improved product selection.

To keep consumers loyal, retailers need to embrace dynamic, competitive pricing strategies.

Promotions: The Right Offer, the Right Time

Consumers are actively seeking out discounts to stretch their budgets.

- Nearly 40% of respondents reported making more sale-driven purchases in the past six months.

- During their most recent shopping trip, 85% of department store shoppers and 65% of supermarket shoppers took advantage of promotional deals.

- Without these discounts, 35% of them would have delayed or even canceled their purchases.

Retailers should take caution—an overload of nonstrategic promotions can overwhelm consumers, creating decision fatigue and diluting the perceived value of deals. When faced with too many options, shoppers may struggle to identify the best offers or simply tune out altogether. Additionally, excessive promotions may backfire, leading to unintended consequences such as cannibalizing sales, pulling future purchases forward and losing them later, or increasing labor demands to manage multiple offers simultaneously. The key to success lies in delivering targeted, meaningful promotions that resonate with a consumer base increasingly driven by discounts.

Private Labels on the Rise

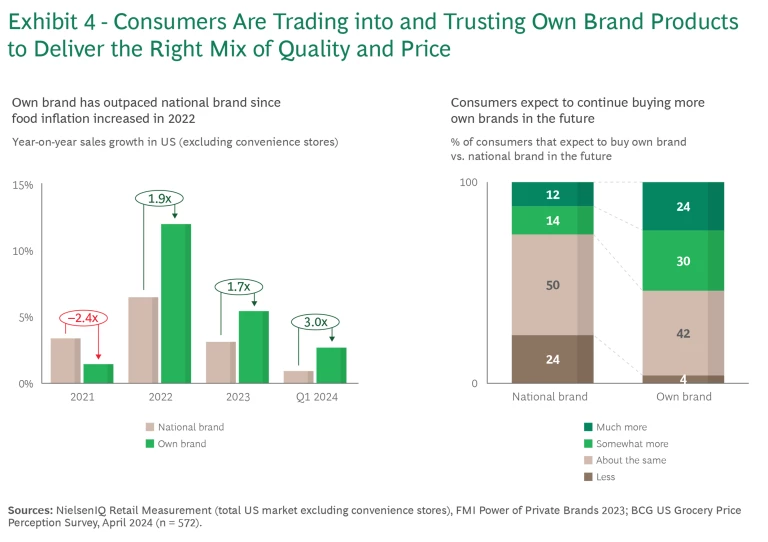

In the face of rising prices, consumers are embracing private label products as a cost-effective alternative to national brands—54% of surveyed consumers indicated they will increase their purchase of private label products in the future. (See Exhibit 4.) This appeal of private labels spans across all categories but has seen particular growth in grocery, where many consumers view them as equivalent in quality to their branded counterparts. Retailers looking to capture value-driven shoppers should seize this opportunity to expand their private label offerings.

Hidden Costs That Drive Consumers Away

In the e-commerce world, nothing deters a shopper faster than unexpected fees, particularly shipping costs, which can create a strong sense of frustration and mistrust. Research from Intelligence Node found that 52% of consumers refuse to pay for shipping, often abandoning their carts when confronted with unexpected charges. This reluctance is even more pronounced among younger shoppers, who are especially sensitive to even small shipping fees—70% of online shoppers would switch retailers over a $1 to $5 difference in shipping costs. For these consumers, transparency and affordability in pricing are critical to securing their loyalty.

The AI-Powered Future of Retail

Data has always been crucial for understanding consumers, but today’s complex market demands a deeper dive into real-time analytics. Retailers must leverage advanced data tools and AI to gain insights that can drive quick, informed decisions on pricing and promotions.

One of the biggest challenges retailers face is transforming massive amounts of data into actionable insights. Traditional pricing models are becoming outdated in this fast-paced, inflationary market. Disparate data sources and tools can slow down decision-making.

AI can help retailers move from broad pricing strategies to precision-driven, dynamic pricing solutions . Retailers leveraging AI-powered solutions have reported consistent revenue and gross profit growth of 2%–5%, while improving consumer-perceived value, as our experience with clients shows.

AI provides real-time insights into evolving consumer behaviors, such as shifting preferences between private labels and national brands—insights that are becoming increasingly vital in today’s competitive market.

Surviving—and Thriving—in an Inflationary Market

Consumers are still anchored to pre-inflation price expectations and have yet to fully adjust to the new, higher price levels, meaning their heightened sensitivity to pricing will persist for some time. Compounding this, the current price levels are likely here to stay. Retailers that respond by leveraging data, deploying advanced AI solutions, and refining their promotional strategies will position themselves as industry leaders. Success in this environment demands staying ahead of the curve—gaining a deep understanding of consumer behavior across categories and demographics to anticipate shifts in spending and make more precise product assortment decisions. As inflation continues to pressure consumer spending, retailers who embrace data-driven strategies will not only weather the storm but excel in this rapidly evolving market.