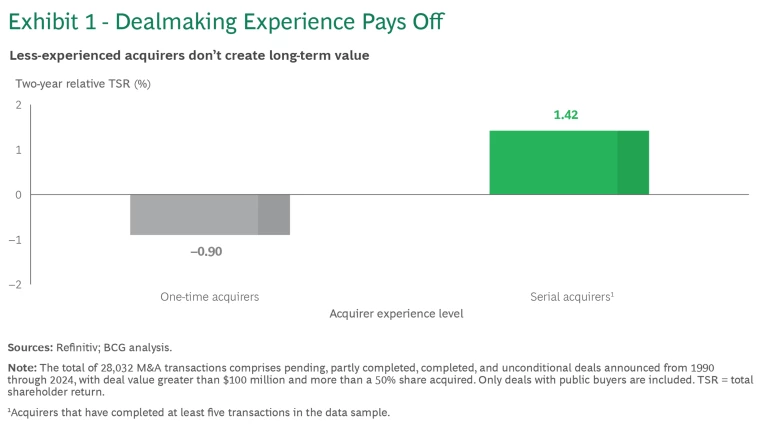

Experience makes the difference between successfully closing M&A deals and either missing opportunities or making poor choices. In BCG’s decades of supporting and studying transactions, we have found that—in the long run—companies that regularly engage in deals create more value and have higher success rates . Overall, they create superior returns, whereas less-experienced companies tend to destroy value. (See Exhibit 1.)

What gives experienced companies their edge? They understand the fundamental importance of strong executive ownership and strategic guidance over M&A priorities. Critically, they also recognize the essential role of a dedicated and capable M&A organization to support their transaction activities. Operating with a clear mandate and a well-structured, end-to-end process, the M&A organization collaborates with business units to identify targets and execute deals while expertly navigating a minefield of risks.

In a large-scale effort, BCG collaborated with global dealmakers to study the common pitfalls and success factors involved in setting up M&A organizations. The study included a survey of senior leaders from various regions, industries, and functions. (See “About the Survey.”)

About the Survey

A total of 129 executives participated, with representation from North America (39%), Europe (39%), and Asia (22%). The respondents work in major industries: technology, media, telecommunications (27%); health care (26%); industrial manufacturing (19%); consumer and services (13%); energy infrastructure (6%); retail (4%); automotive (3%); and materials (2%).

The sample focused on C-level and senior leadership. Approximately 70% of respondents work in their company’s M&A department or in corporate strategy or corporate development. Most respondents (84%) work in the corporate center or headquarters, while the remainder hold positions in business or regional units. Most respondents are highly experienced M&A professionals with comprehensive knowledge of end-to-end M&A functions and processes.

Approximately two-thirds of respondents work for large companies, primarily medium-size (500 to 5,000 FTEs) or very large (over 10,000 FTEs) enterprises. The survey sample included almost equal numbers of respondents from public and private companies.

The study’s findings indicate that making the right choices in several key areas is essential for building effective M&A organizations. Because each organization is unique, companies must tailor their design choices across these topics on the basis of a detailed understanding of the pros and cons. Companies that succeed will create top-notch teams that are prepared to act decisively and effectively throughout the life cycle of each deal.

What Are the Common Challenges?

Understanding the common pain points that M&A professionals face in their daily work is crucial to designing effective organizational structures. Survey respondents highlighted several obstacles that many of them have encountered. (See Exhibit 2.)

The most frequently cited challenge is a lack of promising targets: 47% of respondents mentioned shortcomings in their organization’s target search process. Nearly as many (46%) pointed to unduly prolonged processes during transaction execution. And 43% noted the absence of a clearly defined growth strategy or described their company’s approach as too opportunistic.

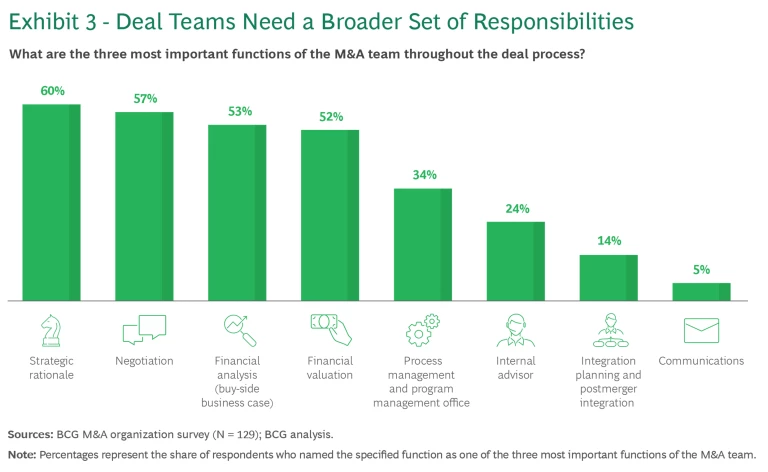

The scope of the M&A organization’s perceived responsibilities throughout the deal process is another significant issue. Survey respondents see themselves as having a clear mandate to develop strategic rationales, conduct negotiations, provide financial analyses, perform valuations, and manage processes and programs. (See Exhibit 3.) But relatively few respondents see themselves as internal advisors, integration planners, and communicators. For maximum effectiveness, the deal team should be deeply involved in all of these areas.

