Social channels where a shopper can buy something with a single click. GenAI -assisted shopping. Virtual stores in the metaverse. Hyper-personalized, gamified experiences embedded in shopping journeys. Near-instant delivery.

Retailers are innovating more and faster to keep pace with changing consumer behaviors and preferences. Innovation gives them an edge, a key source of competitive advantage and resilience. According to new research from BCG and the World Retail Congress, retailers with industry-leading innovation practices perform markedly better than their peers.

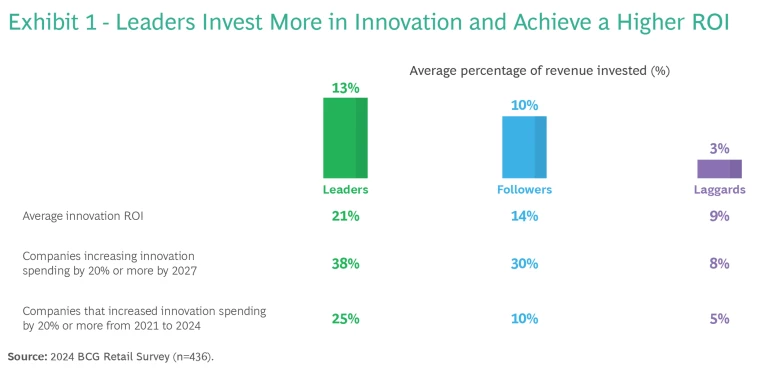

Our survey of more than 400 executives from a cross-section of retail sectors worldwide found that innovation leaders invest significantly more in innovation and achieve a higher ROI. (See Exhibit 1.)

Investing in Innovation

According to our research, both retail innovation leaders and laggards expect to increase how much they invest in innovation in the next three years; leaders anticipate spending 38% more, while laggards will spend only 8%.

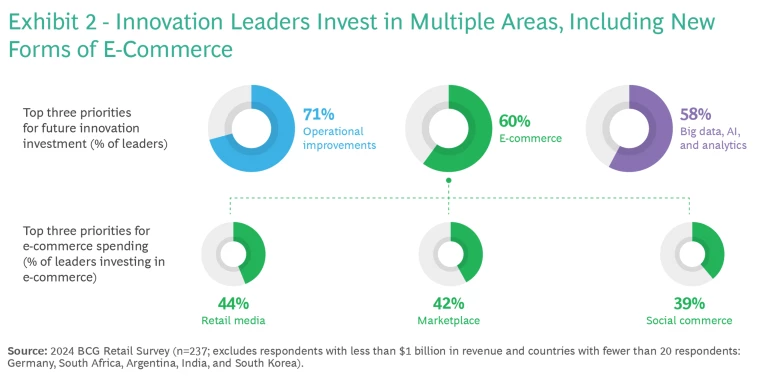

Leaders prioritize innovation investments in three areas: operational improvements; big data , AI, and analytics, and e-commerce. (See Exhibit 2.)

This is a modal window.

Operational Improvements

Retail executives are addressing cost pressures across their value chains by investing in process innovation and automation to improve and streamline operations. They often pass part of the resulting savings to increasingly value-driven consumers.

Big Data, AI, and Analytics

Leaders are developing roadmaps for targeted big data and AI use cases to drive significant changes in top- and bottom-line growth. Many are experimenting with GenAI to prove its value for creative content, customer support, and administrative and operational tasks, among other areas.

E-Commerce

Retailers are embracing new forms of e-commerce to meet consumers’ increasingly sophisticated needs, grow gross merchandising value (GMV), and improve profitability. Innovation leaders are investing in the following areas in particular.

This is a modal window.

Retail Media. Inventive retailers set up retail media networks so brands and other third parties can buy advertising space on the retailers’ owned properties, including stores, websites, and apps. Retailers use the data they gain from their close proximity to customers to offer targeted, high-conversion advertising opportunities to suppliers and other companies. In return, they earn margins of up to 60% or 70% of collected advertising revenue, significantly higher than traditional retail margins. One way companies with mature networks are expanding their activities even further is by selling ad space offsite, including programmatically across the web and on social media. They’re also giving advertisers the ability to target specific customer audiences to generate better returns on advertising spend (ROAS) and visibility into the impact through sophisticated measurement tools. And they’re offering advertising services to companies beyond their existing suppliers.

This is a modal window.

Marketplaces. More than four in ten innovation leaders in our survey have invested in marketplaces, the online platforms that let them collect commissions on goods listed and sold by third parties. Marketplaces help retailers quickly scale their range of products while simplifying internal operations; generating rich, insightful data; and driving superior profitability and ROI. This advantage helps explain why marketplaces have become the prevalent business model in retail e-commerce, generating more than two-thirds of all e-commerce sales. However, these platforms remain a relatively new phenomenon. In many geographies, there are no well-established marketplaces in many product categories—which opens up opportunities for first movers to scale quickly. Innovative retailers are taking their marketplace ventures a step further, creating platforms that are category-specific, offer low prices, or blend games and entertainment with buying.

Social Commerce. The convergence of social media and e-commerce enables brands, influencers, and other sellers to pitch products directly on social platforms in an engaging way, creating stronger shopper interest and higher conversion rates. Social commerce is more prevalent in the East, and covers a variety of emerging formats, including livestreaming and group purchasing opportunities. In China, social commerce already accounts for one out of five e-commerce purchases, and continues to grow. It’s also picking up steam in the West.

Retail Innovation Success Factors

Innovation leaders adopt a bold approach. They use innovation to shift customer expectations rather than launching initiatives solely according to what customer say they want. They identify areas where they can accelerate innovation by augmenting internal operations with external capabilities, including by collaborating with third parties and acquiring new capabilities. And they maximize their anticipated ROI by investing in multiple innovation initiatives at a time rather than focusing on one or two.

In addition, leaders’ winning approach is built on six success factors that separate their performance from that of other retailers. They align priority innovation areas with strategic goals; build a culture that fosters grassroots innovation, and invest in modern modular technology and data infrastructure. They also establish innovation teams and agile ways of working, adopt a risk assessment framework that allows them to take on higher-risk experiments and projects, and establish a dedicated innovation budget and governance.