Our discussions with successful dealmakers reinforce the importance of ensuring that the M&A organization have a broader set of capabilities. (See “Lessons From Maersk’s M&A-Driven Transformation.”)

Lessons From Maersk’s M&A-Driven Transformation

We spoke to Peter Wikstrom, the company’s vice president and head of M&A, to learn how an effective M&A organization supported this transformation.

What was Maersk’s M&A organization like at the beginning of this transformative journey, and what did you change?

Initially, we had a very decentralized setup. Some members of the M&A function were located at the group level, while others belonged to M&A and broader corporate development teams within the regions and business units. So, as the first change, we centralized the M&A function to ensure that we could prioritize opportunities efficiently to achieve our overarching strategic goals.

The second change was to build up our centralized capabilities. Our mantra was to build a team that could compete with the best-in-class M&A teams across the industry, investment banks, and private equity firms. To achieve this, we hired only true M&A professionals—those with in-depth experience and relevant skills, not just a general interest in M&A.

Finally, we clearly defined responsibilities throughout the deal process, based on the four pillars of M&A—strategy and sourcing, due diligence and execution, integration, and long-term monitoring. For example, deal sourcing would only happen centrally to ensure the highest quality standards and strategic fit. This helped us to source and execute opportunities more efficiently.

What do you view as the most important attributes of an M&A organization?

In my experience, three attributes are essential: strategic conviction, internal partnership, and accountability.

Forming a strategic conviction for a specific deal means having a clear-cut answer to the question, “Why should we acquire this target, considering the value it creates for our customers and us?” To reach this answer, we involve key business stakeholders early in the process and define how the deal fits into our roadmap and how it adds value from commercial, operational, technological, and financial perspectives. This internal partnership with stakeholders from business units and regions is crucial. We partner with them throughout the process, rather than simply acquiring a target and dropping it at their feet. Ultimately, we need them to take ownership and accountability for the underlying assumptions and the value-capture initiatives because the target will be integrated into our business.

What are your biggest lessons from several large-scale deals at Maersk?

For many deal teams, their work ends with deal signing or closing. However, the subsequent integration phase is equally important—if not more so. Even if a company has selected the right target to acquire, which is a prerequisite for success, a poorly managed postmerger integration will destroy value. So, one key lesson is that M&A teams must facilitate a proper platform for the integration phase. This setup ensures that the company can utilize all insights gained during the transaction to create a robust target operating model, clarify synergy enablers, and identify the actions required to capture value and mitigate risks.

We have already discussed the importance of involving other parts of the organization in the deal process. Another lesson is that, while this involvement is crucial, it is better to prioritize quality over quantity. The process benefits more from having a few fully engaged stakeholders than from having many people with only lateral involvement. This approach also reinforces the accountability previously mentioned.

Finally, as an M&A leader, you need allies at the highest levels of the organization who understand what an active M&A agenda entails and how dealmaking works. Their support is crucial for gaining and maintaining momentum while also converting on deals—that is, executing and closing them. This includes securing board-level alignment regarding your strategic goals at the start of the M&A journey. Top executives must also be allies to support your framework for end-to-end deal execution and to participate in and stand behind critical decisions for each deal. Only with this level of support can you truly become a successful dealmaker in a complex corporate environment, because M&A is a team sport.

Building an Effective M&A Organization

Building an effective M&A capability involves tailoring various design options to the company’s specific goals. There are four key areas to consider: governance structure, functional structure and team size, collaboration models, and processes and tools. Companies can consider a set of questions to guide their choices among the available options. (See “Questions to Guide Design Decisions.”)

Questions to Guide Design Decisions

- What is the M&A function’s role in the company? Does it reactively support ad-hoc decisions or proactively shape corporate strategy?

- What expected value and volume of deals do we need to realize in the next three to five years?

- Do we want to concentrate expertise on the M&A team or spread it throughout the broader organization?

- How do we anticipate creating value from M&A? Where do we fall on a continuum from purely financial value to deeply strategic value?

- What degree of independence or managerial oversight does the M&A function require in order to fulfill our ambition?

Governance Structure

An M&A organization’s governance structure should align with the company’s strategic objectives and business environment. The top-down governance approach emphasizes a structured and hierarchical decision-making process in which directives flow from senior executives to the operational teams. It is suitable for organizations operating in traditional and less dynamic industries. The primary advantages of this structure are clear guidance and efficiency, leveraging of executive expertise, and structured communication. However, it may also limit flexibility and slow decision making.

Bottom-up governance, in contrast, encourages more ideation and innovation from lower organizational levels. Because this approach facilitates flexibility, innovation, and faster decision making, it is popular in dynamic and innovative industries where agility is crucial. It is also widely employed by large conglomerates that have diverse, unrelated business units. Potential challenges of this governance structure include strategic misalignment among organizational levels and lack of transparency.

In any governance structure, decision-making bodies play important supporting roles. Depending on the region, the board of directors or C-level executives approve and update the investment strategy, allocate capital, and define group policies. These leaders also develop processes and responsibilities related to M&A activities, ensuring strategy implementation across the organization. In an overlapping role, the investment committee prioritizes and recommends investment decisions in line with strategic objectives, challenges deal teams (for example, by verifying assumptions and prioritizing additional analysis), and contributes to M&A strategy execution.

Functional Structure and Team Size

The structure of the M&A function must align with the company's overall strategy, ensure effective integration of acquired entities, and support seamless operations. Several dimensions impact this structure:

- Level of M&A Function. The M&A function’s position within the corporate hierarchy and its reporting structure are crucial. Having the function report directly to C-level executives ensures top-level attention and strategic alignment. On the other hand, integrating the function into another department enhances coordination and resource sharing.

- Allocation of Responsibilities. The distribution of M&A responsibilities among executive roles affects the function’s focus and effectiveness. Assigning responsibility to the CEO ensures strong strategic alignment, whereas placing the CFO at the helm emphasizes financial discipline. Leadership by the chief operating officer or chief strategy officer stresses operational efficiency or strategic execution, respectively.

- Degree of Centralization. A centralized M&A team provides strong cohesion and quick decision making but may give short shrift to business-unit-specific insights. In contrast, a divisional team optimizes capital allocation and supports specialized tasks but requires careful coordination. Integrating the M&A team into a business unit helps align it with business strategies but may raise issues with adherence to enterprise-level strategy.

- Team Size and Resources. The scope of an M&A organization’s activities affects its required team size and skill level. After assessing the tradeoffs between utilization, flexibility, and costs, companies may choose not to build subject matter expertise in certain functions and business areas within the M&A organization. To access needed expertise, companies must establish strong interfaces that promote effective collaboration between the M&A organization and other departments and business units.

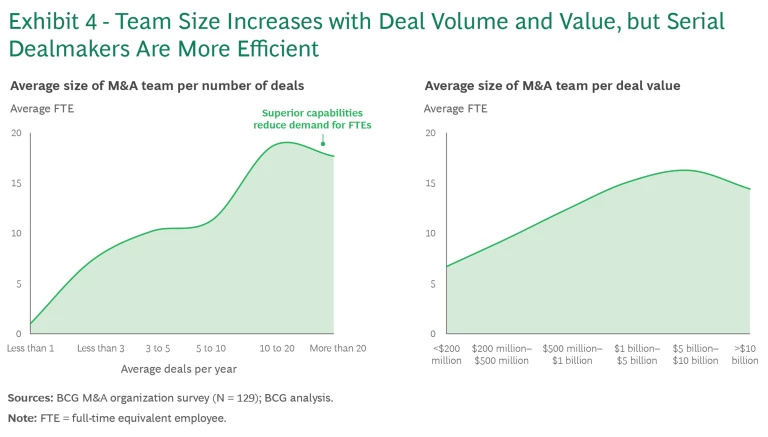

Benchmarking and skill identification are essential to ensure that the M&A team has the resources and skills it needs to handle various challenges. For example, benchmarks are available for calculating the average number of FTEs necessary to deliver a specific number of deals per year, or the optimal ratio of executives to junior professionals. A BCG benchmarking survey revealed that the average number of FTEs per M&A team increases steadily as the volume and value of deals rise. (See Exhibit 4.) For teams with the largest deal volume and value, however, the number of FTEs decreases slightly—suggesting that serial dealmakers can leverage superior capabilities to enhance their teams' efficiency.

Collaboration Models

There are several collaboration models, each with its own distinct levels of interconnectedness and stakeholder involvement:

- Internal Collaboration. Options for internal collaboration include independent, interlinked, and integrated models. An independent model calls for the M&A department to operate with loose ties to adjacent groups. This is suitable for organizations in which the department’s activities are separate from those of other functions. This model offers clear boundaries but may not promote integration with the corporate strategy. In contrast, teams that use an interlinked model share the same reporting line and engage in frequent exchanges. This model enhances cooperation and alignment with strategic goals, but it also requires robust coordination to avoid overlaps. In an integrated model, the strategy department, business units, and M&A teams function as a cohesive unit. This approach promotes alignment and resource sharing but can be complex to manage.

- Stakeholder Involvement Across Deal Stages. Effective collaboration requires participation from the board, executives, strategy departments, business units, and M&A department at different stages. The board and the executive leadership team define strategy top-down, with the M&A department providing guidance. Deal sourcing and screening require high engagement from industry experts, strategy departments, and the M&A team. The M&A department leads on deal design and valuation, often with input from external advisors. The M&A team and board are highly involved in execution, too, with business units joining them to achieve post-merger integration .

- External Collaboration. External collaboration, particularly with regard to leveraging external advisors, is critical for supplementing internal capabilities. Selecting the right advisors can have a major impact on transaction success. Advisors should have a strong track record and must possess the appropriate scale and flexibility to provide services for the transaction. Their skill set should enable them to efficiently handle process-related and administrative tasks, and to offer valuable guidance and insights. In addition, their networks should connect them with relevant investors and stakeholders.

Processes and Tools

Establishing clear processes and leveraging appropriate tools are critical to streamlining activities and achieving desired outcomes.

In designing their processes, companies need to adopt a set of principles that will ensure alignment with best practices. Successful acquirers follow well-defined criteria, maintain a predetermined M&A approach, and have a clear view of desirable targets. They also align key responsibilities and available resources on the basis of deal size. Unambiguous decision-making responsibility averts confusion and ensures accountability. To monitor each deal’s progress, leading companies establish stage gates, approval procedures, and tracking mechanisms.

Companies can use several tools to support processes across the full M&A life cycle. Origination tools assist in the initial stages, including target search, scouting, digital deal marketplaces, and target evaluation. Execution tools aid in project management, data handling, and due diligence . Integration tools track synergies, monitor the progress of integration, and support a post-mortem analysis of the deal. Other tools are available to manage the deal pipeline and track deal progress, thereby providing a comprehensive view of M&A activities.

Imperatives for Top-Notch Functions

Drawing on lessons from best-in-class dealmakers, we have identified nine imperatives for elevating M&A organizations to top-notch functions:

- Ensure executive ownership and strategic alignment. Executive leadership must take ownership of M&A priorities and provide strategic guidance that fully aligns with business objectives. A strong, capable M&A team should support this vision, operating with a clear mandate and a structured approach to ensure successful execution.

- Establish clear processes and responsibilities. Leaders must clearly define decision-making processes and ensure that all participating parties know their responsibilities. For example, planners should designate gatekeepers to make final decisions at specific points in the process.

- Prioritize speed and pragmatism. Speed is essential in many M&A processes, and decision makers often need to be pragmatic and take risks. Experienced dealmakers can make sound decisions even without complete information.

- Align the multiple stakeholders. Leaders should establish common goals and strategies for all participants in the M&A process, including the teams in charge of postmerger integration—a stage at which companies often lose significant value.

- Apply lessons learned and expertise. Successful M&A requires learning from every deal and adhering to standards to maximize value. It is therefore important to staff the organization with internal experts who understand the intricacies of M&A.

- Be willing to invest in a stronger organization. Failed deals and ineffective processes carry high costs. Leaders should consider building M&A muscle as an investment in cost avoidance.

- Build a pipeline of targets. Companies need to use all available internal and external resources to identify opportunities for potential acquisitions. Leaders should ensure that the business systematically organizes and manages these opportunities to prioritize the most promising targets and to streamline the decision-making process. Meticulous preparation enables dealmakers to act quickly when desired targets come to market.

- Seek help from business experts. Leaders should involve business experts in due diligence and postmerger integration planning, coaching them to work effectively within the company’s M&A process.

- Use state-of-the-art tools. Analytics platforms, deal management software, and other high-end tools can help the company keep pace with market and technological advances and conquer the complexity and scale of dealmaking.

As the M&A market’s recovery continues, now is the time for companies to begin investing in their M&A capabilities. Building or transforming an M&A organization is a time-consuming process. Although companies can complete a well-structured program in as little as eight weeks, setting the effort in motion requires significant planning. The potential payoff, however, is big: companies that invest in establishing an effective M&A organization will position themselves to pursue significant value creation.